2012 Annual Report (p.17-23) Adobe PDF version - Lukoil

2012 Annual Report (p.17-23) Adobe PDF version - Lukoil

2012 Annual Report (p.17-23) Adobe PDF version - Lukoil

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

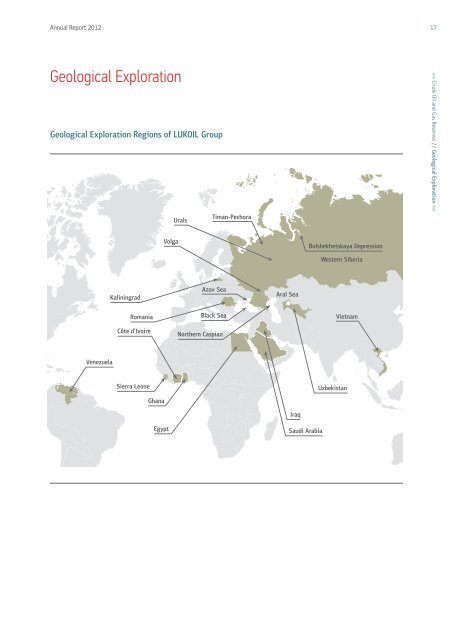

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 19Prospecting work in the Denisovskaya Depression(Komi Republic)A total <strong>23</strong>.4 thousand meters of prospecting and explorationdrilling was carried out in the Komi Republic and five wellswere completed, of which four were productive (80% drillingsuccess rate). Exploration wells № 2 and 4 at the Vostochno-Lambeishorskoye field were completed and transferred to the fieldoperator. They are now operating with daily flow rates of about600 cubic meters.Prospecting drilling in the Baltic SeaLUKOIL carried out exploration work both onshore in KaliningradRegion and on the Baltic Sea shelf during <strong>2012</strong>. Total drilling was6 thousand meters and 100 km of 2D seismic work was carriedout at the Yuzhny license area. Drilling of prospecting well № 1in the Baltic Sea was completed (the distance drilled in <strong>2012</strong> was4 thousand meters). The well is now being tested. A firstprospecting well was also drilled at the Yuzhno-Volodarovskayastructure (1,930 meters drilled).Prospecting work in UzbekistanAt the Kandym block wells Parsankul-9 and Parsankul-10 werecompleted and testing gave daily gas inflows of 90 thousand cubicmeters and 196 thousand cubic meters, respectively. Preparationswere made for 3D seismic data acquisition and 450 km 2 of 3D workwas carried out. The geological model of the Parsankul field wasupdated in <strong>2012</strong> and rapid assessment of C1 hydrocarbon reserveincrement from the new wells was made.Drilling work was completed in the South-West Gissar projectand well Shurdarye-2 was tested. Testing of Upper Carbonaceoussediments gave daily commercial inflow of gas and condensate atrates of 647 thousand cubic meters and 95 tonnes, respectively,marking discovery of the Shurdarye field.Fact Book, p. 24Analyst Databook, p. 5>3D Seismic exploration, km 2Spending on geological exploration, $ millionVertical seismic profiling, wellsExploration drilling, th. meters

