ADOPTED BUDGET - The City of Kingsport

ADOPTED BUDGET - The City of Kingsport

ADOPTED BUDGET - The City of Kingsport

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

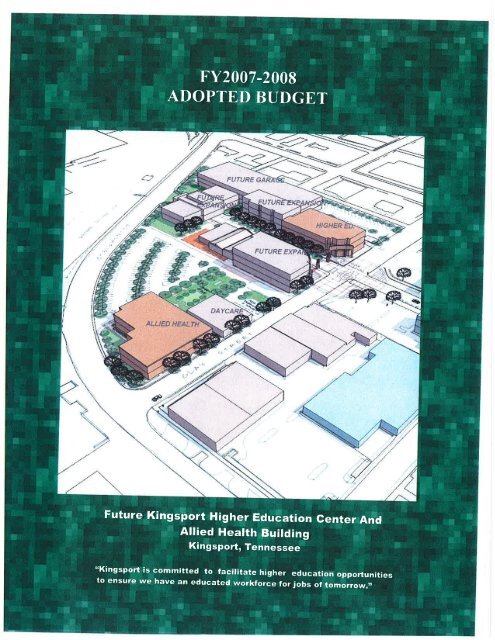

FY2007-2008<strong>ADOPTED</strong> <strong>BUDGET</strong>Future <strong>Kingsport</strong> Higher Education Genter AndAllied Health Buitding<strong>Kingsport</strong>, Tennessee*<strong>Kingsport</strong> is committed to facititate higher education opportun¡t¡esto ensure we have an educated workforce for jobs <strong>of</strong> tomorrow.,t

FY2007-08 Budget<strong>ADOPTED</strong> <strong>BUDGET</strong>Prepared by<strong>The</strong> <strong>City</strong> Manager's OfficeJulv 2007

FY2007-08 BudgetGOVERNMENT FINANCE OFFICERS ASSOCIATIONDistinguishedBudget Presentøtion

FY 2OO7.O8 <strong>BUDGET</strong><strong>The</strong> objective <strong>of</strong> a community is not merely to survive, but to progress, to g<strong>of</strong>orward into an ever-increasing enjoyment <strong>of</strong> the blessings conferred by the richresources <strong>of</strong> this nation under the benefaction <strong>of</strong> the Supreme Being for the benefit <strong>of</strong> allthe people <strong>of</strong> that community.If a well governed city were to confine its governmental functions merely to thetask <strong>of</strong> assuring survival, if it were to do nothing but to provide 'basic services' for ananimal survival, it would be a city without parks, swimming pools, zoo, baseballdiamonds, football gridirons and playgrounds for children. Such a city would be a drearycity indeed. As man cannot live by bread alone, a city cannot endure on cement, asphaltand sewer pipes alone. A crty must have a municipal spirit beyond its physicalproperties, it must be alive with an esprit de corps, its personality must be such thatvisitors-both business and tourist-are attracted to the city, pleased by it and wish toreturn to it. That personality must be one to which the population contributes by massparticipation in activities identified \áith that city. (This quote is from the concurringopinion <strong>of</strong> Justice Musmanno in Conrad v. <strong>City</strong> <strong>of</strong> Pittsburgh, 218 A.zd 906, 421 Pa. 492(1e66).<strong>Kingsport</strong> Greenbelt

T"T 2OO7.O8 BI.IDGETCITY OT KINGSPORTORGA¡IIZATIONAL CHARTCffirftR-or¡Oa-

f,'Y 2007-08 <strong>BUDGET</strong>TABLE OF CONTENTSPageInspirational MessageBoard <strong>of</strong> Mayor and Aldermen and Leadership and Management Team<strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> Organizttional ChartTable <strong>of</strong> ContentsBudget Message12348I. INTRODUCTIONA.B.Budget CalendarBudget Priorities1819<strong>BUDGET</strong> ST]MMARYA.B.C.D.Total Budget SumGrant Project Ordinance X'undsTotal DebtMajor Capital Projects SummaryE. Stafling History---2t27283234IIr.GENERAL X'UNI)A. General X'und SummaB. Major Revenues Described3844IV.ENTERPRISE FUI\TDSA. Cattails---B Meadow View X'und------C. - Solid'Waste X'undD. Waste WaterE. Water tr'und4850535766

PageSPECIAL REYENUE FT]NDSA. Fund DescrþtionB. Summarv7576VII.TRUST AI\D AGENCY X'TJI\DSA. Definition <strong>of</strong> FundsB. Allandale Trust -620C. Bays Mountain Commission-612D. Palmer Center Trust -617E. Public Library CommissÍon - 611F'. Senior Center Advisorv Council - 616G. Steadman Cemeterv Trust - 62177787879798080IX.\CAPITAL GRANT/PROJECT ORDINAI{CE X'UNDSA. Fund Descriptions and Summary8l

xT2OO7-OS<strong>BUDGET</strong>TABLE OF CONTENTSAppendixB. Appendix B - Economic and l)emographic Information--PageB-1

F"T 2OO7.O8 BI]DGETTABLE OF CONTENTS<strong>Kingsport</strong>'s Regional Center for Applied Technology<strong>Kingsport</strong>, Tennessee

FY 2OO7-08 BTIDGETBTIDGET MESSAGEHonorable Board <strong>of</strong> Mayor and Aldermen:In accordance Article XV <strong>of</strong> the <strong>Kingsport</strong> <strong>City</strong> Charter I am pleased to present the <strong>City</strong>Manager's recommended Fiscal Year 2007-2008 annual budget for the <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong>.<strong>The</strong> Fiscal Year 2007-2008 budget is balanced. It has been prepared in accordance with theadopted financial policies <strong>of</strong> the Board <strong>of</strong> Mayor and Aldermen. It includes adequate funding tomaintain the <strong>City</strong>'s high level <strong>of</strong> service and reflects the priorities <strong>of</strong> the Board <strong>of</strong> Mayor andAldermen and community needs. It was also prepared according to the general directives <strong>of</strong> theBoard <strong>of</strong> Mayor and Aldermen which included: that current revenues are sufflrcient to supportcurrent expenditures; that the service delivery to citizens continues to be maintained at least atcurrent levels; that the implementation <strong>of</strong> the pay plan for employees continues. Departmentalneeds to provide desired services to the citizens were also considered.<strong>The</strong> General Fund has no increase in property taxes. <strong>The</strong> step increases for the pay plan arefunded and an additional 2Yo pay adjustrnent. <strong>The</strong>re is also a performance bonus equivalent to$300 per person included in the budget,Water and Sewer rates increased to meet the needs <strong>of</strong> those two funds. <strong>The</strong> water rate increasedfor outside city residentsby 4Yo and a the sewer rate increased for outside ciry residents bv 8%.<strong>The</strong> sewer rate for inside customers increased by 3%.A five year Capital Improvements Plan (CIP) covering the Water Fund, Wastewater Fund andGeneral Fund is also provided. It covers the current known capital improvements anticipated forthe next five years.Copies <strong>of</strong> the budget and the CIP are available for public inspection at the <strong>Kingsport</strong> PublicLibrary and the Offices <strong>of</strong> the Cþ Manager and <strong>City</strong> Recorder.OVERVIEW<strong>Kingsport</strong> is continuing to move forward on a positive course. <strong>The</strong> city continues to improve itsoverall financial position and the delivery <strong>of</strong> services.<strong>The</strong> multi-year capital and operating plans for the Water and Wastewater fi¡nds continue to beimplemented. Critical infrastructure needs are being addressed in a logical, planned manner.<strong>The</strong> <strong>City</strong> has begun major renovation <strong>of</strong> its sewer plant and improvements to the water systemwill continue being made. Capital improvements in the CIP for the General Fund are funded.

FY 2OO7-08 <strong>BUDGET</strong><strong>BUDGET</strong> MESSAGE<strong>The</strong> total recommended budget, less inter-fund transfers, is $140,581,750. Two sources <strong>of</strong>revenue, sales tax and property tax, provide the primary funding for the General Funds. <strong>The</strong>serevenues fund approximately 83% <strong>of</strong> its capital and operating requirements: Property tax frrnds48Yo <strong>of</strong> the General Fund budget and sales taxes funds 35Yo <strong>of</strong> the General Fund budget.RE\rENUESGeneral X'und<strong>The</strong> General Fund is balanced with no recommended increases in taxes. Equalization <strong>of</strong>personal property will occur this year and the equalize percentage is approximately 84Yo.This will reduce revenue for personal propefy taxes approximately $700,000.<strong>The</strong> proposed budget reflects positive trends in the real property and sales ta>< revenues.Total property tax revenue growth is estimated to be about I.2% and the Local Option SalesTax growth is estimated to be about 3%. Regional Sales Tax growth is also estimated to beapproximately 3% and state shared taxes are projected to have an increase <strong>of</strong> 4Yo growth.<strong>The</strong> proposed budget does not utilize as much <strong>of</strong> the undesignated fund balance as previousyears for one time going into capital and, like in past years, the Educate and Grow program.When Sullivan County decided to make the program county wide, the need to use the original$50,000 <strong>City</strong> appropriation was reduced. Consequentþ, we are budgeting $20,000 <strong>of</strong> theunexpended portion <strong>of</strong> the original allocation, which is now $40,947.One major change in the revenue funds is in court fines and traffic fines. <strong>The</strong> Board <strong>of</strong>Mayor and Alderman increased the rates for court cost from $13.50 to $50.00 and we haveadded additional court cost from other sources..Water and Wastewater Funds<strong>The</strong> customer base in the water and sewer utilities remains relatively flat and requires rateincreases in order to finance capital improvements and fund increases in operations costs.Rate increases are recommended and are generally in accordance with the previouslyapproved'Water Fund and Sewer Fund Multi-Year Capital and Operating and MaintenancePlans.o Water Rate Increase: It is recommended that the water rate be increased by 4Yo foroutside city customers. <strong>The</strong> monthly impact on the average residential customer using5,000 gallons <strong>of</strong> water per month is $2.00 outside the city.

