AVIATION - IPM GmbH

AVIATION - IPM GmbH

AVIATION - IPM GmbH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.ipm-scm.com<br />

Content<br />

In Focus: <strong>AVIATION</strong> FORUM 2011<br />

Aerospace Supply Chain: Strategies, Concepts,<br />

Potentials<br />

The supply conference in the aerospace industry<br />

Special Topics: Risk Management, Green Supply Chains,<br />

Globalization of SMEs, Risk and advantages of Consolidation<br />

Key success factors in aerospace supply chain<br />

management<br />

Manfred Hader, Jörg Wahler, Dr. Alexander Schwandt,<br />

Roland Berger Strategy Consultants <strong>GmbH</strong><br />

IT Globalisation on Wings of Steel<br />

Eric Feuillassier, Dimension Data<br />

Aviation Forum 2011<br />

Globalising the Aerospace Supply Chain:<br />

The Airbus Approach<br />

Dr. Klaus Richter, Airbus SAS,<br />

Philippe Advani, EADS<br />

Launch Management – Lean Principles in the<br />

Strategic Supplier Management<br />

Marc Helmold, Bombardier Transportation<br />

III/2011<br />

<strong>AVIATION</strong><br />

Selecting (out)sourcing structures for aerospace<br />

engineering services in India<br />

Prof. Dr. Roger Moser, IIM Bangalore,<br />

Christian Kuklinki, EBS Business School,<br />

Dr. Andreas Wittmer, Universität St. Gallen

Wie behaupten wir unseren<br />

Vorsprung im Markt?<br />

Mit IT geschäftlichen Mehrwert schaffen.<br />

Geschäftsprozesse optimieren sowie Kosten und Kapitalbindung reduzieren: Dafür stellt Siemens IT Solutions and<br />

Services mit umfassender IT-Kompetenz und fundierter Branchen-Expertise innovative Lösungen bereit, die Kunden im<br />

öffentlichen und im privaten Sektor messbaren Mehrwert bieten. Entdecken Sie neue Möglichkeiten für Ihr Geschäft.<br />

siemens.com/answers<br />

Wie kommen wir an unserem<br />

Wettbewerber vorbei?

<strong>AVIATION</strong><br />

Editorial<br />

This special issue of Supply Chain Management ® focuses on the <strong>AVIATION</strong><br />

FORUM 2011, the supply chain conference in the aerospace industry. At the<br />

Aviation Forum key issues in the aerospace industry will be discussed between<br />

aerospace decision makers including Airbus procurement representatives, a<br />

wide spectrum of aerospace supplier companies as well as top executives and<br />

procurement experts from other industries. The international conference focus-<br />

es on strategies, concepts and potentials in the aerospace supply chain. Beside<br />

14 presentations by top executives, four workshops will be held covering the<br />

special topics of consolidation and globalization of the supplier network, as<br />

well as green approaches and risk management.<br />

The introduction articles will discuss specific selection (out)sourcing struc-<br />

tures for aerospace engineering services in India as well as key success factors<br />

in aerospace supply chain management. The global sourcing challenges and the<br />

specific approach of Airbus; the biggest worldwide manufacturer of airplanes;<br />

to globalize the Aerospace Supply Chain will be presented as a best practise<br />

paradigm. Further topics are the IT Globalization on Wings of Steel and Launch<br />

