Top 50 Emerging Global Outsourcing Cities - Tholons

Top 50 Emerging Global Outsourcing Cities - Tholons

Top 50 Emerging Global Outsourcing Cities - Tholons

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

globalservicesmedia.comThe gateway to the global sourcing of IT and BPO servicesSpecial ReportThe gateway to the global sourcing of IT and BPO servicesOctober 2009TOP<strong>50</strong>CITIESEMERGINGGLOBALOUTSOURCINGSponsorsPlatinumSilverA <strong>Global</strong> Services-<strong>Tholons</strong> StudyThe right delivery starts with the right serviceslocation. Watch out for this year’s top <strong>50</strong>emerging global outsourcing cities, top 8 globaloutsourcing cities, top 5 offshore nations, next5 offshore nations, top 10 aspirants, the lists ofemerging and emerged cities by functionsAssociateOctober 2009 www. globalservicesmedia.com Research Partner <strong>Global</strong>Services 1

ContentsTOP<strong>50</strong>CITIESEMERGINGGLOBALOUTSOURCING04The right delivery starts with theright services location. Watch out forthis year’s top <strong>50</strong> emerging globaloutsourcing cities, top 8 globaloutsourcing cities, top 5 offshorenations, next 5 offshore nations, top10 aspirants, the lists of emerging andemerged cities by functions<strong>Top</strong> 5 Offshore NationsIndia.......................................................................................................11The Philippines....................................................................................11China......................................................................................................11Ireland..................................................................................................18Brazil.....................................................................................................18Next 5 Offshore NationsCanada..................................................................................................18Russia..................................................................................................20Mexico..................................................................................................20Vietnam...............................................................................................20Poland..................................................................................................20<strong>Top</strong> 8 <strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong>Bangalore, India................................................................................24Delhi (NCR), India..............................................................................25Mumbai, India....................................................................................26Manila NCR, The Philippines..........................................................27Dublin, Ireland...................................................................................28Chennai, India....................................................................................29Hyderabad, India..............................................................................30Pune, India...........................................................................................31<strong>Top</strong> Established and <strong>Emerging</strong><strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong> by Functions....... 32<strong>Top</strong> 10 Aspirants.......................................... 34Methodology............................................... 35The 2009 Destination Coverage in<strong>Global</strong> Services............................................37October 2009 www. globalservicesmedia.com <strong>Global</strong>Services 3

Special ReportThe gateway to the global sourcing of IT and BPO services4 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

The gateway to the global sourcing of IT and BPO servicesSpecial ReportTOP<strong>50</strong>CITIESEMERGINGGLOBALOUTSOURCINGA <strong>Global</strong> Services-<strong>Tholons</strong> StudyThe right delivery starts with the right services location. Watch out for thisyear’s top <strong>50</strong> emerging global outsourcing cities, top 8 global outsourcingcities, top 5 offshore nations, next 5 offshore nations, top 10 aspirants, thelists of emerging and emerged cities by functionsOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 5

Special ReportThe gateway to the global sourcing of IT and BPO servicesBy Avinash Vashistha, Chairman and CEO, <strong>Tholons</strong>, andImrana Khan, <strong>Global</strong> ServicesThough there is no discounting the effects of thecurrent global economic downturn, the outsourcingand offshoring industry has continued to showsigns of evolution and maturity—with the industryremaining relatively dynamic and established offshore locationsshowing pronounced stability. For instance, the Philippinesincreased outsourcing revenues by 25 percent from$4.8 billion in 2007 to $6 billion in 2008 while increasing industryemployment by 33 percent to an estimated 400,000employees. On the other hand, India posted 35 percent YoYgrowth rates in revenues over the last five years reaching $40billion in IT <strong>Outsourcing</strong> (ITO) and Business Process <strong>Outsourcing</strong>(BPO) export services in 2008. In a parallel view,while a number of developing economies struggled to acquireinvestments from client nations, India’s FDI posted thelargest increase globally at 46 percent in 2008—from $25 billionto $46 billion even as global FDI flows decreased from$1.9 trillion to $1.7 trillion.The general movement of outsourcing destinations in2009 will remain minimal compared to previous years whendrastic movement across different service and value lineswere observed.With increased competition among service providersoffering similar value propositions, distinction and categorizationhas indeed become difficult. Location assessmenthas, hence, become increasingly complex and important.Today, the need to understand the delivery capability ofa potential investment site is determined and based on aplethora of ecosystem variables.Services globalization went through a turbulent phase in2008, combating the fear of losing major client markets toprotectionism and ravaged by the debilitating effects of theglobal downturn. Moreover, the impact of such movementsin the industry is expected to induce long-lasting changes.These changes are not only in the way the stakeholders in theindustry approach offshoring but also a significant paradigmThe general movement ofoutsourcing destinations in 2009will remain minimal comparedto previous years when drasticmovement across different serviceand value lines were observedshift toward the way emerging destinations are viewed.The convergence of offshore nations into regions isviewed as a possibly significant trend in the near future dueto its potential impact on global offshoring delivery models.Although a region provides a common converged areafor the services globalization industry, there is a clear needto further understand this convergence on a more granularlevel.Dropouts and New EntrantsThis year, we noticed a few cities coming in and goingDropoutsRank (2008) City Country15 Pasig City The Philippines21 Quezon City The Philippines47 San Antonio The U.S.45 Mandaluyong City The PhilippinesNew EntrantsRank (2009) City Country43 Tianjin* China44 Casablanca Morocco47 Montevideo Uruguay48 Alexandria Egyptout of the list which is a sign of the tested industry duringthe global economic crisis. Three Philippine cities were removedfrom the list as they were clustered this year withManila NCR – which remains one of the <strong>Top</strong> 8 destinations.Losers & GainersThe only city that has fallen down by more than five<strong>Top</strong> Gainer(s)Rank (2008) Rank (2009) Change City27 20 7 San José26 21 5 Rio de Janeiro44 39 5 Gudalajara<strong>Top</strong> Loser(s)Source: <strong>Global</strong> Services and <strong>Tholons</strong>*Tiajin: Last year, the city was identified as an aspirant city.Source: <strong>Global</strong> Services and <strong>Tholons</strong>Source: <strong>Global</strong> Services and <strong>Tholons</strong>Rank (2008) Rank (2009) Change City6 15 -9 KolkataSource: <strong>Global</strong> Services and <strong>Tholons</strong>6 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

