THE MICROBANKING BULLETIN No. 20 - Microfinance Information ...

THE MICROBANKING BULLETIN No. 20 - Microfinance Information ...

THE MICROBANKING BULLETIN No. 20 - Microfinance Information ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

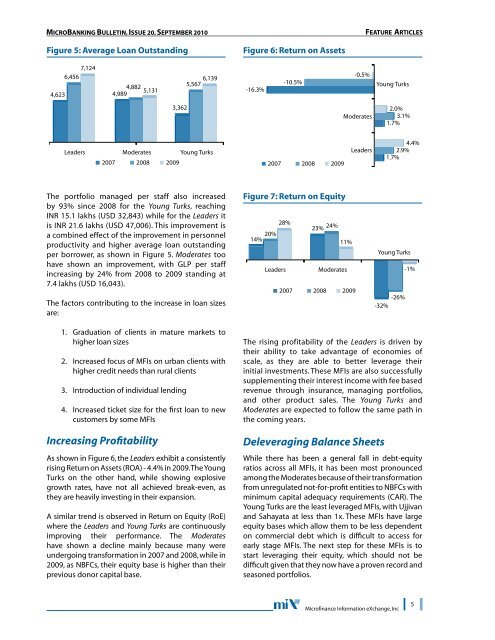

<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, Issue <strong>20</strong>, SEptEMBER <strong>20</strong>10FEATURE ARTICLESFigure 5: Average Loan OutstandingFigure 6: Return on Assets4,6237,1246,4564,8824,9895,1315,567 6,139-16.3%-10.5%-0.5%Young Turks3,362Moderates2.0%3.1%1.7%Leaders Moderates Young Turks<strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09<strong>20</strong>07<strong>20</strong>08<strong>20</strong>09Leaders4.4%2.9%1.7%The portfolio managed per staff also increasedby 93% since <strong>20</strong>08 for the Young Turks, reachingINR 15.1 lakhs (USD 32,843) while for the Leaders itis INR 21.6 lakhs (USD 47,006). This improvement isa combined effect of the improvement in personnelproductivity and higher average loan outstandingper borrower, as shown in Figure 5. Moderates toohave shown an improvement, with GLP per staffincreasing by 24% from <strong>20</strong>08 to <strong>20</strong>09 standing at7.4 lakhs (USD 16,043).The factors contributing to the increase in loan sizesare:Figure 7: Return on Equity28%23% 24%<strong>20</strong>%14%11%LeadersModerates<strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09Young Turks-1%-26%-32%1. Graduation of clients in mature markets tohigher loan sizes2. Increased focus of MFIs on urban clients withhigher credit needs than rural clients3. Introduction of individual lending4. Increased ticket size for the first loan to newcustomers by some MFIsIncreasing ProfitabilityAs shown in Figure 6, the Leaders exhibit a consistentlyrising Return on Assets (ROA) - 4.4% in <strong>20</strong>09. The YoungTurks on the other hand, while showing explosivegrowth rates, have not all achieved break-even, asthey are heavily investing in their expansion.A similar trend is observed in Return on Equity (RoE)where the Leaders and Young Turks are continuouslyimproving their performance. The Moderateshave shown a decline mainly because many wereundergoing transformation in <strong>20</strong>07 and <strong>20</strong>08, while in<strong>20</strong>09, as NBFCs, their equity base is higher than theirprevious donor capital base.The rising profitability of the Leaders is driven bytheir ability to take advantage of economies ofscale, as they are able to better leverage theirinitial investments. These MFIs are also successfullysupplementing their interest income with fee basedrevenue through insurance, managing portfolios,and other product sales. The Young Turks andModerates are expected to follow the same path inthe coming years.Deleveraging Balance SheetsWhile there has been a general fall in debt-equityratios across all MFIs, it has been most pronouncedamong the Moderates because of their transformationfrom unregulated not-for-profit entities to NBFCs withminimum capital adequacy requirements (CAR). TheYoung Turks are the least leveraged MFIs, with Ujjivanand Sahayata at less than 1x. These MFIs have largeequity bases which allow them to be less dependenton commercial debt which is difficult to access forearly stage MFIs. The next step for these MFIs is tostart leveraging their equity, which should not bedifficult given that they now have a proven record andseasoned portfolios.<strong>Microfinance</strong> <strong>Information</strong> eXchange, Inc