Download the PDF - Cambodia Property for Sale & Rent | Knight ...

Download the PDF - Cambodia Property for Sale & Rent | Knight ...

Download the PDF - Cambodia Property for Sale & Rent | Knight ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

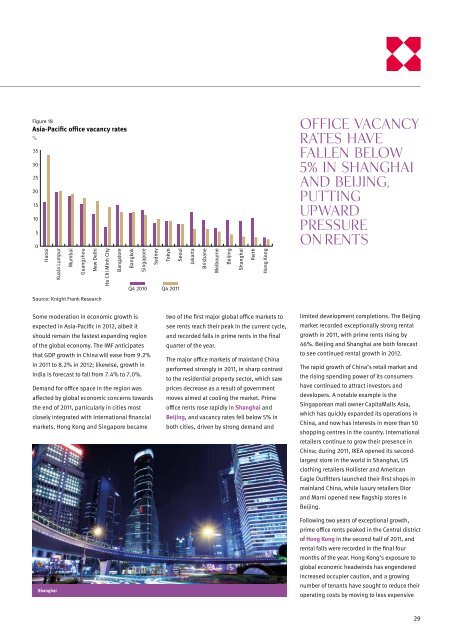

Figure 18Asia-Pacific office vacancy rates%35302520151050HanoiKuala LumpurMumbaiGuangzhouNew DelhiHo Chi Minh CityBangaloreBangkokSingaporeSydneyTokyoSeoulQ4 2010 Q4 2011JakartaBrisbaneMelbourneBeijingShanghaiPerthHong KongOffice vacancyrates havefallen below5% in Shanghaiand Beijing,puttingupwardpressureon rentsSource: <strong>Knight</strong> Frank ResearchSome moderation in economic growth isexpected in Asia-Pacific in 2012, albeit itshould remain <strong>the</strong> fastest expanding regionof <strong>the</strong> global economy. The IMF anticipatesthat GDP growth in China will ease from 9.2%in 2011 to 8.2% in 2012; likewise, growth inIndia is <strong>for</strong>ecast to fall from 7.4% to 7.0%.Demand <strong>for</strong> office space in <strong>the</strong> region wasaffected by global economic concerns towards<strong>the</strong> end of 2011, particularly in cities mostclosely integrated with international financialmarkets. Hong Kong and Singapore becameShanghaitwo of <strong>the</strong> first major global office markets tosee rents reach <strong>the</strong>ir peak in <strong>the</strong> current cycle,and recorded falls in prime rents in <strong>the</strong> finalquarter of <strong>the</strong> year.The major office markets of mainland Chinaper<strong>for</strong>med strongly in 2011, in sharp contrastto <strong>the</strong> residential property sector, which sawprices decrease as a result of governmentmoves aimed at cooling <strong>the</strong> market. Primeoffice rents rose rapidly in Shanghai andBeijing, and vacancy rates fell below 5% inboth cities, driven by strong demand andlimited development completions. The Beijingmarket recorded exceptionally strong rentalgrowth in 2011, with prime rents rising by46%. Beijing and Shanghai are both <strong>for</strong>ecastto see continued rental growth in 2012.The rapid growth of China’s retail market and<strong>the</strong> rising spending power of its consumershave continued to attract investors anddevelopers. A notable example is <strong>the</strong>Singaporean mall owner CapitaMalls Asia,which has quickly expanded its operations inChina, and now has interests in more than 50shopping centres in <strong>the</strong> country. Internationalretailers continue to grow <strong>the</strong>ir presence inChina; during 2011, IKEA opened its secondlargeststore in <strong>the</strong> world in Shanghai, USclothing retailers Hollister and AmericanEagle Outfitters launched <strong>the</strong>ir first shops inmainland China, while luxury retailers Diorand Marni opened new flagship stores inBeijing.Following two years of exceptional growth,prime office rents peaked in <strong>the</strong> Central districtof Hong Kong in <strong>the</strong> second half of 2011, andrental falls were recorded in <strong>the</strong> final fourmonths of <strong>the</strong> year. Hong Kong’s exposure toglobal economic headwinds has engenderedincreased occupier caution, and a growingnumber of tenants have sought to reduce <strong>the</strong>iroperating costs by moving to less expensive29