Individual remuneration for the year ended 31st December <strong>2007</strong>Incentive Plan RetirementBasic salary Cash Deferred benefits Otherand fees element shares expense Remuneration Benefits Total Total(i) (i) (ii) (iii) (iv) <strong>2007</strong> 2006€000 €000 €000 €000 €000 €000 €000 €000Executive DirectorsD. W. Doyle (v) 305 366 - 53 - 12 736 1,344T.W. Hill 730 583 182 146 - 33 1,674 1,825M. Lee 600 453 187 200 - 25 1,465 1,411W. I. O’Mahony (vi) 1,340 1,012 416 - - 26 2,794 2,656J.L. Wittstock (vii) - - - - - - - 2882,975 2,414 785 399 - 96 6,669 7,524Non-executive DirectorsW.P. Egan (viii) 65 - - - 50 - 115 -U-H. Felcht (ix) 28 - - - 15 - 43 -N. Hartery 65 - - - 20 - 85 75J.M. de Jong 65 - - - 56 - 121 75D. M. Kennedy 65 - - - 62 - 127 103K. McGowan (x) 65 - - - 250 - 315 104P. J. Molloy (x) 23 - - - 131 - 154 375T. V. Neill 65 - - - 20 - 85 75A. O’Brien (xi) - - - - - - - 36D.N. O’Connor (xii) 65 - - - 20 - 85 38J.M.C. O’Connor 65 - - - 20 - 85 75571 - - - 644 - 1,215 956(i)(ii)(iii)(iv)Performance-related Incentive Plan Under the executive Directors’ incentive plan for <strong>2007</strong>, a bonus is payable for meeting clearly defined and stretchprofit targets and strategic goals. The structure of the <strong>2007</strong> incentive plan is set out on pages 48 and 49 and includes a cash element paid out whenearned and an element receivable in <strong>CRH</strong> shares deferred for a period of three years, with forfeiture in the event of departure from the Group in certaincircumstances during that time period.Retirement Benefits Expense The Irish Finance Act 2006 established a cap on pension provision by introducing a penalty tax charge on pension assets inexcess of the higher of €5 million or the value of individual prospective pension entitlements as at 7th December 2005. As a result of these legislative changes,the Remuneration Committee has decided that Irish-based executive Directors should have the option of continuing to accrue pension benefits as previously, orof choosing an alternative arrangement - by accepting pension benefits limited by the cap - with a similar overall cost to the Group. The three Irish-basedexecutive Directors chose to opt for the alternative arrangement which involves capping their pensions in line with the provisions of the Finance Act and receivinga supplementary taxable non-pensionable cash allowance, in lieu of prospective pension benefits foregone. These allowances are similar in value to the reductionin the Company’s liability represented by the pension benefit foregone. They are calculated based on actuarial advice as the equivalent of the reduction in theCompany’s liability to each individual and spread over the term to retirement as annual compensation allowances. For <strong>2007</strong> the compensation allowancesamount to €52,577 for Mr. Doyle; €200,137 for Mr. Lee and €631,570 for Mr. O’Mahony. Mr. O’Mahony has waived his right to equivalent prospective benefitentitlements from his benefit plan arrangements, which were fully funded at end-2004, and as a result no net pension-related expense arises in his respect.Other Remuneration Executive Director: Expatriate and housing allowance for Mr. J.L. Wittstock in 2006. Non-executive Directors: Includes remuneration forChairman and for Board Committee work.Benefits These relate principally to the use of company cars and medical/life assurance.(v) Mr. D.W. Doyle retired on 30th June <strong>2007</strong>.(vi) Mr. W.I. O’Mahony became a non-executive Director of the Smurfit Kappa Group plc in March <strong>2007</strong> for which he received fees of €104,167 in <strong>2007</strong>.(vii) Mr. J.L. Wittstock resigned on 26th April 2006.(viii) Mr. W.P. Egan became a Director on 1st January <strong>2007</strong>.(ix) Professor U-H. Felcht became a Director on 25th July <strong>2007</strong>.(x)Mr. K. McGowan became Chairman on 9th May <strong>2007</strong> succeeding Mr. P.J. Molloy who retired as a non-executive Director on the same date.(xi) Mr. A. O’Brien retired on 3rd May 2006.(xii) Mr. D.N. O’Connor became a Director on 28th June 2006.<strong>CRH</strong>51