FY 2OO7-08 BT]DGETBT]DGET MESSAGE<strong>The</strong> following graph reflects the proposed rate increase for the water fund:Average Water Blll (Outs¡de Rate) 5,000 gallonsClevelandKUBCookevilleSurgoinsv¡lleJohnson <strong>City</strong>FUD HawkinsElizebethton<strong>Kingsport</strong>ClarksvilleSev¡erv¡lleLakev¡ewo Wastewater (Sewer) Rate Increase: It is recommended the sewer rate be increased by3%o for inside city customers and 80á increase for outside city customers. <strong>The</strong> monthlyimpact on the average residential customer using 5,000 gallons <strong>of</strong> water per month is $.90inside and $3.00 outside.In previous years rates in these funds would vary significantly from year to year. Onepurpose in developing the Water Fund and Vy'astewater Fund Multi-Year Capital andOperating and Maintenance Plans was to project anticipated future expenses and rates. Thishelps to smooth out rate increa^ses.10

FY 2OO7-08 <strong>BUDGET</strong><strong>BUDGET</strong> MESSAGEThç following graphs reflect the proposed rate increase the sewer funds:Average Sewer B¡ll (lnside Rate) 5,000 gallonsFranklin15.25CookevilleI sro.MonistownJohnson <strong>City</strong>ElizabethtonClevelandSeviervilleClarksvilleOak RidgeK¡ngsportKUB$0.00 $30.00Average Sewer Bill (Outs¡dê Rate) 5,000 gallonsCookevilleFrankl¡nElizabethtonClevelandMonistownJohnson C¡ty<strong>Kingsport</strong>ClarksvilleSeviervilleKUB$0 00 $60.00 $70.00 $80 0011

F'Y2OO7-08 <strong>BUDGET</strong>BT]DGET MESSAGEOther Funds<strong>The</strong>re are no recommended increases in the fees charged within other funds. More detailedinformation on these funds may be found at the end <strong>of</strong> the budget message and in theappropriate sections <strong>of</strong> the budget document.EXPENDITURESGeneral Fund<strong>The</strong> General Fund Budget is balanced. <strong>The</strong> major expenditure <strong>of</strong> the General Fund is forpersonnel. It provides the funding for many services including public safety, recreation, andgeneral services. <strong>The</strong> General Fund is estimated to be 562,520,700. This includes fundingfor additional personnel to equip the new Rock Springs Fire Station and additional police<strong>of</strong>ficers for Zone 7 .Water and Wastewater Funds<strong>The</strong> major expenditure for both enterprise funds are debt service, operations and personnel.<strong>The</strong> debt service as a percentage <strong>of</strong> total fund expenditures reflects previous years wheremajor capital needs were l00olo funded by debt. <strong>The</strong> implementation <strong>of</strong> the multi-year capitaland Operations & Maintenance plans will reduce this percentage in the coming fiscal years.ln the Fiscal Year 2002-2003 the Wastewater Fund provided zero cash for capitalimprovements and reflected 58% <strong>of</strong> the total fund budget for debt service. Debt service forthe Wastewater Fund has declinedto 47Yo <strong>of</strong> total firnd budget.<strong>The</strong> Water Fund expenditure is estimated to be $13,007,400.F?(mì ærFund E¡çendit¡rcsDeüSen¡æ17o/oTo CaFital HqecblAVoCapital O.rüey70/oToerìeral F-rìd9/oFersorEl Sen¡æs3ú/oq€rât¡rE ÞperEes1g/"t2

FY 2OO7-08 <strong>BUDGET</strong><strong>BUDGET</strong> MESSAGE<strong>The</strong> Sewer Fund expenditure is estimated to be $13,102,300.FVü}8 ìllffiuabr Fund Eryetrdih¡æsTo@¡bl PrcùectsCaßttal Orüay7/oToerÊral fundAVoDebtSen¡æ53VoQeraltng Erpenses1AVoÈrsond Seniæs1V/o<strong>BUDGET</strong>ARY IMPACTS ON PERSOI\NEL, PAY AND BENEF'ITSPav Plan and BenefitsPay Plan. <strong>The</strong> scheduled step increases and pay scale adjustment are fully funded. <strong>The</strong>increase cost for this budget year is $683,100. This is less the project amount presented inMay <strong>of</strong> 2005.Health lnsurance. <strong>The</strong> <strong>City</strong> maintains a self-inswed health insurance plan, administered byJohn Deere. Premium rates are expected to increase 5o/o, or $203,000 for all funds. <strong>The</strong> <strong>City</strong>and the employees share the cost <strong>of</strong> health insurance premium on a 70130 percentage split.<strong>The</strong> monthly increase on employees witlì individual and family coverage will increase $5.64and $14.06 per month; respectively. <strong>The</strong> annual increase for the <strong>City</strong> portion will beapproximately $142,100. <strong>The</strong> budget is based upon plan changes beginning January l, 2008,which would increase co-pays for <strong>of</strong>fice visits, prescription co-pays, deductibles, and goingfrom 90/10 to 80/20 share <strong>of</strong> expenses on claims.Retirement Plan. <strong>The</strong> employer contributions for employees retirement is derived from theactuarial prepared by the Tennessee Consolidated Retirement System for employees <strong>of</strong> the<strong>City</strong>. <strong>The</strong> contribution to the Tennessee Consolidated Retirement System (TCRS) isincreasing will remain at l6.36Yo for this fiscal year.13

F'Y 2OO7-08 BTIDGET<strong>BUDGET</strong> MESSAGEStafflrng LevelsAn increase <strong>of</strong> twelve positions in the overall number <strong>of</strong> full time employees isrecommended in the proposed budget. <strong>The</strong> total number <strong>of</strong> full time employees will increaseto 693. <strong>City</strong> administration is looking to the use <strong>of</strong> more part time employees and volunteersas a possible way to meet increased service demands also.Staffrng recommendations are as follows:F'ull time positions:. Add four police <strong>of</strong>ficers for Zone Seven. Add six fire fighters for the new Rock Springs Fire Stationo Add one Librarian. Add a Deputy <strong>City</strong> Manager. Add an electrical inspector for Building and Codes Divisiono Add an internal auditorPart-time positions:o Office Assistant for Records Clerko Maintenance Worker for Grounds Maintenance. Senior Offrce Assistant for Building Divisiono Police Records ClerkSCHOOL FUNDING<strong>The</strong> <strong>City</strong> operates its own city school system. While the majority <strong>of</strong> the revenues for the schoolsystem are derived from the State <strong>of</strong> Tennessee (about 33%) and Sullivan County (about 33yo),the <strong>City</strong> contributes $15,483,000 to the school system. Of this amount $8,721,400 is contributedfor general operations and56,762,000 for school debt service. <strong>The</strong> school funds are shown in thebudget as a total as the Board <strong>of</strong> Mayor and Aldermen does not have the authority to allocatefunding within the various budget codes <strong>of</strong> the school system. Approximately 24% <strong>of</strong> theresources <strong>of</strong> the General Fund are allocated to funding the <strong>Kingsport</strong> <strong>City</strong> Schools. Additionally,25Yo <strong>of</strong> the revenues derived from the annexation <strong>of</strong> a portion <strong>of</strong> Eastman, Inc. on Long Island, or$387,600, is allocated to the school system as a special grant for value added programs. <strong>The</strong>seannexation revenues must be allocated in this manner according to the Plan <strong>of</strong> Services. <strong>The</strong>y donot become part <strong>of</strong> the annual maintenance <strong>of</strong> efilort allocation to the schools, since the revenueswill increase or decrease depending on reinvestment in personal property, etc.<strong>The</strong> schools have requested an additional school resource <strong>of</strong>frcer. This position will be fundedthrcugh the schools budget and transferred to the police deparhnent's budget for the <strong>of</strong>frcer.I4

FY 2OO7-08 <strong>BUDGET</strong><strong>BUDGET</strong> MESSAGEMULTI.YEAR CAPITAL IMPROVEMENTS PLA¡I<strong>The</strong> Board <strong>of</strong> Mayor and Aldermen has previously approved a Multi-year Capital ImprovementsPlan (CIP) for the <strong>City</strong>. [n accordance with the plan the scheduled capital projects for theGeneral Fund is $15,625,600 the Water Fund is 94,695,200 and the Wastewater Fund is$2,860,900. A detailed list <strong>of</strong> these projects and the funding sources are in the summaries <strong>of</strong>each fund section and also in the Capital Improvements section <strong>of</strong> the budget.REGIONAL SALES TAX FT]NDThis fund was established to account for revenues that support the MeadowView Convention andConference Center and the Cattails Golf Course. <strong>The</strong> ñ¡nd is estimated to be $3,330,700 in theupcoming fiscal year.Once the debt for the MeadowView Conference Center is retired in Fiscal Year 2007-2008 theneed for continued financial support for operating contributions and provisions for long termmaintenance and expansion <strong>of</strong> the facility will continue. <strong>The</strong> General Fund doçs not fund theoperating or maintenance contributions <strong>of</strong> the facilities. When MeadowView wÍrs planned andopened in the 1990s, no provision was made for the long-term maintenance and expansion needs<strong>of</strong> the facility. <strong>The</strong> current funds for furniture, fixtures and equipment (FF&E) held in escrowannually are not sufficient to meet these long term obligations.Meadowview X'und<strong>The</strong> total fund is estimated to be $2,697,900 and continues to be totally supported by therevenues generated by the operation <strong>of</strong> the conference center and the Regional Sales TaxFund. <strong>The</strong> General Fund has not contributed to this fund in several yeats. <strong>The</strong> <strong>City</strong> contractswith Marriott Corporation for the day-to-day management and marketing services <strong>of</strong> theconference center.Cattails Fund<strong>The</strong> total fund is estimated to be $910,800. Contributions from the General Fund to Cattailsceased in Fiscal Year 2003-2004 when it was determined that payment <strong>of</strong> the debt servicecontribution could be made from Regional Sales Tax revenues. Cattails is operated andmanaged by Marriott Golf.SOLD WASTE FT]NI)<strong>The</strong> total Solid Waster Fund expenditures are estimated to be $3,811,400. Approximately 84Vo<strong>of</strong> its revenue is from the General Fund in order to provide the services.l5

F'Y 2OO7-08 BI]DGETBT]DGET MESSAGEDEBT, DEBT SERVICE, BOND RATING<strong>The</strong> recommended budget provides for the issuance <strong>of</strong> bonds as follows:o $13,250,000 General Fundo $ 2,145,800 Water FundDuring the 1990s a commitment was made to renovate all <strong>of</strong> the public school buildings as wellas build Washington Elementary School. Debt was incuned to build the MeadowViewConference and Convention Center and the Cattails Golf Course. Significant capital funds beganto be spent on sanitary sewer projects, primarily for the Inflow and Infiltration program inaccordance with the agreed order with the State <strong>of</strong> Tennessee. <strong>The</strong> <strong>City</strong> now has the debt at amanageable level. Capital projects are planned according to the debt service rolling <strong>of</strong>f eachyeaf.<strong>The</strong> percentage <strong>of</strong> debt by charter limitations is 20%o and the Board <strong>of</strong> Mayor and Aldermanadopted a policy <strong>of</strong> lïYo. <strong>The</strong> following graph will reflect the debt policies and the GeneralObligation Debt which includes the Meadow View Convention Center and the golf course.Pe@ntaqe <strong>of</strong> T¡xabl€ Alsa$d Valæ1997 ïhroqgh 2012(Proþctod 2007 Thþugh 2012).--'+ru------'+lopÁdTdMdValæ+Gererd D€btOfttandng^d ^d ^e'"o".d.d n$ "d "d .É "d nst "ú, "$".d ñA detailed analysis <strong>of</strong> the debt position, debt service requirements and bond rating <strong>of</strong> the <strong>City</strong> isin the Total Budget Summary Section.t6

FY 2OO7-08 <strong>BUDGET</strong><strong>BUDGET</strong> MESSAGEMajor Capital Projects<strong>The</strong> Capital projects for FY08 include a Higher Education Center, renovations <strong>of</strong> the LegionPool, traffic signals, a dog park, street improvements and resurfacing, drainage improvements,sidewalk improvements, and park maintenance. <strong>The</strong> impact on the operating budget will beadditional debt service payments and future maintenance for the Higher Education Center.<strong>The</strong> <strong>City</strong> is fumishing the facilities and partnering with North East State University to provideprograms, stafhng, and equipment for the Higher Education Center and the Allied HealthBuilding, which was funded in FY07. <strong>The</strong> Allied Health Building will be used for North EastState University's nursing progams. One <strong>of</strong> the goals <strong>of</strong> the council members and previouscouncil members is to provide a higher education for the citizens. This is found in the StrategicPlan in Appendix E under Key Success Factor #5.<strong>The</strong> Impact on the operating budget for the Legion Pool is also debt service. Staff is looking atbuilding an aquatic center. This will be an enhancement for the community and the high school.<strong>The</strong> impact on the operating budget for street resurfacing, street improvements, sidewalkimprovements, drainage improvements and park maintenance is minimal.A summary <strong>of</strong> major capital projects is listed in the Total Budget Summary Section and in theCapital Improvements book. Each project for the five year plan is listed in the CapitalImprovements book and the impact that each project will have on the operating budget.Budget Contents<strong>The</strong> Citizen's guide explains the different sections <strong>of</strong> the budget book and the page numbers forthe sections.<strong>The</strong> Shategic Plan adopted by the Board <strong>of</strong> Mayor and Alderman is in Appendix E. <strong>The</strong> budgetpriorities, the department narratives and the capital improvement plans are linked to the StrategicPlan.T7

