Assessing potential changes in retail costs 2015-2020 - Water UK

Assessing potential changes in retail costs 2015-2020 - Water UK

Assessing potential changes in retail costs 2015-2020 - Water UK

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

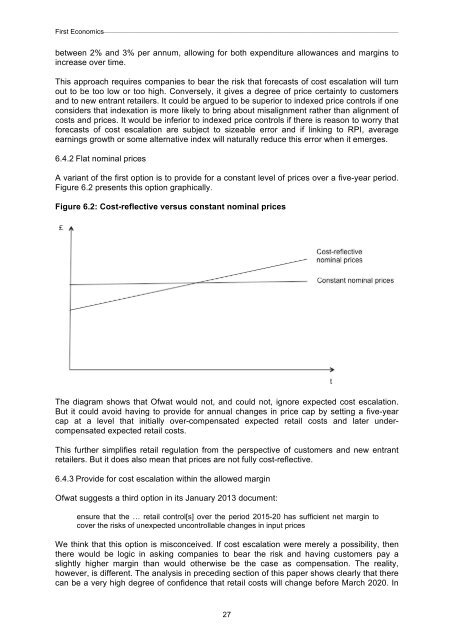

First Economics—––—–—–—–—–—–—–—–—–—–—–—–—–—–—–—–—–—–—–—–—–———–—–—–—–—–—–between 2% and 3% per annum, allow<strong>in</strong>g for both expenditure allowances and marg<strong>in</strong>s to<strong>in</strong>crease over time.This approach requires companies to bear the risk that forecasts of cost escalation will turnout to be too low or too high. Conversely, it gives a degree of price certa<strong>in</strong>ty to customersand to new entrant <strong>retail</strong>ers. It could be argued to be superior to <strong>in</strong>dexed price controls if oneconsiders that <strong>in</strong>dexation is more likely to br<strong>in</strong>g about misalignment rather than alignment of<strong>costs</strong> and prices. It would be <strong>in</strong>ferior to <strong>in</strong>dexed price controls if there is reason to worry thatforecasts of cost escalation are subject to sizeable error and if l<strong>in</strong>k<strong>in</strong>g to RPI, averageearn<strong>in</strong>gs growth or some alternative <strong>in</strong>dex will naturally reduce this error when it emerges.6.4.2 Flat nom<strong>in</strong>al pricesA variant of the first option is to provide for a constant level of prices over a five-year period.Figure 6.2 presents this option graphically.Figure 6.2: Cost-reflective versus constant nom<strong>in</strong>al pricesThe diagram shows that Ofwat would not, and could not, ignore expected cost escalation.But it could avoid hav<strong>in</strong>g to provide for annual <strong>changes</strong> <strong>in</strong> price cap by sett<strong>in</strong>g a five-yearcap at a level that <strong>in</strong>itially over-compensated expected <strong>retail</strong> <strong>costs</strong> and later undercompensatedexpected <strong>retail</strong> <strong>costs</strong>.This further simplifies <strong>retail</strong> regulation from the perspective of customers and new entrant<strong>retail</strong>ers. But it does also mean that prices are not fully cost-reflective.6.4.3 Provide for cost escalation with<strong>in</strong> the allowed marg<strong>in</strong>Ofwat suggests a third option <strong>in</strong> its January 2013 document:ensure that the … <strong>retail</strong> control[s] over the period <strong>2015</strong>-20 has sufficient net marg<strong>in</strong> tocover the risks of unexpected uncontrollable <strong>changes</strong> <strong>in</strong> <strong>in</strong>put pricesWe th<strong>in</strong>k that this option is misconceived. If cost escalation were merely a possibility, thenthere would be logic <strong>in</strong> ask<strong>in</strong>g companies to bear the risk and hav<strong>in</strong>g customers pay aslightly higher marg<strong>in</strong> than would otherwise be the case as compensation. The reality,however, is different. The analysis <strong>in</strong> preced<strong>in</strong>g section of this paper shows clearly that therecan be a very high degree of confidence that <strong>retail</strong> <strong>costs</strong> will change before March <strong>2020</strong>. In27

![Corporate social responsibility [CSR] has different ... - Water UK](https://img.yumpu.com/51398482/1/184x260/corporate-social-responsibility-csr-has-different-water-uk.jpg?quality=85)