Appendixrate, which results in inflation adjustment income,offsetting to some degree the expense generated byadjusting equity. 2 On the balance sheet, this inflationadjustment results in a reordering of equi ty accounts:profits are redistributed between real profit and thenominal profits required to maintain the real valueof equity.MFIs that borrow from banks or mobilize savings havean actual interest expense, which is an operating cost.In comparison, similar MFIs that lend only their equityhave no interest expense and therefore have loweroperating costs. If an MFI focuses on sustainabilityand the maintenance of its capital/asset ratio, itmust increase the size of its equity in nominal termsto continue to make the same value of loans in real(inflation-adjusted) terms. Inflation increases thecost of tangible items over time, so that a borrowerneeds more money to purchase them. MFIs that wantto maintain their support to clients must thereforeoffer larger loans. Employees’ salaries go up withinflation, so the average loan balance and portfoliomust increase to compensate, assuming no increasein interest margin. Therefore, an institution that fundsits loans with its equity must maintain the real value ofthat equity, and pass along the cost of doing so to theclient. This expectation implies MFIs should chargeinterest rates that include the inflation adjustmentexpense as a cost of funds, even if this cost is notactually paid to anyone outside the institution.Some countries with high or volatile levels of inflationrequire businesses to use inflation-based accountingon their audited financial statements. We use a proxyof this same technique in the Bulletin. Of course, weunderstand that in countries where high or volatileinflation is a new experience, MFIs may find it difficultto pass on the full cost of inflation to clients. Theseadjustments not do reflect policy recommendations;rather, they provide a common analytical framework thatcompares real financial performance meaningfully.SubsidiesWe adjust participating institutions’ financialstatements for the effect of subsidies by presentingthem as they would look on an unsubsidized basis.These adjustments do not intend to suggest that MFIsshould or should not be subsidized. Rather, they allowthe Bulletin to see how each MFI would look withoutsubsidies for comparative purposes. Most of theparticipating MFIs indicate a desire to grow beyond2In fact, an institution that holds fixed assets equal to its equityavoids the cost of inflation that affects MFIs which hold much oftheir equity in financial form.<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, Issue <strong>20</strong>, SeptEMBER <strong>20</strong>10the limitations imposed by subsidized funding. Thesubsidy adjustment permits an MFI to judge whetherit is on track toward such an outcome. A focus onsustainable expansion suggests that subsidies shouldbe used to defray start-up costs or support innovation.The subsidy adjustment simply indicates the extentto which the subsidy is being passed on to clientsthrough lower interest rates or whether it is buildingthe MFI’s capital base for further expansion.The Bulletin adjusts for three types of subsidies:(1) a cost-of-funds subsidy from loans at belowmarketrates, (2) current-year cash donations to fundportfolio and cover expenses, and (3) in-kind subsidies,such as rent-free office space or the services ofpersonnel who are not paid by the MFI and thus notreflected on its income statement. Additionally, formultipurpose institutions, the MicroBanking Bulletinattempts to isolate the performance of the financialservices program, removing the effect of any crosssubsidization.The cost-of-funds adjustment reflects the impact of softloans on the financial performance of the institution.The Bulletin calculates the difference between whatthe MFI actually paid in interest on its subsidizedliabilities and what it would have paid at market terms. 3This difference represents the value of the subsidy,which we treat as an additional financial expense. Weapply this subsidy adjustment to the average balanceof borrowings carried by the MFI over the year. Thedecreased profit is offset by generating a “cost of fundsadjustment” account on the balance sheet.If the MFI passes on the interest rate subsidy to itsclients through a lower final rate of interest, thisadjustment may result in an operating loss. If the MFIdoes not pass on this subsidy, but instead uses it toincrease its equity base, the adjustment indicatesthe amount of the institution’s profits that wereattributable to the subsidy rather than operations.Loan Loss ProvisioningFinally, we apply standardized policies for loan lossprovisioning and write-off. MFIs vary tremendously3Data for shadow interest rates are obtained from line 60l ofthe International Financial Statistics, IMF, various years. Thedeposit rate is used because it is a published benchmark inmost countries. Sound arguments can be made for use ofdifferent shadow interest rates. NGOs that wish to borrow frombanks would face interest significantly higher than the depositrate. A licensed MFI, on the other hand, might mobilize savingsat a lower financial cost than the deposit rate, but reserverequirements and administrative costs would drive up theactual cost of such liabilities.18<strong>Microfinance</strong> <strong>Information</strong> eXchange, Inc

