CRH Annual Report 2007 PERFORMANCE AND GROWTH

CRH Annual Report 2007 PERFORMANCE AND GROWTH

CRH Annual Report 2007 PERFORMANCE AND GROWTH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

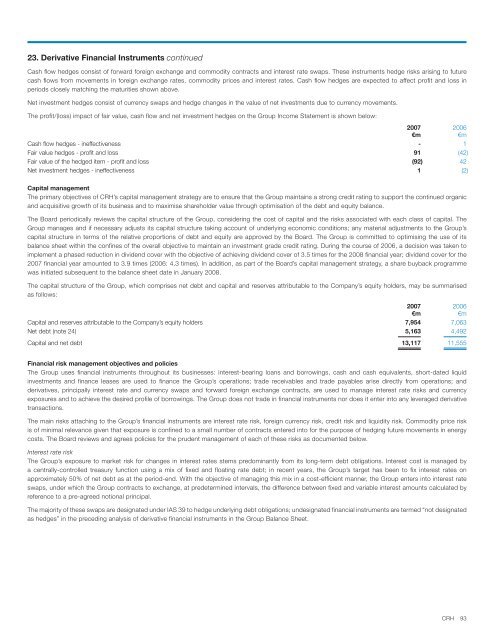

23. Derivative Financial Instruments continuedCash flow hedges consist of forward foreign exchange and commodity contracts and interest rate swaps. These instruments hedge risks arising to futurecash flows from movements in foreign exchange rates, commodity prices and interest rates. Cash flow hedges are expected to affect profit and loss inperiods closely matching the maturities shown above.Net investment hedges consist of currency swaps and hedge changes in the value of net investments due to currency movements.The profit/(loss) impact of fair value, cash flow and net investment hedges on the Group Income Statement is shown below:<strong>2007</strong> 2006€m €mCash flow hedges - ineffectiveness - 1Fair value hedges - profit and loss 91 (42)Fair value of the hedged item - profit and loss (92) 42Net investment hedges - ineffectiveness 1 (2)Capital managementThe primary objectives of <strong>CRH</strong>’s capital management strategy are to ensure that the Group maintains a strong credit rating to support the continued organicand acquisitive growth of its business and to maximise shareholder value through optimisation of the debt and equity balance.The Board periodically reviews the capital structure of the Group, considering the cost of capital and the risks associated with each class of capital. TheGroup manages and if necessary adjusts its capital structure taking account of underlying economic conditions; any material adjustments to the Group’scapital structure in terms of the relative proportions of debt and equity are approved by the Board. The Group is committed to optimising the use of itsbalance sheet within the confines of the overall objective to maintain an investment grade credit rating. During the course of 2006, a decision was taken toimplement a phased reduction in dividend cover with the objective of achieving dividend cover of 3.5 times for the 2008 financial year; dividend cover for the<strong>2007</strong> financial year amounted to 3.9 times (2006: 4.3 times). In addition, as part of the Board’s capital management strategy, a share buyback programmewas initiated subsequent to the balance sheet date in January 2008.The capital structure of the Group, which comprises net debt and capital and reserves attributable to the Company’s equity holders, may be summarisedas follows:<strong>2007</strong> 2006€m €mCapital and reserves attributable to the Company’s equity holders 7,954 7,063Net debt (note 24) 5,163 4,492Capital and net debt 13,117 11,555Financial risk management objectives and policiesThe Group uses financial instruments throughout its businesses: interest-bearing loans and borrowings, cash and cash equivalents, short-dated liquidinvestments and finance leases are used to finance the Group’s operations; trade receivables and trade payables arise directly from operations; andderivatives, principally interest rate and currency swaps and forward foreign exchange contracts, are used to manage interest rate risks and currencyexposures and to achieve the desired profile of borrowings. The Group does not trade in financial instruments nor does it enter into any leveraged derivativetransactions.The main risks attaching to the Group’s financial instruments are interest rate risk, foreign currency risk, credit risk and liquidity risk. Commodity price riskis of minimal relevance given that exposure is confined to a small number of contracts entered into for the purpose of hedging future movements in energycosts. The Board reviews and agrees policies for the prudent management of each of these risks as documented below.Interest rate riskThe Group’s exposure to market risk for changes in interest rates stems predominantly from its long-term debt obligations. Interest cost is managed bya centrally-controlled treasury function using a mix of fixed and floating rate debt; in recent years, the Group’s target has been to fix interest rates onapproximately 50% of net debt as at the period-end. With the objective of managing this mix in a cost-efficient manner, the Group enters into interest rateswaps, under which the Group contracts to exchange, at predetermined intervals, the difference between fixed and variable interest amounts calculated byreference to a pre-agreed notional principal.The majority of these swaps are designated under IAS 39 to hedge underlying debt obligations; undesignated financial instruments are termed “not designatedas hedges” in the preceding analysis of derivative financial instruments in the Group Balance Sheet.<strong>CRH</strong>93