Chapman Law Review - Chapman University

Chapman Law Review - Chapman University

Chapman Law Review - Chapman University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Do Not Delete 12/7/2011 2:17 PM<br />

24 <strong>Chapman</strong> <strong>Law</strong> <strong>Review</strong> [Vol. 15:1<br />

Indeed, almost no federal laws are aimed directly at fringe<br />

banking. 7 Although many states have implemented measures to<br />

protect consumers, the federal government has largely sat on the<br />

sidelines—until now.<br />

The Dodd-Frank Wall Street Reform and Consumer<br />

Protection Act represents a massive overhaul of the federal<br />

government approach to financial markets generally, and a<br />

momentous sea change in the relationship between the federal<br />

government and fringe banking. One part of this legislation<br />

created the Bureau of Consumer Financial Protection (Bureau).<br />

Unlike the federal agencies before it, the Bureau presents a<br />

remarkable opportunity for the federal government to intervene<br />

in the fringe economy. For the first time ever, the federal<br />

government has empowered an agency to monitor and supervise<br />

fringe creditors, to study fringe credit markets, and to<br />

promulgate rules relating to fringe banking transactions.<br />

This Article aims to describe and assess the effects the<br />

Bureau will have on fringe credit markets. I make two central<br />

claims. First, I argue that the Consumer Financial Protection<br />

Act (Act) gives broad, novel powers to the Bureau to regulate<br />

fringe credit. Part I describes the scope of the Bureau‘s power<br />

under the Act, demonstrating how the Act covers the vast<br />

majority of fringe credit transactions. Part II surveys the<br />

substance of the Act to reveal the surprising emphasis the Act<br />

places on the Bureau governing fringe banking transactions. The<br />

scope of the Bureau‘s authority coupled with its substantive<br />

mandate to confront problems in fringe credit markets signal the<br />

new power and interest the federal government has taken in the<br />

fringe economy.<br />

Second, I argue that most of the justifications that have been<br />

offered for the Bureau regulating fringe credit are flawed. To<br />

understand why people have contended the Bureau should<br />

govern the fringe economy, I surveyed the two most important<br />

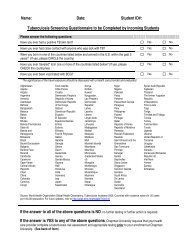

academic articles arguing in favor of the Bureau, and I conducted<br />

an empirical study to measure the frequency of the rationales for<br />

the Bureau regulating fringe credit in media, government press<br />

releases, and testimony to Congress. Part III presents the<br />

results of the study, and it assesses the different rationales for<br />

the Bureau intervening in fringe credit markets. Some<br />

7 The one exception is the Talent-Nelson Amendment aimed at stopping payday<br />

lenders from lending money to military personnel. 10 U.S.C. § 987 (2006). See generally<br />

Patrick M. Aul, Note, Federal Usury <strong>Law</strong> for Service Members: The Talent-Nelson<br />

Amendment, 12 N.C. BANKING INST. 163 (2008) (discussing the intent and effects of the<br />

Talent-Nelson Amendment).