F"r 2007-08 <strong>BUDGET</strong>BTIDGET CALEI\IDAR<strong>The</strong> <strong>City</strong>'s annual budget process provides a framework for communicating major financialoperational objectives and for allocating resources to realize them. <strong>The</strong> budget process began inJanuary and will end in June. <strong>The</strong> <strong>City</strong> Charter requires that a balanced budget must be presented tothe Board <strong>of</strong> Mayor and Aldermen by May 15. A balanced budget must be adopted by June 30 andbe effective July 1.PROPOSED <strong>BUDGET</strong> CALENDAR FOR FY 2OO7 _ 2OO8Monday, December 4, 2006December 19-21.2006Friday, January 12.2007Iuesdav. Jutuwv 16. 2007Fridav. Februarv 2. 2007Monday. Illæch12.2007Mondav. March26.2007Monday, March 19,20073:00 o.m.Monday, April 16,20074:30 n.m. to 7:00 o.m.m#s¿ay;+p¡¡l++209+43o+=m- CancelledMondzy,Iiprit23,2007Thursday, r'ipn126,20074:30 p.m.Monda¡ April 30,20074:30 p.m.Monday, May 14,20074:30 o.m.Thursday, lNJay 24,20074:30 o.m. - 7:00p.m.Tuesday, June 5,20077:00 o.m.Tuesday, June 19,20077:00 o.m.Friday. June 29.2007Mondav. Jt1v2.2007FÅday, July27,2007Fridav. Julv 27. 2007Fridav. Aueust 17 .2007Monday, October 1,2007Budget Meeting and Distribute Budget Call Packages to the Leadership and ManagementTeamMeet with Denartment Heads on CIPFinal Date for DeDartments to Enter Budget NumbersMeetinss with Departnents BeeinDena¡Ínental Budeet Submissions Due lNarratives. benchma¡ks- PE measures etc.)Retum back to DeparÍnent Heads with NumbersBudeet BalancedMeeting with Dr. Kitz miller arid David FryeBMA Budget Work Session for Budget Review: School Budget PresentationSolid W¡tctc, (lriminal Fnrfe:tlro T)nrsFrnd ¡nd Tnrcf filndcìBMA Budget Work Session for Work Budget Overview, Revenue Awa¡eness and GeneralFundBMA Budget Work Session for Work Budget Review (Finalize General Fund, Water andWastewater Funds, Operating arid Capital)BMA Regular Work Session and Budget Work Session for Other Operating Funds (Risk,Fleet Health, Meadow View, Cattails, Regional Sales Tag State Street Aid, Solid Wæte,Criminal Forfeiture. Drus Fund and Trust Funds.Reg. Work Session. BMA Budget Work Session if neededBMA Budget Work Session if neededBMA Business Meeting-Public Hearing and I " Reading <strong>of</strong> Final BudgetBMA Business Meeting-2* ReadingÆinal Adoption <strong>of</strong> Final BudgetFinal. Aooroved Budeet to PrinterFY07 Budget Begins, Final and Approved Budeet Books Available to PublicSubmit entire budset to State <strong>of</strong> Tennessee Comotroller <strong>of</strong>the TreæurvSubmit school budget information to State Department <strong>of</strong> EducationSubmit budget to GFOA for Distinzuished Budset Award ProsramApprovals from State Deparfnent <strong>of</strong>Education and Comptroller <strong>of</strong>the Treasury received in<strong>City</strong> Manager's Office18

FY 2OO7-08 BT]DGET<strong>BUDGET</strong> PRIORITIES<strong>The</strong> Board has a tradition <strong>of</strong> reviewing and setting budget priorities prior to <strong>City</strong> Administrationpreparing the annual budget. In some years, the priorities were very complex and detailed andlast year they were very basic.<strong>The</strong> Board's consensus was that the <strong>City</strong> Manager would prepare a budget that:o Presented a balanced budget without a property tax increase.o <strong>The</strong> capital budget plans are developed in accordance with the approved multi-yearcapital plan.o <strong>The</strong> water and sewer funds are balanced in accordance with the 'Water Fund and SewerFund capital and rate stabilization plans.FY07-08 will continue to have revenue challenges, including,o <strong>The</strong> economy and impacts <strong>of</strong> motor fuel increases, etc.o Loss <strong>of</strong> sales tax revenue from Sam's Club and the temporary closing <strong>of</strong> a major foodchain due to construction <strong>of</strong> the shopping Center.o Impacts from State <strong>of</strong> Tennesseeo School Funding issueso Basic service delivery issues including:o Health Insurance increase <strong>of</strong> 5Yoo Building Maintenance , Equipment Replacement, and Cultural Arts Fundingo Hiring Police Offrcer to patrol Zone 7o Staffrng the New Rock Springs Fire Stationo Annexation impacts on utility revenues (decreasing), increasing tax base revenues andincreased costs to provide services.Continuation <strong>of</strong> FY07 Major Projects that will impact FY08o New Rock Springs Elementary Schoolo Allied Health Building and Higher Education Centero New Rock Springs Fire Stationl9

F'Y 2OO7.O8 <strong>BUDGET</strong>BT]DGET PRIORITIES20

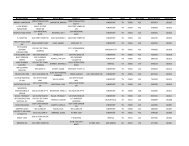

FY2OO7-2008 <strong>BUDGET</strong>TOTAL BI]DGET SUMMARYunappropfa¡eo tsuno uaEst. EÊmings - June 3(FUNDING SOURCES:TaxesGross Reæipts TaesPenalt¡es and lnlerestLicensés and PêmitsCharg€s for Serv¡ceslntergovemmentelState Shered TaxêsSaleslntergst EamedFines and Forfe¡turesM¡sllâneousTap FeesSgec¡el Donat¡onsFrom School tundFrom Eastman AnnêxFrom Gen Proj FundFrom Gensal FundFund TrênsfèrsFund Balance/Rata¡nedGeneral FundnæfKelatneo$18,652,000$30,569,3003,513,500o603,0003,265,O0015,491,4@5,029,40001,300,0002,037,@0't 0l,600050,0o()173,900166.600Fund Entemfise Funds :ê Fund3HæIMEaatnän Cattails MeadowV¡ew tolid Wætr Waatemterlnsurilcê Fleet ile¡ntAnnex Funr Fund Fund Fund Fund WatGr Fund Fund FundDebt SefliceFunds92 000$0000o000000006,872,500¿168,400997,2002,'177,100$166 000$o0o0000000000094 000$0000001,OO0000000$85 000s0000 0107,9@0005 0000000$793,000$0000696,60000030,000000000$4,076,000$001 10,000or32,O000012,210,æO295,000014,500340,000000$3,229,000w0292,O@0207,4000o12,008,000190,0000o320,000000$2,636,000$00005,660,0000001o0,000000000$1 838 000s00004,880,50000120,00000000Risk tgt.Fund$2,621,000$0002,027,600000000000001,550,500 745,7@ 2,545,O00 3,0€4,8000000000000 1661,(nOnTotal Fund¡nq Sources $62.520.700 $10 515 200 $1.550,500 $777.300 $2.697.900 5J U11 4LlU $13 ',tuz :Jt'U $13.U0l 4(X) s5 /60 (Xx) $6 661 $2 o27CÀTENUI I UñEÐ:Leg¡slativs Govêmmsnt $.178,100000000000o0 000000002,157,000 10,495,100 ¿168,400 654,500 2,096,400 235,000 6,086,200 2,2U,W000n no0ônnnGeneral Govemment 6,73'1,0000000000000nDevelopment Sêru¡cés 'I,566,00000 00000000Poliæ Department't 0,291,900000000000Firs Dgpartment6,76 1,60000 00000000Community Serviæs 8,039,600o0 00 3,576,40000000Conferênc€ Center000 0 600,400000000Le¡surs Seruiæs4,548,70000 2Æ,2000000000H¡ghwey and Slrêels000 0000000To Olher Funds14,417,1æ0 694,500 000000000 000000000000000U1,032,85000 00000o 6,661,5000000 000 675,900 1,1 73,9000000ñ 000 157,500 383,6000000 000 1,755,7@ 1,424,40000000 000 2,O93,900 3,216,2æ000000 0000 955,9000006,29,700 20,1000 f0,1001,1000000000000 718,600 764,600 5,760,0002,027,600542,1000 387,600000 1,614,500 2Ail,200000$10,515.200 s1,550,500 $910.800 $'2.697.900 $3,811.¿foo sl3 1UZ.3UU s13 (ru/ 4ül s6 ô6't 500 s2.027,600Jnappropriated Fund Bal¡ ¡næ/RetainedEst. Eârn¡nos - Juæ30. I s18.652 000 ß92 0ü) st66 000 s34 6rX) ßR5 fxn $793 000 M 770 900 $3_437 100 s2 636 000 s1 83A 000 $2 621 000-otal Budqet Summarv Cont¡nued on Pæe 22.21

FY2O{'-2008 <strong>BUDGET</strong>TOTAL BIJDGET STJMM^A.RYFY07 Túl Budgst RoEnu* ¡nd Erpend¡h¡rct and U4aplmpltrlod Fund B¡hnærRelein€d Eem¡ng3 Summrysvenæ FundrTrut E Agsncy FundsDrug FundReg¡omlSales TårFundGemãl SchælE¡y! Allendrle Palml n lJbnry Sen¡orPurp@ Núrlüonllan3lm Canter Com.e Fund Schæl Fund Fund Ald Fund Fund Fund Fund Y Fund Fund Fundlot¡lEsL Eeminqs - Jure 30,FUNDING SOURCES:TãesGmss Ræeipt8 TdesPenalties ånd lnteßstLiHs and Pem¡teChargeg for S6ru¡coslntêrgovemmentalState ShaÊd TdesSaleslnt€Est EemêdF¡nes ând ForfeituGsM¡sælfanæusTap FæsSpec¡al Donel¡onsFrom Sdìool fundGrantsFund TrânsfeßFund Balânca/R€tain€d| $r02,00oIl$0l0lotît;0õfi7,3000000000$1,8t5,000$55,0(x)s3,955,000sl, I I 0,0005235,000$'116,000s1 58,000958 000$17,0(n$23 0ü)i24,oto$3,280,70000$000$20,762,0{X)00$000so00$000s000$000s0005000s0000 000000 0 0 0 0o 0 I,139,100o000 o 0 0 66,3000 0 20,298,400 28,400 1,298,7@000 0 0 00 0000000 0 0 00 o0 2,666,5000000 0 0 050,00000000008,0000000000155,00000009,550073,550000000000004,0{x)0001 8,000006,000o0000500o00000100000000500000000s@00050000 0 '15,493,4000 760,00000 0 0 0 00 n I 10,5002?m00s3.330.700 s8,mo ú5/.95ö.4{rU 62ttg.ow) 82'l s45 C $6.000 s500 glnô s67 300$41,598,000¡54,612,000$3,5t3,500$392,mO$603,000$18,3'15,900$37,1 16,900s5,029,400$26,885,300$2,112,'tæ$2,162,300s344,650s660,000$68,500¡173,900$0$31,93't,800ß, mq ÃmLegisletive GovemmentGôn€El GovemmenlDevelopmilt Sery¡æsPol¡€ DeparlmentFiß DepertmentCommunlty Seru¡æsConfænæ CenterLe¡sure SoryiæsH¡glMåy ând SlrætsTo Other FundsTEns To Meadowìy'¡ilM¡sc Govt Seru¡æsAdmin'EtEt¡onF¡nanc¡alPlant OpeEtionsSystem MaintenancêReâdinq and SeruicesOpe€lionsClsims andTÉnsf€r to Prcject FundEduet¡on - OptrDsbt Seru¡ce (P&l)ìeseruesTo Capital Prcjectglo't l000117 300000000o000000000000000o00745,7000002,585,0000000000000000008,000000000000000000000000000 0 0 0 0 $178,1@000000 0 0 0 s6,73t,000000000 0 0 0 $1,566,0000000 00 0 0 0 6'10,417,200000000 0 0 0 $6,761,600000000 t00 0 0 $11,8s't,100000000 0 0 0 $1 ,346,100000 45,000 6,0000 0 500 67 300 $4,913,70000 2,113,700000 0 0 0 $2,1 13,7001,591,550000 0 0 0 0 0 s16,1 75,300000000 0 0 0 $2,585,00000o000 0 0 0 s7,694,350000000 0 0 0 $1,849,80000000 0 0 0 $54't,100000000 0 0 o $3,580, t0000000 0 0 0 0 s5,31 0,100000000 0 0 0 9955,900000000 0 0 0$049,494,350000 00 0 0 $58,765,1 50000000 0 0 0 $4,998,,1000 2,774,ñO000 5m 0 0 0 $2,778,5006,872,50000000 0 0 0 $37,870,600000000 0 0 0$0nnnn0m$57.958.,100 52.//ö.o(ru s2 11 s45 0c $6.000 55{X) $500 s67 5luu.g9u.ð00JneppropnaBo Funõ H€il8tEßt Eâminos-.rrrm30l ßln, ônn s1.645 000 ß55 (xX) s3 955 <strong>of</strong>f) $l.t10000 s235 000 Sl 16 (x),0 sl 58 0t)0 $58.000 s1 7 000 $23.0m s24 m0 sat7Á tnnTotel Budget Sumrory Continu4 from Pâgo 2122

