Putnam Multi-Cap Value Fund - Putnam Investments

Putnam Multi-Cap Value Fund - Putnam Investments

Putnam Multi-Cap Value Fund - Putnam Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

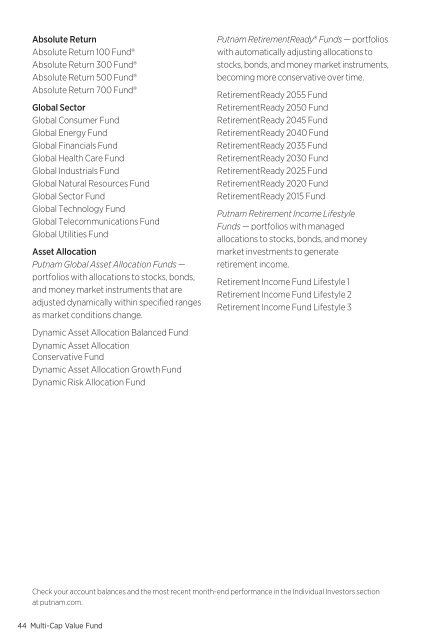

Absolute ReturnAbsolute Return 100 <strong>Fund</strong>®Absolute Return 300 <strong>Fund</strong>®Absolute Return 500 <strong>Fund</strong>®Absolute Return 700 <strong>Fund</strong>®Global SectorGlobal Consumer <strong>Fund</strong>Global Energy <strong>Fund</strong>Global Financials <strong>Fund</strong>Global Health Care <strong>Fund</strong>Global Industrials <strong>Fund</strong>Global Natural Resources <strong>Fund</strong>Global Sector <strong>Fund</strong>Global Technology <strong>Fund</strong>Global Telecommunications <strong>Fund</strong>Global Utilities <strong>Fund</strong>Asset Allocation<strong>Putnam</strong> Global Asset Allocation <strong>Fund</strong>s —portfolios with allocations to stocks, bonds,and money market instruments that areadjusted dynamically within specified rangesas market conditions change.Dynamic Asset Allocation Balanced <strong>Fund</strong>Dynamic Asset AllocationConservative <strong>Fund</strong>Dynamic Asset Allocation Growth <strong>Fund</strong>Dynamic Risk Allocation <strong>Fund</strong><strong>Putnam</strong> RetirementReady® <strong>Fund</strong>s — portfolioswith automatically adjusting allocations tostocks, bonds, and money market instruments,becoming more conservative over time.RetirementReady 2055 <strong>Fund</strong>RetirementReady 2050 <strong>Fund</strong>RetirementReady 2045 <strong>Fund</strong>RetirementReady 2040 <strong>Fund</strong>RetirementReady 2035 <strong>Fund</strong>RetirementReady 2030 <strong>Fund</strong>RetirementReady 2025 <strong>Fund</strong>RetirementReady 2020 <strong>Fund</strong>RetirementReady 2015 <strong>Fund</strong><strong>Putnam</strong> Retirement Income Lifestyle<strong>Fund</strong>s — portfolios with managedallocations to stocks, bonds, and moneymarket investments to generateretirement income.Retirement Income <strong>Fund</strong> Lifestyle 1Retirement Income <strong>Fund</strong> Lifestyle 2Retirement Income <strong>Fund</strong> Lifestyle 3Check your account balances and the most recent month-end performance in the Individual Investors sectionat putnam.com.44 <strong>Multi</strong>-<strong>Cap</strong> <strong>Value</strong> <strong>Fund</strong>