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 21Spending on prospective projects during <strong>2012</strong> amounted to$3.4 billion, which is more than 28% of total capital spendingin <strong>2012</strong>. In Russia the Company invested more than $1.4 billionfor development of the Caspian region, and about $0.5 billion onfields in the Bolshekhetskaya Depression. The greater partof foreign capex in the exploration & production segment in<strong>2012</strong> was at the West Qurna-2 field in Iraq.The Imilorskoye field has enormous resource potential, andownership by the Company of developed infrastructure close bywill reduce development costs. Efficient development of the fieldwill create new jobs and increase tax revenues to the state budget.First production from Imilorskoye is expected in 2015.>Capital expenditures in prospective regions in <strong>2012</strong>DescriptionTwo oil fields have been discovered at the territory:Imilorskoye + Zapadno-Imilorskoye (1987) and Istochnoye(1988). The company offered a single payment of 50.8 billionrubles for mineral usage rights, representing $1.2 per barrel ofproved and appraised reserves. Geological and recoverable oilreserves (C1+C2) at the area as of January 1, <strong>2012</strong> were855.5 and 193.7 million tonnes, respectively.Prospective regions in RussiaWestern SiberiaWestern Siberia is an established region of hydrocarbonproduction for LUKOIL, and most of its oil fields are highlydepleted. Prospects for increase of production of hydrocarbonsin the region depend on the acquisition of new licenses,intensification of drilling work and use of secondary and tertiaryrecovery techniques (hydraulic fracturing, sidetracking,horizontal wells, etc.). Increase of hydrocarbon productionwill also be achieved through the development of gas fieldsin the region.Imilorskoye + Zapadno-Imilorskoye and Istochnoye fieldsThe area is located in Surgut administrative sub-division ofKhanty-Mansiysk Autonomous District, 65 km south-west ofthe city of Noyabrsk, which is in Yamal-Nenets AutonomousDistrict. A communication corridor passes at a distance of29 km from the center of the area, and consists of a road withhard surface connecting Surgut with Noyabrsk, a trunk oilpipeline connecting the Kholmogory and West Surgut pumpingstations, power transmission lines (500, 220 and 110 kilovolt)and a gas pipeline connecting Kholmogorskaya compressionstation to the Surgut gas-processing plant. A pipeline carryingmarketable crude oil passes 15 km to the east of the areaboundary, and trunk oil and gas pipeline routes pass 55 km tothe east of the boundary.The Imilorskoye field is directly adjacent to the largest LUKOILfield currently in development – the Tevlinsko-Russkinskoyefield – and shares many of its geological features. The regionaround Imilorskoye is well equipped with facilities, having allof the necessary production and transportation infrastructurefor field development, so Imilorskoye can be made ready andbrought into production relatively quickly and with best-possibleeconomic and synergy effects.LUKOIL strengthened its base in Western Siberia during <strong>2012</strong>through the acquisition of a license, which gives rights at theImilorskoye + Zapadno-Imilorskoye and Istochnoye fields.Geological and recoverable oil reserves (C1+C2) at the area asof January 1, <strong>2012</strong> were, respectively, 855.5 and 193.7 milliontonnes. The license will enable the Company to greatly increase itsreserves and raise future production levels in the strategic regionof Western Siberia.Khanty-MansiAutonomousDistrictDistance to a fieldoil pipelineImilorsky21 km60 km30 kmYamal-NenetsAutonomousDistrictDistance to trunkoil pipelineNoyabrskGCS KogalymskayaKOGALYM

22>Timan-PechoraThe Timan-Pechora oil & gas province has substantial potential forproduction growth. LUKOIL plans to bring the heavy oil reservesof Timan-Pechora (about 4.4% of the Company's total provedreserves) into production more quickly by applying newtechnologies. Most of the Company’s heavy oil reserves arelocated at the Yaregskoye and Usinsk fields, and developmentof the Trebs and Titov fields via a joint venture also offerspotential for increase of hydrocarbon production in the region.Trebs and Titov fieldsIn 2011 LUKOIL together with OJSC Bashneft set up a joint ventureto develop the Trebs and Titov oil fields, with LUKOIL taking a25.1% stake in the development project. Production is expectedto begin in 2013 and peak production will be 4.8 million tonnesper year. LUKOIL will obtain major synergies from the useof its own oil transport infrastructure (the Yuzhnoye Khylchuyu-Varandey pipeline and the Varandey terminal) to export oilfrom the fields.Fact Book, p. 32Vostochno-Lambeishorskoye fieldThe Vostochno-Lambeishorskyoe field was discovered in theDenisovskaya Depression, in <strong>2012</strong> and first production wasobtained in <strong>2012</strong>, when three exploration wells were put intotrial operation and gave flows of 1.4 thousand tonnes per day.Oil production in <strong>2012</strong> was 0.4 million tonnes and is expected torise to 0.8–1.2 million tonnes per annum in 2013–2015 (a plateaulevel is expected 1.3 million tonnes). Proved oil reserves at theend of <strong>2012</strong> were 81 million barrels.Yaregskoye fieldYaregskoye is the Company’s largest field with high-viscosity oildeposits and has proved reserves of 314 million barrels (equivalentto 47 million tonnes taking account of the high density of the oil).Output from the field has benefited from a preferential export dutyrate, equal to 10% of the standard rate, since mid-<strong>2012</strong>. The peakproduction level should be 3.1 million tonnes.Fact Book, p. 33Usinskoye field (permian-carbonaceous)The permian-carbonaceous deposit at the Usinskoye field is theCompany’s second largest source of high-viscosity oil.Such oil qualifies for preferential taxation under the ‘10-10-10’system. The target production level at the field is 2.5 milliontonnes per year.Proved hydrocarbon reserves at the end of <strong>2012</strong> were444 million boe.Fact Book, p. 33Analyst Databook, p. 30Northern CaspianThe Northern Caspian will be a key region for growth of oil & gasoutput by LUKOIL in the medium term thanks to the developmentof large fields, which were discovered in the 2000s. The Companyis giving special attention to the development of resource potentialin the region. Additional exploration of fields there led to increaseof the Company's proved reserves to international standards by109 million barrels in <strong>2012</strong> (+14.9% to 2011).Yu. Korchagin fieldLUKOIL began its production operations in the Russian sector ofthe Caspian Sea at the Yu. Korchagin field in 2010 and outputfrom the field rose by 135% in <strong>2012</strong>. The target is to produce2.4 million tonnes per year at the field using long, highly complexhorizontal wells. Proved hydrocarbon reserves at the end of<strong>2012</strong> were 86.5 million boe.V. Filanovsky fieldThe V. Filanovsky field will be the second production asset launchedby LUKOIL in the offshore Caspian. Production is scheduled tobegin in 2015 and should reach the target level of 6.1 milliontonnes in 2016. Intensive work is currently underway onconstruction of infrastructure facilities (offshore platforms,pipelines, and equipment). The V. Filanovsky field is the biggestin the region and, unlike earlier discoveries, its reserves consistmainly of oil. Proved hydrocarbon reserves here at the end of <strong>2012</strong>were 487 million boe.Fact Book, p. 37Gas fields in the Bolshekhetskaya depressionFields in the Bolshekhetskaya depression represent the Company'score production base for natural gas in Russia. LUKOIL’s biggestoperating gas field is Nakhodkinskoye, which accounted for about95% of the Company’s natural gas production in Russia in <strong>2012</strong>.Other, equally large fields are scheduled for launch in the future.

