Levitt Report - NHL.com

Levitt Report - NHL.com

Levitt Report - NHL.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

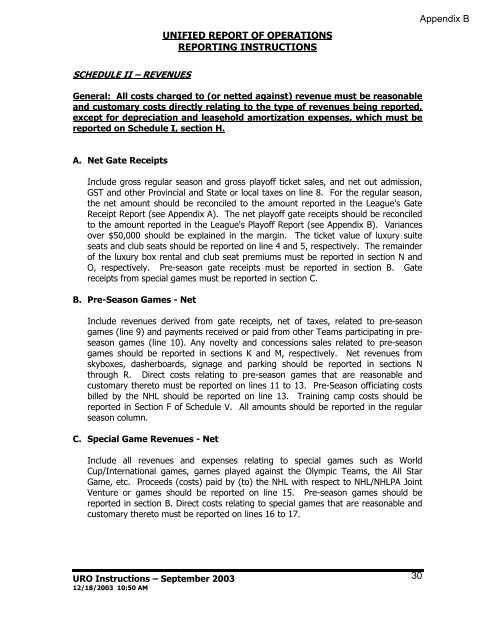

UNIFIED REPORT OF OPERATIONSREPORTING INSTRUCTIONSSCHEDULE II – REVENUESGeneral: All costs charged to (or netted against) revenue must be reasonableand customary costs directly relating to the type of revenues being reported,except for depreciation and leasehold amortization expenses, which must bereported on Schedule I, section H.A. Net Gate ReceiptsInclude gross regular season and gross playoff ticket sales, and net out admission,GST and other Provincial and State or local taxes on line 8. For the regular season,the net amount should be reconciled to the amount reported in the League's GateReceipt <strong>Report</strong> (see Appendix A). The net playoff gate receipts should be reconciledto the amount reported in the League's Playoff <strong>Report</strong> (see Appendix B). Variancesover $50,000 should be explained in the margin. The ticket value of luxury suiteseats and club seats should be reported on line 4 and 5, respectively. The remainderof the luxury box rental and club seat premiums must be reported in section N andO, respectively. Pre-season gate receipts must be reported in section B. Gatereceipts from special games must be reported in section C.B. Pre-Season Games - NetInclude revenues derived from gate receipts, net of taxes, related to pre-seasongames (line 9) and payments received or paid from other Teams participating in preseasongames (line 10). Any novelty and concessions sales related to pre-seasongames should be reported in sections K and M, respectively. Net revenues fromskyboxes, dasherboards, signage and parking should be reported in sections Nthrough R. Direct costs relating to pre-season games that are reasonable andcustomary thereto must be reported on lines 11 to 13. Pre-Season officiating costsbilled by the <strong>NHL</strong> should be reported on line 13. Training camp costs should bereported in Section F of Schedule V. All amounts should be reported in the regularseason column.C. Special Game Revenues - NetInclude all revenues and expenses relating to special games such as WorldCup/International games, games played against the Olympic Teams, the All StarGame, etc. Proceeds (costs) paid by (to) the <strong>NHL</strong> with respect to <strong>NHL</strong>/<strong>NHL</strong>PA JointVenture or games should be reported on line 15. Pre-season games should bereported in section B. Direct costs relating to special games that are reasonable andcustomary thereto must be reported on lines 16 to 17.URO Instructions – September 2003 3012/18/2003 10:50 AM