Management, and the Lean Principles in the Strategic Supplier Management.<br />

Prof. Dr. Johannes Walther Dr. Walter Huber<br />

Institute for Production Management Siemens IT Solutions and Services<br />

S u p p l y Chain Management iii /2011<br />

3

Today’s multi-polar world, with its dynamic<br />

emerging markets, new and sometimes surprising<br />

competitors, and rising importance of services<br />

and customer-centricity, will make strategic<br />

investment, not retrenchment, the key to<br />

emerging from the downturn not simply as a<br />

survivor, but as a stronger company that can win<br />

in the long term – a high-performance business.<br />

Accenture offers a number of tailored industry<br />

solutions that help global companies and their<br />

partners, including:<br />

Shifting to Services<br />

Accenture helps aerospace and defense<br />

companies reshape and reposition themselves<br />

successfully from a pure product focus to a<br />

service-orientated way of working. Our capability<br />

assets help aerospace and defense companies win<br />

and support availability and performance-based<br />

contracts.<br />

Engineering Services<br />

Our Engineering Services solution supports<br />

drawing updates, common part maintenance<br />

and other vital but lower value-tasks, allowing<br />

in-house engineering staff to focus on innovation<br />

and higher value activities.<br />

Mergers and Acquisitions and<br />

Post Merger Integration<br />

Accenture has helped numerous clients in<br />

many sectors to achieve high performance by<br />

identifying and extracting the value from mergers<br />

Achieving high performance<br />

in the global Aerospace &<br />

Defense industry<br />

Tackling the problems of today while preparing<br />

for growth tomorrow<br />

and acquisitions and perpetuating it through<br />

effective post merger integration to maximise<br />

cost savings.<br />

Talent Management<br />

We combine Accenture’s Human Capital<br />

Transformation approach with our aerospace<br />

and defense experience to help our clients<br />

overcome the challenges that stand in the way<br />

of rapidly and cost-effectively building strong<br />

workforces. Using these tools, we work with<br />

our clients to increase workforce productivity,<br />

decrease workforce attrition, decrease time to<br />

competence, lower learning costs, and streamline<br />

human resource management.<br />

Mission Software<br />

Accenture helps aerospace and defense companies<br />

design, develop and roll out robust and reusable<br />

software for mission-critical applications.<br />

Aerospace and Defense Security<br />

Accenture helps aerospace and defense<br />

companies manage their security risks and<br />

capitalise on new business opportunities, through<br />

the analysis, design and deployment of advanced<br />

information and cyber security solutions.<br />

For more information and to arrange an<br />

appointment please email A&D@accenture.com

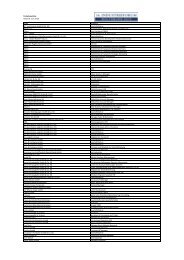

Fundamental topics<br />

Selecting (out)sourcing structures for<br />

aerospace engineering services in India<br />

Prof. Dr. Roger Moser, IIM Bangalore,<br />

Christian Kuklinki, EBS Business School,<br />

Dr. Andreas Wittmer, Universität St. Gallen 7<br />

Key success factors in aerospace<br />

supply chain management<br />

Manfred Hader, Jörg Wahler,<br />

Dr. Alexander Schwandt,<br />

Roland Berger Strategy Consultants <strong>GmbH</strong> 13<br />

Practical topics<br />

Globalising the Aerospace Supply Chain:<br />

The Airbus Approach<br />

Dr. Klaus Richter, Airbus SAS,<br />

Philippe Advani, EADS 19<br />

IT Globalisation on Wings of Steel<br />

Eric Feuillassier,<br />

Client Executive Airbus/EADS,<br />

Dimension Data 25<br />

Launch Management – Lean Principles<br />

in the Strategic Supplier Management<br />

Marc Helmold, Bombardier Transportation 29<br />

<strong>AVIATION</strong> FORUM 2011<br />

Aerospace Supply Chain:<br />

Strategies, Concepts, Potentials 34<br />

Greeting 35<br />

Partners and Sponsors 36<br />

Exhibition plan 37<br />

Program: Wednesday, 19 th of October 2011 38<br />

Speaker/Expert profiles 39<br />

Program: Thursday, 20 th of October 2011 56<br />

Speaker/Expert profiles 59<br />

Recension 78<br />

Editorial 3<br />

Register of authors 10<br />

Event Calendar 28<br />

Impressum 23<br />

List of advertisers 12<br />

Selecting (out)sourcing structures for<br />

aerospace engineering services in India<br />

Content<br />

Prof. Dr. Roger Moser, IIM Bangalore, Christian Kuklinki,<br />

EBS Business School, Dr. Andreas Wittmer, Universität St. Gallen<br />

Sourcing of engineering services from India is increasingly gaining<br />

attention from Western aerospace firms such as European Aeronautic<br />

Defence and Space (EADS), Boeing and many others. Since the<br />

industry faces rising competition and cost pressure, the interests<br />

behind this sourcing strategy seem twofold: to enter the rapidly<br />

growing Indian defense and civil aerospace market as well as to<br />

reduce development costs. Yet, the Indian engineering sourcing<br />

market remains still relatively untapped since firms are challenged<br />

in selecting an appropriate sourcing structure for (outsource) offshoring<br />

high-end aerospace engineering services. Page 7<br />

Key success factors in aerospace<br />

supply chain management<br />

Manfred Hader, Jörg Wahler, Dr. Alexander Schwandt,<br />

Roland Berger Strategy Consultants <strong>GmbH</strong><br />

The growing strategic relevance of supply chain management in the<br />

aerospace industry and the growing complexity of supply chain networks<br />

enforces a transition of the current responsive supply chain approach<br />

towards an agile supply chain. Significant efforts and changes<br />

in the collaboration between supply chain stakeholders are needed<br />

to secure the success for the whole industry. Leading OEMs have<br />

already started with this transition in their latest programs. Given full<br />

order books, high pressure for a timely ramp-up and increased cost<br />

pressure from global competition, we expect that the leading OEMs<br />

will accelerate the transition in the coming years. Page 13<br />

Globalising the Aerospace Supply Chain:<br />

The Airbus Approach<br />

Dr. Klaus Richter, Airbus SAS, Philippe Advani, EADS<br />

As Western economies are still affected by one of the worst economic<br />

global crises, the commercial aerospace industry, surprisingly, has<br />

been spared by these trends. Driven by the sustained growth of<br />

Asian economies and the timely development of well-positioned programmes,<br />

the Airbus business outlook remains positive with an expected<br />

continuous growth in revenues. In order to sustain this growth<br />

as well as to consolidate an optimal economic proposition, Airbus<br />

remains steady-on-course with the ambitious globalisation road-map<br />

it has set over the past years. This article aims at describing the rationale<br />

behind it, while exposing the challenges and modus operandi<br />

that has been put in place to carry out this program. Page 19<br />

IT Globalisation on Wings of Steel<br />

Eric Feuillassier, Dimension Data<br />

A stable, yet flexible global IT solutions and services partnership can<br />

help multinational manufacturers leverage the advantages of shifting<br />

elements of their supply chain into new territories, but without<br />

cross-border business costs and risks taking to the skies. This is an<br />

important lesson to be learnt from a large aircraft builder, as it rallies<br />

to position itself competitively within booming emerging markets.<br />

A strategic focus for this organisation is executing on a sound unified<br />

communications and collaboration strategy that will help its<br />

employees work together seamlessly over an increasing amount of<br />

international borders. Page 25<br />

S u p p l y Chain Management ii i/2011<br />

5

International<br />

Suppliers Center ISC<br />

1st-hand information about future trends<br />

B2B meetings with international buyers<br />

Effi cient 3-days global market place<br />

Enhancing the<br />

aerospace supply chain<br />

September 11–13, 2012<br />

Berlin ExpoCenter Airport<br />

www.isc-ila.com<br />

International<br />

Buyers’ Days<br />

September 12 & 13, 2012<br />

Hosted by

Summary<br />

Sourcing of engineering services from India is increasingly<br />

gaining attention from Western aerospace firms such<br />

as European Aeronautic Defence and Space (EADS),<br />

Boeing and many others. Since the industry faces rising<br />

competition and cost pressure, the interests behind this sourcing<br />

strategy seem twofold: to enter the rapidly growing Indian defense<br />

and civil aerospace market as well as to reduce development<br />

costs. Yet, the Indian engineering sourcing market remains still<br />

relatively untapped since firms are challenged in selecting an appropriate<br />

sourcing structure for (outsource) offshoring high-end<br />

aerospace engineering services.<br />

Status Quo<br />

In contrast to other services, offshore sourcing and outsourcing<br />

of engineering services to India has only recently<br />

emerged. Of the $750 billion spent on engineering services<br />

worldwide, only $10-15 billion were offshored – of which<br />

12 % were sourced from India. Within the next few years,<br />

the share of offshored engineering services is expected to<br />

Aerospace Engineering Services<br />

Selecting (out)sourcing<br />

structures for aerospace<br />

engineering services in India<br />

Prof. Dr. Roger Moser, IIM Bangalore, Christian Kuklinki, EBS Business School,<br />

