2012 Comprehensive Annual Financial Report - City of Kingsport ...

2012 Comprehensive Annual Financial Report - City of Kingsport ...

2012 Comprehensive Annual Financial Report - City of Kingsport ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

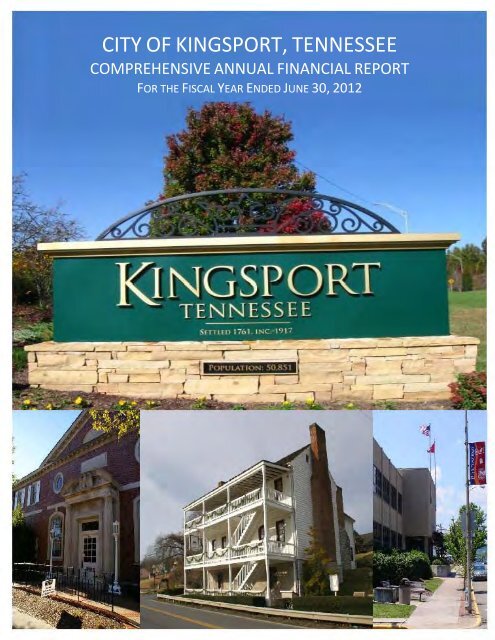

CITY OF KINGSPORT, TENNESSEECOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE FISCAL YEAR ENDED JUNE 30, <strong>2012</strong>

<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>, Tennessee<strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong>Fiscal Year Ended June 30, <strong>2012</strong>Prepared ByThe Finance DepartmentJames H. Demming, <strong>City</strong> Recorder

THIS PAGE INTENTIONALLY LEFT BLANK

CITY OF KINGSPORT, TENNESSEECOMPREHENSIVE ANNUAL FINANCIAL REPORTFor the Fiscal Year Ended June 30, <strong>2012</strong>TABLE OF CONTENTSPageI. INTRODUCTORY SECTION (UNAUDITED)Letter <strong>of</strong> Transmittal 1GFOA Certificate <strong>of</strong> Achievement 8Organizational ChartHistory and Organization910List <strong>of</strong> Principal Officials 11II. FINANCIAL SECTIONIndependent Auditors' <strong>Report</strong> 12A. MANAGEMENT'S DISCUSSION AND ANALYSIS 14B. BASIC FINANCIAL STATEMENTSGovernment-Wide <strong>Financial</strong> StatementsStatement <strong>of</strong> Net Assets 27Statement <strong>of</strong> Activities 28Fund <strong>Financial</strong> StatementsGovernmental Fund <strong>Financial</strong> StatementsBalance Sheet 29Reconciliation <strong>of</strong> the Balance Sheet <strong>of</strong> Governmental Funds to the Statement <strong>of</strong> Net Assets 31Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances 32Reconciliation <strong>of</strong> the Statement <strong>of</strong> Revenues, Expenditures, and Changes in FundBalances <strong>of</strong> Governmental Funds to the Statement <strong>of</strong> Activities 34Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - General Fund 35Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - General Purpose School Fund 38Proprietary Fund <strong>Financial</strong> StatementsStatement <strong>of</strong> Net Assets 40Statement <strong>of</strong> Revenues, Expenses, and Changes in Fund Net Assets 42Statement <strong>of</strong> Cash Flows 43Notes to the <strong>Financial</strong> Statements 45Required Supplementary InformationSchedule <strong>of</strong> Funding Progress - Defined Benefit Pension Plan 132Schedule <strong>of</strong> Funding Progress - Post Employment Healthcare Plans 133C. COMBINING AND INDIVIDUAL FUND FINANCIAL STATEMENTS AND SCHEDULESMajor Governmental FundsSchedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Debt Service Fund 134

CITY OF KINGSPORT, TENNESSEECOMPREHENSIVE ANNUAL FINANCIAL REPORTFor the Fiscal Year Ended June 30, <strong>2012</strong>TABLE OF CONTENTSPageNonmajor Governmental FundsCombining Balance Sheet 135Combining Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances 136Combining Balance Sheet - Nonmajor Governmental Funds - Public Safety 137Combining Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Nonmajor Governmental Funds - Public Safety 138Combining Balance Sheet - Nonmajor Governmental Funds - Transportation 139Combining Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Nonmajor Governmental Funds - Transportation 140Combining Balance Sheet - Nonmajor Governmental Funds - Culture and Recreation 141Combining Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Nonmajor Governmental Funds - Culture and Recreation 142Combining Balance Sheet - Nonmajor Governmental Funds - Education 143Combining Statement <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Nonmajor Governmental Funds - Education 144Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Criminal Forfeiture Fund 145Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Drug Fund 146Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - State Street Aid Fund 147Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Regional Sales Tax Revenue Fund 148Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Visitors Enhancement Fund 149Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Steadman Cemetery Fund 150Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Public Library Commission Fund 151Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Bays Mountain Park Fund 152Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Senior Citizens Advisory Board Fund 153Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - School Nutrition Services Fund 154Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Palmer Center Fund 155Schedule <strong>of</strong> Revenues, Expenditures, and Changes in Fund Balances -Budget and Actual - Allandale Trust Fund 156

CITY OF KINGSPORT, TENNESSEECOMPREHENSIVE ANNUAL FINANCIAL REPORTFor the Fiscal Year Ended June 30, <strong>2012</strong>TABLE OF CONTENTSPageInternal Service FundsCombining Statement <strong>of</strong> Net Assets 157Combining Statement <strong>of</strong> Revenues, Expenses, and Changes in Fund Net Assets 158Combining Statement <strong>of</strong> Cash Flows 159Discretely Presented Component UnitsStatement <strong>of</strong> Cash Flows 160D. SUPPLEMENTAL INFORMATIONCapital Assets Used in the Operation <strong>of</strong> Governmental FundsComparative Schedules by Source 161Schedule by Function and Activity 162Schedule <strong>of</strong> Changes by Function and Activity 164OtherSchedule <strong>of</strong> Operating Costs - Enterprise Funds 165Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal Awards 166Schedule <strong>of</strong> Expenditures <strong>of</strong> State Awards 171III. STATISTICAL SECTION (UNAUDITED)Net Assets by Component 173Changes in Net Assets 174Governmental Activities Tax Revenues by Source 176Fund Balances <strong>of</strong> Governmental Funds 177Changes in Fund Balances <strong>of</strong> Governmental Funds 178General Government Tax Revenues by Source 180Assessed Value and Estimated Actual Value <strong>of</strong> Taxable Property 181Property Tax Rates - Direct and Overlapping Governments 182Principal Property Taxpayers 183Property Tax Levies and Collections 184Local Option Sales Tax Collections185Ratios <strong>of</strong> Outstanding Debt by Type 186Ratios <strong>of</strong> General Bonded Debt Outstanding 187Direct and Overlapping Governmental Activities Debt 188Legal Debt Margin Information 189Pledged-Revenue Coverage 190Demographic and Economic Statistics 191Principal Employers 192Full-Time Equivalent <strong>City</strong> Government Employees by Function 193Operating Indicators by Function 194Capital Asset Statistics by Function 195Utility Rate Structure and Number <strong>of</strong> Customers 196Schedule <strong>of</strong> Unaccounted for Water 197Schedule <strong>of</strong> Unaccounted for Water - AWWA Method 198

CITY OF KINGSPORT, TENNESSEECOMPREHENSIVE ANNUAL FINANCIAL REPORTFor the Fiscal Year Ended June 30, <strong>2012</strong>TABLE OF CONTENTSPageTop Ten Water Customers 199Top Ten Sewer Customers 200Schedule <strong>of</strong> Bonds Payable - Future Requirements 201Salaries and Surety Bonds <strong>of</strong> Principal Officials 202Schedule <strong>of</strong> Insurance in Force 203IV. COMPLIANCE SECTIONIndependent Auditors' <strong>Report</strong> on Internal Control Over <strong>Financial</strong> <strong>Report</strong>ing and onCompliance and Other Matters Based on an Audit <strong>of</strong> <strong>Financial</strong> StatementsPerformed in Accordance with Government Auditing Standards 204Independent Auditors' <strong>Report</strong> on Compliance with Requirements That Could Havea Direct and Material Effect on Each Major Program and on Internal Control OverCompliance in Accordance with OMB Circular A-133 206Schedule <strong>of</strong> Findings and Questioned Costs 208