The gateway to the global sourcing of IT and BPO servicesSpecial ReportLocation Before Service ProviderBy Karen Tillyer and Stephen Bullas, eCodeWhat became apparent after viewingthe results of a recent poll on the<strong>Global</strong> Services Website, was theimportance for companies to seekfurther advice and direction when embarkingupon a long-term outsourcing strategy. At lastcount 70 percent of respondents were of theopinion that choosing the “outsourcing serviceprovider” should take priority over “location.”In this short article we will discuss whythis, in our opinion, is not a logical decisionand why pivotal providers such as eCODE andindeed industry research giants, such as Gartner,have been advocating an opposing viewfor many years.In these times of financial instability, it isincreasingly important to think about the costsinvolved in outsourcing a particular businessfunction. Different countries and indeed differentregions will have certain price bracketsfor overheads such as rent and labor. Certainskill sets will demand more or less in the wayof wages depending on the supply and demandfor the region. Choosing a perfect service provideris all very well, but if your chosen serviceprovider is situated in somewhere like WesternEurope or the U.S., this could bring withit a significant price tag. Furthermore eachcountry will offer different labour skill sets;for example, Malta is a prominent location forhousing multilingual outsourced functions. Itis important to look at the total availability ofyour desired skill set as well as the attritionrate before selecting a service provider. Whilstyou may find that your chosen service providerhas ample staff for your current needs, if youwanted to ramp up your operation in future,you might find that there is simply not enoughof the desired skill set in the region to enablethis, or that the cost is prohibitive comparedwith other suitable locations.Another financial consideration to look atis shipping costs and methods; do you want tobe near a port, main roads or an airport? It isall very well choosing the perfect provider butif you cannot get your goods to your customersor cannot visit your offshore team in timesof crisis, then major problems can occur andFinal Poll ResultsShould you first choose outsourcing location or partner?(%)LocationService Provider34to sort these out can be an ongoing and costlyprocess. Choosing the right environment cannot only be crucial when looking at logistics butalso many other issues such as governmentalfactors; FDI incentives, transfer fees, taxation,TUPE or other similar directives, future development,infrastructure and ICT capabilities, politicalissues and potential clash with client CSRpolicy. All such issues exist outside of a sin-gleservice provider and therefore must be consideredin the context of location.We do not dispute the importance of choosinga service provider that is compatible withyour company, but for the most part they arein abundance. We do concede, however, that ifyou are outsourcing a niche process, which requiresspecific skills, then perhaps you shouldbe looking at the service provider first as thereis a smaller chance of a service provider with theexpertise needed being situated in the desiredlocation; but even in this situation, the issuesconcerned with location should not be ignored.Expanding upon the issue of cultural fit, itmust be stressed that it is not only the businessculture that must be considered. Youcertainly need a strong relationship with theservice provider but it may also be importantthat you find a company that understands notonly your language but also the sensitivity ofyour culture and vice versa. Various regionswill denote a closer cultural affinity to yourown, and, therefore, it is important to thinkabout your business needs in the context oflocation. The same can be said for linguistics:Some countries will have a greater degree offluency / articulation / clarity in your chosen66Total Votes Polled: 143Source: <strong>Global</strong> Services Pollslanguage than others. It is particularly importantto think about this when outsourcing helpcenter or call-center operations.Time-zone differences are also locationdependant and may represent something thatcould impact your operations considerably. Forexample, if you are situated in the U.K., yourhead-quarters is in the U.S. and your serviceproviders in India it could potentially causecommunication issues between various teammembers and, in some cases, certain vitalmembers might be unobtainable at a pivotalpoint in the project. Further to this,different cultures celebrate differentholidays and have alternateworking hours. For example, many ofthe Muslim countries have a workingweek of Sunday through Thursday orSaturday through Wednesday leavingFriday for religious observance.However, sometimes the differencesin time zones can be advantageousas companies can position themselvesto have out-of-hours staffingand therefore problems such as software bugsmay be fixed overnight.All of the issues mentioned must be consideredwhen looking into outsourcing anybusiness operation and, as you can clearly see,many of the fundamental strategic issues arelocation dependant. Despite, therefore, indicationfrom the recent poll results, we wouldurge all those thinking of outsourcing to lookat location as a key factor, and if necessary toseek further guidance before embarking uponan outsourcing strategy. GSKaren TillyerStephen BullasKaren Tillyer, BusinessProcess Researcher, andStephen Bullas, ManagingPartner, eCODE, a leadingindependent advisor onnearshore and offshoreoutsourcing, with customersthroughout Western Europeand the U.S.October 2009 www. globalservicesmedia.com <strong>Global</strong>Services 7

