Review of Operations - Commercial Bank of Kuwait

Review of Operations - Commercial Bank of Kuwait

Review of Operations - Commercial Bank of Kuwait

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

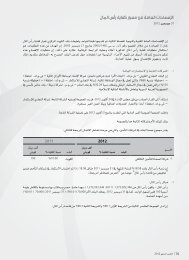

c) Liquidity RiskThe <strong>Bank</strong> manages liquidity risks that are evident in maturity mismatches and liability-side concentrations. Limits are inplace for the control <strong>of</strong> liquidity risk and these include the maximum allowable cumulative mismatches. The erstwhilelimit for the loan to deposit ratio was replaced during the year with the new limit for maximum amount allowedfor lending, in line with the Central <strong>Bank</strong>’s instructions. Internal alert limits are also laid down to ensure continuedadherence to the regulatory limits. Liquidity risk management was further enhanced during the year through new limitsthat attempt to restrict concentration <strong>of</strong> deposits from sensitive significant depositors as well as products. Limits werealso introduced for mismatches in different time buckets thereby ensuring that maturing liabilities and assets remainlargely matched. A detailed liability side analysis is conducted periodically to discern rollover patterns, identify coredeposits, behavioural trends in short-term funds and correlations with macro economic variables.The <strong>Bank</strong>’s liquidity risk management policy also requires that proper liquidity planning is periodically conducted andthat stress tests are performed based on scenario analyses. A detailed contingency plan also forms part <strong>of</strong> the liquiditymanagement framework. Economic capital for liquidity risk under pillar two <strong>of</strong> Basel II using internally developedmethodology is also measured regularly.The Basle Committee for <strong>Bank</strong>ing Supervision has introduced the Basel III regulations covering, among others, a globalframework for liquidity risk management. While these regulations are currently being developed for <strong>Kuwait</strong> banks,the <strong>Bank</strong> has in 2012 proactively introduced the new liquidity ratios, the Liquidity Coverage Ratio (LCR) and the NetStable Funding Ratio (NSFR). These ratios are being measured and monitored regularly against internal limits that areprogressively phased to meet the regulatory standards.d) Interest Rate RiskInterest rate risk is managed as per the guidelines laid down in the interest rate risk management policy. The majority<strong>of</strong> the assets and liabilities <strong>of</strong> the <strong>Bank</strong> mature and / or re-price within one year and hence there is limited exposureto interest rate risk. Interest rate risk is monitored with the help <strong>of</strong> an interest rate sensitivity monitor (IRSM) in whichassets and liabilities are distributed in pre-defined maturity/re-pricing time bands. The Earnings at Risk (EaR) is computedby applying pre-defined rate shocks to the IRSM and this is compared against internal limits that define the <strong>Bank</strong>’sappetite for this risk. During the year the <strong>Bank</strong> moved from a single, across-the-board rate shock on the IRSM to variedrate shocks for different time buckets/currencies for calculating the EaR. In addition, the economic value <strong>of</strong> equity isrequired to be calculated under certain pre-defined circumstances. Economic capital under pillar two for interest raterisk is measured regularly using an internally developed methodology.e) Operational Risk<strong>Commercial</strong> <strong>Bank</strong> Of <strong>Kuwait</strong>Operational Risk management is focused on identifying, assessing and minimising the impact <strong>of</strong> risk events that may arisethrough inadequate processes, human error, system failures as well as external factors by using a range <strong>of</strong> assessmentmethods including Risk Control Self Assessments (RCSA) and a comprehensive review <strong>of</strong> group-wide procedures.An objective scorecard is used to assess the different operational risk areas based on pre-defined parameters and tograde them under certain categories. This gradation is used in the measurement <strong>of</strong> economical capital for operationalrisk and legal risk. Internally maintained loss data, consolidated principally from incident reporting channels, providesinformation on the frequency and impact <strong>of</strong> operational risk events. A group-wide business continuity framework isin place to tackle any unforeseen contingencies that aims to ensure that business continuity is achieved with minimaldisruption to critical processes and systems.22