FY2OO7.2OO8 <strong>BUDGET</strong>TOTAL <strong>BUDGET</strong> STJMMARYTotal Budqet SummarvActualRevised Budget Requested Recommend Approvedlevenues0,f{¡5 05{6 06-{17 0748 07{8 07{8Seneral Fund 54.420.104 57.330.486 60.584.561 62,520.70(, 62.s20.70( 62.s20.700Debt Service Fund 9.887.524 10.459.755 10.394.41 10.515.20C 10.515.20C 10.515.200Â/ater Fund 12.191.129 12.698.084 12.839.001 13.007.40C 13.007.40C 13.007.400Sewer Fund 11.786.'t32 12.453.020 12.460.106 13.102.300 13.102.30C 13.102.300Solid Waste Manaoement Fund 3.3'10_45€ 3AU.84e 4.463.155 3.811.40C 3.811 400 3.81 1.40CMeadowView CC Fund 2-993.824 2.90S.60C 3.128.100 2.697.900 2.6S7.900 2.697.90CCattails Golf Gourse Fund 700.585 754.51e 825.50C 910.800 910.800 910,80CFleet lnternal Service Fund 6.021.776 7.O't9.179 9.212.918 ô.661.50C 6.661.500 6.661.50CRisk Manaqement Fund 1.882.829 2.053.936 1.820.922 2.027.60C 2.027.600 2.027.60CHealth lnsurance Fund 4.960.362 5.376.20C 5.519.50C 5.760.00( 5.760.000 5.760.00cCriminal Forfeiture Fund 83.069 83 393 29.00c 8.00c 8.000 I 00cDruo Fund 185.570 203.2U 129.8M 17.30C 117.300 117.30CGeneral Pumose School Fund 52,438.518 55.262.435 56.399.55C 58.037.40C 57.958,400 57.958.40CSchool Food & Nutrition Fund 2.674.O51 2.686.038 2.714.45C 2.778.OOC 2.778.O00 2.778.00CReoional Sales Tax Fund 3.270.O01 3,150,429 4.330.00c 3.330.70C 3,330.70C 3.330.700State Street Aid Fund 2.020.195 2.069.930 2.057.700 2.113.70C 2.113.70C 2.113.704Public Librarv Commission Fund 3.402 1.719 27.504 50c 50c 500Bavs Mountain Commission Fund 133.46C 118.02( 134 000 45.00c 45 00c 45.000Senior Citizens Adv. Board Fund 52.352 68.682 67.100 67.30C 67.30C 67.300Steadman Gemeterv Trust Fund 32S 667 100 10c 100 10(Palmer Center Trust Fund 1i^e 2.323 50t 500 500 50(Allandale Fund 5.552 5.64C 6.00( 6.000 6.000 6.00(Eastman Annex Fund 1.728.7U 1 .681 .1 15 1.586.073 1.550.500 1,550.500 1.550.50C170.751.15a 179.793.299 188.729.952 189.069.800 188.990 800 188.990.80(23

FY2OO7-2008 <strong>BUDGET</strong>TOTAL BTIDGET SUMMARYAGTUAIlevenues o4-{¡5 05{¡6Less lnterfund Transfersfo School Fund:F(evrseo Èluogel06¡7rrequesteg07-08rlecommenqApptove{¡07-08 0748From Eastman Annex Fund 562.20C 562.20C 562.20(From General fund 13.646.2U 16,564,182 r5.863.700 14.955.50C 14.955.50C 14.955.50Cto MeadowView Fund:From Reoional Sales Tax Fund 2.603.U2 2.590.65s 2.605.700 2.585.00C 2.585.00C 2.585.00ClÊo State Streed Aid FundFrom General Fund 659.30C 738.700 704.000 760.000 760.00c 760 00cIo Solid Waste FundFrom Fleet Fund c c 990.300 0 cFrom General Fund 2.726.'t74 2.903.20C 2.871.000 3.084.800 3.084.80C 3,084,80Cfo Debt Se¡vice:From General Fund 3.009,331 1,819.175 2.163.900 2.177.100 2.177.104 2.177.10CFrom General Proiect Fund 997.200 997.20C 997.20CFrom Eastman Annex Fund 468.400 468.400 468.40CFrom School Fund 6.216.757 7.U2.782 7.509.100 6.872_500 6,872,500 6.872.50Cfo Cattails FundFrom Regional Sales Tax Fund 513,97€ 555.289 655.300 745.70C 745.700 745.70Cfo General Fund:From ìNaler Admin Senriccs 774.459 820.262 860.90C 817,00( 817,000 817.00CFrom Sewer Admin. Services 511.522 il3.Ue 484.30C 575.20t 575.204 575.20CFrom Water Fund IPILOT) 333.00C 333.00C 333.00C 393.00t 393.000 393_00CFrom Reqional Sales Tax 0 0 1.069.00c C 0 cFrom Sewer Fund (PILOT) 408.000 408 00c 408.00c 468.00( 468.000 468 00CFrom Eastman Annex Fund 0 0 c 166.60( 166.600 166.60CFrom Fleet Fund 0 0 c ( 0 cTo Transit Fund:From General Fund 0 0 c 239.75C 239.750 239.75(fo Gen Proi€pecial Rev Fund:From General Proiect Fund (fo General Proiect Fund:0 c 21.50( 21,500 21.50(From General Fund c 0 0 520.60C 520.60C 520.60(Io MPO FundFrom General Fund c 0 0 61.20C 61.20C 61.20(to Risk Fund:From General fund 68/.321 672.85e 678.620 631.50C 631.50C 631.50(From Fleet Fund 43.461 u.o74 83.100 112.20C 112.20C 112.20(From Water Fund 1AO.12t 24633e 252.47â 298.60C 298.60C 298.60tFrom Sewer Fund 223.96C 201.2v 153.1 15 198.80C 198.80C 198.80(From Solidwaste Fund 138.79C 71.55Í 67,600 79.70C 79.70C 79.70CFrom School Fund 447.70C M5.l0c 546_600 533.30C 533.30C 533.30(to Fleet Fund:From General fund '|,.979.626 2_143.35,E 2.v2.OO0 2.070.80c 2.070.80c 2.O70.80CFrom Water Fund 367.221 431.792 508.800 535 90C 535.90C 535.90CFrom Sewer Fund 247.352 237.587 317.100 300.90c 300.90c 300.90(From Solid Waste Fund 763.097 775.631 795.00( 918.50C 918.50C 918.50(From Solid Waste Fund 199.00C 199.00C 199.00CFrom School Fund 723.029 766.74C 875.70C 808.50C 808.50CIo Health Fund808.50CFrom Water Fund 357,138 380,477 410.70C 421.OOA 421.00C 421,00CGeneral Fund 2.119 614 2.201.021 2.466.30C 2.694.600 2.694.60C 2,694,60tFrom Sewer Fund 206.248 224.167 228.40C 251.400 2il 40A 251.40CFrom Solid Waste Fund 175.4il 172.539 181.60C 198.600 198.600 198.60CFrom Fleet Fund 107.177 118.53C 127.60( 134.000 134.000 134.00CTo Eastman Annex FundGeneral Fund 1.254.9U 1.522.379 1.586.073 1.550.500 1.550-500 1.550.50CSub-Total 41425.427 45.913.972 48.138.983 48.409.050 48.409.050 48.409.05CTotal Budset Revenues 129.325.7: 133.879.327 140-590-96ç 140.660 750 140.581.750 140.581.

FY2OO7-2008 <strong>BUDGET</strong>TOTAL <strong>BUDGET</strong> SUMMARYwTotal SummaryActual Revised Budqet Requested Recommend Approvedlend¡tures 04.05 05-06 0647 07{8 0748 07483eneral Fund s53-5 17.553 $55.984.76: $ó0.584.561 s64.309.72( 62.520.70( 62.520.70()ebt Service Fund 9.923.59( 10.385.451 10.394-412 10.515.20( 10.515.20( 10.515.20(Water Fund t1.963.564 12.379.58t 12.839.001 13.007.40( 13.007.40( 13.007.40(Sewer Fund l 1.605.85: l 1.870.38( 12-460-10( 13.317.40C r3.102.30( 13.102.30(Solid Waste Manaqement Fund 3.304.561 3.166.284 4-463-t55 3.811.40c 3.811.40( 3.811.40(MeadowView CC Fund 2-92s-493 2-711.9s8 3. r 28.1 0( 2.707.126 2.697.90( 2-697.90(Cattails Golf Course Fund 664.24: 704.49( 825.50C 910.80C 910.80( 910.80(Fleet lnternal Service Fund 5.564.24: 6.401.99i 9,212.918 6.ó61.500 6.661.50( 6.661.50CRisk Manaqement Fund r-661-428 1.675,435 1.820.922 2.027-60( 2.027-60( 2,027.60(Health lnsurance 4.400.838 4.956.932 5.5r9.500 5.760.00( 5.760.00( 5.760.00(Sriminal Forfeiture Fund 3.00c 54.85ç 29.004 8.00( 8.00( 8.00(Druq Fund 1t9.367 t2t.3t2 t29.80t r r7.30( l r7,30( r 17.30(Seneral Puroose School Fund 52.210^737 54.689.805 56.399-55( 58.493.00( 57.958.40( 57.958.40(School Food & Nutrition Fund 2-572-273 2,686.038 2.7t4.45( 2.778-00( 2.778-00( 2,778.00(ìeqional Sales Tax Fund 3.016.601 3.130.810 4.330.00( 3,330,70( 3"330.70( 3.330.70(State Street Aid Fund 1.875.03i 2.022-422 2,057.70( 2.113.70( 2.1t3.70c 2.1t3.70(¡ublic Librarv Commission Fund 4S 27.50( 50( 50c )ut3ays Mountain Commission Fund 50.541 12.29( t34.00( 45.00( 45.00c 45.00(lenior Citizens Adv. Board Fund 47 -6tt 61-85t 67.10( 67.30( 67.30(, 67,30(Steadman Cemetery Trust Fund l0( l0( r0c r0()almer Center Trust Fund 50( 50( 500 50(\llandale Fund t-42: 2.00( 6.00( ó.00c ó.000 6.00(Eastman Annex Fund 1.580.213 1.623.95t r.58ó.073 1.550.50c 1.550.500 1.550.50(Sub-Total Expenditures 8163.703.622 $171.476.399 st88.729.952 $191.538.746 $188.990.80( s188.990.80t25