CITY OF KINGSPORT, TENNESSEEDecember 28, <strong>2012</strong>To the Honorable Mayor, Members <strong>of</strong> the Board <strong>of</strong> Mayor and Aldermen, and Citizens <strong>of</strong> the <strong>City</strong> <strong>of</strong><strong>Kingsport</strong>, Tennessee:State law requires that all general-purpose local governments publish within six months <strong>of</strong> the close <strong>of</strong>each fiscal year a complete set <strong>of</strong> financial statements presented in conformity with generally acceptedaccounting principles (GAAP) and audited in accordance with generally accepted auditing standards by afirm <strong>of</strong> licensed certified public accountants. Pursuant to that requirement, we hereby issue the<strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong> (CAFR) <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> for the fiscal year ended June30, <strong>2012</strong>.This report consists <strong>of</strong> management's representations concerning the finances <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>.Consequently, management assumes full responsibility for the completeness and reliability <strong>of</strong> all <strong>of</strong> theinformation presented in this report. To provide a reasonable basis for making these representations,management <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> has established a comprehensive internal control framework that isdesigned both to protect the government's assets from loss, theft, or misuse and to compile sufficientreliable information for the preparation <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s financial statements in conformity withGAAP. Because the cost <strong>of</strong> internal controls should not outweigh their benefits, the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'scomprehensive framework <strong>of</strong> internal controls has been designed to provide reasonable, rather thanabsolute assurance that the financial statements will be free from material misstatement. Asmanagement, we assert that, to the best <strong>of</strong> our knowledge and belief, this financial report is complete andreliable in all material respects.Brown, Edwards & Company, L.L.P., a firm <strong>of</strong> licensed certified public accountants, have issued anunqualified ("clean") opinion on the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s financial statements for the fiscal year ended June30, <strong>2012</strong>. The independent auditors' report is located at the front <strong>of</strong> the financial section <strong>of</strong> this report.The independent audit <strong>of</strong> the financial statements <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> was part <strong>of</strong> a broader, federallymandated "Single Audit" designed to meet the special needs <strong>of</strong> federal grantor agencies. The standardsgoverning Single Audit engagements require the independent auditor to report not only on the fairpresentation <strong>of</strong> the financial statements, but also on the audited government's internal controls andcompliance with legal requirements, with special emphasis on internal controls and legal requirementsinvolving the administration <strong>of</strong> federal awards. These reports are available in the compliance reportsection <strong>of</strong> this CAFR.GAAP require that management provide a narrative introduction, overview, and analysis to accompanythe basic financial statements in the form <strong>of</strong> Management's Discussion and Analysis (MD&A). This letter<strong>of</strong> transmittal is designed to complement MD&A and should be read in conjunction with it. The <strong>City</strong> <strong>of</strong><strong>Kingsport</strong>'s MD&A can be found immediately following the report <strong>of</strong> the independent auditors.Pr<strong>of</strong>ile <strong>of</strong> the GovernmentThe <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> was incorporated in 1917 and operates under a council-manager form <strong>of</strong>government. It is located in the northeast part <strong>of</strong> the state. The <strong>City</strong> currently occupies a land area <strong>of</strong><strong>City</strong> Hall 225 West Center Street <strong>Kingsport</strong>, TN 37660-4237 (423) 229-9400<strong>Kingsport</strong> - The Best Place To Be1

approximately 53 square miles and serves a population <strong>of</strong> 50,561 . Its established urban growth boundaryencompasses 107 square miles which provides potential areas for the <strong>City</strong> to expand its corporate limitsin the future. The <strong>City</strong> is authorized by state statutes to levy a property tax on both real and personalproperties located within its boundaries. It is also empowered by state statute to extend its corporatelimits by annexation, which occurs periodically when deemed appropriate by the Board <strong>of</strong> Mayor andAldermen.The <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> has operated under the council-manager form <strong>of</strong> government since 1917. Policymakingand legislative authority are vested in the Board <strong>of</strong> Mayor and Aldermen (BMA) consisting <strong>of</strong> themayor and six other members. The BMA is responsible, among other things, for passing ordinances,resolutions, adopting the budget, appointing committees, and hiring the <strong>City</strong> Manager. The <strong>City</strong>'sManager is responsible for carrying out the policies and ordinances <strong>of</strong> the BMA, for overseeing the dayto-dayoperations <strong>of</strong> the <strong>City</strong> and for appointing the heads <strong>of</strong> various departments. The BMA is elected ona non-partisan basis. Board members serve four-year staggered terms, with an election every two years.The Mayor is elected to serve a two-year term. The <strong>City</strong> Manager serves at the pleasure <strong>of</strong> the Board .The <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> provides a full range <strong>of</strong> services, including police, fire and rescue, elementary andsecondary education, street construction and maintenance, planning and zoning , parks and recreation ,cultural events, public transportation and general administrative services. In addition, water and sewerservice, storm water management, solid waste collection, convention center and golf course are providedunder an Enterprise Fund concept with user charges established by the BMA to ensure adequatecoverage <strong>of</strong> operating expenses and payments on outstanding debt. Vehicle maintenance andreplacement and self-insurance activities are provided through Internal Service Funds. The <strong>City</strong> <strong>of</strong><strong>Kingsport</strong> provides water and sewer service and solid waste collection service outside the city limits.The <strong>City</strong> is financially accountable for two legally separate organizations; the Industrial DevelopmentBoard <strong>of</strong> <strong>Kingsport</strong> and the Emergency Communications District <strong>of</strong> <strong>Kingsport</strong>. Both <strong>of</strong> theseorganizations are reported separately within the <strong>City</strong>'s financial statements. Additional information onthese legally separate entities can be found in the notes to the financial statements (see note 1.A) .The annual budget serves as the foundation for the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s financial planning and control. Alldepartments <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> are required to submit requests for appropriation to the <strong>City</strong>Manager. The <strong>City</strong> Manager uses these requests as the starting point for developing a proposed budget.The <strong>City</strong> Manager then presents th is proposed budget to the BMA for review by May 15 th . The BMA isrequired to hold two public hearings on the proposed budget and to adopt a final budget no later thanJune 30, the close <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s fiscal year. The appropriation budget is prepared by fund ,function and department. The <strong>City</strong> Manager may make transfers <strong>of</strong> appropriations with in a departmentand between departments within any fund . Transfers <strong>of</strong> appropriations between funds, however, requirethe approval <strong>of</strong> the BMA. Budget-to-actual comparisons are provided in this report. The general fundcomparison is presented on pages 35 through 37 as part <strong>of</strong> the basic financial statements for the <strong>City</strong>'sfunds.Factors Affecting <strong>Financial</strong> ConditionThe information presented in the financial statements is perhaps best understood when it is consideredfrom the broader perspective <strong>of</strong> the specific environment within which the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> operates.Local Economy <strong>Kingsport</strong> is the largest <strong>City</strong> in the <strong>Kingsport</strong> - Bristol, TN - Bristol, VA MetropolitanStatistical Area which has a population <strong>of</strong> 312 ,908 (per 2011 U.S. Census ACS 1-Year Estimates). On aregional basis, there are approximately 416,000 persons living within a radius <strong>of</strong> 25 miles, 896 ,000persons living within a radius <strong>of</strong> 50 miles and 1,898,000 persons living within a radius <strong>of</strong> 75 miles.Job creation, sales tax collections and Eastman Chemical all continued to rebound in <strong>Kingsport</strong> in <strong>2012</strong>, asthe <strong>City</strong> eclipsed pre-recession retail sales figures posted in 2007, third quarter unemployment dropped to 7.22