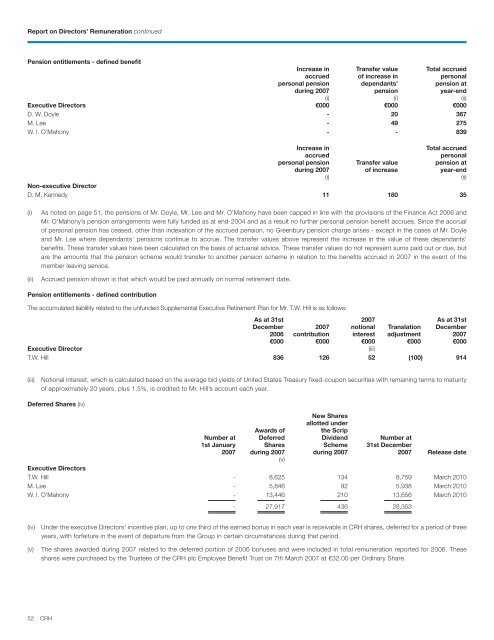

<strong>Report</strong> on Directors’ Remuneration continuedPension entitlements - defined benefitIncrease in Transfer value Total accruedaccrued of increase in personalpersonal pension dependants’ pension atduring <strong>2007</strong> pension year-end(i) (i) (ii)Executive Directors €000 €000 €000D. W. Doyle - 20 367M. Lee - 49 275W. I. O’Mahony - - 839Increase inTotal accruedaccruedpersonalpersonal pension Transfer value pension atduring <strong>2007</strong> of increase year-end(i)(ii)Non-executive DirectorD. M. Kennedy 11 180 35(i)(ii)As noted on page 51, the pensions of Mr. Doyle, Mr. Lee and Mr. O’Mahony have been capped in line with the provisions of the Finance Act 2006 andMr. O’Mahony’s pension arrangements were fully funded as at end-2004 and as a result no further personal pension benefit accrues. Since the accrualof personal pension has ceased, other than indexation of the accrued pension, no Greenbury pension charge arises - except in the cases of Mr. Doyleand Mr. Lee where dependants’ pensions continue to accrue. The transfer values above represent the increase in the value of these dependants’benefits. These transfer values have been calculated on the basis of actuarial advice. These transfer values do not represent sums paid out or due, butare the amounts that the pension scheme would transfer to another pension scheme in relation to the benefits accrued in <strong>2007</strong> in the event of themember leaving service.Accrued pension shown is that which would be paid annually on normal retirement date.Pension entitlements - defined contributionThe accumulated liablility related to the unfunded Supplemental Executive Retirement Plan for Mr. T.W. Hill is as follows:As at 31st <strong>2007</strong> As at 31stDecember <strong>2007</strong> notional Translation December2006 contribution interest adjustment <strong>2007</strong>€000 €000 €000 €000 €000Executive Director(iii)T.W. Hill 836 126 52 (100) 914(iii)Notional interest, which is calculated based on the average bid yields of United States Treasury fixed-coupon securities with remaining terms to maturityof approximately 20 years, plus 1.5%, is credited to Mr. Hill’s account each year.Deferred Shares (iv)New Sharesallotted underAwards ofthe ScripNumber at Deferred Dividend Number at1st January Shares Scheme 31st December<strong>2007</strong> during <strong>2007</strong> during <strong>2007</strong> <strong>2007</strong> Release date(v)Executive DirectorsT.W. Hill - 8,625 134 8,759 March 2010M. Lee - 5,846 92 5,938 March 2010W. I. O’Mahony - 13,446 210 13,656 March 2010- 27,917 436 28,353(iv) Under the executive Directors’ incentive plan, up to one third of the earned bonus in each year is receivable in <strong>CRH</strong> shares, deferred for a period of threeyears, with forfeiture in the event of departure from the Group in certain circumstances during that period.(v)The shares awarded during <strong>2007</strong> related to the deferred portion of 2006 bonuses and were included in total remuneration reported for 2006. Theseshares were purchased by the Trustees of the <strong>CRH</strong> plc Employee Benefit Trust on 7th March <strong>2007</strong> at €32.00 per Ordinary Share.52 <strong>CRH</strong>