Special ReportThe gateway to the global sourcing of IT and BPO servicesRegion-wise breakup of the top <strong>50</strong> emerging globaloutsourcing cities 2009(%)14268 4101010414<strong>Top</strong> & Next 5 Offshore NationsEstablished offshore nations with a high degree of maturityand record of successful delivery capabilities are categorizedas the <strong>Top</strong> 5 Offshore Nations. These countries typicallyhave centers of excellence across multiple outsourcingsegments and rank highly in a number of location-assessnnnnnnnnnCentral AmericaEast AsiaEastern EuropeMiddle East and AfricaNorth AmericaSouth AmericaSouth AsiaSoutheast AsiaWestern EuropeTotal Votes Polled: 143Source: <strong>Global</strong> Services and <strong>Tholons</strong>places from the last year’s ranking is Kolkata. The city hasrolled down by 9 places to reach the 15th position in the2009 <strong>Top</strong> <strong>50</strong> <strong>Emerging</strong> <strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong> list.Kolkata was considered to have the potential to becomeanother hub in India, but due to the recent developmentsthere is a cognizable alteration in the way the city is perceived.Significantly increased concerns about labor risk, sociopoliticalrisk, bureaucracy and corruption have hinderedthe progress of Kolkata and the entire state of West Bengal asa whole. Some of the incidents that have contributed to this.The land problem of tech companies such as Wipro and Inofsys.Number of strikes (bands) during the last year, at leastone major strike every month. Tata plant at Singur receivedthe attention of the international media, that was the reasonfor the drop in rank last year. Apart from the deterioratingbusiness environment, the major factor is that due to therecent sequence of events and negative publicity—no customeror service provider is looking at Kolkata seriously.The rankings of other cities were more or less the same,except for San José, which ranked at the 20th position thisyear (up by seven places from the previous year) followedNearshore has become an importantcomponent of outsourcing andLatin America has become the hotspot. The region has attracted a lotof attention during the last year.However, most of its part suffers dueto the high risk componentby Rio de Janeiro (up by five places) and Guadalajara (upby five places).Nearshore has become an important component of outsourcingand Latin America has become the hot spot. Theregion has attracted a lot of attention during the last year.However, most of its part suffers due to the high risk component.San José, however, is perceived as one of the safest destinationsto do business. Costa Rica ranks as one of the safestcountries for investment in Central America, as risk ratingfirms and the Central American Monetary Council confirm.Majority of the population is fluent in English, making itthe only country in the region, which is low risk, and offersrelatively improved scalability. Other advantages like multilingualcapabilities, proximity to the U.S., Central Time Zone,good infrastructure, Spanish language capability and incentivesprovided by the government are added value, which arenow considered almost basic requirements when making animportant choice on BPO. Low corruption, exchange ratestability and geopolitical conditions in the city of San José,Costa Rica is another value proposition. Successful expansionby firms like HP, People Support, Sykes, Teletech and toan extent by IBM, Fujitsu during the last couple of years issignificant, now employing over almost 20,000 people in theoutsourcing industry. The effects of Intel locating in San José(1996) has been very significant, as the center for assembly,testing and other similar processes was established and expandedin the capital. This has had a positive ripple effect onother businesses and industries. This has also ‘upgraded’ theskills capabilities of the local labor pool.8 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

The gateway to the global sourcing of IT and BPO servicesSpecial Report<strong>Outsourcing</strong> CityClustersWe noticed an interesting trend this year: Some of the cityclusters have started to surface. They also have some futurepossibilities to emerge as outsourcing city clusters. Theseclusters are based on the seamless nature of talent pool in theirgiven region, and the availability of talent pool in the proposedclusters are not limited or restricted to individual city limits, administrationand/ or national and international boundaries. Thefollowing are the basic qualitative and analytical factors consideredfor identifying a cluster:>> Time to Travel>> Means and Ease of Transportation>> Affinity (Economic-Social-Political-Cultural)>> Future convergence due to outsourcing activities/capacities.This is a significant development due to the fact that servicesglobalization has now reached a level of maturity where it hasDelhi NCRthe capability to influence the development of cities—this is aclassic case of globalization and its impact on the offshore landscape.Some of the city clusters categorized by regions are:>> Southeast Asia: Manila NCR>> South Asia: Delhi NCR>> Southeast Asia: Kuala Lumpur-Cyberjaya>> South Asia: Hyderabad-Secunderabad>> South America: Greater São Paulo. GSment scenarios. These five countries offer the strongestvalue propositions to clients based on the Location AssessmentPlatform and are considered as prime locations whenconsidering specific outsourced processes. These emergeddestinations will most often also have the unique advantageof scale and capacity as compared to smaller or emerginglocations.The difference between the <strong>Top</strong> 5 and the Next 5 offshorenations is most pronounced in the service-level maturity.In terms of potential, the Next 5 are not far behind, howeverthis potential is considered to be still unrealized dueto specific inhibiting factors. It also must be stated that theservice-level maturity has been taken into considerationfrom the client point of view, as client nations look at offshorenations in a distinct manner. This has been taken intoconsideration when categorizing locations. This customerperception may change or alter over time, but takes significanteffort and time on a destination’s operational front.Successful service delivery is the most significant factor inaltering customer perception.About the Study<strong>Global</strong> Services and <strong>Tholons</strong> have been conducting thisstudy titled “<strong>Top</strong> <strong>50</strong> <strong>Emerging</strong> <strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong>” forthe fourth year in a row.In the first study, which was conducted in 2006, we hadidentified top <strong>50</strong> emerging global outsourcing, withouthaving them ranked. In the very next year, we dedicated afull team to identify and rank top <strong>50</strong> emerging outsourcingcities as well as top 5 global outsourcing cites. Besides themain top <strong>50</strong> list, the <strong>Global</strong> Services and <strong>Tholons</strong> team extendedtheir top outsourcing global cities’ list from top 5 totop 10 and also named top emerging and established outsourcingcities by functions.This year again, we have introduced a new categorynamed “<strong>Top</strong> 10 Aspirants.” The cities mentioned in this categoryare the ones that have potential to enter into the mainlist in the coming years and are being supported by theirgovernments to develop and facilitate outsourcing sectors.In addition, we have not only identified three to six establishedand emerged cities by functions but also haveintroduced three new sub categories—Animation / GameDevelopment, Health-care Services and InfrastructureManagement Services. Other categories are: ApplicationDevelopment and Management (ADM), Business Analytics,Contact Center (English), Contact Center (Multilingual),Engineering Services, Finance and Accounting (F&A), HR,Legal Services, Product Development, Research and Development(R&D) and Testing.In addition, we have also analyzed the way buyers ofservices (or client nations) look at offshore nations, and forthat purpose, we also have identified the <strong>Top</strong> 5 and the Next5 Offshore Nations. While the <strong>Top</strong> 5 are considered as matureor established outsourcing nations, the Next 5 are greatalternatives for specific types of processes and are seen asdestinations with considerable near-term potential. GSOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 9