percent following 10 consecutive quarters <strong>of</strong> job growth, and Eastman completed its $4.3 billion acquisition <strong>of</strong>Solutia, bringing new jobs and talent to <strong>Kingsport</strong>.Economic diversification also continued to pick up, with continuing <strong>City</strong> focus on growing the AcademicVillage, a recovering new housing construction market, and renewed retail reinvestment as well.Eastman Chemical Company, a FORTUNE 500 company which employs approximately 6,700 employeesand between 2,500 to 3,000 contractors in <strong>Kingsport</strong>, is the second largest private employer in Tennessee,largest regional employer and largest taxpayer in the <strong>City</strong>. Eastman completed its $4.3 billion acquisition <strong>of</strong>Solutia, a global company with 3,400 employees on five continents, and 24 manufacturing locations. Itposted $2.1 billion in annual sales in 2011 . Approximately 300 pr<strong>of</strong>essional jobs were added to the <strong>Kingsport</strong>area as a result <strong>of</strong> this acquisition.Solutia is active in rubber materials, performance films and advanced interlayers, specialty fluids andphotovoltaics.Eastman had 2011 pro forma revenues, giving effect to the Solutia acquisition, <strong>of</strong> approximately $9.3 billion.The company is based in <strong>Kingsport</strong>, and, with the completion <strong>of</strong> the Solutia acquisition, now employsapproximately 13,500 people around the world .Eastman, which has had a major presence in <strong>Kingsport</strong> since 1920, is a leading supplier <strong>of</strong> coatings rawmaterials, specialty chemicals and plastics, as well as fine chemicals for pharmaceutical, agriculturalchemicals, and other markets.In addition, Eastman manufactures cellulose esters used in LCD screens as well as Bisphenol - free (BPA)plastics for the food industry in <strong>Kingsport</strong>. Eastman has added three new product lines in <strong>Kingsport</strong> over thelast few years.The <strong>Kingsport</strong>, TN-based company reported adjusted third quarter net income <strong>of</strong> $1 .57 per share in <strong>2012</strong>, upmore than 24% from $1 .26 per share in the year-ago period. Revenue rose 25% from last year to $2.26billion.Meanwhile, BAE Systems, contracted operator <strong>of</strong> Holston Army Ammunition Plant on the <strong>City</strong>'s westernborder, continues to employ more than 540 persons at this facility engaged in the production <strong>of</strong> highexplosives for the U.S. Military. In addition, the Army and BAE are undertaking a $140 million modernization<strong>of</strong> the facility.Job growth and confidence in the local economy are further reflected in the sales tax performance <strong>of</strong><strong>Kingsport</strong>. For Fiscal Year <strong>2012</strong>, sales tax collections were up 6.36 percent above the previous year, whileNovember <strong>2012</strong> collections representing September sales were up 7.61 percentMajor retail announcements for <strong>2012</strong> include the development <strong>of</strong> a new 12 screen theatre complex at the<strong>Kingsport</strong> Town Center mall, with five 3D screens and an IMAX facility.In addition, Belk reinvested $1 .2 million plus in the <strong>Kingsport</strong> Town Center facility, while two new furniturestores, Ashley's Furniture, and Zak's Attic, also opened their doors in <strong>Kingsport</strong> in <strong>2012</strong>, helping recover amajor categorical source <strong>of</strong> sales tax leakage.Notably, while Eastman Chemical Company represented 40 percent <strong>of</strong> all property tax revenue for the <strong>City</strong>some 20 years ago, today that ratio is in the range <strong>of</strong> 25 percent, with the change largely due to the growth <strong>of</strong>commercial , medical, retail and residential properties in the community.In particular, the medical sector has been an important source <strong>of</strong> job growth in the <strong>City</strong>. <strong>Kingsport</strong> is home to3

During FY<strong>2012</strong>, the <strong>City</strong> adopted a new comprehensive Debt Management Policy to comply with newrequirements from the State <strong>of</strong> Tennessee. This new policy replaced the <strong>City</strong>'s existing debtmanagement policy and provides specific guidelines for the <strong>City</strong> to manage its debt and related annualcosts while promoting understanding and transparency for citizens, taxpayers, rate payers, businesses,vendors, investors and other interested parties.Major InitiativesIn <strong>2012</strong>, <strong>Kingsport</strong> continued an active focus on the promotion <strong>of</strong> access to higher education, peoplerecruitment, and tourism development.<strong>Kingsport</strong>'s Academic Village, featuring five structures, including the Regional Center for AdvancedManufacturing (RCAM), provides both pr<strong>of</strong>essional degree programs and industry-specific training tosupport existing businesses and recruit new industry.The Academic Village currently hosts Northeast State Community College, with NSCC enrollmentgrowing 127 percent, from 753 in 2007 to 1,706 in <strong>2012</strong>. Including students attending King College,Lincoln Memorial University, and the University <strong>of</strong> Tennessee, <strong>2012</strong> attendance is more than 2,000students.And , late this year, East Tennessee State University, announced that it would locate a downtown facilitythat could push total enrollment to more than 3,000 by 2018.<strong>Kingsport</strong>'s efforts in Higher Education have been honored by Harvard University, the National League <strong>of</strong>Cities and the Tennessee Municipal League.According to the U.S. Census Bureau, <strong>Kingsport</strong> has recognized a 36 percent increase in the populationwith an associate degree and a 34 percent increase in population with graduate and higher level degrees.A full 24 percent <strong>of</strong> the population holds a bachelor's degree, graduate degree or higher.<strong>Kingsport</strong> also continued to annex urbanized areas on the <strong>City</strong> fringe including many neighbourhoods thatalready received at least some urban services. Incorporation provides for the orderly development <strong>of</strong>these already established areas, new opportunities for reinvestment in these areas, and generates newrevenue to support on-going <strong>City</strong> operations. It also provides the <strong>City</strong> additional abilities to makeimprovements to water quality and other environmental issues related to sanitary and storm water seweroperations.Statistics compiled by <strong>Kingsport</strong>'s Development Services <strong>of</strong>fice indicate that each newcomer generated$25,000 per year in consumer expenditures. And based on the number <strong>of</strong> newcomers to <strong>Kingsport</strong> since2006, the impact is estimated at more than $30 million annually.<strong>Kingsport</strong> also hosted the American Association <strong>of</strong> Retirement Communities national conference this yearat the MeadowView Marriott Conference, Resort, and Convention Center, and was presented with theAARC's prestigious "Seal <strong>of</strong> Approval.<strong>Kingsport</strong>'s Liveable Community Collaborative, an effort to improve the everyday walk ability andliveability <strong>of</strong> the Community for seniors and youngsters alike earned an Award <strong>of</strong> Excellence in ProgramInnovation from the Archstone Foundation and the American Public Health Association at the APHA'srecent annual conference in San Francisco.Meanwhile, <strong>Kingsport</strong>'s investment in the Marriott MeadowView Conference, Resort & Convention Centerpaid <strong>of</strong>f with the best sales volume ever in <strong>2012</strong> for the facility, following $16 million in public reinvestmentin the facility in 2011 .5