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> <strong>23</strong>These are Pyakyakhinskoye (scheduled launch in 2016), Yuzhno-Messoyakhskoye (2018) and Khalmerpayutinskoye (2019).Natural gas production by the Company in Russia should morethan double over the next 10 years thanks to commissioning ofthese fields. Total production of natural gas by the Company inthe Bolshekhetskaya depression, when all of the fields there areoperational, should be in the order of 20 billion cubic meters.Proved hydrocarbon reserves at fields in the Bolshekhetskayadepression at the end of <strong>2012</strong> were 2,140 million boe.Fact Book, p. 31Analyst Databook, p. 33Prospective regions abroadProspects for increasing hydrocarbon production in internationalprojects relate mainly to the development of existing assets inUzbekistan and Iraq.UzbekistanLUKOIL’s main gas projects outside Russia are concentratedin Uzbekistan. The Khauzak-Shady and South-West Gissarprojects are in production and the Kandym project is scheduledfor production launch in 2014. These projects are beingimplemented with support from the Government of Uzbekistanon financial terms, which are attractive to the Company.Production at the Gissar block reached the plateau targetlevel in <strong>2012</strong> (1.1 billion cubic meters of natural gas per year).The target for annual production at the Kandym group of fieldsis 8.1 billion cubic meters of gas.Total marketable hydrocarbon production from the Company’sprojects in Uzbekistan was 26 million boe in <strong>2012</strong>, which is53.3% more than in 2011.Proved hydrocarbon reserves at fields in Uzbekistan were793 million boe at the end of <strong>2012</strong>.IraqChapter: Uzbek Projects as Business Drivers, p. 30Fact Book, p. 51Analyst Databook, p. 37The West Qurna-2 field in Iraq will make the biggest singlecontribution to future growth in Company output of crude oil.Production drilling at the field began in <strong>2012</strong>, and first outputsare expected in 2014. LUKOIL’s contract at the field is for25 years. The production target is 1.2 million barrels per dayand should be maintained for 19.5 years.LUKOIL’s share of proved reserves at West Qurna-2 amountedto 165 million boe the end of <strong>2012</strong>.Agreement in principle was reached with authorizedrepresentatives of Iraqi state companies in late <strong>2012</strong> forreduction of the target levels of oil production at West Qurna-2from 1.8 million to 1.2 million barrels per day and on extensionof the production plateau from 13 to 19.5 years, togetherwith extension of the total contract period from 20 to25 years. These new base parameters will be reflected in the finaldevelopment plan. The changes significantly lower levels of riskin implementation of the West Qurna-2 project.Fact Book, p. 54Analyst Databook, p. 36>