CRH Annual Report 2007 PERFORMANCE AND GROWTH

CRH Annual Report 2007 PERFORMANCE AND GROWTH

CRH Annual Report 2007 PERFORMANCE AND GROWTH

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

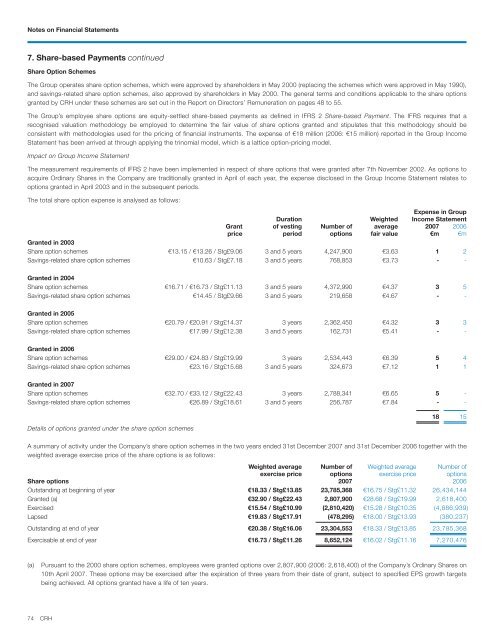

Notes on Financial Statements7. Share-based Payments continuedShare Option SchemesThe Group operates share option schemes, which were approved by shareholders in May 2000 (replacing the schemes which were approved in May 1990),and savings-related share option schemes, also approved by shareholders in May 2000. The general terms and conditions applicable to the share optionsgranted by <strong>CRH</strong> under these schemes are set out in the <strong>Report</strong> on Directors’ Remuneration on pages 48 to 55.The Group’s employee share options are equity-settled share-based payments as defined in IFRS 2 Share-based Payment. The IFRS requires that arecognised valuation methodology be employed to determine the fair value of share options granted and stipulates that this methodology should beconsistent with methodologies used for the pricing of financial instruments. The expense of €18 million (2006: €15 million) reported in the Group IncomeStatement has been arrived at through applying the trinomial model, which is a lattice option-pricing model.Impact on Group Income StatementThe measurement requirements of IFRS 2 have been implemented in respect of share options that were granted after 7th November 2002. As options toacquire Ordinary Shares in the Company are traditionally granted in April of each year, the expense disclosed in the Group Income Statement relates tooptions granted in April 2003 and in the subsequent periods.The total share option expense is analysed as follows:Expense in GroupDuration Weighted Income StatementGrant of vesting Number of average <strong>2007</strong> 2006price period options fair value €m €mGranted in 2003Share option schemes €13.15 / €13.26 / Stg£9.06 3 and 5 years 4,247,900 €3.63 1 2Savings-related share option schemes €10.63 / Stg£7.18 3 and 5 years 768,853 €3.73 - -Granted in 2004Share option schemes €16.71 / €16.73 / Stg£11.13 3 and 5 years 4,372,990 €4.37 3 5Savings-related share option schemes €14.45 / Stg£9.66 3 and 5 years 219,658 €4.67 - -Granted in 2005Share option schemes €20.79 / €20.91 / Stg£14.37 3 years 2,362,450 €4.32 3 3Savings-related share option schemes €17.99 / Stg£12.38 3 and 5 years 162,731 €5.41 - -Granted in 2006Share option schemes €29.00 / €24.83 / Stg£19.99 3 years 2,534,443 €6.39 5 4Savings-related share option schemes €23.16 / Stg£15.68 3 and 5 years 324,673 €7.12 1 1Granted in <strong>2007</strong>Share option schemes €32.70 / €33.12 / Stg£22.43 3 years 2,788,341 €6.65 5 -Savings-related share option schemes €26.89 / Stg£18.61 3 and 5 years 256,787 €7.84 - -Details of options granted under the share option schemes18 15A summary of activity under the Company’s share option schemes in the two years ended 31st December <strong>2007</strong> and 31st December 2006 together with theweighted average exercise price of the share options is as follows:Weighted average Number of Weighted average Number ofexercise price options exercise price optionsShare options <strong>2007</strong> 2006Outstanding at beginning of year €18.33 / Stg£13.85 23,785,368 €16.75 / Stg£11.32 26,434,144Granted (a) €32.90 / Stg£22.43 2,807,900 €28.68 / Stg£19.99 2,618,400Exercised €15.54 / Stg£10.99 (2,810,420) €15.28 / Stg£10.35 (4,886,939)Lapsed €19.83 / Stg£17.91 (478,295) €18.00 / Stg£13.93 (380,237)Outstanding at end of year €20.38 / Stg£16.06 23,304,553 €18.33 / Stg£13.85 23,785,368Exercisable at end of year €16.73 / Stg£11.26 8,652,124 €16.02 / Stg£11.16 7,270,476(a)Pursuant to the 2000 share option schemes, employees were granted options over 2,807,900 (2006: 2,618,400) of the Company’s Ordinary Shares on10th April <strong>2007</strong>. These options may be exercised after the expiration of three years from their date of grant, subject to specified EPS growth targetsbeing achieved. All options granted have a life of ten years.74 <strong>CRH</strong>