In addition, a new 50-meter indoor aquatic center in the MeadowView area is scheduled for completion inMay 2013, along with an outdoor water park area as well. The facility is designed to meet thecommunity's immediate needs as well as serve as a new tourist attraction for the region . The 50-meterpool is the only such facility within a 120 mile radius. The project is collocated with a YMCA fitness facility.In April <strong>2012</strong>, the Board <strong>of</strong> Mayor and Aldermen adopted a new defined contribution retirement plan for allfull-time municipal and non-teacher employees that were hired after June 30, <strong>2012</strong>. The new plan is a401 (a) defined contribution plan with a 457(b) supplemental plan to accommodate voluntary employeecontributions. This new plan requires the employee and the <strong>City</strong> to each contribute 5 percent <strong>of</strong> salaryinto the program. Employee voluntary contributions into the 457(b) are matched by the <strong>City</strong> up to 3percent.The <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> has recently implemented several efficiencies within their Public Works Operations.This past year, the <strong>City</strong> has begun the implementation <strong>of</strong> automated single-stream curbside recyclecollection. The initial step in this conversion was to transfer the sorting <strong>of</strong> recyclable material from thecurbside to a single location. Not only does the new system expand the collection <strong>of</strong>fering to include highvalued cardboard, but also gives the <strong>City</strong> the ability to collect on a two week rotation rather than weekly.Additionally, the <strong>City</strong> has included an automated leaf collection truck into its fleet. This one manoperation is able to perform the same amount <strong>of</strong> production as three separate three-man crews utilizingthe older manual collection technologies. Additionally, due to the use <strong>of</strong> this automated equipment, taskspreviously done manually will either be Significantly reduced or eliminated. It is expected that workrelatedinjuries will be reduced and improvements made to the overall safe working conditions <strong>of</strong> theemployee.<strong>Kingsport</strong> also embarked on the first steps in creating a Border Region Retail Tourist District under a newTennessee law written and initiated by the <strong>City</strong>. It has secured an agreement with a principal propertyowner in the district, as well as two other major parcels, and is beginning marketing <strong>of</strong> the site.<strong>Kingsport</strong>'s Retail Tourism District is located at the intersection <strong>of</strong> 1-26 and 1-81 , providing newopportunities to expand the tax base and continue diversification <strong>of</strong> the local economy.Awards and AcknowledgementsAwards The Government Finance Officers' Association <strong>of</strong> the United States and Canada (GFOA)awarded a Certificate <strong>of</strong> Achievement for Excellence in <strong>Financial</strong> <strong>Report</strong>ing to the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> for itscomprehensive annual financial report (CAFR) for the fiscal year ended June 30, 2011 . This was the 12thconsecutive year that the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> has achieved this prestigious award. In order to be awarded aCertificate <strong>of</strong> Achievement, a government unit must publish an easily readable and efficiently organizedcomprehensive annual financial report. This report must satisfy both generally accepted accountingprinciples and applicable legal requirements.A Certificate <strong>of</strong> Achievement is valid for a period <strong>of</strong> one year only. We believe our current comprehensiveannual financial report continues to meet the Certificate <strong>of</strong> Achievement Program's requirements and weare submitting it to GFOA to determine its eligibility for another certificate.In addition, the <strong>City</strong> also received the GFOA's Distinguished Budget Presentation Award for its annualbudget document dated July 1, 2011 . The annual budget document dated July 1, <strong>2012</strong> has beensubmitted to the GFOA for review and it is anticipated that it will also receive this award. In order toqualify for the Distinguished Budget Presentation Award , the <strong>City</strong>'s budget document was judged to bepr<strong>of</strong>icient in several categories, including as a policy document, a financial plan , an operations guide, anda communications device.6

Acknowledgment The preparation <strong>of</strong> this CAFR could not have been accomplished without the effortsand dedication <strong>of</strong> the staff <strong>of</strong> the Department <strong>of</strong> Finance. We would like to express our appreciation to allstaff members and other personnel from various departments, agencies, and authorities that assisted inits preparation , especially Comptroller Lisa Winkle for all <strong>of</strong> the hard work and numerous hours she put into ensure the timely completion <strong>of</strong> this report. We would also like to thank the Board <strong>of</strong> Mayor andAldermen for their guidance and support.Respectfully submitted,1~,Aa,..~John G. Campbell. ty Manager~tt ').v--. ----.' 1James H. Demming<strong>City</strong> Recorder/CFO7

Certificate <strong>of</strong>Achievementfor Excellencein <strong>Financial</strong><strong>Report</strong>ingPresented to<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>TennesseeFor its <strong>Comprehensive</strong> <strong>Annual</strong><strong>Financial</strong> <strong>Report</strong>for the Fiscal Year EndedJune 30, 2011A Certificate <strong>of</strong> Achievement for Excellence in <strong>Financial</strong><strong>Report</strong>ing is presented by the Government Finance OfficersAssociation <strong>of</strong> the United States and Canada togovernment units and public employee retirementsystems whose comprehensive annual financialreports (CAFRs) achieve the higheststandards in government accountingand financial reporting.~ p 7I.(.otM.tIPresident~/.~Executive Director8

<strong>City</strong> <strong>of</strong>ELECTORATEBOARD OF MAYORAND ALDERMANBOARD OF EDUCATIONCITY MANAGERJohn G. CampbellDIRECTOR OFSCHOOLSDr. Lyle AilshieASSISTANT CITYMANAGERDEVELOPMENTT. Jeffery FlemingBUDGET OFFICEJudy A. SmithASSISTANT TO CITYMANAGERChris McCarttCITY ATTORNEYJ. Michael BillingsleyFIRE DEPARTMENTCraig T. DyePOLICE DEPARTMENTGale OsborneCITY RECORDERJames H. DemmingPUBLIC WORKSRyan O. McReynoldsCOMMUNITY & GOVRELAIONS DIRECTORTim WhaleyFLEETSteve HightowerPROCUREMENTSandy CrawfordBUILDINGPUBLIC TRANSITCODE ENFORCEMENTCENTRAL DISPATCHFINANCEWATER UTILITYGRANTS & GOVRELATIONSPLANNINGLEISURE SERVICESHUMAN RESOURCESCOMMUNICATIONSINFORMATIONSERVICESSEWER UTILITYGEOGRAPHICINFORMATIONSYSTEMSRISK MANAGEMENTCITY CLERKSOLID WASTE UTILITYMETROPOLITANPLANNINGORGANIZATIONSTORM WATERUTILITYTRANSPORTATIONENGINEERINGPROPERTYMAINTENANCE9

CITY OF KINGSPORT, TENNESSEEHISTORY AND ORGANIZATIONThe <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> was incorporated in 1917 and has been operated under theCouncil-Manager form <strong>of</strong> government since that time. The Board <strong>of</strong> Mayor and Aldermen wasexpanded from five to seven members through a Charter amendment effective May 15, 1973.On the third Tuesday in May <strong>of</strong> each odd numbered year three members are elected by thequalified voters <strong>of</strong> the <strong>City</strong> for a four-year term and the mayor is elected for a two-year termbeginning at the first regular meeting <strong>of</strong> the Board in July following the election. The Boardappoints a <strong>City</strong> Manager who is responsible for the administration <strong>of</strong> the <strong>City</strong> according to theCharter and Ordinances in effect.The <strong>City</strong> Manager appoints various department heads,<strong>of</strong>ficials and employees to operate the <strong>City</strong> except for the Education Department. The Board <strong>of</strong>Education, consisting <strong>of</strong> five members with two or three elected by the qualified voters <strong>of</strong> the<strong>City</strong> each odd number year, is responsible for the hiring <strong>of</strong> a Director <strong>of</strong> Schools and otherpersonnel, formulating policies and operating the school system within the framework <strong>of</strong> Statestatutes and the <strong>City</strong> Charter and Code.Pay scales for employees and <strong>of</strong>ficials <strong>of</strong> all departments are approved by the Board <strong>of</strong>Mayor and Aldermen, and all appropriations <strong>of</strong> funds are made by the Board.10

CITY OF KINGSPORT, TENNESSEEPRINCIPAL OFFICIALSAS OFJune 30, <strong>2012</strong>BOARD OF MAYOR AND ALDERMENDennis R. PhillipsTom C. ParhamJohn ClarkValerie JohMike McIntireTom SegelhorstJantry ShupeMayorVice MayorAldermanAldermanAldermanAldermanAldermanCHARTER OFFICERSJohn G. Campbell<strong>City</strong> ManagerJames H. Demming<strong>City</strong> Recorder/Chief <strong>Financial</strong> OfficerJ. Michael Billingsley <strong>City</strong> AttorneyGale OsbornePolice ChiefWilliam K. Rogers<strong>City</strong> JudgeDr. Lyle C. AilshieSuperintendent <strong>of</strong> SchoolsDEPARTMENT HEADSChristopher W. McCarttAssistant to the <strong>City</strong> ManagerCraig T. DyeFire ChiefRyan O. McReynoldsPublic Works DirectorT. Jeffrey Fleming Assistant <strong>City</strong> Manager for DevelopmentJudy A. SmithBudget Officer11

THIS PAGE INTENTIONALLY LEFT BLANK

CITY OF KINGSPORT, TENNESSEEBASIC FINANCIAL STATEMENTSAND SUPPLEMENTARY INFORMATION WITHINDEPENDENT AUDITORS’ REPORTFor the Fiscal Year Ended June 30, <strong>2012</strong>