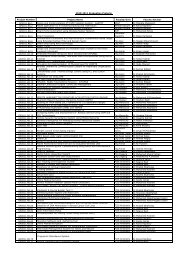

Special ReportThe gateway to the global sourcing of IT and BPO services<strong>Top</strong> <strong>50</strong> <strong>Emerging</strong> <strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong>Rank 2009 City Country Region Rank 2007 Rank 20081 Cebu City Philippines Southeast Asia 4 12 Shanghai China East Asia 8 23 Beijing China East Asia 10 34 Kraków Poland Eastern Europe 16 55 Ho Chi Minh City Vietnam Southeast Asia 6 46 Buenos Aires Argentina South America 14 97 Cairo Egypt Middle East and Africa 11 78 São Paulo Brazil South America 15 89 Shenzhen China East Asia 13 1010 Hanoi Vietnam Southeast Asia 12 1111 Curitiba Brazil South America 17 1312 Dalian (Dairen) China East Asia 18 1613 Chandigarh India South Asia 9 1214 Prague Czech Republic Eastern Europe 20 1415 Kolkata India South Asia 5 616 Santiago Chile South America 19 1817 Colombo Sri Lanka South Asia 7 1918 Coimbatore India South Asia 21 1719 Johannesburg South Africa Middle East and Africa 25 2020 San José Costa Rica Central America 29 2721 Rio de Janeiro Brazil South America - 2622 Budapest Hungary Eastern Europe 28 2523 Toronto Canada North America - 2224 Guangzhou (Canton) China East Asia 22 2325 Belfast U.K. Western Europe 24 2426 Mexico City Mexico Central America - 3027 Kuala Lumpur Malaysia Southeast Asia 31 3328 Warsaw Poland Eastern Europe 26 2829 Jaipur India South Asia - 3130 Brno Czech Republic Eastern Europe 27 2931 St. Petersburg Russia Eastern Europe 32 3232 Accra Ghana Middle East and Africa 33 3433 Chengdu China East Asia - 3734 Bucharest Romania Eastern Europe 41 3835 Bratislava Slovakia Eastern Europe 38 3536 Singapore Singapore Southeast Asia - 3637 Monterrey Mexico Central America 44 4138 Moscow Russia Eastern Europe 40 3939 Guadalajara Mexico Central America - 4440 Sofia Bulgaria Eastern Europe 39 4041 Brasília Brazil South America 42 4342 Glasgow City U.K. Western Europe 30 4243 Tianjin China East Asia - -44 Casablanca Morocco Middle East and Africa - -45 Halifax Canada North America 34 4846 Tallinn Estonia Eastern Europe 45 4647 Montevideo Uruguay South America - -48 Alexandria Egypt Middle East and Africa - -49 Ljubljana Slovenia Eastern Europe 47 <strong>50</strong><strong>50</strong> Kyiv Ukraine Eastern Europe 46 49Source: <strong>Global</strong> Services and <strong>Tholons</strong>10 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

AdvertorialInterview of Country RepresentativeWe need to continue to invest in humancapital development programsHow is the Philippines economy growingpresently, and what are the projections forthe immediate future?The Philippine economy is faring better thanmost in the ongoing global financial crisis.Remittances from overseas Filipino workerscontribute to this resiliency.The continuedgrowth of the IT-BPO industry also helpssustain economic activity and makes up forzero growth in other major export sectors,such as semiconductors and electronics. Astrong and prudent banking sector, followingreforms after the Asian financial crisis of thelate 1990s, with minimal exposure to failedglobal financial institutions also kept thebusiness environment stable in the face ofglobal uncertainty.The World Bank has projected a GDP growthof 1.9 percent in 2009 and 2.8 percent in 2010.Business Monitor International projections forPhilippine GDP are 1.5 percent for 2009 and2.6 percent for 2010.Do you observe scaling up of BPOoperations in the country?There are over 600 IT-BPO companies in thePhilippines. Some of the notable new entrants(within the last year) are Startek, Stream(recently merged with eTelecare), andCognizant. Surveys show that mostcompanies expect to expand within the yearby about 10-15 percent. Some smallercompanies are planning growth of up to 200percent within the year. Among the largecompanies that have announced expansionplans are Convergys,TeleTech,Teleperformance, Sitel, and StarTek.In what areas is the country improving theexisting infrastructure?Real estate developers have either completedor are building world-class BPO structures,providing adequate office space in majorlocations. Telecommunications companiescontinue to upgrade and expand theirnetworks to ensure reliability, redundancy,and to provide more location options tooperators.The government (national andlocal) continues to upgrade and expandtransport infrastructure.People are a key asset in this industry.What measures are the industry and thegovernment taking to ensure quality oftalent?The industry and government work togetherto spread awareness of the benefits of acareer in the IT-BPO sector.The governmentprovides subsidies for short-term trainingwhich industry distributes and monitors.Minimum employment rates after trainingby training companies or industry playersare tracked and only those who maintainhiring rates of 60 percent or more are givenadditional subsidies.This $8.4 millionprogram has resulted in 43,000 traineesbeing hired in the industry in 2008 and 2009.What about talent building at theuniversity level?Industry works with universities and collegesto incorporate short-term training programsin the curriculum.This program, called theAdvanced pre-Employment TrainingProgram, makes tertiary graduatesimmediately employable on graduation.From a pilot program involving five schoolslast year, the program is scaling up to reach<strong>50</strong> tertiary institutions by next year. Industryis also working with top-tier universities topromote post-graduate courses in BPOmanagement to address the demand formid-level managers.Industry and government are also workingto roll out a national competencyassessment test that prospective employeesOscar Sanez ~CEO, BPAPcan take to gauge their readiness to applyfor a job in the industry.This test is aimed atstreamlining the recruitment process.What measures do you think the sectorneeds to adopt to stay competitive inthe global market today?We need to continue to invest in humancapital development programs andincrease investment in campaigns toaddress negative perceptions of doingbusiness in the Philippines. We need tourge and support the telecommunicationsindustry in its efforts to upgrade andexpand its networks.We need to educatelegislators and other government officialson regulatory requirements for theindustry to remain globally competitive.Weneed to advocate for reforms that wouldstrengthen the business environment forthe industry and reduce risks for operatorsand investors.<strong>Global</strong> Services / www.globalservicesmedia.com