Dr. Andreas Wittmer, Universität St. Gallen<br />

Figure 1: Influencing Factors on Selecting Sourcing Structures<br />

grow at least tenfold and to reach $150-225 billion worldwide,<br />

resulting in a market potential of $35-50 billion for<br />

the Indian supplier base (NASSCOM & Booz Allen Hamilton<br />

2006). Surprisingly, in light of India’s favorable factor<br />

conditions such as low costs and the largest talent pool for<br />

engineering services in emerging markets, most companies<br />

have been struggling so far to integrate Indian suppliers<br />

into their high-end engineering activities.<br />

Aerospace firms aspiring to benefit from the favorable<br />

factor conditions in offshoring engineering services to India<br />

can choose among three strategies:<br />

n to directly engage with Indian engineering services<br />

outsourcing (ESO) providers such as Wipro, Infosys, or<br />

QuEST from Headquarters;<br />

n to establish local, fully-owned development centers, labeled<br />

as “captive centers” (CC), as in the case of Boeing<br />

and Airbus;<br />

n to maintain an international purchasing office (IPO)<br />

which acts as an interface between Headquarters in Europe<br />

or US and the ESO providers in India.<br />

Boeing, for example, sources engineering services for<br />

aircraft design from TCS and Infosys among others and<br />

additionally operates a CC in<br />

India, the Boeing Research and<br />

Technology Center, Bangalore.<br />

Similarly, Airbus sources engineering<br />

services from five<br />

Indian ESO suppliers and has<br />

established a CC in Bangalore,<br />

the Airbus Engineering Centre<br />

India.<br />

Besides cultural challenges<br />

and structural considerations<br />

of the aerospace industry on an<br />

international level, in particular<br />

strategic considerations have to<br />

be integrated in an analysis and<br />

evaluation of an appropriate<br />

sourcing structure for engineering<br />

services in India (Figure 1).<br />

For global aerospace firms,<br />

questions aiming at how to<br />

S u p p l y Chain Management iii /2011 7

8<br />

Aerospace Engineering Services<br />

reap India’s market opportunities for sourcing and sales<br />

remain partially unanswered: Will efforts in disseminating<br />

aerospace-specific engineering capabilities and domain<br />

knowledge to ESO providers in India pay off? Will it be<br />

advantageous to establish CCs or IPOs in India to manage<br />

challenges associated with the nature of sourcing engineering<br />

services?<br />

Specificities of Engineering Services<br />

As engineering services are complex and knowledgeintensive,<br />

these services require a high level of interaction<br />

and coordination between client and supplier. Here,<br />

the knowledge-intensive character points towards major<br />

concerns centering on a decrease in service quality or inadequate<br />

intellectual property (IP) protection (Dossani &<br />

Kenney 2007). With these services being highly specialized,<br />

the sourcing process for offshoring engineering services<br />

appears challenging as engineering suppliers in India also<br />

require extensive domain knowledge with respect to the<br />

specifications of the aerospace industry. Expertise which is<br />

hardly found in India so far.<br />

Strategic Considerations for Selecting<br />

Sourcing Structures<br />

As aerospace firms have recently started to re-direct their<br />

attention towards sourcing of engineering services in India,<br />

an integration of strategic considerations at this early stage<br />

enables to exploit the benefits of an appropriately selected<br />

sourcing structure on a long-term basis.<br />

A recent study of the EADS-SMI Endowed Chair at the<br />

Indian Institute of Management Bangalore (IIMB) about the<br />

engineering challenges in the Indian aerospace industry has<br />

identified three key elements to select an appropriate sourcing<br />

structure (Figure 2):<br />

n objectives towards supplier,<br />

n objectives towards local market and,<br />

n the nature of sourced services.<br />

Objectives towards Suppliers<br />

The objectives towards a supplier have to account for<br />

the targeted relationship with the supplier and the associated<br />

risks. During the last years, the global aerospace in-<br />

Figure 2: Strategic Considerations and Selection of Sourcing Structure<br />

S u p p l y Chain Management iii /2011<br />

dustry has substantially reduced the number of preferred<br />

engineering services suppliers of which five suppliers have<br />

their headquarters in India (George 2008). In the course of<br />

this process, the preferred suppliers from India are expected<br />

to gain a more important role.<br />

The importance of local presence for the establishment<br />

of trust among client and supplier seems indispensable;<br />

particularly at the beginning of business relationships, faceto-face<br />

meetings on a personal and frequent basis play an<br />

essential role in India.<br />

Local Presence<br />

Without local presence, there will be no link between<br />

the customer and the supplier. In this respect, IPOs and<br />

CCs utilize their local presence very different. IPOs in India<br />

build relationships with local suppliers on a more general<br />

basis with the aim to identify a range of potential local suppliers.<br />

A primary objective of IPOs is assessing potential<br />

local suppliers’ capabilities and transferring the analyzed<br />

information across the borders of India. The challenge for<br />

IPOs is that they are themselves only facilitating communication<br />

between engineers in Europe or the US and the<br />

suppliers in India. However, very shortly after the initial<br />

meetings the IPOs loses its function. A fact, that they are<br />

very much aware of and often unnecessarily fight against<br />

with negative consequences for the overall process efficiency.<br />

In contrast, CCs utilize their local presence to additionally<br />

strengthen their established relationships on a more<br />

operational level building strong working relationships on<br />

a project basis. This allows them to also spot quite fast the<br />

potential weaknesses of their suppliers and take appropriate<br />

actions.<br />

The fact that Indian suppliers are often still considered<br />

to be high-risk partners in the aerospace industry takes a<br />

dominant role in the selection process of a sourcing structure.<br />

Especially Indian ESO providers frequently outline<br />

themselves the importance of having security systems and<br />

secure channels for IP protection implemented. Engineering<br />

services are only outsourced to suppliers if they can<br />

prove sufficient capabilities and security systems.<br />

Intellectual Property<br />

One has to be very sensitive to the fact that most of the<br />

information coming from a customer is bordering on IP and<br />

it will always be a concern as to whether that IP is being infringed.<br />

A high level of associated<br />

supplier risks will probably<br />

continue to deter firms of utilizing<br />

an Indian ESO for offshoring<br />

engineering services. On the<br />

contrary, these risks strongly<br />

reason investment efforts associated<br />

with the establishment<br />

of local CCs. Once having established<br />

a local presence, these<br />

offices substantially improve an<br />

identification of potential sup-

Figure 3: Strategic Considerations: Objectives towards market<br />

plier risks and at the same time enable the company to efficiently<br />

provide trainings to suppliers of interest.<br />

Objectives towards Market<br />

For the aerospace industry, the interests in India are not<br />

only the low-cost sourcing potentials of the market, but also<br />

the current state and future growth opportunities of the local<br />

customer market – and the related offset requirements<br />

(Figure 3).<br />

As confirmed in the IIM Bangalore study, the option to<br />

leverage the lower cost-levels in India pertains as a motivating<br />

driver for implementing all three sourcing structures –<br />

but to a varying extend. An IPO enables to gain insights into<br />

the local industry, its current conditions and developments,<br />

and to create knowledge about the Indian supply base. CCs<br />

allow not only to perform critical tasks internally at lowcost<br />

levels in India but also to efficiently outsource lesscritical<br />

tasks to local suppliers. The local presence through<br />

a CC also supports the fulfillment of offset requirements in<br />

India and serves as hedge against currency fluctuations in<br />

other industrialized markets.<br />

Nature of Engineering Services<br />

In any case, the high complexity of aerospace engineering<br />

services calls for a high degree of interaction between<br />

client and supplier as the dispersed teams perform subtasks<br />

for a final product or service. Meeting a client’s requirements<br />

entails huge efforts from the suppliers as a<br />

perfectly detailed and self-explanatory task descriptions<br />

for engineering services remain<br />

exceptional. Within this process,<br />

one has to account for the<br />

fact that some of the supplier’s<br />

engineers in India may simply<br />

not have gained sufficient experience<br />

and domain knowledge<br />

for interpreting the requirements<br />

according to the client’s expectations.<br />

The necessity of face-to-face<br />

communication becomes also<br />

apparent as one reflects upon<br />

Aerospace Engineering Services<br />

multiple visits and employee<br />

exchanges that most ESO providers<br />

conduct – not only in<br />

the beginning of sourcing projects,<br />

but also throughout the<br />

complete engineering process.<br />

Without a face to a name it is<br />

very difficult for the supplier to<br />

deliver anything as every customer<br />

has a different process.<br />

Still, the high interdependence<br />

between sub-tasks and<br />

the related degree of required interaction<br />

and coordination between client and supplier often<br />

hinders aerospace firms to consider direct offshore outsourcing<br />

for engineering services.<br />

Interaction between Indian Suppliers and the<br />

Customer in Europe<br />

It is very important that Indian suppliers interact with<br />

the team in Europe (Figure 4). One needs interaction on a<br />

daily basis. For establishing an IPO in India, the degree of<br />

task interdependence plays a minor role – despite its ample<br />

options to interact with local suppliers. As daily interaction<br />

for sourced engineering services occur a high technical<br />

level, most IPOs cannot provide the necessary technical capabilities.<br />

Hence, if an IPOs’ responsibilities are not clearly<br />

assigned this can hamper the efficacy of client-supplier coordination<br />

efforts and the further development of buyersupplier<br />

relationships. Since IPOs concentrate on supplier<br />

market intelligence and the facilitation of business relationship<br />

development for their internal clients (including the<br />

engineers at headquarters), an involvement in (technical)<br />

day-to-day discussions seems of little use – not even if the<br />

IPO aspires to take a mediating role between the dispersed<br />

teams.<br />

When communication is started and channel through<br />

two or three people, by the time it reaches the customer<br />

or the person who has to answer the query, the meaning is<br />

totally different. In addition, it always involves a time lag.<br />

On the contrary, a CC enables direct face-to-face interaction<br />

with local suppliers to coordinate the sourcing process of<br />

engineering services on a daily basis.<br />

Figure 4: Strategic Considerations: Nature of Engineering Services<br />

S u p p l y Chain Management iii /2011 9

Aerospace Engineering Services<br />

Conclusion<br />

In any case, spatial proximity between the parties involved<br />

in (outsource) offshoring engineering services is required<br />

to prevent or quickly address arising challenges. At<br />

the same time, a local presence supports the establishment<br />

of a strong market presence towards clients in the Indian<br />

aerospace sector and to gain local industry insights on a<br />

technical and commercial level. The right sourcing structure<br />

is therefore crucial to support Western aerospace companies<br />

in India to achieve competitive advantages.<br />

References<br />

n Dossani, R., & Kenney, M. (2007). The next wave of globalization:<br />

Relocating service provision to India. World<br />

Development, 35(5) 2007, p. 772-791.<br />

n George, B., Aerospace supply chain: Opportunities<br />

for Indian suppliers, 2008, in: http://www.nasscom.<br />

in/Nasscom/templates/NormalPage.aspx?id=55118,<br />

Stand: 24.09.2011.<br />

n NASSCOM, & Booz Allen Hamilton, Globalization of<br />

engineering services: The next frontier for India, 2006,<br />

in: http://www.boozallen.com/media/file/Globalization_of_Engineering_Services.pdf<br />