BROWNEDWARDScertified public accountantsINDEPENDENT AUDITOR'S REPORTHonorable Mayor and Board <strong>of</strong> Aldermen<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong><strong>Kingsport</strong>, Tennessee 37660We have audited the accompanying financial statements <strong>of</strong> the governmental activities, thebusiness-type activities, the aggregate discretely presented component units, each major fund, and theaggregate remaining fund information <strong>of</strong> the <strong>City</strong> <strong>of</strong> KingspOlt, Tennessee, ("the <strong>City</strong>") as <strong>of</strong> and for theyear ended June 30, <strong>2012</strong>, which collectively comprise the <strong>City</strong>'s basic financial statements as listed inthe table <strong>of</strong> contents. These financial statements are the responsibility <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>,Tennessee's management. Our responsibility is to express opinions on these financial statements basedon our audit. We did not audit the financial statements <strong>of</strong> the Emergency Communications District (theECD), which represent 15 percent, 27 percent, and 25 percent, respectiveiy, <strong>of</strong> the assets, net assets, andrevenues <strong>of</strong> the aggregate discretely presented component units. Those financial statements were auditedby other auditors whose report thereon has been furnished to us, and our opinion, ins<strong>of</strong>ar as it relates tothe amounts included for the ECD, is based on the report <strong>of</strong> the other auditors.We conducted our audit in accordance with auditing standards generally accepted in the UnitedStates <strong>of</strong> America and the standards applicable to financial audits contained in Government AuditingStandards, issued by the Comptroller General <strong>of</strong> the United States, and the requirements prescribed by theComptroller <strong>of</strong> the Treasury, State <strong>of</strong> Tennessee. Those standards require that we plan and perform theaudit to obtain reasonable assurance about whether the financial statements are free <strong>of</strong> materialmisstatement. An audit includes examining, on a test basis, evidence supporting the amounts anddisclosures in the financial statements. An audit also includes assessing the accounting principles usedand significant estimates made by management, as well as evaluating the overall financial statementpresentation. We believe that our audit and the report <strong>of</strong> the other auditors provide a reasonable basis forour opinions.In our opinion, based on our audit and the report <strong>of</strong> the other auditors, the financial statementsreferred to above present fairly, in all material respects, the respective financial position <strong>of</strong> thegovernmental activities, the business-type activities, the aggregate discretely presented component units,each major fund, and the aggregate remaining fund information <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>, Tennessee as <strong>of</strong>June 30, <strong>2012</strong>, and the respective changes in financial position and, where applicable, cash flows there<strong>of</strong>and the respective budgetary comparison for the General Fund and the General Purpose School Fund forthe year then ended in conformity with accounting principles generally accepted in the United States <strong>of</strong>America.In accordance with Government Auditing Standards, we have also issued our report datedDecember 26, <strong>2012</strong>, on our consideration <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>, Tennessee's internal control overfinancial repOlting and on our tests <strong>of</strong> its compliance with certain provisions <strong>of</strong> laws, regulations,contracts, and grant agreements and other matters. The purpose <strong>of</strong> that report is to describe the scope <strong>of</strong>our testing <strong>of</strong> internal control over financial reporting and compliance and the results <strong>of</strong> that testing, andnot to provide an opinion on internal control over financial reporting or on compliance. That report is anintegral part <strong>of</strong> an audit performed in accordance with Government Auditing Standards and should beconsidered in assessing the results <strong>of</strong> our audit.---------- - Providing Pr<strong>of</strong>essional Business Advisory & Consulting Services -----------1969 Lee Highway. P.O. Box 16999. Bristol, VA 24209-6999 • 276-466-5248 • Fax: 276-466-9241 • www.BEcpas.comMember: SEC and Private Companies Practice Sections <strong>of</strong> American Institute <strong>of</strong> Certified Public Accountants12

Accounting principles generally accepted in the United States <strong>of</strong> America require that themanagement's discussion and analysis, schedules <strong>of</strong> funding progress, and budgetary comparisoninformation for the debt service fund on pages 14 through 26, pages 132 through 133, and page 134 bepresented to supplement the basic financial statements. Such information, although not a part <strong>of</strong> the basicfinancial statements, is required by the Governmental Accounting Standards Board, who considers it to bean essential part <strong>of</strong> financial reporting for placing the basic financial statements in an appropriateoperational, economic, or historical context. We and the other auditors have applied certain limitedprocedures to the required supplementary information in accordance with auditing standards generallyaccepted in the United States <strong>of</strong> America, which consisted <strong>of</strong> inquiries <strong>of</strong> management about the methods<strong>of</strong> preparing the information and comparing the information for consistency with management'sresponses to our inquiries, the basic financial statements, and other knowledge we obtained during ouraudit <strong>of</strong> the basic financial statements. We do not express an opinion or provide any assurance on theinformation because the limited procedures do not provide us with sufficient evidence to express anopinion or provide any assurance.Our audit was conducted for the purpose <strong>of</strong> forming opinions on the financial statements thatcollectively comprise the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>, Tennessee's financial statements. The accompanyingcombining and individual fund financial statements and schedules, and supplemental information,including the schedule <strong>of</strong> expenditures <strong>of</strong> federal awards, as required by U.S. Office <strong>of</strong> Management andBudget Circular A-133, Audits <strong>of</strong> States, Local Governments, and Non-Pr<strong>of</strong>it Organizations, arepresented for purposes <strong>of</strong> additional analysis and are not a required part <strong>of</strong> the financial statements. Suchinformation is the responsibility <strong>of</strong> management and was derived from and relates directly to theunderlying accounting and other records used to prepare the financial statements. The information hasbeen SUbjected to the auditing procedures applied by us and the other auditors in the audit <strong>of</strong> the financialstatements and certain additional procedures, including comparing and reconciling such informationdirectly to the underlying accounting and other records used to prepare the financial statements or to thefinancial statements themselves, and other additional procedures in accordance with auditing standardsgenerally accepted in the United States <strong>of</strong> America. In our opinion, based on our audit and the report <strong>of</strong>other auditors, the combining and individual fund financial statements and schedules, and supplementalinformation, including the schedule <strong>of</strong> expenditures <strong>of</strong> federal awards are fairly stated in all materialrespects in relation to the financial statements as a whole.Our audit was conducted for the purpose <strong>of</strong> forming opinions on the financial statements thatcollectively comprise the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>, Tennessee's financial statements. The introductory andstatistical sections are presented for the purposes <strong>of</strong> additional analysis and are not a required part <strong>of</strong> thebasic financial statements. Such information has not been subjected to the auditing procedures applied byus and the other auditors in the audit <strong>of</strong> the basic financial statements and, accordingly, we do not expressan opinion or provide any assurance on it.CERTIFIED PUBLIC ACCOUNTANTSBristol, VirginiaDecember 26, <strong>2012</strong>13

THIS PAGE INTENTIONALLY LEFT BLANK

A. MANAGEMENT'S DISCUSSION AND ANALYSIS

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)As management <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> (the <strong>City</strong>), we <strong>of</strong>fer readers <strong>of</strong> the <strong>City</strong>'s financial statements thisnarrative overview and analysis <strong>of</strong> the financial activities <strong>of</strong> the <strong>City</strong> for the fiscal year ended June 30,<strong>2012</strong>. We encourage readers to consider the information presented here in conjunction with additionalinformation that we have furnished in our letter <strong>of</strong> transmittal, which can be found on pages 1 through 7 <strong>of</strong>this report.<strong>Financial</strong> HighlightsThe assets <strong>of</strong> the <strong>City</strong> exceeded its liabilities at the close <strong>of</strong> the most recent fiscal year by$429,935 (net assets). Of this amount, $18,057 (unrestricted net assets) may be used to meet the<strong>City</strong>'s ongoing obligations to citizens and creditors.The <strong>City</strong>'s total net assets decreased by $8,359. Of this decrease $4,012 relates to currentoperations and can be attributed to accruing OPEB liabilities and recording depreciation ongovernmental capital assets. The additional decrease <strong>of</strong> $4,347 relates to prior period adjustmentsto write <strong>of</strong>f certain capital assets, record claims payable, and correct landfill closure costs.As <strong>of</strong> the close <strong>of</strong> the current fiscal year, the <strong>City</strong>'s governmental funds reported combined endingfund balances <strong>of</strong> $54,542, an increase <strong>of</strong> $225. Approximately 22% <strong>of</strong> this total fund balance,$11,810, is unassigned and therefore available for spending at the <strong>City</strong>'s discretion.At the end <strong>of</strong> the current fiscal year, unassigned fund balance for the general fund was $11,810 orapproximately 18% <strong>of</strong> total general fund expenditures including transfers out.The <strong>City</strong>'s total gross debt increased by $18,464 (9%) during the current fiscal year. The increaseis the result <strong>of</strong> three new bond issues. General Obligation Public Improvement Bonds, Series 2011were issued in December 2011 for $16,140. General Obligation Bonds, Series <strong>2012</strong>A were issuedin June <strong>2012</strong> for $3,110. General Obligation Public Improvement Bonds, Series <strong>2012</strong>C wereissued in June <strong>2012</strong> for $9,305. In addition the <strong>City</strong> issued General Obligation Refunding Bonds,Series <strong>2012</strong>B in June <strong>2012</strong> for $9,970. The <strong>2012</strong>B Refunding Bonds <strong>of</strong> $9,970 refunded certain2003 and 2004 bonds totaling $10,100.Overview <strong>of</strong> the <strong>Financial</strong> StatementsThis discussion and analysis is intended to serve as an introduction to the <strong>City</strong>'s basic financialstatements. The <strong>City</strong>'s basic financial statements comprise three components: 1) government-widefinancial statements, 2) fund financial statements and 3) notes to the financial statements. This report alsocontains other supplementary information in addition to the basic financial statements themselves.Government-wide financial statementsThe government-wide financial statements are designed to provide readers with a broad overview <strong>of</strong> the<strong>City</strong>'s finances in a manner similar to a private-sector business.The statement <strong>of</strong> net assets presents information on all <strong>of</strong> the <strong>City</strong>'s assets and liabilities, with thedifference between the two reported as net assets. Over time, increases or decreases in net assets mayserve as a useful indicator <strong>of</strong> whether the financial position <strong>of</strong> the <strong>City</strong> is improving or deteriorating.14