The Republic of the Philippines, anarchipelago of over 7,000 islands, is areservoir of natural resources.AdvertorialThe Philippines FactfileThe fertile lands and rainforests have been a source of revenue for the Philippines.In the 1980s, the country realized that away from the verdant countryside, therelies another big resource - the city-based large pool of English-educated people.With this talent base, the IT-BPO sector was born in the ’80s.The Philippines has all the ingredients that go into making a country an outsourcing destination ofchoice.The demographic profile is the country’s main competitive advantage with a literacy rate of92.6 percent (The CIA World Factbook 2007). It is one of the highest among competing countriesin the IT-BPO space.The Social Weather Stations (SWS) , a highly credible research company,reported in 2008 that 60 percent of Filipino college graduates think in English, 72 percent speak inEnglish and 83 percent write in English. However, in terms of graduates of science and technologyinstitutes for IT-related work, the Philippines has some catching up to do with India and China.Theservice orientation, work ethics, and cultural adaptability in this multi-ethnic country have gone along way in building the outsourcing industry.Besides people, the Philippines offers investors an enabling business environment with world-classinfrastructure in terms of office space, telecom network, power, connectivity, and transportation.The cost competitiveness that the country offers global clients makes the Philippines a compellingoutsourcing destination. The Philippines is the most competitive in English-language customerservice; for non-voice services, the industry is currently seeing rapid growth.The back-office andKPO sector more than doubled in 2008, from US$ 400 million to US$ 830 million, and is continuingto expand especially in F&AO, HRO, and LPO. IT, animation, transcription, engineering, gamedevelopment, publishing, creative, and other niche services are attracting attention from bothestablished and new markets.at a glanceCurrency: Philippine PesoMain industries: Agriculture, food processing,textiles and garments, manufacturing of electronicsand automobile parts, mining, tourism, IT-BPO and fishingLiteracy rate: 92.6%Languages spoken: Filipino, English and eightmajor dialectsInternational airport: Metro ManilaGDP growth (World Bank): 1.9 % in 2009 and2.8 % in 2010Quick look at the IT-BPO sectorGrowth: One customer service contact centerin 1997 to 600+ companies in 2008Total number of employees: 400,000Countries that outsource business to the Philippines: NorthAmerica, Europe, Australia and New Zealand, Japan, the MiddleEast, Korea, and other countriesKey verticals: Healthcare, energy, telecommunications andentertainmentSome big players: TeleTech, Accenture, Convergys, SPi, Sitel,Stream/eTelecare, Sykes Asia, Aegis PeopleSupport,Teleperformance,TELUS, IBM Daksh, IBM Business Services, HSBC,Hinduja TMT, Infosys, Wipro, Deutsche Knowledge ServicesKey competitive advantages: Large pool of English-speakinggraduates, domain expertise, service orientation, work ethic,cultural adaptability and fit, infrastructure and connectivity, costcompetitiveness, and supportive environmentMain cities: Metro Manila, comprising 16 cities, plus over 30 citiesand towns outside Metro Manila.<strong>Emerging</strong> locations: Next Wave <strong>Cities</strong> outside Metro Manila<strong>Global</strong> Services / www.globalservicesmedia.com

AdvertorialOpportunities and Future Potentialsa bright futureThe foundation that was built in the ’80s has begun to offer rich dividends. The contribution of the IT-BPO sectorto the country’s GDP is growing. The knowledge industry is creating jobs for thousands of Filipinos and hasstimulated growth in many other sectors, leading to the overall development of the country. The buoyancy inthe Philippines IT-BPO sector is slated to continue in the years ahead.By end-2008, the IT-BPO export industry inthe Philippines had contributed US$ 6.061billion in revenues, which accounted for fourpercent of GDP.The number of peopleemployed in this sector was 372,000. Everydirect job in this sector has helped create anestimated 2-3 indirect jobs.There are over 600companies exporting services toorganizations around the world.The industryhas helped in the development of othersectors such as telecomm-unications, realestate, consumer services and retail, food,transportation, training and education,insurance, banking, and industry-supportsectors.In the short term, the Business ProcessingAssociation of the Philippines (BPAP) has settargets of 20 percent growth by end-2009,followed by 26 percent growth in 2010, and27 percent in 2011. Growth targets are both interms of revenue and employment, thoughrevenues will grow faster as the sector shiftsto higher-value services.The Philippines willsustain its position as a preferred offshorelocation for English-language services,particularly in customer service. Companieswill use this leading global position to expandinto non-voice, complex, and higher-valueoutsourced services. In the medium andlong-term, the Philippines will provide awhole range of IT-BPO services. In the next 5-10 years, non-voice services may overtakevoice services in terms of market share.So far, Metro Manila, which comprises 16cities, has been the hub of IT-BPO activitiesin the Philippines. Outside Metro Manila, thesector has significant presence in over 30cities and towns. The government, workingclosely with the private sector, is developingwhat it call the Next Wave <strong>Cities</strong> as ideallocations for IT-BPO companies outsideMetro Manila. Government and otherstakeholders are working on building thehuman resource and infrastructurecapabilities of these cities.The government has declared IT-BPO apriority industry and has brought inprograms and policies to boost investment,like income-tax holidays and formation ofeconomic zones.The government is helpingindustry build and sustain its keycompetitive advantages, whether it’s inexpanding the telecom network, subsidizingtraining to increase employability of theexisting talent, supporting the marketing ofthe IT-BPO sector, or running investorassistanceprograms.To channelize theefforts, the government has created theCommission of Information andCommunications Technology (CICT) as thelead agency to ensure government supportfor the IT-BPO sector.The future of the sector looks bright.Theindustry hopes to grow in all fields—voicecustomer service, IT, animation,transcription, engineering, and gamedevelopment. Back-office and KPO arelikely to lead in terms of growth rates andwill eventually become as large as thecurrent voice-BPO field—with the potentialto eventually surpass the voice sub-sector.Oscar R. SanezPresident and CEOBusiness Processing Association of the PhilippinesThe umbrella association of the IT-BPO industryin the PhilippinesContact: info@bpap.org<strong>Global</strong> Services / www.globalservicesmedia.com

