Review of Operations - Commercial Bank of Kuwait

Review of Operations - Commercial Bank of Kuwait

Review of Operations - Commercial Bank of Kuwait

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

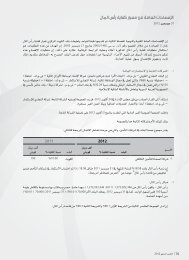

Insurance management which is integrated into this framework facilitates prudent transfer <strong>of</strong> risks. Insurance coverageprovides partial mitigation for operational risk. The operational risk management policy lays down general guidelinesfor insurance management including factors to be considered in structuring insurance policies, credit risk <strong>of</strong> insurer,definition <strong>of</strong> policy limits and deductibles, policy reviews and handling <strong>of</strong> claims.f) Other risksPolicies are in place for other risks including legal risk, strategic risk and reputational risk. These policies establishroles and responsibilities for various stakeholders in managing and controlling these risks. In addition, quantificationmethodologies are in place for measuring the economic capital for these risks.INFORMATION TECHNOLOGY |Branch ImprovementsCard printing systems for instant ATM card issuance has been installed in all branches for improved customer service.New Revel Digital Signage Devices has also been installed in branches. In addition, <strong>of</strong>fsite ATMs has been installed atJumeirah hotel, KAC and PAI.Outsourcing <strong>of</strong> systemsAs per the <strong>Bank</strong>s strategy, the Swift System and Email has been outsourced in order to improve availability and businesscontinuity.Ongoing major system upgradesThe banks ATM switch and its HR system are in the process <strong>of</strong> being upgraded to include latest features.Compliance and SecurityAs per Central <strong>Bank</strong> requirements, all outgoing Swift messages are being screened against international sanction lists.The <strong>Bank</strong>s Anti-Money Laundering system has also been enhanced to cater for Central <strong>Bank</strong> regulations.CDM (Cash Deposit Machine)CDMs has been implemented as the new primary channel for cash withdrawal and deposit transactions. This smartsystem has reduced the queue time and increased the volume <strong>of</strong> daily transactions conducted in all CBK branches. Thesystem provides easy and secured access for both parties (customer and bank).Annual Report 201323