, Stand: 24.09.2011.<br />

Zusammenfassung<br />

Das Sourcing von Ingenieurdienstleistungen aus Indien steht<br />

immer mehr im Fokus der westlichen Luftfahrtunternehmen wie<br />

European Aeronautic Defence and Space (EADS) und Boeing.<br />

Die unter wachsendem Kostendruck stehende Luftfahrtindustrie<br />

will dabei gleichermaßen von der wachsenden Flugzeugsnachfrage<br />

in Indien und dem indischen Angebot von Ingenieurdienstleistungen<br />

profitieren. Allerdings ist der indische Markt für entsprechende<br />

Ingenieurdienstleistungen noch recht unterentwickelt.<br />

Unternehmen haben daher zieladäquate (Out)Sourcingstrategien<br />

zu entwickeln<br />

Authors<br />

CHRISTIAN KUKLINSKI, 1983, is completing his<br />

Ph.D at the Automotive Institute for Management at<br />

the EBS Business School, Wiesbaden.<br />

PROF. DR. ROGER MOSER, 1977, is a Faculty Member<br />

at the EADS-SMI endowed chair for Sourcing Supply<br />

Management at the Indian Institute of Management<br />

in Bangalore und Professor for Strategy and International<br />

Management of Automotive Institute for Management<br />

at the EBS Business School, Wiesbaden. He<br />

consults companies with specific aspects of their business<br />

expansion in India.<br />

DR. ANDREAS WITTMER, 1973, is Managing Director<br />

of the Center for Aviation Competence und Vice<br />

President of Institute for Systemic Management und<br />

Public Governance at the University St. Gallen. In addition<br />

he is President of the Swiss Aerospace Cluster.<br />

10<br />

S u p p l y Chain Management iii /2011<br />

Register of authors<br />

Philippe Advani<br />

EADS France<br />

Phone +33 1 42242160<br />

Email philippe.advani@eads.net<br />

Eric Feuillassier<br />

Dimension Data<br />

Phone +33 53460-6214<br />

Email eric.feuillassier@dimensiondata.com<br />

Manfred Hader<br />

Roland Berger Strategy Consultants <strong>GmbH</strong><br />

Phone +49 40 37631-4327<br />

Email manfred.hader@de.rolandberger.com<br />

Marc Helmold<br />

Bombardier Transportation<br />

Phone +49 3302 89-3240<br />

Email marc.helmold@de.transport.bombardier.com<br />

Christian Kuklinki<br />

EBS Business School<br />

Phone +49 611 7102-2062<br />

Email christian.kuklinski@ebs.edu<br />

Prof. Dr. Roger Moser<br />

IIM Bangalore<br />

Phone +91 99027609-38<br />

Email roger.moser@iimb.ernet.in<br />

Dr. Klaus Richter<br />

Airbus SAS<br />

Phone +33 5 61933333<br />

E-Mail klaus.k.richter@airbus.com<br />

Joerg Wahler<br />

Roland Berger Strategy Consultants <strong>GmbH</strong><br />

Phone +49 711 3275-7225<br />

Email joerg_wahler@de.rolandberger.com<br />

Dr. Andreas Wittmer<br />

Universität St. Gallen<br />

Phone +41 224 3346<br />

Email andreas.wittmer@unisg.ch<br />

Dr. Alexander Schwandt<br />

Roland Berger Strategy Consultants <strong>GmbH</strong><br />

Phone +49 30 39927-3570<br />

Email alexander_schwandt@de.rolandberger.com

12<br />

List of advertisers<br />

We deliver solutions that work. Backed by the synergy of a highly experienced<br />

international team, we focus on a single object: your success.<br />

Get more information: www.drozak.com<br />

List of advertisers<br />

Accenture<br />

Phone +0808 1011169<br />

www.accenture.com<br />

Airbus<br />

Phone +33 561 933333<br />

www.airbus.com<br />

Drozak Consulting <strong>GmbH</strong><br />

Phone +49 30 3067330<br />

www.drozak.com<br />

GITO Verlag mbH<br />

Phone +49 30 41938364<br />

www.gito.de<br />

H&D International Group<br />

Phone +49 5361 308560<br />

www.hud.de<br />

Heinkel Group<br />

Phone +49 40 41307590<br />

www.heinkel-group.com<br />

<strong>IPM</strong> <strong>GmbH</strong><br />

Phone +49 511 47314790<br />

www.ipm-scm.com<br />

S u p p l y Chain Management ii i/2011<br />

Messe Berlin <strong>GmbH</strong><br />

Phone +49 30 30382116<br />

www.isc-ila.com<br />

Siemens AG<br />

Phone +49 1805 444713<br />

www.siemens.com/answers<br />

Virginia Economic Development Partnership<br />

Phone +32 26477433<br />

www.YesVirginia.org<br />

Vogel Industrie Medien <strong>GmbH</strong> & Co. KG<br />

Phone +49 937 4182068<br />

www.vogel.de<br />

Volkswagen AG<br />

Phone +49 5361 90<br />

www.volkswagen.de<br />

CONSULTANT<br />

Managementberater<br />

Berlin München Warschau Shanghai Chicago<br />

2010<br />

<strong>AVIATION</strong><br />

®

Summary<br />

Success factors in the Aerospace Supply Chain<br />

Key success factors in<br />

aerospace supply chain<br />

management<br />

Manfred Hader, Jörg Wahler, Dr. Alexander Schwandt, Roland Berger Strategy Consultants <strong>GmbH</strong><br />

