CRH Annual Report 2007 PERFORMANCE AND GROWTH

CRH Annual Report 2007 PERFORMANCE AND GROWTH

CRH Annual Report 2007 PERFORMANCE AND GROWTH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

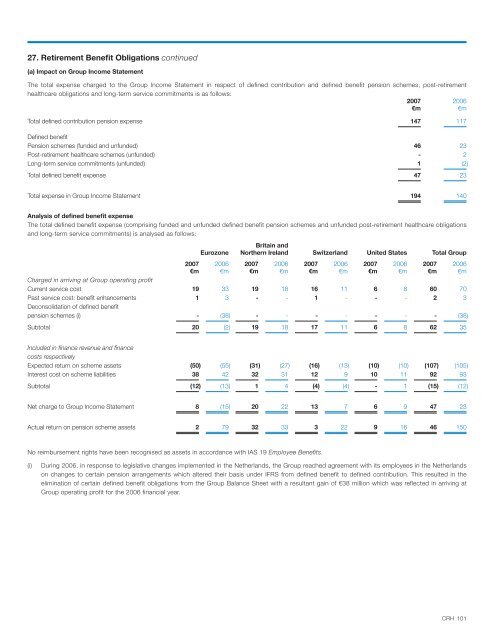

27. Retirement Benefit Obligations continued(a) Impact on Group Income StatementThe total expense charged to the Group Income Statement in respect of defined contribution and defined benefit pension schemes, post-retirementhealthcare obligations and long-term service commitments is as follows:<strong>2007</strong> 2006€m €mTotal defined contribution pension expense 147 117Defined benefitPension schemes (funded and unfunded) 46 23Post-retirement healthcare schemes (unfunded) - 2Long-term service commitments (unfunded) 1 (2)Total defined benefit expense 47 23Total expense in Group Income Statement 194 140Analysis of defined benefit expenseThe total defined benefit expense (comprising funded and unfunded defined benefit pension schemes and unfunded post-retirement healthcare obligationsand long-term service commitments) is analysed as follows:Britain andEurozone Northern Ireland Switzerland United States Total Group<strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006€m €m €m €m €m €m €m €m €m €mCharged in arriving at Group operating profitCurrent service cost 19 33 19 18 16 11 6 8 60 70Past service cost: benefit enhancements 1 3 - - 1 - - - 2 3Deconsolidation of defined benefitpension schemes (i) - (38) - - - - - - - (38)Subtotal 20 (2) 19 18 17 11 6 8 62 35Included in finance revenue and financecosts respectivelyExpected return on scheme assets (50) (55) (31) (27) (16) (13) (10) (10) (107) (105)Interest cost on scheme liabilities 38 42 32 31 12 9 10 11 92 93Subtotal (12) (13) 1 4 (4) (4) - 1 (15) (12)Net charge to Group Income Statement 8 (15) 20 22 13 7 6 9 47 23Actual return on pension scheme assets 2 79 32 33 3 22 9 16 46 150No reimbursement rights have been recognised as assets in accordance with IAS 19 Employee Benefits.(i)During 2006, in response to legislative changes implemented in the Netherlands, the Group reached agreement with its employees in the Netherlandson changes to certain pension arrangements which altered their basis under IFRS from defined benefit to defined contribution. This resulted in theelimination of certain defined benefit obligations from the Group Balance Sheet with a resultant gain of €38 million which was reflected in arriving atGroup operating profit for the 2006 financial year.<strong>CRH</strong> 101