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)The statement <strong>of</strong> activities presents information showing how the <strong>City</strong>'s net assets changed during themost recent fiscal year. All changes in net assets are reported as soon as the underlying event giving rise tothe change occurs, regardless <strong>of</strong> the timing <strong>of</strong> related cash flows. Thus, revenues and expenses arereported in this statement for some items that will only result in cash flows in future fiscal periods (e.g.,uncollected taxes or earned but unused vacation leave, etc.).Both <strong>of</strong> the government-wide financial statements distinguish functions <strong>of</strong> the <strong>City</strong> that are principallysupported by taxes, licenses and permits, and intergovernmental revenues (governmental activities) fromother functions that are intended to recover all or a significant portion <strong>of</strong> their costs through user fees andcharges (business-type activities). The governmental activities <strong>of</strong> the <strong>City</strong> include general government, publicsafety, public works, highway transportation planning, economic and physical development, culture andrecreation, and education. The business-type activities <strong>of</strong> the <strong>City</strong> include water, sewer, solid waste, stormwater management, conference center and golf course. The government-wide financial statements can befound on pages 27 and 28 <strong>of</strong> this report.Fund financial statementsA fund is a grouping <strong>of</strong> related accounts that is used to maintain control over resources that have beensegregated for specific activities or objectives. The <strong>City</strong>, like other state and local governments, uses fundaccounting to ensure and demonstrate compliance with finance-related legal requirements. All <strong>of</strong> the funds <strong>of</strong>the <strong>City</strong> can be divided into two categories: governmental funds and proprietary funds.Governmental fundsGovernmental funds are used to account for essentially the same functions reported as governmentalactivities in the city-wide financial statements. However, unlike the government-wide financial statements,governmental fund financial statements focus on near-term inflows and outflows <strong>of</strong> spendable resources, aswell as on balances <strong>of</strong> spendable resources available at the end <strong>of</strong> the fiscal year. Such information may beuseful in evaluating a <strong>City</strong>'s near-term financing requirements. Because the focus <strong>of</strong> governmental funds isnarrower than that <strong>of</strong> the government-wide financial statements, it is useful to compare the informationpresented for governmental funds with similar information presented for governmental activities in thegovernment-wide financial statements. By doing so, readers may better understand the long-term impact <strong>of</strong>the government's near-term financing decisions. Both the governmental fund balance sheet and thegovernmental fund statement <strong>of</strong> revenues, expenditures, and changes in fund balances provide areconciliation to facilitate this comparison between governmental funds and governmental activities.The <strong>City</strong> maintains twenty-three (23) individual governmental funds. Nineteen (19) <strong>of</strong> these governmentalfunds are classified as nonmajor and are summarized under the heading "Other Governmental Funds" in thegovernmental fund presentation. Information is presented separately in the governmental fund balance sheetand in the governmental fund statement <strong>of</strong> revenues, expenditures, and changes in fund balances for thegeneral fund, the general purpose school fund, the capital project fund, the debt service fund and nonmajorgovernmental funds, all <strong>of</strong> which are combined into a single, aggregated presentation. Individual fund datafor nonmajor governmental funds is provided in the form <strong>of</strong> combining statements elsewhere in this report.The basic governmental fund financial statements can be found on pages 29-39 <strong>of</strong> this report.The <strong>City</strong> adopts an annual appropriation budget for its general and other major special revenue funds.Budgetary comparison statements have been provided for these funds to demonstrate compliance with thisbudget.15

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Proprietary fundsThe <strong>City</strong> maintains ten (10) different types <strong>of</strong> proprietary funds, including enterprise and internal servicefunds. Enterprise funds are used to report the same functions presented as business-type activities in thegovernment-wide financial statements. The <strong>City</strong> uses enterprise funds to account for its water, sewer, solidwaste, storm water management, convention center and golf course activities. Internal service funds are anaccounting device used to accumulate and allocate costs internally among the <strong>City</strong>'s various functions. The<strong>City</strong> uses internal service funds to account for vehicle maintenance and replacement and self-insuranceactivities. Because these services predominantly benefit governmental rather than business-type functions,they have been included within governmental activities in the government-wide financial statements.Proprietary funds provide the same type <strong>of</strong> information as the government-wide financial statements, only inmore detail. The proprietary fund financial statements provide separate information <strong>of</strong> the water, sewer, solidwaste, storm water management, convention center and golf course activities, which are considered to bemajor funds <strong>of</strong> the <strong>City</strong>. Conversely, internal service funds are combined into a single, aggregatedpresentation in the proprietary fund financial statements. Individual fund data for internal service funds isprovided in the form <strong>of</strong> combining statements elsewhere in this report. The basic proprietary fund financialstatements can be found on pages 40-44 <strong>of</strong> this report.Notes to the financial statementsThe notes provide additional information that is essential to a full understanding <strong>of</strong> the data provided in thegovernment-wide and fund financial statements. The notes to the financial statements can be found onpages 45-131 <strong>of</strong> this report.Other informationThe combining statements referred to earlier in connection with nonmajor governmental funds and internalservice funds are presented immediately following the required supplementary information. Combining andindividual fund statements and schedules can be found on pages 134-159 <strong>of</strong> this report.Government-wide <strong>Financial</strong> AnalysisAs noted earlier, net assets may serve over time as a useful indicator <strong>of</strong> a <strong>City</strong>'s financial position. In thecase <strong>of</strong> the <strong>City</strong>, assets exceed liabilities by $429,935 at the close <strong>of</strong> the most recent fiscal year.By far the largest portion <strong>of</strong> the <strong>City</strong>'s net assets (96%) reflects its investment in capital assets (e.g. land,buildings, equipment); less any related debt used to acquire those assets that is still outstanding. The <strong>City</strong>uses these capital assets to provide services to citizens; consequently, these assets are not available forfuture spending. Although the <strong>City</strong>'s investment in capital assets is reported net <strong>of</strong> related debt, it should benoted that the resources needed to repay this debt must be provided from other sources, since the capitalassets themselves cannot be used to liquidate these liabilities.16