The growing strategic relevance of supply chain management<br />

in the aerospace industry and the growing<br />

complexity of supply chain networks enforces a<br />

transition of the current responsive supply chain approach<br />

towards an agile supply chain. Significant efforts and<br />

changes in the collaboration between supply chain stakeholders<br />

are needed to secure the success for the whole industry. Leading<br />

OEMs have already started with this transition in their latest<br />

programs. Given full order books, high pressure for a timely<br />

ramp-up and increased cost pressure from global competition,<br />

we expect that the leading OEMs will accelerate the transition<br />

in the coming years.<br />

Initial situation<br />

The latest results of the 2011 Roland Berger Strategy<br />

Consultants “Aerospace and Defence Top Management<br />

Issues Radar” – our annual survey involving more than<br />

110 top industry executives – underline that supply chain<br />

management remains a core strategic challenge at the heart<br />

of every company in the aerospace industry.<br />

Increasing supply chain complexity<br />

has resulted in continuous fire fighting activities<br />

and increased resource needs. Con-<br />

sequently more than 80 % of potential cost<br />

reduction levers mentioned by the participants<br />

of the survey are related to supply<br />

chain activities (supplier management, manufacturing/<br />

assembly efficiency improvement) [Roland Berger 2011].<br />

These levers aim to reduce the Total Cost of Acquisitions<br />

which represent in around two thirds of total costs of an<br />

aerospace OEM.<br />

To cope with the increasing supply chain challenges<br />

we expect that the supply chain management approach of<br />

leading aerospace players will evolve from a resource intensive,<br />

responsive supply chain to an agile supply chain<br />

that will leverage the intelligence of the whole supply<br />

chain network through professionalized interfaces, synchronized<br />

information, stronger IT systems, strict rules,<br />

and enhanced trustworthy collaboration. To achieve this<br />

evolution, our experience points to four main key fields of<br />

action: Flow Management, Development of Supplier Portfolio,<br />

Supply Chain Design and Development of Strategic<br />

Suppliers.<br />

In the following discussion we will present a strategic<br />

framework for sustainable supply chain management development<br />

as well as the related key success factors.<br />

Methodology<br />

The discussions and findings presented are based on the<br />

results of the “Aerospace and Defence Top Management<br />

Issues Radar” 2011 and two in-depth case studies [Roland<br />

Berger 2011]. The survey was conducted in March – April<br />

2011 and includes responses for more than 110 top managers<br />

across six countries (Belgium, France, Germany, Italy,<br />

Spain, UK). Participants represent 52 firms, covering a wide<br />

range of business segments (commercial aeronautics, defence<br />

& security, space). Approximately one third of the<br />

participants are CEOs of leading companies on OEM, Tier-<br />

1 and Tier-2 levels of the aerospace value chain. In depth<br />

cases studies were conducted between May 2010 to August<br />

2011 in the aerospace industry.<br />

Today OEMs recognize that they are forced<br />

to develop and implement new skills and toolboxes to<br />

monitor, steer and support the complex supply chains.<br />

Initial situation<br />

Key players in the aerospace industry are struggling<br />

with today’s complexity of their supply chain – e.g. Boeing<br />

with ~70 % outsourced value creation of the 787 and<br />

Airbus with an increased outsourcing proportion of ~50 %<br />

for the new A350 XWB have both significantly increased<br />

the work share for their top strategic suppliers who now<br />

are involved earlier and act as risk sharing partners. Yet,<br />

ramp-up of the new programs and supply chain performance<br />

continue to be a huge challenge for all involved<br />

parties.<br />

S u p p l y Chain Management iii /2011 13

Success factors in the Aerospace Supply Chain<br />

Introduction: Key priorities and general<br />

industry trends and their impact on<br />

supply chain management<br />

Generally, in the post-crisis landscape, many A&D companies<br />

have started to pursue growth strategies again. To<br />

secure profitable growth and strengthen current market positions<br />

the following priorities shape the companies’ agendas<br />

and determine the challenges for supply chain management<br />

(Figure 1) [Roland Berger 2011]:<br />

n Consistently over the last 4 years program management<br />

is #1 priority in companies agenda. Unprecedented number<br />

of programs in the aerospace and defence industry<br />

are in the development phase or early ramp up phase.<br />

Due to increasing level of integration (e.g. risk sharing,<br />

development partnerships, supplier pre-assembly,<br />

platform integration concepts) program management<br />

is seriously concerned with aligning development, and<br />

industrial ramp up with supply chain partners. Today’s<br />

resulting key challenge for supply chain management<br />

is to move from a fire fighting mode to anticipation and<br />

better managed interfaces.<br />

n #2 priority in companies agenda is the market strategy/<br />

globalization. The need to gain presence in rising stars<br />

(e.g. China, Brazil, Russia) to address opportunities in<br />

growing markets (e.g. Middle East for Defence & Security)<br />

and to establish or maintain a low cost footprint<br />

and balanced dollar cost base are key topics for the companies.<br />

The impact on supply chain management is significant.<br />

SC managers struggle to achieve an optimum<br />

between cost targets, offset requirements, quality standards,<br />

currency volatility reduction and operational efficiency.<br />

The accelerated globalization – e.g. market and<br />

production shift to Asia and Latin America – results in<br />

significantly increased supply chain complexity.<br />

#1<br />

#2<br />

#3<br />

#4<br />

14<br />

2008 2009 2010 2011<br />

>� Programme<br />

Management<br />

>� Market Strategy /<br />

Globalisation<br />

>� Supply Chain<br />

>� External Growth /<br />

PMI<br />

>� Programme<br />

Management<br />

>� Market Strategy /<br />

Globalisation<br />

>� Flexibility<br />

S u p p l y Chain Management iii /2011<br />

>� Programme<br />

Management<br />

>� Market Strategy /<br />

Globalisation<br />

n Innovation and R&D efficiency is #3 priority and first<br />

time in the top three priority list. Increasing competitiveness<br />

and rising consolidation pressure as well as<br />

shortening technological development cycles push this<br />

topic on the agenda. Especially due to fact that research<br />

and development responsibilities were pushed to subtier<br />

suppliers, new challenges in managing joint design<br />

processes and configuration changes occur in the supply<br />

chain.<br />

n The performance and efficiency of the supply chain itself<br />

is ranked #4 priority in companies agenda and has consistently<br />

been in the top priorities of the past years.<br />

Concluding, key industry trends and priorities increase<br />

strategic relevance and complexity of today’s supply chain<br />

management. Therefore supply chain management evolves<br />

to form the backbone of global aerospace organizations<br />

[Schwandt, Franklin 2010].<br />

In the following section we discuss how an appropriate<br />

supply chain set-up and tool box needs to be designed to<br />

enable increasing supply chain integration and collaboration<br />

and master increasing complexity and cost pressure in<br />

the aerospace industry.<br />

Key success factors for supply chain<br />

management in the aerospace industry<br />

Today OEMs recognized that they are forced to develop<br />

and implement new skills and toolboxes to monitor, steer<br />

and support the complex supply chains and development<br />

networks. Aerospace companies like Airbus increase efforts<br />

to apply proven concepts from automotive industry to their<br />

own supply chain. As presented in figure 2, the increasing<br />

numbers of stakeholders in such supply and development<br />

networks enforce different supply chain capabilities<br />

reaching from optimization, integration, collaboration to<br />

synchronization to master the<br />

>� Programme<br />

Management<br />

>� Market Strategy /<br />

Globalisation<br />

>� Product Strategy >� Innovation and R&D<br />

efficiency<br />

>� Marketing & Sales >� Supply Chain >� Supply Chain<br />

Figure 1: Top priorities in aerospace companies’ agendas [4 most frequent answers]<br />

growing complexity [Baumgarten,<br />

Thoms 2002].<br />

While internal optimization,<br />

which is only focused on a single<br />

organization, has the lowest<br />

capabilities to manage system<br />

wide complexity, synchronization,<br />

at the highest degree of integration,<br />

focuses on complexity<br />

in the whole network.<br />

Supply chain synchronization<br />

strives for full transparency<br />

and availability of information,<br />

joint optimization of processes<br />

and interfaces and has<br />

the highest capability to handle<br />

complexity. Today’s aerospace<br />

supply chain management is<br />

mainly focused on improving<br />

integration and collaboration<br />

capabilities but it needs to get

Participants<br />

Whole<br />

network<br />

Network-<br />

partner,<br />

Industry partner<br />

Wholesaler,<br />

Customer<br />

1 st tier<br />

Supplier<br />

Own<br />

Organization<br />

Collaboration<br />

Cooperation with defined<br />

processes and rules<br />

Integration<br />

IT-based data exchange<br />

with partners<br />

Optimization<br />

Internal supply chain<br />

Low Medium<br />

High<br />

Mastering complexity capabilities<br />

ready for a paradigm change to enable systematic synchronization.<br />

Depending on the targeted supply chain capabilities different<br />

configurations and tools need to be applied.<br />

As shown in figure 3 supply chain configurations/typologies<br />

can be distinguished along the two axes of “strategic<br />

relevance of the SC” and “supply chain complexity” – Efficient,<br />

Accurate, Responsive and Agile [Rappl, Schwandt<br />

2010].<br />

The efficient supply chain (I) is characterized by low<br />

complexity combined with supply chain management<br />

having a low strategic relevance for the organization. An<br />

efficient supply chain is not a suitable typology for the<br />

Success factors in the Aerospace Supply Chain<br />

Synchronization<br />

Cross network collaboration,<br />

common, joint databases<br />

Maximal<br />

Figure 2: Supply chain management capabilities to cope with or master complexity<br />