FY2OO7-2008 <strong>BUDGET</strong>TOTAL <strong>BUDGET</strong> SUMMAR YActual Revised Eudoet Reouested Recommend Aoorovedenditures 0¡f45 0546 06{7 07{8 07{8 07{8-ess lnterfund Transferssrom General Fund:To School Fund st3.646.264 $16.564.18' $r5.863.70( $r4.955.50( $14.955.500 $r4.955.50(To State Streed Aid Fund 659.30{ 738.70( 704.00( 760.00( 760.000 760.00(To Solid Waste Fund 2.726.t74 2.903,20( 2.871-00t 3.084,80( 3.084.800 3.084,80(To Debt Service Fund 3.009.331 1.819.17: 2.1ó3.90( 2.177.10(. 2.t77.104 2.177 -10(To Fleet Maintenance Fund 1.979.62( 2.143-35: 2-342.00( 2.070.80( 2.070.800 2.070.80(To Risk Manaoement Fund 684.321 672.85( 678.62( 631.50C 63 r.500 63 r.50(To Transit 239-75C 89-7sA 239.75(To General Proiect Fund 520.ó0c 520.600 520.60(To Gen Proiect-Soecial Rev Fund 21.50( 21.500 21.50(To MPO 61.20c 61.204 6r-20(To Health Fund 2.119,6t4 2.201,021 2.466.30C 2.694.60C 2.694-604 2.694.60(From General Proiect Fund:To Debt Service Fund 997.20C 997.20( 997.20(From Eastman Annex Fund:To General Fund 166.60C 166.60( 166.60(To Debt Service Fund 468,400 4ó8.40( 468.40(To School Fund 562.20C 562.20( 562.20(From School FundTo Debt Service Fund 6.2t6.75i 7.842.782 7.509.10c 6.872.50C 6.872.s0( 6.872.50rTo Risk Fund 447.70C 545.10( 546.60C 533.300 533.30( 533.30(To Fleet Fund 723.029 766.74( 875,70C 808.500 808.50( 808.50[From Water Fund:General Fund (Pilot) 333.00C 333.00( 333.00C 393.000 393,00( 393,00CGeneral Fund (Admin. Services) 774.459 820,262 860,900 817,000 817.00( 817.00CTo Risk Fund 180.t27 246.33( 252.475 298.600 298-60( 298.60CTo Fleet Fund 367-221 431-792 508-800 535,900 535.90( 535.90CTo Health Fund 357.138 380.471 410.700 421.000 421-00( 421.000From Sewer Fund:To General Fund (Pilot) 408.000 408.00c 408.000 468.00( 468.00( 468.000To General Fund (Admin. Services) 51t.522 543,348 484.300 575.20( 575.20( 575.20(To Risk Fund 223.964 201.234 153.1 l5 198.80( 198.80( 198.80(To Fleet Fund 247.352 237.581 317.100 300.90( 300.90( 300.90(To Health Fund 206.248 224.16',1 228.400 251.40( 25t-40( 25t-40(From Solid WasteTo Risk Fund 138.79( 71.555 67.60( 79.701 79.70C 79.70(To Fleet Fund 763.09i 775-631 795.00( 918.50( 918,50C 9r8.50(To FLecl Fu¡d (Lsa¡) 0 199.00( 199.00( t99.00(To Health Fund 175.454 172.539 r81.60( 198.60( 198.60C 198-60(=rom Reqional Sales:To Meadowview Fund 2.603.341 2.590,655 2.605.70( 2.585.00( 2.585.00C 2.585.00(To Cattails Fund 513.97: 555.289 655.30( 745-70( 74s.70C 745.70(To General Fund 0 1.069.00(From Fleet Fund:To Risk Fund 43"46: 84-074 83.10( rt2-20( ll2.20c t12.20(To Solid Waste Fund 990.30(To Health Fund t07.t1i I 18.53( t27 -60( r34.00( 134.00c 134.00(From General FundTo Eastman Annex Fund r,258.984 t.522.37t 1.586.073 1.550.50( 1.550.50c 1.550.50(Subtotal s41.42s.42i s45.913.97t $48.138.983 s48.409.0sr $48.409.05C $48.409.05(otal Budqet Expenditures s122.278.t9( s125.562.421 $140.590.96ç s143.129.69( s140.581.750 $140.581.7s(

FY 2OO7-08 BT]DGETGRANT PROJECT ORDINAIICE FUNDSFUND DESCRIPTION AND SUMMARYGrant Project FundsSpecial SchoolFunds142 & 145MetropolitanUrban MassCommunity7,000Proiects Fund Plannino Office Transit DeveloomentBeginning Fund Balance FY0810 000 $ 1 18,000 $ (6,000)Total$r1.95L8:ì4$l3trt00 $rL166-000 s 420.000Endinq Fund Balance - FY08 s 17.000 s 10.000 s 18.000 $ (6.000)Fund¡nq Source:Federal Grants3,788,492396,000420,000Federal through State759,042383,750Local Revenues387,60089,000From School Fund-'14116,700Federal FHWA VA4,500Federal FHWA TN224,400FTA Section 5303 TN38,1 00FTA Section 5303 VA3,200From General Fund61,200 239,750UMTA357.500Total Funding Sources$ 4.951.834 $ 331.400 $ 1.466.000 420,000Expenditures:Education & Administration4,951,834MPO331,400Transit1,466,000CDBG420,00027

F'Y2OO7-08 BI]DGETTOTAL DEBTTOTAL DEBTDuring the 1990s a commitment was made to renovate all <strong>of</strong> the public school buildings as well as buildthe new Washington Elementary School. Additionally, debt was incurred to build the MeadowViewConference and Convention Center and Cattails Golf Course. Significant funds began to be spent onlong neglected sanitary sewer projects, primarily for the Inflow and Infiltration program, as ordered bythe State <strong>of</strong> Tennessee.<strong>The</strong> combined impacts <strong>of</strong> these public policy decisions was to increase the debt from $49.2 million inFY89 to a record hish <strong>of</strong> $142.5 million in FY00.<strong>The</strong> adoption <strong>of</strong> a well reasoned multi-year capital improvements and financing plan is to provide afunding plan to address the needs <strong>of</strong> capital infrastructure. <strong>The</strong> debt service roll <strong>of</strong>f will fund the newprojects each year. <strong>The</strong> plan is reviewed annually.It was proposed that the Five Year Capital Improvements Plan be amended to provided for the issuance<strong>of</strong> new debt for the upcoming five fiscal years.<strong>The</strong> projects that will be funded by bonds for Fiscal Year 2008 are as follows:Higher Education Center$7,000,000Rock Springs Rd Safety Audit-Construction 50,000Ryder Dr/Eastman Road Signalization200,000Legion Pool-Design & Construction6,000,000Water Plant Solids Handling2,145,800*FY07 Sewer SRF Loan draw 4,250,000<strong>The</strong> Sewer SRF Loan for the Sewer Treatment Plant was approved in FY07 budget. <strong>The</strong> amountestimated for FY08, FY09, FY10, and FY11 is $4,250,000 each year making the total amount <strong>of</strong> the loan$17,000,000. <strong>The</strong> project is expected to be complete by FY12.<strong>The</strong> impact on the operating budgets is principle and interest payments. <strong>The</strong>se will be absorbed throughdebt service roll-<strong>of</strong>f. <strong>The</strong>re will not be a need for a property tax increase.28

FY2OO7-08 <strong>BUDGET</strong>TOTAL DEBTAnticiDebt Issues and Position: FY03 to FY29FYDebtRevisedDebtGeneralPlanned New DebtSchools WaterSeweraJ456l8910llt2t3t4l516t71819202t22242526272829$127,592,483121,682,553117,722,872110,333,946130,755,519Total Five-Year PlannedNew Debt137,090,526 13,250,000139,843,988 6,250,000147,244,415 6,625,000149,849,321 4,450,000144,522,373 100,000132,160,113 0119,476,151 0107,400,184 096,867,344 087,172,741 078,129,347 070,224,046 063,424,915 056,359,157 050,047,386 043,462,728 036,591,471 029,528,091 022,273,170 014,713,950 09,658,347 05,799,247 0$30,675,000s59.660.400Vy'ater and Sewer debt issues based on Multi-Year CIP and Rate Plan.Total Planned New Debt includes FY07 SRF loan Sl7M. theestimated amount each yea is $4,250,000 in FY08, 09,10 and I l.0000000000000000000000$02,145,9001,965,0000143,5001,266,10000000000000000000$sJ2oloo4,250,0005,3 15,0005,450,0006,350,0002,100,00000000000000000000$23,465,000General Fund debt issues based on Multi-Year CIP fundineplan.Updated as <strong>of</strong>04-17-0729

F'Y2OO7.O8 <strong>BUDGET</strong>TOTAL DEBTDEBT SERVICE AND DEBT SERWCE RECOVERIESDebt service is the term used to describe the allocation <strong>of</strong> operating funds for the retirement <strong>of</strong>debt þrincipal and interest). Debt service is the first item in the budget for which resources arebudgeted. Understanding and planning for the impacts <strong>of</strong> debt service on the various operatingbudgets is critical.Given the growth in debt service recoveries, an opportunity exists to leverage these funds to issuedebt for the next four fiscal years and address pressing facility and infrastructure needs. <strong>The</strong>amount <strong>of</strong> annual cash funding is still prorated between schools and general services per theBoard's policy; however the general services piece will be used to pay debt service. Debt servicerecoveries is a revenue stream 100% dedicated to the capital improvement plan per Board <strong>of</strong>Mayor and Alderman policy.<strong>The</strong> chart below includes total planned debt through FY12.Total Debt Trcnd Ardysb160,000,000140,000,000120,000,000100,000,00080,000,00060,ooo,00040,000,00020,000,0000æ04.66g,7ææ101112131430

FY2OO7-08 BTIDGETTOTAL DEBT<strong>The</strong> FY08 debt service requirement fòr the total budget is $20,288,600, as reflected in thefollowing chart:Debt Seruice Requirements EstimateFYOSSolid General/ School Water Sewer MeadowView Gattails TotalFY07 Waste L/E AnnexDebtPrincipal& lnterest 36.100 92,625,400 $7,369,700 $2,046,300 $5,460,700 $ 2,096,200 $654,500 $20,288,600Subtotal$2.625,400 $7,369,700 $2.046.300 $5.460,700 $2,096,200 $654,500 $20,288,600As <strong>of</strong> 03-20-07Debt ServiceScheduleBOND RATING<strong>The</strong> <strong>City</strong> enjoys a solid Ar bond rating with a stable rating. Our sister cities <strong>of</strong> Johnson <strong>City</strong> andBristol, TN each enjoy an Al rating as well. <strong>The</strong> <strong>City</strong>'s written hnancial policies, strong GeneralFund undesignated balance, well reasoned and conservative multi-year capital improvementsplans and reducing total debt levels all contribute to helping maintain this excellent bond rating.31

