THE MICROBANKING BULLETIN No. 20 - Microfinance Information ...

THE MICROBANKING BULLETIN No. 20 - Microfinance Information ...

THE MICROBANKING BULLETIN No. 20 - Microfinance Information ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

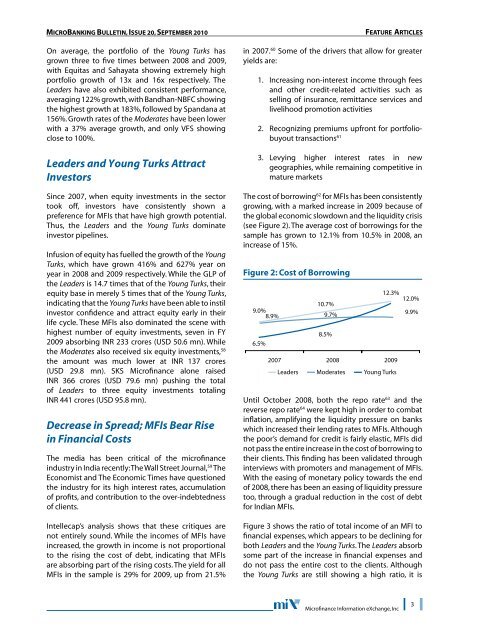

<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, Issue <strong>20</strong>, SEptEMBER <strong>20</strong>10On average, the portfolio of the Young Turks hasgrown three to five times between <strong>20</strong>08 and <strong>20</strong>09,with Equitas and Sahayata showing extremely highportfolio growth of 13x and 16x respectively. TheLeaders have also exhibited consistent performance,averaging 122% growth, with Bandhan-NBFC showingthe highest growth at 183%, followed by Spandana at156%. Growth rates of the Moderates have been lowerwith a 37% average growth, and only VFS showingclose to 100%.Leaders and Young Turks AttractInvestorsSince <strong>20</strong>07, when equity investments in the sectortook off, investors have consistently shown apreference for MFIs that have high growth potential.Thus, the Leaders and the Young Turks dominateinvestor pipelines.Infusion of equity has fuelled the growth of the YoungTurks, which have grown 416% and 627% year onyear in <strong>20</strong>08 and <strong>20</strong>09 respectively. While the GLP ofthe Leaders is 14.7 times that of the Young Turks, theirequity base in merely 5 times that of the Young Turks,indicating that the Young Turks have been able to instilinvestor confidence and attract equity early in theirlife cycle. These MFIs also dominated the scene withhighest number of equity investments, seven in FY<strong>20</strong>09 absorbing INR 233 crores (USD 50.6 mn). Whilethe Moderates also received six equity investments, 58the amount was much lower at INR 137 crores(USD 29.8 mn). SKS <strong>Microfinance</strong> alone raisedINR 366 crores (USD 79.6 mn) pushing the totalof Leaders to three equity investments totalingINR 441 crores (USD 95.8 mn).Decrease in Spread; MFIs Bear Risein Financial CostsThe media has been critical of the microfinanceindustry in India recently: The Wall Street Journal, 59 TheEconomist and The Economic Times have questionedthe industry for its high interest rates, accumulationof profits, and contribution to the over-indebtednessof clients.Intellecap’s analysis shows that these critiques arenot entirely sound. While the incomes of MFIs haveincreased, the growth in income is not proportionalto the rising the cost of debt, indicating that MFIsare absorbing part of the rising costs. The yield for allMFIs in the sample is 29% for <strong>20</strong>09, up from 21.5%FEATURE ARTICLESin <strong>20</strong>07. 60 Some of the drivers that allow for greateryields are:1. Increasing non-interest income through feesand other credit-related activities such asselling of insurance, remittance services andlivelihood promotion activities2. Recognizing premiums upfront for portfoliobuyouttransactions 613. Levying higher interest rates in newgeographies, while remaining competitive inmature marketsThe cost of borrowing 62 for MFIs has been consistentlygrowing, with a marked increase in <strong>20</strong>09 because ofthe global economic slowdown and the liquidity crisis(see Figure 2). The average cost of borrowings for thesample has grown to 12.1% from 10.5% in <strong>20</strong>08, anincrease of 15%.Figure 2: Cost of Borrowing9.0%8.9%10.7%6.5%<strong>20</strong>079.7%8.5%<strong>20</strong>08<strong>20</strong>09Leaders Moderates Young Turks12.3%12.0%9.9%Until October <strong>20</strong>08, both the repo rate 63 and thereverse repo rate 64 were kept high in order to combatinflation, amplifying the liquidity pressure on bankswhich increased their lending rates to MFIs. Althoughthe poor’s demand for credit is fairly elastic, MFIs didnot pass the entire increase in the cost of borrowing totheir clients. This finding has been validated throughinterviews with promoters and management of MFIs.With the easing of monetary policy towards the endof <strong>20</strong>08, there has been an easing of liquidity pressuretoo, through a gradual reduction in the cost of debtfor Indian MFIs.Figure 3 shows the ratio of total income of an MFI tofinancial expenses, which appears to be declining forboth Leaders and the Young Turks. The Leaders absorbsome part of the increase in financial expenses anddo not pass the entire cost to the clients. Althoughthe Young Turks are still showing a high ratio, it is<strong>Microfinance</strong> <strong>Information</strong> eXchange, Inc