Strategic Relevance<br />

High<br />

Low<br />

Accurate<br />

Supply Chain<br />

II<br />

Efficient<br />

Supply Chain<br />

I<br />

Agile<br />

Supply Chain<br />

IV<br />

Responsive<br />

Supply Chain<br />

III<br />

Low High<br />

Complexity<br />

Figure 3: Supply chain typologies<br />

<<br />

aerospace industry. Rather it is<br />

a suitable typology for small,<br />

closed systems, which are characterized<br />

by a high level of control<br />

and stability [Schwandt,<br />

Franklin 2010].<br />

The accurate supply chain (II)<br />

is also characterized by low to<br />

medium complexity, but where<br />

the supply chain has medium to<br />

high strategic relevance. In contrast<br />

to the efficient supply chain<br />

typology, a failure in the supply<br />

chain can have significant impact<br />

on the whole organization.<br />

Hence, the supply chain management<br />

has not only to comply<br />

with efficiency requirements,<br />

but it needs to be trustworthy,<br />

reliable, and transparent. Redundancies<br />

and safety stocks<br />

are needed to secure continuous<br />

supply. Specific measures, such<br />

as quality or sustainability certificates, are required to secure<br />

the accuracy of the products or resources. Nevertheless,<br />

complexity remains low since production quantities are relatively<br />

small, supplier basis is stable and development cycle<br />

are moderately long [Schwandt, Franklin 2010].<br />

The responsive supply chain (III) is characterized by<br />

high complexity and low to medium strategic relevance.<br />

The responsive supply chain has to cope with high levels of<br />

uncertainty and diversity and needs to respond with flexibility<br />

to unpredictable demands or events. A higher degree<br />

of freedom in supply chain processes allows responding<br />

more spontaneously and more individually to changing<br />

situations. The low to medium strategic relevance is determined<br />

by several factors:<br />

n the level of external value creation is limited,<br />

n resources or partners in the supply chain network are<br />

interchangeable or redundantly available, or<br />

n the products cycles are moderately long.<br />

Responsive supply chains aim at maximizing the performance<br />

for a specific and dominant partner in the supply<br />

chain by increasing efficiency through defined processes<br />

and rules [Schwandt, Franklin 2010].<br />

The agile supply chain (IV) typology is distinguished by<br />

high levels of supply chain complexity and by high strategic<br />

relevance. A failure in the supply chain (or network) can<br />

have significant impact on overall performance. Hence, the<br />

requirements for control and reliability increase. Despite<br />

this, the speed for rapid reaction enforces decentralized<br />

decision-making, and high diversity and specificity of resources,<br />

products, suppliers, and customers results in strategic<br />

interdependencies that need to be managed as well<br />

[Schwandt, Franklin 2010].<br />

In the past the aerospace supply chain developed from<br />

an accurate supply chain approach towards a responsive<br />

S u p p l y Chain Management iii /2011 15

16<br />

Success factors in the Aerospace Supply Chain<br />

supply chain approach. High levels of quality and security<br />

standards were secured by flexible and individual<br />

solutions with different suppliers. Over the years increasing<br />

supply chain resources were needed to manage operational<br />

and strategic tasks and to cope with the growing<br />

complexity. Since ramp-up of new programs is crucial to<br />

secure the cash flow and margins, significant efforts were<br />

put in place to solve rising supply chain challenges by<br />

task forces, supplier on-site support teams, MAP teams<br />

(mise au point) and other approaches. Consequently, the<br />

total cost of acquisition increased. This years “A&D Top<br />

Management Issues Radar” results underline this fact.<br />

Participants stated that 41 % of targeted cost reduction<br />

Today’s aerospace supply chain configuration is in<br />

a transition from a responsive supply chain to an<br />

agile supply chain.<br />

levers are directly related to the supply chain (e.g. renegotiation,<br />

reorganization of supply chain organization or<br />

joint improvement programs). Another 41 % of targeted<br />

cost reduction levers are indirectly related to the supply<br />

chain and the management of suppliers as they are linked<br />

to manufacturing and assembly efficiency improvement<br />

[Roland Berger 2011].<br />

Today’s aerospace supply chain configuration is in a<br />

transition from a responsive supply chain to an agile supply<br />

chain. Increasing quantities, shortening development<br />

cycles and increasing cost pressure do not allow anymore<br />

a fire fighting modus that was still feasibly in a responsive<br />

supply chain configuration.<br />

Synchronization<br />

Cross network<br />

collaboration, common,<br />

joint databases<br />

Collaboration<br />

Cooperation with<br />

defined processes<br />

and rules<br />

Integration<br />

IT-based data<br />

exchange with<br />

partners<br />

Optimization<br />

Internal supply<br />

chain<br />

Accurate<br />

Supply Chain<br />

II<br />

Efficient<br />

Supply Chain<br />

I<br />

S u p p l y Chain Management iii /2011<br />

Complexity<br />

Low High<br />

Agile<br />

Supply Chain<br />

IV<br />

Responsive<br />

Supply Chain<br />

III<br />

Low Medium High Maximal<br />

Mastering complexity capabilities<br />

Figure 4: Framework for designing high quality supply chains with adequate<br />

capabilities to master complexity<br />

New ways of interactions are needed to cope with the<br />

growing complexity. As illustrated in figure 4, supplier<br />

management in terms of collaboration and synchronization<br />

needs to be enforced and supported by appropriate<br />

technological solutions and processes [Schwandt, Franklin<br />

2010].<br />

Based our project experiences we identified four success<br />

factors to strengthen supplier management and establish an<br />

agile supply chain configuration (Figure 5):<br />

1. Improve Flow Management between OEM and suppliers<br />

in all stages of the Program life cycle by<br />

n professionalizing interfaces through improved reporting<br />

processes and end-to-end responsibilities,<br />

n defining and applying strict and shared<br />

rules (e.g. consequent design freeze dates,<br />

shared and stable design rules in development<br />

phases, clear quality and test procedure<br />

definitions in industrialization preparation,<br />

shared KPI definitions in production<br />

phase),<br />

n reducing volatility in the supply chain through more robust<br />

planning.<br />

2. Develop Supplier Portfolio by<br />

n establishing transparent and reliable risk and performance<br />

evaluation through shared assessment criteria’s<br />

and early communication of bottlenecks,<br />

n synchronizing information flow through suitable IT<br />

solutions (e.g. PDM link systems, web based planning<br />

tools, shared tracking and monitoring systems),<br />

n setting a clear vision of target supplier portfolio.<br />

3. Improve Supply Chain Design by<br />

n focusing on key suppliers with the right capabilities,<br />

n assessing robustness of the supplier network,<br />

n leveraging best practices and<br />

supplier know how through<br />

High<br />

Low<br />

Strategic Relevance<br />

the whole network.<br />

4. Develop Strategic Suppliers<br />

by<br />

n establishing high degree of<br />

trustworthy collaboration<br />

(e.g. risk sharing partnerships,<br />

joint improvement<br />

programs, open book policy,<br />

on-site representatives, joint<br />

development plateaus),<br />

n transferring knowledge by<br />

co-location of critical teams<br />

and ramp up supplier capabilities.<br />

References<br />

n Baumgarten, H., Thoms, J.,<br />

Trends und Strategien in der<br />

Logistik: Supply Chain im<br />

Wandel, Berlin 2002.

•� Establishing high degree of<br />

trustworthy collaboration<br />

n Fischer, M.L., What is the right supply chain for your<br />

product?, in: Harvard Business Review, March-April<br />

1997, Reprint No. 97205, pg. 106-116.<br />

n Rappl, T., Schwandt, A., Supply chain management: The<br />

backbone of complex, global acting organizations, in:<br />

Nedopil, C., Steger, U., Amann, W. (2010), Managing<br />

complexity in Organizations: Text and Cases, Hampshire<br />

2010, pg. 156-176.<br />

n Roland Berger Strategy Consultants, Top Management<br />

Issues Radar 2011 - European Aerospace & Defence<br />

industry, http://www.rolandberger.com/media/<br />

publications/2011-06-20-rbsc-pub-Top_Management_<br />

Issues _ Radar_2011.html (2011).<br />

n Schwandt, A., Franklin, J. R., Logistics: The Backbone for<br />

Managing Complex Organizations, in: Kuehne Foundation<br />

Book Series on Logistics 17, Bern 2010.<br />

Success factors in the Aerospace Supply Chain<br />

•� Professionalizing interfaces<br />

through improved reporting<br />

processes and end-to-end<br />

responsibilities<br />

Authors<br />

Zusammenfassung<br />

1<br />

Die wachsende strategische Be-<br />

Improve<br />

Flow Management<br />

deutung des Supply Chain Man- Man-<br />

•� Transferring knowledge by<br />

co-location of critical teams<br />

•� Defining and applying strict and<br />

shared rules (e.g. consequent design<br />

freeze dates)<br />

agements in der Luftfahrtindus trie<br />

und die wachsende Komplexität<br />

4<br />

Supplier<br />

2<br />

•� Reduce volatility in the Supply<br />

Chain through more robust<br />

planning<br />

der Zuliefernetzwerke erfordert<br />

einen Wandel von dem aktuellen<br />

Develop Strategic<br />

Supplier<br />

•� Focusing on key<br />

suppliers with the right<br />

capabilities<br />

•� Assessing robustness of<br />

the supplier network<br />

•� Leveraging best practices<br />

and supplier know how<br />

through the whole network<br />

Management<br />

and<br />

Development<br />

3<br />

Improve Supply<br />

Chain Design<br />

Develop Supplier<br />

Portfolio<br />

•� Establishing transparent and<br />

reliable risk and performance<br />

evaluation<br />

•� Synchronizing information flow<br />

through suitable IT solutions<br />

•� Setting a clear vision of target<br />

supplier portfolio<br />

reaktiven Supply Chain Ansatz<br />

zu einem agilen Supply Chain Ansatz.<br />

Erhebliche Anstrengungen<br />

und Veränderungen in der Zusammenarbeit<br />

zwischen den Zulieferpartnern<br />

sind notwendig, um den<br />

Erfolg für die gesamte Branche<br />

zu sichern. Führende OEMs haben<br />

bereits diesen Wandel in ihrer<br />

Figure 5: Key success factors for the aerospace supply chain management<br />

neuesten Programme initialisiert.<br />

Angesichts voller Auftragsbücher,<br />

hohem Druck für ein rechtzeitiges Ramp-up und erhöhtem Kostendruck<br />

durch den globalen Wettbewerb erwarten wir, dass die<br />

führenden OEMs diesen Wandel in den kommenden Jahren noch<br />

beschleunigen.<br />

TOM HEINKEL<br />

Geschäftsführung<br />

MATTHIAS GEH<br />

Recruiting<br />

MANFRED HADER, b. 1965, is a Partner at Roland<br />

Berger Strategy Consultants <strong>GmbH</strong>.<br />

DR. ALEXANDER SCHWANDT, b. 1980, is a Senior<br />

Consultant bei Roland Berger Strategy Consultants<br />

<strong>GmbH</strong>.<br />

JÖRG WAHLER, b. 1967, is a Principal at Roland<br />

Berger Strategy Consultants <strong>GmbH</strong>.<br />

LENA MACHATE<br />

Recruiting<br />

JOACHIM AGGER<br />

Geschäftsleitung<br />

S u p p l y Chain Management iii /2011 17

TO LEARN MORE<br />

Virginia<br />

Virginia’s Aerospace Industry<br />

Industry Assets include:<br />

- Mid-Atlantic Regional Spaceport<br />

- National Institute of Aerospace<br />

- NASA Langley Research Center<br />

- NASA Wallops Flight Facility<br />

- Commonwealth Center for Advanced Manufacturing<br />

- Commonwealth Center for Aerospace Propulsion Systems<br />

Companies with operations in Virginia include:<br />

- Rolls-Royce<br />

- Alcoa Howmet<br />

- Orbital Sciences Corporation<br />

- Northrop Grumman<br />

- EADS North America<br />

- And many more<br />

CNBC RANKS VIRGINIA #1 IN U.S.A.<br />

AMERICA’S TOP STATE FOR BUSINESS<br />

CNBC, the leading financial media outlet that reaches influential business and financial leaders around the world,<br />

has confirmed what many businesses already know: that Virginia’s pro-business values, low cost of operations,<br />

access to markets and a skilled and educated workforce make us the best state for doing business in the U.S.A.<br />