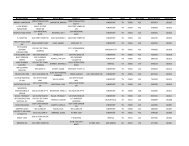

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s Net AssetsGovernmental Activities Business-Type Activities Total<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Current and Other Assets $ 130,044 $ 131,152 $ 36,273 $ 31,865 $ 166,317 $ 163,017Capital Assets 340,754 329,180 250,852 248,395 591,606 577,575Total Assets 470,798 460,332 287,125 280,260 757,923 740,592Long-term Liabilities Outstanding 159,840 138,537 95,408 92,938 255,248 231,475Other Liabilities 68,843 66,121 3,897 4,702 72,740 70,823Total Liabilities 228,683 204,658 99,305 97,640 327,988 302,298Net Assets:Invested in Capital Assets,net <strong>of</strong> Related Debt 241,652 246,177 169,428 163,891 411,080 410,068Restricted 178 185 620 1,432 798 1,617Unrestricted 285 9,312 17,772 17,297 18,057 26,609Total Net Assets $ 242,115 $ 255,674 $ 187,820 $ 182,620 $ 429,935 $ 438,294A portion <strong>of</strong> the <strong>City</strong>'s net assets, $798 (less than 1%) represents resources that are subject to externalrestrictions on how they may be used. The remaining balance <strong>of</strong> unrestricted net assets $18,057 may beused to meet the government's ongoing obligations to citizens and creditors.During the current fiscal year, the government's net assets decreased by $8,359. Net assets forgovernmental activities decreased by $13,559 while net assets for business-type activities increased by$5,200.The $13,559 current year decrease in net assets for governmental activities was primarily a result <strong>of</strong>recording the annual OPEB liability <strong>of</strong> $4,993 in accordance with GASB 45, as well as recording <strong>of</strong>$13,926 in depreciation expense on general fixed assets in accordance with GASB 34. In addition thedecrease in net assets for governmental activities includes prior period adjustments to write <strong>of</strong>f capitalassets <strong>of</strong> $1,365 and increase claims payable <strong>of</strong> $2,251.The primary reason for the increase in net assets in the business-type activities is due to the favorableresults <strong>of</strong> the <strong>City</strong>'s water and sewer utility funds. The rate structure in place for both the water and sewerutilities is consistently adequate in proving stable funding for operating costs and debt servicerequirements. Water rates remained the same for customers inside the <strong>City</strong> limits and customers outsidethe <strong>City</strong> limits. Sewer rates increased 5% for outside customers while customers inside the <strong>City</strong> remainedat the same rates. These rate increases are part <strong>of</strong> a continuing rate stabilization plan to provide fundingfor capital improvements and expansion.17

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)The following is a summary <strong>of</strong> activities for the <strong>City</strong> during the fiscal year ended June 30, <strong>2012</strong>:<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s Change in Net AssetsGovernmental Activities Business-Type Activities Total<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Revenues:Program Revenues:Charges for Services $ 6,508 $ 8,081 $ 28,227 $ 26,732 $ 34,735 $ 34,813Operating Grants and Contributions 38,727 37,442 187 230 38,914 37,672Capital Grants and Contributions 4,787 9,218 66 655 4,853 9,873General RevenuesProperty Taxes 48,236 47,145 0 0 48,236 47,145Sales Taxes 29,470 27,515 0 0 29,470 27,515Other Taxes and Intergovernmental 5,634 5,235 0 0 5,634 5,235Unrestricted Investment Earnings 401 421 153 147 554 568Grants and Contributions NotRestricted to Specific Programs 1,361 987 0 0 1,361 987Other 961 755 6 0 967 755Total Revenues 136,085 136,799 28,639 27,764 164,724 164,563Expenses:General Government 12,575 14,877 0 0 12,575 14,877Public Safety 20,995 20,186 0 0 20,995 20,186Public Works 13,398 15,325 0 0 13,398 15,325Highway Transportation Planning 3,805 3,847 0 0 3,805 3,847Economic and Physical Development 4,853 4,792 0 0 4,853 4,792Culture and Recreation 6,691 6,591 0 0 6,691 6,591Education 75,545 75,901 0 0 75,545 75,901Interest on Long-term Debt 4,551 4,718 0 0 4,551 4,718Water 0 0 10,329 9,630 10,329 9,630Sewer 0 0 8,267 8,228 8,267 8,228Solid Waste Management 0 0 4,367 4,010 4,367 4,010Storm Water Management 0 0 672 0 672 0MeadowView Conference Resortand Convention Center 0 0 1,363 1,598 1,363 1,598Cattails at MeadowView Golf Course 0 0 1,325 1,384 1,325 1,384Total Expenses 142,413 146,237 26,323 24,850 168,736 171,087Increase (Decrease) in Net Assetsbefore Transfers (6,328) (9,438) 2,316 2,914 (4,012) (6,524)Transfers (3,615) (4,425) 3,615 4,425 0 0Change in Net Assets (9,943) (13,863) 5,931 7,339 (4,012) (6,524)Net Assets, beginning <strong>of</strong> period 255,674 269,370 182,620 175,281 438,294 444,651Prior Period Adjustment - Seized Cash 0 167 0 0 0 167Prior Period Adjustment - Capital Assets (1,365) 0 0 0 (1,365) 0Prior Period Adjustment - Claims Payable (2,251) 0 0 0 (2,251) 0Prior Period Adjustment - Landfill Costs 0 0 (731) 0 (731) 0Net Assets, end <strong>of</strong> period $ 242,115 $ 255,674 $ 187,820 $ 182,620 $ 429,935 $ 438,29418

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Governmental Activities - RevenueGovernmental activities reduced the <strong>City</strong>'s net assets by $13,559. The <strong>City</strong>’s governmental revenuestotaling $136,085 was less than the prior year by $714. Charges for services and capital grants andcontributions were less than the prior year by $1,573 and $4,431, respectively. However property taxeswere more than the prior year by $1,091 and sales taxes were more than the prior year by $1,955.Revenues by Source - Governmental ActivitiesSales Taxes22%Property Taxes35%Operating Grantsand Contributions28%Other2%Capital Grants andContributions4%Charges for Services5%Other Taxes andIntergovernmental4%19

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Governmental Activities – Operating ExpensesOperating expenses for governmental activities were less than the prior year by $3,824. Operatingexpenses for the general government function was less than the prior year by $2,302 while operatingexpenses for the public works function was less than the prior year by $1,927.$80,000Operating Expenses by Function - Governmental Activities$70,000$60,000$50,000$40,000$30,000$20,000$10,000$-GeneralGovernmentPublic SafetyPublic WorksHighwayTransportationand PlanningEconomic andPhysicalDevelopmentCulture andRecreationEducationInterest on Long-Term DebtFY<strong>2012</strong> $12,575 $20,995 $13,398 $3,805 $4,853 $6,691 $75,545 $4,551FY2011 $14,877 $20,186 $15,325 $3,847 $4,792 $6,591 $75,901 $4,71820

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Business-Type Activities - RevenueBusiness-type activities increased the <strong>City</strong>'s net assets by $5,200. The <strong>City</strong>’s business-type revenues totaling$28,639 was more than the prior year by $875. A primary factor in the increased revenue is the <strong>City</strong>’s StormWater Management Fund which was established in December 2011.Revenue by Source - Business-Type ActivitiesCapital Grants andContributions0%Operating Grantsand Contributions1%Other0%Charges forServices99%21

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Business-Type Activities – Operating ExpensesOperating expenses for business-type activities were more than the prior year by $1,473. Of this, $672relates to the newly established Storm Water Management Fund. In addition Water Fund operatingexpenses were more than the prior year by $699 primarily due to the cost <strong>of</strong> feasibility studies that couldnot be capitalized.$12,000Operating Expenses by Function - Business-Type Activities$10,000$8,000$6,000$4,000$2,000$-WaterSewerSolid WasteManagementStorm WaterManagementMeadowViewConference CenterCattails atMeadowView GolfCourseFY<strong>2012</strong> $10,329 $8,267 $4,367 $672 $1,363 $1,325FY2011 $9,630 $8,228 $4,010 $- $1,598 $1,38422

