Download the PDF - Cambodia Property for Sale & Rent | Knight ...

Download the PDF - Cambodia Property for Sale & Rent | Knight ...

Download the PDF - Cambodia Property for Sale & Rent | Knight ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

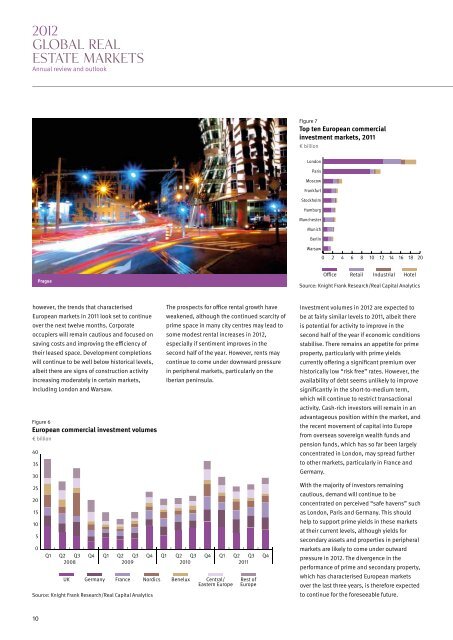

2012GLOBAL REALESTATE MARKETSAnnual review and outlookFigure 7Top ten European commercialinvestment markets, 2011€ billionLondonParisMoscowFrankfurtStockholmHamburgManchesterMunichBerlinWarsaw0 2 4 6 8 10 12 14 16 18 20PragueOffice Retail Industrial HotelSource: <strong>Knight</strong> Frank Research/Real Capital Analyticshowever, <strong>the</strong> trends that characterisedEuropean markets in 2011 look set to continueover <strong>the</strong> next twelve months. Corporateoccupiers will remain cautious and focused onsaving costs and improving <strong>the</strong> efficiency of<strong>the</strong>ir leased space. Development completionswill continue to be well below historical levels,albeit <strong>the</strong>re are signs of construction activityincreasing moderately in certain markets,including London and Warsaw.Figure 6European commercial investment volumes€ billion4035302520151050The prospects <strong>for</strong> office rental growth haveweakened, although <strong>the</strong> continued scarcity ofprime space in many city centres may lead tosome modest rental increases in 2012,especially if sentiment improves in <strong>the</strong>second half of <strong>the</strong> year. However, rents maycontinue to come under downward pressurein peripheral markets, particularly on <strong>the</strong>Iberian peninsula.Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q42008 2009 2010 2011UK Germany France Nordics Benelux Central/ Rest ofEastern Europe EuropeSource: <strong>Knight</strong> Frank Research/Real Capital AnalyticsInvestment volumes in 2012 are expected tobe at fairly similar levels to 2011, albeit <strong>the</strong>reis potential <strong>for</strong> activity to improve in <strong>the</strong>second half of <strong>the</strong> year if economic conditionsstabilise. There remains an appetite <strong>for</strong> primeproperty, particularly with prime yieldscurrently offering a significant premium overhistorically low “risk free” rates. However, <strong>the</strong>availability of debt seems unlikely to improvesignificantly in <strong>the</strong> short-to-medium term,which will continue to restrict transactionalactivity. Cash-rich investors will remain in anadvantageous position within <strong>the</strong> market, and<strong>the</strong> recent movement of capital into Europefrom overseas sovereign wealth funds andpension funds, which has so far been largelyconcentrated in London, may spread fur<strong>the</strong>rto o<strong>the</strong>r markets, particularly in France andGermany.With <strong>the</strong> majority of investors remainingcautious, demand will continue to beconcentrated on perceived “safe havens” suchas London, Paris and Germany. This shouldhelp to support prime yields in <strong>the</strong>se marketsat <strong>the</strong>ir current levels, although yields <strong>for</strong>secondary assets and properties in peripheralmarkets are likely to come under outwardpressure in 2012. The divergence in <strong>the</strong>per<strong>for</strong>mance of prime and secondary property,which has characterised European marketsover <strong>the</strong> last three years, is <strong>the</strong>re<strong>for</strong>e expectedto continue <strong>for</strong> <strong>the</strong> <strong>for</strong>eseeable future.10