Are you ready to say “yes” to more opportunities for success?<br />

Then say “yes” to Virginia.<br />

Please contact Matthias Duys at 32-2-647-7433<br />

Email at MDuys@YesVirginia.org or visit www.YesVirginia.org<br />

AMERICA’S<br />

BEST STATE<br />

FOR<br />

BUSINESS

Summary<br />

Globalising the<br />

The globalisation of the aerospace industry has now gathered<br />

momentum: Newly emerged nations are providing<br />

the foundations for a sustainable business proposition<br />

both due to market size and increased industrial maturity.<br />

This trend is reflected in the future Airbus procurement spend<br />

profile: In general, the global spend will double from 22bn Euros in<br />

2010 to more than 45bn Euros beyond 2020, of which the so-called<br />

“rest of the world” outside of Europe will have a significant share.<br />

In order to sustain this growth as well as to consolidate an optimal<br />

economic proposition, Airbus remains steady-on-course with the<br />

ambitious globalisation road-map it has set over the past years. The<br />

company has put in place a set of strategic responses and organisational<br />

enablers to address globalisation challenges at the various<br />

stages of the procurement process, from market analysis to implementation<br />

support. A specific dedicated organisation, the “Global<br />

Sourcing Network”, including the establishment of so-called Country<br />

Sourcing Offices, such as India and China, reinforces the support<br />

of the regions. Airbus is confident that, by focusing its efforts<br />

and setting up the right organisational support, it will improve its<br />

overall business proposition through global sourcing.<br />

Initial situation<br />

As Western economies are still affected by one of the<br />

worst economic global crises, the commercial aerospace in-<br />

Global Aerospace Supply Chain<br />

Aerospace Supply Chain:<br />

The Airbus Approach<br />

Dr. Klaus Richter, Airbus SAS, Philippe Advani, EADS<br />

2001<br />

1,575 aircraft worth $130bn<br />

Figure 1: Airbus order book evolution 2001 to 2011<br />

2011<br />

4,233 aircraft worth >$500bn<br />

dustry, surprisingly, has been spared by these trends. Driven<br />

by the sustained growth of Asian economies and the<br />

timely development of well-positioned programmes, the<br />

Airbus business outlook remains positive with an expected<br />

continuous growth in revenues. Boosted by the unprecedented<br />

sales success for the A320neo (new engine option),<br />

Airbus raised its overall backlog to currently over 4,000<br />

aircraft, worth more than 500bn$ and representing more<br />

than seven years of production output (Figure 1). At the<br />

same time, in light of make-to-buy strategies put in place,<br />

procurement increasingly gains in importance for Airbus,<br />

representing 75 % of the company’s cost base today, compared<br />

to 50 % in the 1990s.<br />

In order to sustain this growth as well as to consolidate<br />

an optimal economic proposition, Airbus remains steadyon-course<br />

with the ambitious globalisation road-map it has<br />

set over the past years.<br />

This article aims at describing the rationale behind it,<br />

while exposing the challenges and modus operandi that has<br />

been put in place to carry out this programme.<br />

Globalisation Drivers<br />

The Western aerospace industry has developed tightly<br />

around its North American and European hubs. In the early<br />

2000’s, roughly three quarters of Airbus’ procurement<br />

footprint was originating from<br />

North America<br />

Europe<br />

Africa<br />

Middle East<br />

Latin America<br />

Asia/Pacific<br />

Lessors<br />

Western Europe while a small<br />

quarter was originating from<br />

North America.<br />

Very limited sourcing volumes<br />

were spread across the<br />

world, mainly by market access<br />

considerations dubbed as offsets<br />

in several countries. Dating back<br />

to the post-war period (the 1960s<br />

in India, the 1970s in China, …),<br />

these efforts were driven by governments<br />

in search of strategic<br />

self-reliance and centred around<br />

government-controlled national<br />

champions. Although the role of<br />

S u p p l y Chain Management iii /2011 19

20<br />

Global Aerospace Supply Chain<br />

Average<br />

Average<br />

cost<br />

cost<br />

of labour<br />

of labour<br />

per<br />

per<br />

hour<br />

hour<br />

in US$.<br />

in US$.<br />

2011<br />

2011<br />

INDONESIA 0,8<br />

INDONESIA 0,8<br />

SRI LANKA<br />

0,9<br />

SRI LANKA<br />

0,9<br />

EGYPT<br />

1,1<br />

EGYPT<br />

1,1<br />

PHILIPPINES 1,2<br />

PHILIPPINES 1,2<br />

ECUADOR<br />

1,8<br />

ECUADOR<br />

1,8<br />

THAILAND 2<br />

THAILAND 2<br />

PERU 2,1<br />

PERU 2,1<br />

MEXICO<br />

2,3<br />

MEXICO<br />

2,3<br />

UKRAINE 2,5<br />

UKRAINE 2,5<br />

AZERBAIJAN 2,5<br />

AZERBAIJAN 2,5<br />

INDIA 2,9<br />

INDIA 2,9<br />

CHINA 2,9<br />

CHINA 2,9<br />

TURKEY 3,2<br />

TURKEY 3,2<br />

VENEZUELA 3,6<br />

VENEZUELA 3,6<br />

COLOMBIA 3,8<br />

COLOMBIA 3,8<br />

KAZAKHSTAN 4<br />

KAZAKHSTAN 4<br />

RUSSIAN FEDERATION 4,6<br />

RUSSIAN FEDERATION 4,6<br />

CHILE 4,6<br />

CHILE 4,6<br />

BULGARIA 4,9<br />

BULGARIA 4,9<br />

ARGENTINA 4,9<br />

ARGENTINA 4,9<br />

MALAYSIA 5,4<br />

MALAYSIA 5,4<br />

ROMANIA 5,5<br />

ROMANIA 5,5<br />

HONG KONG 5,5<br />

HONG KONG 5,5<br />

TAIWAN 7,4<br />

TAIWAN 7,4<br />

BRAZIL 7,8<br />

BRAZIL 7,8<br />

PORTUGAL<br />

9,1<br />

PORTUGAL<br />

9,1<br />

HUNGARY<br />

10,3<br />

HUNGARY<br />

10,3<br />

SLOVAKIA<br />

10,5<br />

SLOVAKIA<br />

10,5<br />

SINGAPORE<br />

11,7<br />

SINGAPORE<br />

11,7<br />

POLAND<br />

12,3<br />

POLAND<br />

12,3<br />

CZECH REPUBLIC<br />

15,1<br />

CZECH REPUBLIC<br />

15,1<br />

ISRAEL<br />

15,5<br />

ISRAEL<br />

15,5<br />

KOREA, REP. OF<br />

15,7<br />

KOREA, REP. OF<br />

15,7<br />

GREECE<br />

21,6<br />

GREECE<br />

21,6<br />

NEW ZEALAND<br />

21,9<br />

NEW ZEALAND<br />

21,9<br />

SPAIN<br />

23,8<br />

SPAIN<br />

23,8<br />

UNITED KINGDOM<br />

25,6<br />

UNITED KINGDOM<br />

25,6<br />

UNITED STATES<br />

27,4<br />

UNITED STATES<br />

27,4<br />

JAPAN<br />

28<br />

JAPAN<br />

28<br />

FRANCE<br />

32,1<br />

FRANCE<br />

32,1<br />

ITALY<br />

32,5<br />

ITALY<br />

32,5<br />

CANADA<br />

33,4<br />

CANADA<br />

33,4<br />

IRELAND<br />

34<br />

IRELAND<br />

34<br />

NETHERLANDS<br />

37<br />

NETHERLANDS BELGIUM<br />

37 39,3<br />

BELGIUM<br />

39,3<br />

GERMANY<br />

40,3<br />

GERMANY FINLAND<br />

40,3 40,4<br />

FINLAND<br />

40,4<br />

AUSTRIA<br />

41<br />

AUSTRIA<br />

41<br />

SWEDEN<br />

43<br />

SWEDEN<br />

43<br />

AUSTRALIA<br />

45,6<br />

AUSTRALIA<br />

45,6<br />

SWITZERLAND<br />

47,5<br />

SWITZERLAND DENMARK<br />

47,5 47,6<br />

DENMARK<br />

47,6 59,4<br />

NORWAY<br />

59,4<br />

NORWAY<br />

0 10 20 30 40 50 60<br />

0 10 20 30 40 50 60<br />

© Reproduced by permission of the Economist Intelligence Unit<br />

Figure 2: Labour cost and sustainability of cost advantage<br />

the state has progressively decreased in importance, especially<br />

with regards to the control of commercial airlines, an<br />

increasing number of nations have bartered access to their<br />

markets for local added value. Apart from giants like China,<br />

which has carefully mapped technology infusion in its aerospace<br />

supply chain, a multitude of nations are set on this<br />

path – either as an effort of industrial consolidation (Brazil,<br />

Malaysia, Korea, Turkey) or diversification (United Arab<br />

50<br />