<strong>Global</strong> Services / www.globalservicesmedia.comB&M <strong>Global</strong> Services Manila, Inc.AdvertorialClient TestimonialsBaker & McKenzie has been a pioneer in theuse of offshoring to reduce the overall cost ofservice delivery to clients and to maintainoperational efficiency. In 2000, the firmestablished the first law firm captive BPOcenter in the Philippines, <strong>Global</strong> ServicesManila (GSM), to initially provide documentmanagement and administrative support tothe firm’s 68 offices.Today, around <strong>50</strong>0 GSM employees are anintegral and growing part of our firm.Theteam provides a broad range of back officeand front line services, with many suchservices operating on a 24/7 basis.This is byfar the largest captive offshore service centerof any global law firm. Our GSM staff workfrom attractive offices in the heart of Manila’smain business district, and they are directlyconnected to the rest of our firm throughtechnology, firm culture and reporting lines.Not only are services delivered typicallyassociated with a BPO setting (IT support,finance support, document support), but thecenter is seen as an ideal location to sourcespecialized staff (law graduates, financialmanagers, and project managers) whobecome individual contributors to theworldwide organization.As a law firm, it is important that our servicecenter staff are Baker & McKenzieemployees, not independent contractorsand/or employees of third-party vendors.This was we are able to maintainconfidentiality and the highest standards ofquality control.The creation of the captive service center inManila has been highly successful becauseof the nature of the Manila labor market.Young and skilled employees are availablein abundance. Moreover, the level ofEnglish proficiency is extremely high.Weare able to source other language skills(currently five languages supported).University trained employees are eager tobuild a career with a professional servicesfirm that offers a global perspective andcareer opportunities. Invariably our localoffices are impressed with the dedicationand energy brought to the table by ourManila service center colleagues.Joeri J. TimpExecutive DirectorB&M <strong>Global</strong> Services Manila, Inc.StarTek, Inc.StarTek, Inc. is a New York Stock ExchangelistedBPO firm that selected the Philippinesas the first operations site in Asia. StarTekspecializes in high value customer caresolutions for the communications andtechnology sectors. Headquartered in Denver,Colorado (US), the company provides theseservices from 19 operational facilities.Wewere impressed with the level of governmentsupport for investors in the Philippines.StarTek completed the construction of a78,000 square-foot facility in Makati City inSeptember 2008.The delivery center has acapacity of 1,100 customer carerepresentatives.We selected the Philippinesfor the state-of-the-art delivery centerbecause of the country’s highly educatedtalent pool, world-class telecominfrastructure, and competitive labor rates.By opening a facility in the Philippines, weare able to provide our clients with theflexibility of a new quality delivery channelfor customer management solutions andback office support. Our Philippine facilityhas been highly successful and is held inhigh regard by our clients.Larry JonesPresident and CEOStarTek, Inc.Wipro BPO, PhilippinesThe Philippines has emerged as a topoutsourcing destination due largely to itsstrong higher education system.Theuniversities supply the industry with highquality human resource whose education is inline with industry needs, spoken English skillsand customer service orientation issignificantly better than other Asianoutsourcing hotspots. Additionally, thePhilippines has a cultural affinity to US clients.The strategic direction of government isanother key factor.The priority and focusaccorded to this industry nationally and theincentive package offered through thePhilippine Economic Zone Authority (PEZA)are significant investment magnets. Mostimportantly, the one-stop facilitation for allregulatory issues through the PEZA isextremely helpful for new entrants.The presence of internationally competitivereal estate, telecom and professionaleducation sectors has been another keycatalyst for the emergence of Philippines asan outsourcing hotspot.The well-structured,transparency and high standards ofprofessional ethics, not to mention, theefficiency and responsiveness, I encounterin my everyday dealings with all ourexternal stakeholders make doing businesshere truly a pleasure.Romit GuptaCountry HeadWipro BPO, Philippines

<strong>Tholons</strong> is a leading full-service Strategic Advisory firm for <strong>Global</strong> <strong>Outsourcing</strong>and Investments. Our advisors pioneered the offshore advisory space morethan a decade ago and continue to lead and evolve it. We offer the full rangeof service from developing globalization strategies, execution of outsourcingstrategies and monitoring and tracking of outsourcing outcomes in order tomeet client’s business objectives.As a leading provider of location analysis and strategic growth & expansionservices for outsourcing providers and buyers, we present for the third yearrunning - a detailed analysis of the world’s <strong>Top</strong> <strong>50</strong> <strong>Emerging</strong> <strong>Outsourcing</strong>Destinations.Buy Report @$699 (use source code TEC2009 to save $100)

Special ReportThe gateway to the global sourcing of IT and BPO services4IrelandIreland has established itself as one of the premier shared servicescenters in the world, delivering value for locators with itsexcellent infrastructure and various shared services expertise (andplatforms). The country has evolved from being a regional supportcenter to becoming a regional hub for shared service centers in thelast decade. Its proximity and affinity to the U.K. (its second-largestclient market) has helped the country establish as a nearshore centerfor many European customers.Business and Technology park, IrelandBrazil 5Brazil is the largest economy in South America and is fast mergingas a major player in the services globalization arena, duein part to its huge technical talent pool and nearshore advantage.Brazil has achieved excellence in Applications Management, InfrastructureManaged Services and security technologies developmentalong with multilingual BPO capabilities. The high concentration ofpost-graduates and PhDs also enhance the county’s attractivenessfor high-value services such as R&D and engineering services outsourcing.As the strongest member of the MERCOSUR, Brazil alsohas a dominant role in the macroeconomics of the region. GSIT and BPO park, BrazilNext 5 Offshore NationsHi-tech nation Canda1CanadaAn interesting characteristic of Canada’s outsourcing industryis evidenced in the fact that despite its relatively higher costscompared to other nearshore destinations south of the U.S., such asMexico and Costa Rica—Canada remains an attractive investmentsite for service providers. This is due to the wide array of outsourcedservices the country provides which includes low-end services incustomer support to high-value shared services centers. However,the country’s niche service continues to be of high-value servicesin FAO, engineering services as well as ITO-related processes in applicationsdevelopment and management, testing and R&D. Severalarea clusters in the country house outsourcing hubs such as Toronto,Halifax, Calgary, Montreal and Vancouver.Montreal, Quebec, Canadauu page 2018 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

The gateway to the global sourcing of IT and BPO servicesSpecial ReportOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 19