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)<strong>Financial</strong> Analysis <strong>of</strong> the <strong>City</strong>'s FundsAs noted earlier, the <strong>City</strong> uses fund accounting to ensure and demonstrate compliance with finance-relatedlegal requirements.Governmental FundsThe focus <strong>of</strong> the <strong>City</strong>'s governmental funds is to provide information on near-term inflows, outflows, andbalances <strong>of</strong> spendable resources. Such information is useful in assessing the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s financingrequirements. In particular, unreserved fund balance may serve as a useful measure <strong>of</strong> a <strong>City</strong>'s netresources available for spending at the end <strong>of</strong> the fiscal year. As <strong>of</strong> the end <strong>of</strong> the current fiscal year, the<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s governmental funds reported combined ending fund balances <strong>of</strong> $54,542 an increase <strong>of</strong>$225 in comparison with the prior year. Approximately 22% <strong>of</strong> this total amount, $11,810 constitutesunassigned fund balance, which is available for spending at the <strong>City</strong>'s discretion. The remainder <strong>of</strong> fundbalance consists <strong>of</strong> $415 nonspendable primarily attributed to inventories and a perpetual care trust,$32,899 restricted primarily for capital projects, $15 committed for specific school projects, and $9,403assigned primarily to the <strong>City</strong>’s various governmental funds most significantly for education, capitalprojects, and debt service.The general fund is the chief operating fund <strong>of</strong> the <strong>City</strong>. At the end <strong>of</strong> the current fiscal year, unassigned fundbalance <strong>of</strong> the General Fund was $11,810 while total fund balance was $12,573. Of the total fund balance$23 is considered nonspendable while $740 is considered assigned. The majority <strong>of</strong> the assigned fundbalance represents fund balance allocations for fiscal year 2013. As a matter <strong>of</strong> the General Fund's liquidity,it may be useful to compare both unassigned fund balance and total fund balance to total fund expendituresand transfers out.Unassigned fund balance represents approximately 18% <strong>of</strong> total general fund expenditures and transfers out,while total fund balance represents 19% <strong>of</strong> that same amount. During fiscal year <strong>2012</strong>, the fund balance <strong>of</strong>the <strong>City</strong>'s General Fund decreased by $1,011. This decrease is less than the fund balance appropriationsapproved by the <strong>City</strong>’s Board <strong>of</strong> Mayor and Aldermen totaling $1,606.The general purpose school fund has a total fund balance <strong>of</strong> $3,870, <strong>of</strong> which most is unreserved. The netdecrease in fund balance during the current year in the general purpose school fund was $300.The capital project fund has a total fund balance <strong>of</strong> $33,508. Of this amount, $32,888 represents unspentbond proceeds restricted for capital projects. The remainder <strong>of</strong> $620 is assigned to the capital project fund.The net increase in this fund balance <strong>of</strong> $1,561 was primarily due to bond proceeds received during thecurrent fiscal year.The debt service fund has a total fund balance <strong>of</strong> $22. This represents a decrease <strong>of</strong> $148 as compared tothe previous fiscal year. This decrease is primarily a result <strong>of</strong> budgeted use <strong>of</strong> prior year’s investmentearnings to fund current year’s interest expense. In addition, the fund experienced a decrease in investmentearnings on bond proceeds. Debt service expenditures (principal and interest) totaled $9,976 for fiscal year<strong>2012</strong>. This was $225 less than the debt service expenditures paid in fiscal year 2011.Nonmajor (other) governmental funds have a fund balance <strong>of</strong> $4,569. The net increase in fund balanceduring the current year in nonmajor governmental funds was $123.23

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Proprietary fundsThe <strong>City</strong>'s proprietary funds provide the same type <strong>of</strong> information found in the government-wide financialstatements, but in more detail.Unrestricted net assets <strong>of</strong> the water and sewer funds at the end <strong>of</strong> the fiscal year amounted to $8,819 and$9,331 respectively. Other factors concerning the financial position <strong>of</strong> these funds have already beenaddressed in the discussion <strong>of</strong> the <strong>City</strong>'s business-type activities.General Fund Budgetary HighlightsDifferences between the original budget and the final amended budget represent a $389 decrease and aredetailed as follows:$ (718) Reduce appropriations fund-wide in accordance with available revenues163 Appropriate fund balance for furniture and equipment for Fire Station #828 Appropriate various donations received141 Provide funding for prior year encumbrances(3) Other miscellaneous$(389)By far the largest <strong>of</strong> the revenue reductions was $297 attributed to red light camera court costs. Well afterthe FY<strong>2012</strong> budget was adopted, the State <strong>of</strong> Tennessee passed legislature to disallow local court costs forcamera documented traffic violations.Capital Asset and Debt AdministrationCapital AssetsThe <strong>City</strong>'s investment in capital assets for its governmental and business-type activities as <strong>of</strong> June 30, <strong>2012</strong>,amounts to $591,606 (net <strong>of</strong> accumulated depreciation). This investment in capital assets includes land,buildings, improvements other than buildings, equipment, infrastructure and construction in progress.Major capital asset events during the current fiscal year included the following:The most significant business-type construction projects during fiscal year <strong>2012</strong> were completion <strong>of</strong>renovations and improvements at the sewer treatment plant and substantial completion <strong>of</strong> the buildingexpansion project at MeadowView Conference Center. Business-type construction in progress at theclose <strong>of</strong> the fiscal year was $71,328.Construction continued and/or began on a variety <strong>of</strong> general governmental projects including variousroad improvement projects. The most significant <strong>of</strong> the governmental projects during FY<strong>2012</strong> wasconstruction <strong>of</strong> an Aquatics Center. The budget for the Aquatic Center is currently $19,626. Construction<strong>of</strong> the indoor center is expected to be complete in spring 2013 with an anticipated opening in May 2013.There will also be an outdoor area and lazy river feature.24

CITY OF KINGSPORT, TENNESSEEMANAGEMENT'S DISCUSSION AND ANALYSISFor the Fiscal Year Ended June 30, <strong>2012</strong>(amounts expressed in thousands)Additional information on the <strong>City</strong>'s capital assets can be found in Note 4.C on pages 60-64 <strong>of</strong> this report.<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s Capital Assets(Net <strong>of</strong> Depreciation)Governmental Activities Business-Type Activities Total<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Land $ 23,233 $ 23,337 $ 5,466 $ 5,436 $ 28,699 $ 28,773Buildings and Systems 84,507 80,445 170,013 166,039 254,520 246,484Improvements other than Buildings 4,689 5,309 2,986 4,350 7,675 9,659Machinery and Equipment 14,191 10,794 1,034 938 15,225 11,732S<strong>of</strong>tware 265 212 25 39 290 251Infrastructure 152,934 155,889 0 0 152,934 155,889Construction in Progress 60,935 53,194 71,328 71,593 132,263 124,787Total Capital Assets $ 340,754 $ 329,180 $ 250,852 $ 248,395 $ 591,606 $ 577,575Long-term debtAt the end <strong>of</strong> the current fiscal year, the <strong>City</strong> had total gross debt outstanding <strong>of</strong> $225,094. All <strong>of</strong> this debt isbacked by the full faith and credit <strong>of</strong> the government.<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>'s Outstanding Debt(Gross Amounts)Governmental Activities Business-Type Activities Total<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Notes Payable $ 1,095 $ 1,228 $ 0 $ 0 $ 1,095 $ 1,228General Obligation Bonds 121,845 107,173 68,975 66,373 190,820 173,546Loans from Other Governments 9,520 7,568 23,659 24,288 33,179 31,856Total Long-term Debt $ 132,460 $ 115,969 $ 92,634 $ 90,661 $ 225,094 $ 206,630During the current fiscal year, the <strong>City</strong>'s total gross debt increased by $18,464 (9%). The $16,491 governmentalactivities increase was a result <strong>of</strong> new debt exceeding principal payments. The $1,973 business-type activitiesincrease was also a result <strong>of</strong> new debt exceeding principal payments.The increase can be attributed to three new bond issues during the <strong>2012</strong> fiscal year. General Obligation PublicImprovement Bonds, Series 2011 were issued in December 2011 for $16,140. General Obligation Bonds, Series<strong>2012</strong>A were issued in June <strong>2012</strong> for $3,110. General Obligation Public Improvement Bonds, Series <strong>2012</strong>C wereissued in June <strong>2012</strong> for $9,305. In addition the <strong>City</strong> issued General Obligation Refunding Bonds, Series <strong>2012</strong>B inJune <strong>2012</strong> for $9,970. The <strong>2012</strong>B Refunding Bonds totaling $9,970 refunded certain 2003 and 2004 bondstotaling $10,100.The <strong>City</strong> currently has a rating <strong>of</strong> AA- from Standard & Poor’s Rating Services and a rating <strong>of</strong> Aa2 from Moody’sInvestors Service. Both ratings were reaffirmed in June <strong>2012</strong> in conjunction with a June <strong>2012</strong> bond sale.25