FY 2OO7-08 <strong>BUDGET</strong>MAJOR CAPITAL PROJECTS SUMMARYMAJOR CAPITAL IMPROVEMENTS<strong>The</strong> late 1980s was the last time the <strong>City</strong> had a unified multi-year capital improvements plan.This was seen as a critical deficiency and incremental steps have been made to develop such aplan by this Board and Administration. <strong>The</strong> Water Fund and Sewer Fund Capital ImprovementsPlans were approved in FY02 and FY03; respectively. <strong>The</strong> General Fund Capital ImprovementsPlan was approved in FY04.Prior to the development <strong>of</strong> the multi-year capital planning, much work was not getting done andnone was getting done in a coordinated fashion. A summary <strong>of</strong> the planned major capitalimprovements for FY08 is provided below. <strong>The</strong> reader is directed to the water, sewer andgeneral fund capital improvement plans found in the Capital Improvements budget book.CIP Projects For FY2007-2008General Fund Proiects:Higher Education CenterRyder Dr./Eastman Road SignalizationLegion Pool-Design & ConstructionRock Springs Safety Audit-ConstructionK-Play Phase ll & lllDog ParkMiscellaneous Annexationslndian Trail/Stone Dr. SignalizationStreet ResurfacingMinor Street lmprovementsMinor Storm Drainage lmprovementsParks & Recreation Maintenance lmprovementsRoad DesignFleet Ro<strong>of</strong> & Back Wall RepairMeadow View Conference Center Major Maint.John B. Dennis/Pavilion Dr. SignalizationSidewalk lmprovementsFundinq SourceNew BondsNew BondsNew BondsiPrior YrsNew Bonds/Reallocated BondsReallocated BondsReallocated BondsGeneral FundGeneral Fund/Reallocated BondsGeneral FundGeneral FundGeneral Fund/Reallocated BondsGeneral FundReallocated BondsFleet Fund BalanceRegional Sales TaxTDOT/STP FundsGeneral FundTotalGeneral Fund CIPProjectAmount$7,000,000200,0006,250,00075,00030,00040,00045,60095,000350,00020,00030,00030,000310,000400,000480,000220,00050,000$15.625.60032

F'Y2OO7-08 <strong>BUDGET</strong>MAJOR CAPITAL PROJECTS SUMMARYProjectAmountSewer Fund Proiects:Maintenance Building Ro<strong>of</strong> ReplacementSewer Maintenance StorageHemlock Park lmprovementsMiscellaneous Annexationslnflow & lnfiltration Replacement ProgramWgter Fund Proiects:Water Plant Solids Handling-Design/ConstStorage Tank Rehabilitation ProgramRock Springs Water UpgradesFordtown Road RelocationM iscel laneous AnnexationsWater Plant Window ReplacementFundinq SourceSewer FundsSewer FundsSewer FundsSewer FundsSewer FundsReallocated BondsTotal Wastewater Fund CIPNew BondsWater FundsWater FundsWater FundsReallocated BondsWater FundsWater FundsWater FundsTotalWater Fund CIP$ 75,00060,000550,000700,90028,6001.446.400$2.860.9002,145,80054,200300,0001,000,000295,200204,800595,200100,000$4.695.200aaJJ

FY 2007-08STAFFING HISTORYCitv Staffins HistorvApprovedDepartment Division 04 05 06 07 08Governine BodyCiw ManaserBoard <strong>of</strong> Mavor & Aldermen 7 7 7Citv Judse I I 1 ITOTAL EMPLOYEES I 8 8 8 8Administration 5 6n8 9Communiw Relations 1 I IFull-Time Total 6 8 9 t0Part-Time 2 0 0 0 0Interns-Part Time Total 0 0 0 0 2TOTAL EMPLOYEES 8 7 8 9 t2+Fleet Maintenance 20 20 20 20 20Purchasine 5Part-Time Purchasins/Mail Courier 1 I IPart-TimeTotal I I I I IFull Time Total ¿J ZJ ZJ z) ZJTOTAL EMPLOYEES 24 24 24 24 24aJnJJIJCitv AttornevAdministration 4 4 4 4 4Code Enforcement (Assigned from PoliceDept-Patrol FY07 and FY08) 0.5 0.5 0.5 0 0Full-Time 4.5 4.5 4.5 4ATOTAL EMPLOYEES 4.5 4.5 4.5 4 4Human ResourcesAdministration 4 4 5 4 4Risk Manasement 2.5 2.5aJaJJ*Health Insurance I I 1TOTAL EMPLOYEES 7.5 7.5 9 8 8FinanceAdministration 2 2 2 2 2CiW Clerk I I I IAccountins 10 ll l2 t2 l3Grant Accountant Partiallv Funded bv Grants I IBillins/Collections l4 T4 t¿ ll l1Temoorarv Efficiencv Full-Time Carryover I 1 0 0 0Information Services 9 9 9 9 9Part-Time Office Assistant-CiÛ Clerk Office 0 0 0 0Full-Time Employees 37 38an)t 36 37TOTAL EMPLOYEES )t 38 JI 36 3834

FY 2007-08STAFFING HISTORYCitv Staffrns HistorvAoorovedDenartment Division 04 05 06 07 08FireAdministration 4 4 4Á a 4Central Station 43 43 43 43 43Prevention 4 4 4 4 4Substation 2- Center St. 9 9 9 9 9Substation 3-Memorial Dr. 9 9 9 9 9Substation 4-W. Stone Dr. 9 9 9 9 9Substation 5-Lvnn Garden Dr. 9 9 9 9 9Substation 6-Colonial Heiehts 9 9 9 9 9Full--TimeSubstation 7-Rock Sorinss 0 0 0 0 6Admin. Partiallv Funded bv Granl 0 0 0 I ITotal Part-Time 0 0 0 0Total Full-Time 96 96 96 96 103TOTAL EMPLOYEES 96 96 96 97 r03PoliceFull-Time Administration 4 4 4 4 ^+Sworn Officers 98 99 99 102 106Civilian - Intellisence & Support 0 ICivilian - Records & Traffic CourtClerk 8 8 8 9 9Civilian - Jail 7 7Civilian - Animal Control 2 2 2 2 2Civilian Parkins Enforcement I I 1 1Central Dispatch l8 l8 t8 18 l8Communication - Radio Shoo a a J Ja J J JGrantSworn Officers 3 3 3 I IPositionsPart-Time Central Dispatch 0 0 0 0 0Civilian Records 0 0 0 0 ICivilian- School Guards bt) I5 t5 I5 I5 I5Total Part-Time 15 15 15 t5 t6aGrant Funded Full Time J JJ I IResular Full-Time I4l r43 143 147 151TOTAL EMPLOYEES 159 161 161 t63 16835

FY 2007-08STAFFING HISTORYCitv Staffins HistorYApprovedDeDartment Division 04 05 06 07 08Leisure ServicesBavs Mountain Park t5 15 l6 t6 l6AllandaleaJ J 3aJaJSenior Citizens 7 7 7L brary - Downtown n l2 t2 t2 l3L brarv - Carver Branch I 0 0 0 0L brarv - Archives I 1 I I IParks & Recreation t6 l8 18 l8 l8Part-Time Bavs Mountain Park 4 4 4 2 2Senior Citizens 2 3 3 3tJLibrarv - Carver Branch 2 2 2 2 2Librarv Downtown 7 7 7 5 5Development ServicesParlæ & Recreation I I I I IParks & Recreation -Seasonal39 39 39 39 39Total Part-T me 55 56 56 5t 5lTotal Full-T me 54 56 57 57 58TOTAL EMPLOYEES 109 It2 ll3 108 109Administration 2 2 2 JPlannins 6 6 6 6 6Buildins /Inspection I I 8 7 7/1GIS 4 4 I 4 4Partiallv Grant Fund Mass Transit* I l0 11 11 l1aPartiallv Grant Fund MPO* 4 2 2 JJ100% Grant Funded CDBGX 2 2 2 2 .5Part-TimeMass Transit*(Partial 1l I1 I] t0 10Grant Fund)MPO (Partial GrantFund)InternMPO (Partial Grant I I I I IFund)Developmenl ^Svcs..Part- Time Senior OfficeAsst. 0 0 0 0 IGrant Fund,Partial l2 l2 t2 t2 t2Part-TimeTotal Part-Time t2 t2 T2 l2 t3Resular Full-Time 20 20 20 20 21Partial Grant Funded l3 t2 13 t4 t4Full-Time*Hope VI & CDBG Fully Grant Funded 2 2 2 2 5Total Full-Time 35 34 35 36 36TOTAL EMPLOYEES 47 46 +t ^n 48 49.5II36

FY 2007-08STAFFING HISTORYCitv Staffins HistorvAoorovedDeoartment Division 04 05 06 07 08PublicWorksWater Adm nlstratron l0 l0 t0 10nSewer Adm nlstratlon 4 2 2 2 2Streets/SanitationAdministration4 6 6 6 6Streets MaintenanceJJaaJJ JJ JJaaJJSolid Waste - Collections(includes vard waste and trash)25 25 25 2l 20Part-TimeSolid Waste - Landfill 6 6 6 6 6Solid Waste - Recvcline 4 4 4 4 4Water Plant l3 t6 t6 16 t7Water Svstem Maintenance 36 36 36 36 36Sewer Plant l5 t2 I2 t2 t2Sewer Svstem Maintenance 26 26 26 26 26Meter Readins & Services 8 l8 t8 18 l8TransportationaJ l3 T3 l3 l3Ensineerins 2 t2 l3 l4 t7Public Buildines Maintenance 9 t9 20 20 20Public Grounds, Parks &Landscaoins27 27 27 27 27Resular Full Time Employees 26s 265 267 264 264Seasonal Temporary Grounds(Mowers)4 4 4 4 4Maintenance Worker-Streets &Sanitation0 0 0 0 ITOTAL EMPLOYEES 269 269 271 268 269SummarvGoverning Body 8 8 8 8 8Citv Manaser 8 7 8 9 T2Fleet Maint./Purchasins 24 24 24 24 24Citv Attornev 4.5 4.5 4.5 4 4Human Resources 7.5 7.5 9 8 8Finance 38 )I 36 38Fire 96 96 96 97 103Police 159 161 l6l r63 168Leisure Services 109 r12 ll3 108 109Develooment Services 47 46 47 48 48Public Works 269 269 271 268 269Total Part-time Employees 97 96 96.5 93 98Total Full Time Emolovees 672 677 682 680 693Total Emplovees 769 773 778.5 I tJ 79137

FY 2OO7-08 <strong>BUDGET</strong>GENERAL FTII\DSUMMARYGENERAL FUND SUMMARYMISSIONTo provide efficient, effective services to all <strong>of</strong> the <strong>City</strong>'s citizens and customers.SUMMARY<strong>The</strong> <strong>City</strong> <strong>of</strong> <strong>Kingsport</strong> is a municipal cooperation founded in l9l7 as a modem industrial center <strong>of</strong> businessand commerce. As such, it created at an early date a high level <strong>of</strong> services and expectations <strong>of</strong> qualitymanagement. <strong>The</strong> General Fund provides a wide array <strong>of</strong> services ranging from general administration topublic safety, streets maintenance to planning and development, contributions to various community pafiners,economic development and perhaps the <strong>City</strong>'s most important service, an outstanding public education system.o KSF # l: Citizen Friendly Governmento KSF # 2: Qualified Municipal Work Forceo KSF # 3: Economic Growth and Developmento KSF # 4: Stewardship <strong>of</strong> the Public Fundso KSF # 6: Reliable, Dependable Infrastructureo KSF # 8: Safe CommunitySIP _ KEY SUCCESS FACTORSKEY ISSUES. Maintain the General Fund debt service recoveries funding plan for the multi-year capitalimprovements plan. <strong>The</strong> amount <strong>of</strong> annual cash funding is still prorated between schools and generalservices per the Board's policy; however, the general services piece will be used to pay debt service.This is the same approach utilized by the school system with its annual funding allocations.o Economic development is a now a major activity <strong>of</strong> the General Fund. <strong>The</strong> creation <strong>of</strong> a JointEconomic Development Partnership for Sullivan County, <strong>Kingsport</strong>, Bristol and Bluff <strong>City</strong> promisesto increase economic activities.38