Special ReportThe gateway to the global sourcing of IT and BPO servicesTower, RussiaNestle Duilding, MexicoOffice Duilding, VietnamKWK Promes Poland2RussiaRussia continues on the path of becoming one of the leaders for hitechR&D outsourcing in the world. Russia’s deepening service deliveryexpertise and rich talent pool have made the country a researchfactory for top organizations like Intel, IBM, Motorola, Samsung andGoogle. Being a part of the Eastern European outsourcing region hasalso enabled Russia to collectively share the niche service characteristicfor the offshoring and outsourcing industry. The country, however,stands out in the region due to its capacity to fulfill large-scale, highvalueservices, though the processing of such services are coming atan increasingly higher cost (as compared to smaller Eastern Europeandelivery locations).Mexico 3With a business landscape centered on manufacturing and historicallycatering to the U.S. market, Mexico has slowly addedoutsourced services into its business portfolio. The country is consideredto be one of the Next 5 offshore destinations—an attribute owedto its favorable nearshore characteristics. Outsourced services in thecountry started with voice-based services catering to both English andSpanish speaking customers. This attribute—the provision of multilingualcapabilities—distinguishes it from Asian competitors such asIndia and the Philippines.4VietnamVietnam’s economic growth over the last several years has been invaluabletowards its emergence as a Next 5 Offshore Nation. Forinstance, net FDI inflow to Vietnam reached $6 billion in 2007, up from$2.3 in 2006. Further, even as the global economic crisis took full swingtowards the end of 2008, Vietnam’s GDP grew by a decent 6.2 percentby year-end, just down from 8 percent posted in 2007. The country’seconomic dynamism is also attributed to its rapidly maturing businessenvironment. Vietnam is perceived as one of the more vibrant destinationsfor engineering services outsourcing and software developmentservices in the Asian region.Poland 5Poland is emerging as a premiere nearshore shared services centerfor Western European and Scandinavian client markets. With itscapabilities in serving the full spectrum of services in both ITO andBPO spaces—Poland has emerged as arguably the strongest competitorin the region for a spot in the <strong>Top</strong> 5 Offshore Nations list. Whileother countries in the region struggle to develop and build a scalable/employable talent pool, Poland’s population of almost 40 million andworld-class education system—has successfully positioned its placeamong the top offshore nations. GS20 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

Special ReportThe gateway to the global sourcing of IT and BPO services<strong>Top</strong> 8 <strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong>Despite the tremendously changed global economic dynamics, the <strong>Top</strong> 8 <strong>Global</strong> <strong>Outsourcing</strong><strong>Cities</strong> list notices no change this year. It continues to be dominated by Indian outsourcinglocations, with only two non-Indian locations (Dublin and Manila)Rank 2009 City Country Region Rank 2007 Rank 20081 Bangalore India South Asia <strong>Top</strong> 5 <strong>Top</strong> 82 Delhi NCR India South Asia <strong>Top</strong> 5 <strong>Top</strong> 83 Mumbai India South Asia <strong>Top</strong> 5 <strong>Top</strong> 84 Manila NCR The Philippines Southeast Asia <strong>Top</strong> 5 <strong>Top</strong> 85 Dublin Ireland Western Europe <strong>Top</strong> 5 <strong>Top</strong> 86 Chennai India South Asia 1* <strong>Top</strong> 87 Hyderabad India South Asia 2* <strong>Top</strong> 88 Pune India South Asia 3* <strong>Top</strong> 8Source: <strong>Global</strong> Services and <strong>Tholons</strong>Ranked among 2008 top <strong>50</strong> emerging global outsourcing cities22 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

The gateway to the global sourcing of IT and BPO servicesSpecial ReportOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 23

Special ReportThe gateway to the global sourcing of IT and BPO servicesQ&AMukesh Aghi, Chairman and CEO, Steria (India)“Awesomecosmopolitan city”How do you perceive Bangalore as anoutsourcing destination?Even when outsourcing hadn’t taken offin India, Bangalore was known for itsexcellence in education and infrastructure.Moreover, the city has an added advantageof defense support. The presence ofinstitutions like IIS (Indian Institute ofScience) and DRDO ( Defence Research andDevelopment Organization) adds value tothe talent pool in the city.What are the other factors that signifythe city as a “talent and IT hub”?The cosmopolitan culture in Bangalore isincredible. It’s an awesome cosmopolitancity. The youth is attracted to the citybecause of its lively pub culture andamazing weather, any time of the year. Ibelieve that the people in the city are moreadaptable as compared to big cities likeDelhi. It would be unfair not to mention thesafety of women in Bangalore. The femaleworkforce is more than willing to do nightshifts in a city like Bangalore because of thelow crime rate. Thus, highly efficient laboris easily available and enthusiastic to work.However, the city needs to keep pacewith the increasing crowd by handling itsinfrastructure carefully. Otherwise, it isanticipated that there will be a trend toinvest in smaller Indian cities instead. GS— By Diksha DuttaBangalore, IndiaBangalore needs no introduction in the global outsourcing community. Thecity continues to be in the top slot of the <strong>Top</strong> 8 <strong>Global</strong> <strong>Outsourcing</strong> <strong>Cities</strong>list for the fourth consecutive year. Despite changed economic and outsourcingdynamics, the city continues to be as charming as ever.Amidst the after effects of Satyam scam, low and stagnant pay packages ofIT professionals, and the not-so-improving infrastructure problem, Bangalorestill survives as the Silicon Valley of India. Big three service providers—Infosys,TCS and Wipro—in the city continue to attract major chunk of global buyers.The city came into focus way back in 1991 as an IT hub with the support ofSoftware Technology Parks of India and soon developed its BPO capabilitiesas well. Bangalore has grown from low-end ITO and BPO such as coding anddata-entry processes to now doing high-end ITO and BPO such as embeddedsystems and voice-based technical support respectively.Many global firms have also set up their outsourcing capabilities in the city.For example, Simbiosys Bio, the U.S.-based biotechnology firm, opened a centerin Bangalore in 2006. HP’s subsidiary <strong>Global</strong> E-business Operations in thecity provides finance accounting solutions with a focus on HR, supply chainand business analytics. Blue Vector is a radio frequency identification technologymanagement appliances provider with an engineering and design centerin Bangalore. Visionet has a mortgage-processing center in the city catering totop banks in the U.S.However, the attrition rate in the city is a concern. The ball park numberfor ITO companies in Bangalore is around 15 to 30 percent. BPO has a higherrange due to the large spectrum of services, around 40 to 80 percent.The city is the technical hub for semiconductors due to the presence ofa large number of semiconductor companies, design and engineering firms,research facilities, and such. It now has the headquarters for one of the leadingsemiconductor consortiums – Indian Semiconductor Association. Theprominent <strong>Global</strong> semiconductor companies in Bangalore are Intel, Samsung,Toshiba, Texas Instruments and ST Microelectronics.Magma,SpringSoft, Icon Design, D’gipro and CMR are the main EDA vendors.In addition, firms like Wipro, TCS, Patni, Larsen & Tubro eEngineeringSolutions, Infosys, Infotech, Quest, Mahindra Satyam, ABB, HCL, GeometricSoftware, NeilSoft, IBM, Cadence Design Systems, to name a few have competenciesin design automation / CAD and other engineering services.Bangalore could undoubtedly claim tohave the highest number of captives acrossThe city came intofocus in 1991 asan IT hub with thesupport of SoftwareTechnology Parksof India and soondeveloped its BPOcapabilities as wellthe globe. Intel, Microsoft, Oracle, SAP, Cisco,Google, Yahoo, HP, Motorola, Siemens, Samsungare among the ITO sector. BPO / KPOwould cover Citi, Reuters, HSBC, GoldmanSachs, Dell and JP Morgan.There have been noticeable changes in theattitude of service providers after the economicdownturn shaking. Their emphasis has shiftedfrom FTE-based (Full-time Employees) pricingto output-based pricing, which gives clientsmore worth for the work they outsource. Mostrecently, Mahindra decided to pay the savingsfor the entire project upfront to retain theirlargest and most critical client BT.GS24 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