Emirates, Kazakhstan or Vietnam).<br />

45<br />

However, value for cost has emerged progressively as<br />

a leading driver for aerospace globalisation and this for 40<br />

several reasons: Beyond massive labour cost arbitrage 35<br />

(Figure 2), policies driven by market access have not only<br />

30<br />

successfully provided fundamental aerospace capabilities<br />

25<br />

in emerging countries, but these are now actively tapped<br />

and leveraged by the emerging private sector. India is 20 a<br />

point in case, where private business houses are building 15<br />

an independent industry by tapping aerospace engineers<br />

10<br />

from national champion HAL or government labs such as<br />

5<br />

NAL or DRDO and blending them with low cost labour and<br />

established private sector productivity. These joint trends 0<br />

converge towards fostering a genuinely competitive proposition<br />

from third countries in aerospace, following the pattern<br />

of other industries (automotive, power etc.).<br />

S u p p l y Chain Management iii /2011<br />

A third leading driver for globalisation of the Aerospace<br />

industry has been access to rare resources. While raw materials<br />

are controlled by oligopolies in the upstream part<br />

PLEASE of the aerospace NOTE: supply The chain, following engineering resources have<br />

acknowledgement become scarcer in the line Western has world to be as young engineers<br />

mentioned:<br />

are progressively less attracted to the manufacturing world.<br />

Globalisation usefully contributes to addressing these is-<br />

© sues Reproduced with countries by such permission as Russia or of Kazakhstan the for Tita-<br />

Economist nium, and India, Intelligence and even the Unit. USA, for engineering.<br />

A fourth globalisation driver relates to risk management:<br />

Commercial aviation remains a Dollar-dominated industry.<br />

Whereas over 80 % of Airbus sales are denominated in<br />

Dollars, only two thirds of its procurement is, leading to<br />

a net exposure of roughly €10bn. Globalisation offers the<br />

potential to reduce this gap. The erosion of the US$ as the<br />

predominant reference currency will provide opportunities<br />

to diversify progressively sales denominations. Apart from<br />

risk of currency fluctuations, Airbus adjusts its globalisation<br />

targets in order to minimise its exposure to classical<br />

risks and boundary conditions such as geopolitical, factor<br />

cost inflation, loss of intellectual property and supply chain<br />

risks.<br />

It is through regular review of and arbitration between<br />

these drivers that Airbus has defined its globalisation targets.<br />

PLEASE NOTE: The following<br />

acknowledgement line has to be<br />

mentioned:<br />

© Reproduced by permission of the<br />

Economist Intelligence Unit.<br />

Airbus Global Sourcing Vision 2020<br />

Airbus has incorporated global sourcing targets in its strategic<br />

road-map “Vision 2020” (Figure 3). At the beginning<br />

of its global sourcing programme, Airbus sourced roughly<br />

a third of its spend (including engines) from beyond Western<br />

European borders. This spend originated predominately<br />

from the US, while the share of third countries was very limited.<br />

By 2020, Airbus intends to source, whether directly or<br />

indirectly, about half of its procurement spend from beyond<br />

Western Europe: The share of the US spend is to increase<br />

marginally in relative terms and representing a doubling in<br />

absolute terms. The share of third countries is to represent<br />

Bn� Challenges<br />

�� Market Access<br />

RoW<br />

�� Value for Cost<br />

USA<br />

�� Risk Management<br />

W. Europe �� Access to Resources<br />

22bn<br />

45+bn<br />

2010 2020<br />

Figure 3: Airbus global sourcing evolution to 2020

close to 15 %, i.e. an annual spend of about €6bn, with a<br />

significant contribution to originate from indirect sourcing,<br />

whether through the foreign subsidiaries of Western suppliers<br />

or the volumes they procure from those countries.<br />

For Western Europe, the scenario would still represent an<br />

increase in absolute figures over the decade.<br />

The Airbus Approach to the Global<br />

Sourcing Challenge<br />

In the case of aerospace, one of the primary challenges<br />

linked to global sourcing is the maturity of the supply chain.<br />

The hurdle of technological complexity is compounded by<br />

stringent certification requirements and high upfront investments.<br />

For this reason, only a segment of the Airbus spend –<br />

aerostructures, materials, engineering – is adapted to direct<br />

off-shoring. Conversely, propulsion, systems & equipment<br />

contribute mainly indirectly through the upstream part of<br />

the supply chain (mechanical parts, electronic components,<br />

sub-assemblies). In all cases, developing new suppliers requires<br />

an active involvement of customers.<br />

A second major hurdle is the sheer size of the industry.<br />

Although aerospace enjoys a reputation of advanced technology<br />

and strategic value, the total turnover of the industry<br />

is a fraction of that of the automotive industry. The question<br />

for, say a large Indian forging house, is not to tie-up<br />

capacity with one or the other aerospace OEM, but rather to<br />

compare the interest of investing into aerospace rather than<br />

in the automotive or power industry.<br />

A third issue relates to consistency with other aspects of<br />

the procurement policy such as the overall consolidation of<br />

the supply chain. The top 20 equipment suppliers of Airbus<br />

represent 91 % of the company’s equipment spend. They<br />

were 40 suppliers ten years ago. Similarly, it is the policy<br />

of Airbus in the field of aerostructures to shift from smaller<br />

build-to-print towards larger design-and-build packages<br />

entrusted to larger risk sharing partners.<br />

Airbus has put in place a set of strategic responses and<br />

organisational enablers to address these challenges at the<br />

various stages of the procurement process:<br />

Preparation<br />

A significant effort has been devoted to understanding the<br />

markets, analysing the capability & capacity of current players<br />

and potential new entrants as well as the policy framework<br />

in which they operate. A thorough country screening<br />

process and supplier screening process have been elaborated<br />

and have been instrumental in the identification of global<br />

sourcing targets whether in terms of countries or partners. It<br />

is the policy of Airbus, in complement to its strong relationship<br />

with large public players, to pro-actively develop its relationship<br />

with local private sector players with the objective<br />

to build consistent aerospace clusters in strategic countries.<br />

Focus & Guidance<br />

This preparation work allows providing focus and guidance.<br />

Airbus Call for Tenders have to systematically take<br />

Global Aerospace Supply Chain<br />

into account global sourcing opportunities. Call for Tenders<br />

are directed towards only very few relevant future partners<br />

which are intensively supported by local Airbus teams to<br />

ensure compatibility of requirements and understanding.<br />

An illustration is the Engineering Services procurement<br />

policy which has inducted Indian engineering companies<br />

in its core list of suppliers. Similarly, Airbus has worked<br />

closely with its Western Suppliers to provide convergence<br />

on country priorities and supports tie-ups between them<br />

and the local industry. The associated efforts are planned<br />