FY 2OO7-08 <strong>BUDGET</strong>GENERAL FUNDSUMMARYCAPITAL PROJECTS<strong>The</strong> Fund's capital improvement plan is funded through two sources <strong>of</strong> revenues, tax revenue generated fromthe Long Island annexation in FY02 and debt service recoveries.<strong>The</strong> capital projects included in the FY2008 Plan are as follows:FY2008 ExpendituresStreet ResurfacinglSidewalk Improvements'Minor Drainage ImprovementsMinor Street ImprovementsK-Play Phase II & IIIParks & Recreation Maintenance ImprovementsDog ParkRock Springs Rd Safety Audit-ConstructionFleet Ro<strong>of</strong> and Back Wall Repair ''Miscellaneous AnnexationsnHigher Education CenterLegion Pool-Design & ConstructionMeadow View Conference Center Major Maint.TJohn B. Dennis/Pavilion Dr SignalizationTotal Expenditure$350,00050,00030,00020,00030,00030,00040,00075,000400,00050,000200,000250,00095,000305,6007,000,0006,000,000480,000220,000$_ll.é25-600FY2008 RevenuesReallocated BondsCashBondsPrior YearsFleet Fund BalanceState MaintenanceTDOT/STP FundsRegional Sales Tax FundsTotal Revenuess 459,000520,60013,250,000250,000400,00046,000220,000480.000$15-625=6001. An additional $100,000 is funded for Street Resurfacing in the State Street Aid fund.2. An additional $70,000 is funded for Sidewalks in the State Street Aid fund.3. <strong>The</strong> Fleet Ro<strong>of</strong> and Back Wall will be funded from the Fleet Fund Balance.4. <strong>The</strong> Legion Pool -Design & Construction will be funded from bonds reserved in the Legion Poolproject account.5. <strong>The</strong> funding for the Indian Trail Signalization will be $46,000 in cash and $49,000 from statemarntenance.6.7.Road Design will be funded from reallocated bonds.MeadowView Conference Center Major Maintenance will be funded from the Regional Sales TaxFund.39

FY 2OO7-08 <strong>BUDGET</strong>GENERAL FUNDSUMMARYREVENUES<strong>The</strong> General Fund has been balanced without any recommended tax or fee increases.RevenuesACTUAL04-05ACTUAL0s-06<strong>BUDGET</strong>06-07REQUESTED07-08RECOMMENDED07-08APPROVED07-08Property Taxes927,722,393$29,858,204$30,211,800$30,569,300$30,569,300$30,569,300Gross Receipts3,036,5823,439,3983, I 80,5003,513,5003,513,5003,5 13,500Licenses & Permits349,751349,77133 1,500603,000603,000603,000Fines & Forfeitures314,670435,779351,0002,037,0002,037,0002,037,000Investments512,652899,8361,061,0001,300,0001,300,0001,300,000Charges For Services2,268,2632,568,7412,995,5003,265,0003,265,0003,265,000Interlocal Government14,019,83714,360,61314,587,20015,491,40015,491,40015,491,400State Shared4,042,3194,740,0704,552,9005,029,4005,029,4005,029,400Fund Balance1,926,642594,5411,761,200220,000220,000220,000From Reg Sales TaxFund001,069,000000Miscellaneous226,995242,2234g3,0g l492,100492,100492,100$54.420_lg4$fl,ry-!]6s60.s84.68rs62.520.700s62.s20.700$é2J20J0040

FY 2OO7-08 BTIDGETGENERAL FI]I\DSUMMARYExpendituresFY 04-05ActualFY 05-06ActualFY 06-07Rev.BudgetFY 07-08RequestFY 07-08RecommendFY 07-08ApprovedSalariess16,524,206$ló,993,65 I$ l 8,38 1,s39$19,565,600$19,565,600$19,565,600Career LadderRequest for New PositionOvertimeFunFestSocial SecurityGroup Health lnsuranceRetirementLife InsuranceLong Term Disability Ins.Workmen's CompensationUnemploymentEmployee EducationContractualCommoditiesOther ExpensesInsurance00542,19363,2101,239,4992,119,6142,196,92643,2843 8,55 I336,16330,55811,9413,810,9261,047,950928,447735,09500609,14293,872t,273,5032,201,0212,297,69648,9t740,498313,6942r,20514,0914368,t70t,013,674984,ss4748,47700s37,388'73,695r,416,0222,466,3002,927,s0059,1 8048,980304,39322,660l 9,5004,483,6091,186,407987,1 l s777 ,7 5660,200403,200s4 1,80094,8001,5 12,5002,694,6003, l 00,60063,7005 1,000250,20023,30014,500s,1 21,s50l,4l 1,600I, I 14,700766,600ó0,200403,200541,r0094,8001,5 12,5002,694,6003,1 00,60063,7005 1,000250,20023,30014,5005, l2 1,5501,3 19,800l,l 14,700766,60060,200403,20054 1,1 0094,8001,5 12,5002,694,6003,100,ó0063,7005 1,000250,2002330014,5005,121,550r,3 19,8001,1 14,700766,600PartnersCapital Outlay1,238,890439,504t,348,593450,6781,646,800749,8371,847,82088ó,600r,492J00438,900t,492J00438,900SubsidiesDebt ServiceSchool DebtSchool OperationsTransfer to Solid WasteFundTransfer to State StreetAid FundTransfer to Mass TransitFundTo Capital Projects - GeneralTo MPO FundTo Eastman Annex FundTIFF- East Stone Commons21,1773,009,3315,916,8647,729,4002,726,174659,300165,030546,68943,7001,258,984021,2412,018,2007,406,2008,721,4002,888,200738,700I 56,1 l969,80443,436I,445,13793,59226,7002,r63,9006,448,6008,721,4002,87 1,000704,000197,3001,677,50057,400I,550,500177,70032,7002,177,t006,344,6008,72t,4003,084,800760,000223,750520,60061,2001,550,500184,40032,7002,t77,t006,344,6008,72r,4003,084,800760,000223,750520,6006r,200I,550,500184,40032,7002,177,1006,344,6008,72r,4003,084,800760,000223,750520,6006t,2001,550,500184,400Other Transfers94,9s867,7000209,000209,000209,000Gen. Proj. Spec. Rev. Funds0002 1.5002 1.s002 1.s00Total Expenditures $53JUJ53 ss6.4er.r6s $60-s84,681$63.416.020s62.520.700 S62.s20.70041

FY 2OO7-08 BT]DGETGENERAL FUNI)SUMMARYFY08 èræral R¡rd Fènærr.e$62.5MSFrrtiandAreaLæd $ionSdesTaçenses$6¿5MbyRrEt¡fialAreaTËEfsto$il\ htetrd8/oScdQsáiG'l4VoTEEfsto Sde SredA¡dFrd1o/oToGFitd FkjectsGãsd1VoTohtrãìArfÞ(RrdÈsõdSsv'xE8/oScdsÈÈt11VoÈbtSsvi:e?/oGFatd o.dSy'lvoF*æ?/<strong>of</strong>sæ10/oOfsEçerE€2/o42

43FY 2OO7.O8 BTIDGETGENERAL FUNI)SUMMARY

FY 2OO7-08 <strong>BUDGET</strong>MAJOR REVENUES DESCRIBEDProperty Ta

FY 2OO7-087 <strong>BUDGET</strong>MAJOR REVENUES DESCRIBEI)Gross Receipts Taxes represent a small and relatively stable, but very low growth, revenue category forthe General Fund It is anticipated that revenue growth from this sector for the new fiscal year will berelatively flat, with growth only in the Cable TV category. <strong>The</strong> motel tax, traditionally a strong revenuegrowth category, is expected to be flat due to the effects <strong>of</strong> the recession.<strong>The</strong> <strong>City</strong> collects the taxes in the referenced categories as follows: beer at l7%o, alcohol beverage at 5o/o,gross receipts on business at ranging from l/8 <strong>of</strong> l% to 1160 <strong>of</strong> l%o depending on the type <strong>of</strong> business,minimum business permit at $15, motel tax at5Yo, and cable TV franchise fee. All revenues from thesesources, except for the motel tax, may be allocated at the discretion <strong>of</strong> the BMA. 87 .5% <strong>of</strong> the receiptsfrom the motel tax are allocated to the <strong>Kingsport</strong> Convention and Visitors Bureau. 12.5% <strong>of</strong> the receiptsare retained by the city for administrative charges.Gross Receipt RevenuesActual lrounded in 000'sl Budset Estimated00-01 0r-02 02-0J 03-04 04-05 05-06 06-07 07-08Beer lVholesale$736 $750 $860 $842 $873 $868 $900 $900Alcoholic Beverase 2t8 200 23s 235 245 270 245 260Gross Receiots Business 833 820 901 983 834 l.l 57 900 1,100Minimum Business 3l 30 3l ZJ 3l 42 34 40Interest & Penalties I l I I I 0 t2 IMotel Tax 652 703 764 735 743 791 800 800Cable TV Franchise 233 200 280 293 297 310 290 412Miscellaneous 4 o 0 0 0 0 0 0TOTAL s2.708 s2.710 s3.072 $3.1 12 $3.024 s3.438 s3-l 8l $3.5 l345

FY2OO7.O8 <strong>BUDGET</strong>MAJOR REVENUES DESCRIBEI)3503æ2æm1501m50Ucerces & Pemib! RrildirgI Gntrætqtr Eectictr HurtirgrC6¡ El,siness L¡(HËef Zmirg CtrãìgetrAnind¡ Alãmf BeerLicenses and Permits represent a small, yet highly volatile revenue category for theGeneral Fund. It is heavily dependent on local building construction and improvements,permit revenues generally rise during strong economic times and are reduced duringweaker economic periods. <strong>The</strong> significant increase in building permits for FY02 is theresult <strong>of</strong> Willamette's $500M expansion and a significant increase in the fees. <strong>The</strong> <strong>City</strong>issues beer privilege licenses to local establishments and, on average, reflects a no newgrowthrevenue source. Alarm charges are for false alarms and alarm monitoring forADT.Licenses & Permits Actual (rounded, in 000s)00-01 01-0202-03 03-0404-05 05-06 06-07Budget EstimatedBuildine 99 242 r7t 183 2r0 219 200 JlfContractor 16 t9 l5 l) t4 t2 l) l5Electric t9 JZ 32 32 42 34 34 125Plumbine t2 l5 25 t5 20 l8 l5 50Gas 28 3l 2t 32 t+ 27 30 60Business License l3 t4 12 t4 l3 l3 IJ t3Zonins Chanse 2 3 2 I 3 2Animal I 0 0 0 0 0 0 0Alarm I 32 l5 l8 0 8 6 6Beer 1416 l4 t4 l{ t7 t7 t6 l7q?r{$35 I $349 s332 s603TOTAL S2O7 $401 $30807-0846

FY 2OO7.O8 <strong>BUDGET</strong>MAJOR REYENUES DESCRIBEDFines & Forfeitures Actual (rounded, in 000s) Budget Estimated00-01 01-02 02-03 03-04 04-05 05-06 06-07 I oZ-oeCitv Court Fines $403 $348 $283 ï220 $300 $421 $336 $2,022Librarv Fines $19 $18 $14 $16 $15 $15 $r5 $15422 366 297 236 315 436 351 2,037lrwesfuirtsI ln,esftæds0G 01- @- G 0+ 0G G 0z-01 e.æu056s76lnvestmentsAcutal (rounded, in 000s00-01 01-02 02-03 03-04 04-05 05-06Budget Estimated06-07 07-08lnvestments s1.445 $538 s357 $301 $51 3 $900 $1,061 $1,300Total $1.445 $538 $357 $301 $513 $900 $1,061 $1.30047