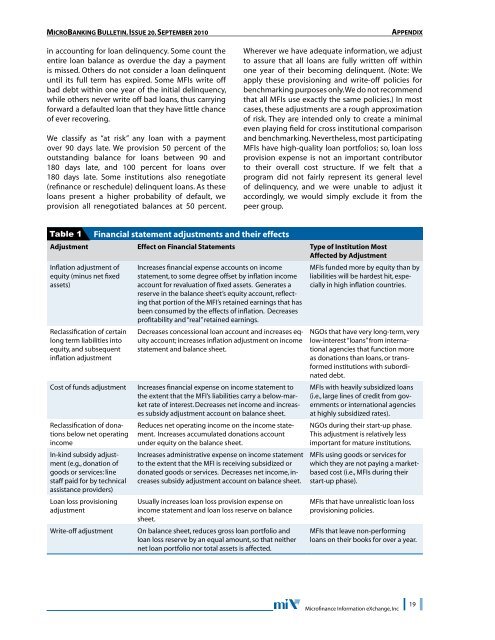

<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, Issue <strong>20</strong>, September <strong>20</strong>10in accounting for loan delinquency. Some count theentire loan balance as overdue the day a paymentis missed. Others do not consider a loan delinquentuntil its full term has expired. Some MFIs write offbad debt within one year of the initial delinquency,while others never write off bad loans, thus carryingforward a defaulted loan that they have little chanceof ever recovering.We classify as “at risk” any loan with a paymentover 90 days late. We provision 50 percent of theoutstanding balance for loans between 90 and180 days late, and 100 percent for loans over180 days late. Some institutions also renegotiate(refinance or reschedule) delinquent loans. As theseloans present a higher probability of default, weprovision all renegotiated balances at 50 percent.AppendixWherever we have adequate information, we adjustto assure that all loans are fully written off withinone year of their becoming delinquent. (<strong>No</strong>te: Weapply these provisioning and write-off policies forbenchmarking purposes only. We do not recommendthat all MFIs use exactly the same policies.) In mostcases, these adjustments are a rough approximationof risk. They are intended only to create a minimaleven playing field for cross institutional comparisonand benchmarking. Nevertheless, most participatingMFIs have high-quality loan portfolios; so, loan lossprovision expense is not an important contributorto their overall cost structure. If we felt that aprogram did not fairly represent its general levelof delinquency, and we were unable to adjust itaccordingly, we would simply exclude it from thepeer group.Table 1Financial statement adjustments and their effectsAdjustment Effect on Financial Statements Type of Institution MostAffected by AdjustmentInflation adjustment ofequity (minus net fixedassets)Reclassification of certainlong term liabilities intoequity, and subsequentinflation adjustmentCost of funds adjustmentReclassification of donationsbelow net operatingincomeIn-kind subsidy adjustment(e.g., donation ofgoods or services: linestaff paid for by technicalassistance providers)Loan loss provisioningadjustmentWrite-off adjustmentIncreases financial expense accounts on incomestatement, to some degree offset by inflation incomeaccount for revaluation of fixed assets. Generates areserve in the balance sheet’s equity account, reflectingthat portion of the MFI’s retained earnings that hasbeen consumed by the effects of inflation. Decreasesprofitability and “real” retained earnings.Decreases concessional loan account and increases equityaccount; increases inflation adjustment on incomestatement and balance sheet.Increases financial expense on income statement tothe extent that the MFI’s liabilities carry a below-marketrate of interest. Decreases net income and increasessubsidy adjustment account on balance sheet.Reduces net operating income on the income statement.Increases accumulated donations accountunder equity on the balance sheet.Increases administrative expense on income statementto the extent that the MFI is receiving subsidized ordonated goods or services. Decreases net income, increasessubsidy adjustment account on balance sheet.Usually increases loan loss provision expense onincome statement and loan loss reserve on balancesheet.On balance sheet, reduces gross loan portfolio andloan loss reserve by an equal amount, so that neithernet loan portfolio nor total assets is affected.MFIs funded more by equity than byliabilities will be hardest hit, especiallyin high inflation countries.NGOs that have very long-term, verylow-interest “loans” from internationalagencies that function moreas donations than loans, or transformedinstitutions with subordinateddebt.MFIs with heavily subsidized loans(i.e., large lines of credit from governmentsor international agenciesat highly subsidized rates).NGOs during their start-up phase.This adjustment is relatively lessimportant for mature institutions.MFIs using goods or services forwhich they are not paying a marketbasedcost (i.e., MFIs during theirstart-up phase).MFIs that have unrealistic loan lossprovisioning policies.MFIs that leave non-performingloans on their books for over a year.<strong>Microfinance</strong> <strong>Information</strong> eXchange, Inc19