F'Y 2OO7-08 BTJDGETENTERPRISE FUNDSCATTAILS FUIID 421MISSIONTo provide a quality golf facility that continues to maintain a leadership position in service delivery and product quality, alongwith a sound economic retum on the <strong>City</strong>'s investment.Cattails at MeadowView is a par-71 championship course, designed by Dennis Griffith, opened July I, 1998. Cattails has alreadypositioned itself as the finest daily fee golf product in the Tri-Cities. As the only municipal golf course managed by ManiottGolf, Director <strong>of</strong> Golf, Pete DeBraal and his stafftake great pride in making a resort golf experience available at an affordableprice.STRATEGIC IMPLEMENTATION PLANKSF #3: Ecoxorrrc Gnowru. Drvnl,opùrsNr. lxo RnDevnl,opìdnNr:. Increase tourism and conventions ÍÌs an economic development driverKSF #7: Supnnron Ounr¡rrY or Lrnn:o To provide a well-planned and aesthetically designed community that <strong>of</strong>fers a wide variety <strong>of</strong> cultural and recreationalopporhrnities and encourages citizen involvement in community affairs.Cattails is a municipal golf course that also services the MeadowView Resort and Conference and Convention Center. <strong>The</strong> <strong>City</strong>contracts with Marriott Corporation for the management <strong>of</strong> the golf course. Operating revenues are not suffrcient to cover thecost <strong>of</strong> the facility less debt service and depreciation, thus transfers from the general fund were required for prior years.Beginning in FY04, the debt service was funded from the Regional Sales Tax Fund.RevenuesBudgetEstimatedRecommendedApprovedCommissionInvestmentsMiscellaneousFund Balance04-0s$tztr68s1,2190005-06$139,2351,3610006-07$ 131,2002,0000007-08$133,5001,0000007-08$133,5001,0000007-08$l 33,5001,00000Furniture & FixturesTransfer from FFE Reserve27,903028,8310037,000030,600030,600030,600From General FundTransfer from RegionalSales Tax FundTOTAL0513,97500655,3000745,7000745,7000745,700,Commission represents net operating revenues from operations <strong>of</strong>the golfcourse. FF&E represents a percentage <strong>of</strong>net eamingsthat is reserved for future improvements to the facility. Investments represent earnings on cash-on-hand and reserves. Transferfrom General Fund represents the net amount to fund debt service.ExpendituresContractualCommoditiesOther ExpensesMiscellaneousCapital OutlayInsuranceDebt ServiceFF&E Reserves92,632(6,369)35,134000514,94527,90305-065tt^ozs(22,020)35,142000571,75928,831Estimated07-08-$tt^600034,400085,0004,600664,60030,600Recommended07-08$91,600034,400085,0004,600664,60030,600$91,600034,400085,0004,600664,60030,60048

FY 2OO7.O8 BT]DGETENTERPRISE F'UIU)SCATTAILS F[]NI)PERFOR]VIANCE INDICATORSPerformanceMeasureActual03-04Actual04-05Actual05-06Projected06-07Estimated07-08Rounds <strong>of</strong> golf 26,064 25,900 26925 27,100 28,200Golf cards sold 606 625 650 700 77549

FY 2OO7-08 BT]DGETENTERPRISE F'UI\DSMEADOWVIEW-420MISSIONTo provide a world class conference and convention center for the region.SUMMARYTo be recognized as the standard for an operating team that produces outstanding services for owner andcustomer alike within a balanced set <strong>of</strong> mutuallv shared values.MeadowView Convention and Conference Center is a city owned facility operated via contract with theMarriott Corporation. <strong>The</strong> Center requires operating contributions from the Regional Sales Tax Fund for thepayment <strong>of</strong>annual debt service and operations subsidy and from the General Fund for operations subsidy.RevenuesAcluøl04-05 I 0s-06Budget06-07Requesto7-nrRecommended07-08Approved07-08INT LGIP$0$93s0$s,000$5,000$5,000Restricted Cash Accounts000Room Surcharge93,666100,850101,400107,900I 07,900107,900Furniture/Fixture & Equip FeesMiscellaneousInvestmentsFrom Regional Sales Tax FundFund BalanceFrom FF&EFrom Maintenance SinkingFundTOTAL156,14217,0007,1742,603,3420I 16,5000152,582015,3462,544,429096,3000001,0002,605,7000300,00000002,585,0000000002,585,0000000002,585,000s2993.824 $2.909.600 s3.008. I 00 s2.697.900 $2,697,900 s2.697.900000Room Surcharge is a percentage <strong>of</strong>gross room revenues generated by the Hotel for consideration <strong>of</strong>the facilityeasements granted by the <strong>City</strong> to the hotel. <strong>The</strong> percentage rate applicable in the 7rn and subsequent years is2%o. This revenue source is expected to gradually trend upward. Investments represent eamings on cash onhand and investments. Transfer from Reeional Sales Tax Fund provides funding for debt service paymentsand operating contribution and is funded via the $0.0025 regional sales tax. This revenue source is economydependent. From FF&E represents the percentage <strong>of</strong>gross revenues that is to be held for FF&E needs by thefacilitv.50

FY 2OO7-08 <strong>BUDGET</strong>ENTERPRISE FTII\DSMEADOWVIEWExoendituresAclual04-05 I 05-06Budget06-07Requested07-08Recommend07-08Approved07-08ContractualCommoditiesOther ExpensesInsuranceMiscellaneousSubsidies &ContributionsCapital OutlayDebt Service$47,1 800280,3695,1270298,84302,137,838s37,6020140,3816,2400240,54002,134,613$47,0000105,0009,2000298,000300,0002,097,500$36,7000177,20011,4000283,70002,097,500$36,7000717,20011,4000283,70002,097,500$36,7000117,20011,4000283,70002,097,500FF&E ReserveTransfersTotal156,142 152,582 151,400 151,400 151,400 151,400s2.925.493 s2.71 1.958 s3.008.100 s2,697,900 s2.697.900 $2,697,90051

[.Y 2OO7-08 BIJDGETENTERPRISE T'UNDSMEADOWVIEW-420Meadow View Convention and Conference Center52

FY 2OO7-08 <strong>BUDGET</strong>ENTERPRISE FT]NDSSOLU) WASTE F'UND -415SUMMARYMISSIONTo provide a clean and healthy environment through a variety <strong>of</strong> services that meets the needs <strong>of</strong> residents,businesses and industries.SUMMARY<strong>The</strong> <strong>City</strong> provides solid waste services to 16,100 households within the city under the auspices <strong>of</strong> its PublicWorks Department, Streets and Sanitation Division. Services that are provided include:1. Residential curbside organic refuse collection and disposal2. Small commercial and governmental bulk container collection and disposal3. Residential yard debris collection and disposal4. White goods and tires collection and disposal5. Demolition landfill services6. Residential and <strong>of</strong>fice paper recycling collection and disposal<strong>The</strong> <strong>City</strong> does not charge for these services except for tires, backdoor service for a very limited targetpopulation, and tipping fees at the demolition landfill. If pickup <strong>of</strong> white goods is done by the <strong>City</strong>, there is acharge, but if the residents take them to the Landfill themselves, there would be no charge to them. <strong>The</strong> bulk<strong>of</strong> the service is financed via an inter-fund transfer from the General Fund.STRATEGIC IMPLEMENTATION PLANKSF # 7: SupBRroR Qu¡lrrv oF Lmn:o Continued improved handling <strong>of</strong> code enforcement.o Maintaining a clean, healthy urban environment.PERFOR}IANCE EXCELLENCE<strong>The</strong> Solid Waste Division <strong>of</strong> Public Works has attained sienificant results from its efforts withperformance excellence. Specifically:l. Increased recycling volumes <strong>of</strong> all categories including new <strong>of</strong>fice paper recycling: the $45,000savings realized in FY04 continues in succeeding fiscal years.2. Recycling rebates from the State <strong>of</strong> Tennessee averaging 52,300 annually pay for the <strong>City</strong>'spurchase <strong>of</strong>new recycling bins.Please refer to Performance Excellence Appendix for more information.53

FY 2OO7.O8 BTJDGETENTERPRISE FUNDS: SOLD WASTE F{JND 415SUMMARYMajor Revenues Describedo Refuse Collection Charees: charges for service to small commercial (14 accounts) andgovemmental bulk container service. <strong>The</strong> current charge is $20.00 per pick-up for one cart.General commercial service was terminated in FY96, thus the significant decrease inrevenues.o Backdoor Collection Charees: charges for service to 85 customers. <strong>The</strong> current charge is$264 per year.o Landfill Tippine Fee: charges for service, on a per-ton basis, for those that use thedemolition landfill. <strong>The</strong> cost per ton is $30.50.o General Fund Transfer: transfer <strong>of</strong> general tax dollars to support solid waste services. <strong>The</strong>transfer has generally been increasing due to increasing costs <strong>of</strong> personnel and otheroperating costs. <strong>The</strong> transfer is reduced this year primarily due to the levying <strong>of</strong> landf,rll feesfor the city operations. It provides 84o/o <strong>of</strong> the fund's revenues.RevenuesActualActualRevisedBudgetRequestRecommendApprovedFY 04-05FY 05-06FY 06-07FY 07-08FY 07-08FY 07-08RecyclingRefuse Coll. ChargesConstruction WasteTire DisposalMt. CarmelCollectionsWood ChipFuelBack Door Coll. FeesLandfill Tipping FeeInvestmentsMiscellaneousFrom General FundFrom Fleet FundFund Balances76,34776,8971,9351,46800406422,7784,45102,726,17400$5s,23173,4372,0702,2980020,570334,759t3,28302,903,20000$50,00085,000I,900I,7000023,000400,00012,00002,871,000990,30028,25s$50,00075,0001,9001,700I 35,000023,000400,00030,00050003,084,80000$50,00075,0001,9001,700I 35,0005,00023,000400,00030,00050003,084,80000$50,00075,0001,9001,700135,0005,00023,000400,00030,000s0003,084,80000$3.310.456 s3.404.848 s4.463.155 $3.806.400 s3.811.400 53lllrCIO54

FY 2OO7.O8 <strong>BUDGET</strong>ENTERPRISE X'UIIDSSOLD WASTE FUND J15STIMMARYFUND <strong>BUDGET</strong> INFORMATIONFYOT{!8 Sol¡d ìllåsþ Fund Revenue Sourcesljppins ree,$4æ,0æ,11%Érnirgs ørlrnresfrent,$0,0m,1%Ail Ctfpr,$156,6æ,4%èrerd turdTransfer,$3,185,800, 84%EXPENDITURESActualFY 04-0sActualFY 05-06RevisedBudgetFY 06-07RequestFY 07-08RecommendFY 07-08ApprovedFY 07-08Trash Coll-4021s782,571s692,397$740,900$768,400$768,400$768,400Organic Refuse-40221,511,9921,493,0932,500,2501,470,600t,470,6001,470,600Demo. Landhll-4023652,667580,579757,453820,400820,400820,400Recycling-40273t6,657359,259403,052473,800473,800473,800Nondepartment-409940,67439,01361,50042,70042,70042,700Other Expenses-5010Total01.9430 235.500235,500235,500s3.304.561 s3.r66.284 s4.463.155 $3.811.400 s3.8 l r.400 s3.81 1.40055

FY 2OO7-08 BI]DGETENTERPRISE FUNDS: SOLID WASTE FII¡ID --415SUMMARYF'YO7{)8 Sol¡dlllffi Fund Þ

57FY 2OO7.O8 <strong>BUDGET</strong>ENTERPRISE F[]1\DSWASTEWATER FUI\D SUMMARY