Delhi (NCR), IndiaThe gateway to the global sourcing of IT and BPO servicesTill the time outsourcers’ destination search remains at the country level,undoubtedly India is their top of mind choice. And when their searchgets deeper and reaches to the next level, which is finding best locationwithin India, Delhi (NCR) emerges as their second choice after Bangalore.These two Indian cities have different outsourcing advantages to offer.If Bangalore’s strength lies in high-tech talent pool due to abundance ofeducational institutions in the city, Delhi is far better in terms of its BPOcapabilities, especially contact centers. Delhi (NCR), the national capitalregion, which is formed of three cities Delhi, Noida and Gurgaon, offer aconducive eco-system for business analytics, finance and accounting, softwaredevelopment, product development, engineering services and contactcenter services in English.According the Nasscom (National Association of Software and ServicesCompanies) figures, software and services exports contributed $40 billionto Indian revenues in 2008. Of which Delhi NCR contribution stood from17 to 18 percent.The major advantage of Delhi is its fast growing educational setups,which attract graduates from all over the country giving access to 400,000technical graduates in India.The city’s entry-level labor cost is $320 in the IT sector and $22 to $240in the BPO sector. It is home to prominent firms like IBM, Microsoft, Intel,Oracle, Accenture, HP, Amdocs, Capgemini, SAP, Siemens, Motorola, Delland Indian players such as Infosys, TCS, Wipro.However, the city faces problems of political disturbances from time totime, although it has a stable state government. The law and order and securityfor women are its major concerns. Like any other Indian city, realestate in the capital city became very expensive. BPOs faced high attritionrates due to recession. Hiring was frozen for a long time but the situationhas improved drastically during the last couple of months. The city is stilltackling with huge traffic jams, which creates a lot of chaos.Harsh Singh Lohit, Chairman, National Association of Software and ServicesCompanies (Nasscom) Regional Council NCR and MD, Headstrongadds, “Nasscom has taken up five initiatives in Noida for which we are goingto the government of UP to ask fortheir help to develop strong infrastructureas we are the significant contributorto the economy. Noida’s positioning isso powerful that its design and embeddedservices are after Bangalore in India.Product development and BPO are itsother strong areas.”The city has a large contact-centerindustry, which is in competition withthe Philippines. Nasscom is confidentthat the city has a lot of potential to growand become the best outsourcing destinationin India due to massive amountof investment going into the developmentof infrastructure. With metro joiningNCR region by the end of next yearwould be a boon to the city. GSThe major advantageof Delhi is its fastgrowing educationalsetups, which attractgraduates from allover the countrygiving access to400,000 technicalgraduates in IndiaSpecial ReportHarsh Singh Lohit, Chairman, Nasscom RegionalCouncil NCR and MD, Headstrong“An attractivedestination”Q&AHow did Delhi NCR develop over time?There was a time when all IT was in Delhi,and there was nothing in Noida andGurgaon but over a decade, it emergedas an attractive destination. At present,it has got a lot of strength.What has been the impact of recessionon the city’s business environment?The impact of recession was largelypositive. There were excess ofexpectations, compensations, demandfor real estate due to recession,which resulted in dropping the priceof real estate dramatically. Now, thecommercial and residential propertycould be purchased easily.The entire business industry has gone fora massive rationalization of its businessmodels and its business costs. It doesnot mean cutting electricity, salaries,expenses but it means rethinking theentire business model that how doesthe IT Industry make money under theadverse circumstances where businessis less, the customers are payingless. All these factors have forced thetechnology industry to become efficient.Bubbles have gone away. We are goingto optimize our cost. GS— By Pratibha VermaOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 25

Special ReportThe gateway to the global sourcing of IT and BPO servicesQ&ANeeraj Bhargava, CEO, WNS“Quality of talent isexcellent”What challenges did your company facein the past five years.We have witnessed a biggest problem ofpower and transportation, which needs tobe addressed by the government. Over thepast five years, the real estate cost havesoftened which came as a respite.What are the reasons to set up a centerin Mumbai? And how do you utilizethe destination to improve on youroutsourcing capabilities?Mumbai has good infrastructure and highqualitytalent pool. This makes Mumbaian attractive destination for providingBPO services, and it is because of theseadvantages, we opened our headquarterin Mumbai.Our organization currently has over 23,000full-time employees, delivering servicesfrom 22 global delivery centers spreadacross 3 continents. A large portion of theworkforce operates from India. Employeesare predominantly between the age groupof 25 to 35 years.The quality of talent is excellent acrossthe board for BPO services, which helpsus cater for over 200 customers includingBritish Airways, Travelocity, Aviva, BritishGas, T-Mobile. GS— By Pratibha VermaMumbai, IndiaMumbai, the financial capital of India, is not only home to Bombay StockExchange, which is the oldest stock exchange in Asia, but also is the centerof excellence for its outsourcing capabilities in financial services, ApplicationDevelopment and Management (ADM) and health-care services.India’s largest city Mumbai generates 5 percent of the country’s total GDP.The emerging services areas in Mumbai are engineering services, media andentertainment outsourcing, animation and game development.The city’s GDP is $41.3 billion, and its per capita income is $1,010, which isalmost three times the national average.The city exhibits an established position in the global outsourcing spaceowing to various factors like infrastructure, a large talent pool of around60,000 in BPO sector and developed policies. It had traditionally owed itsprosperity largely to its textile mills and its seaport till the 1980s, which werereplaced by industries employing more skilled labor such as engineering,health care and IT.India’s IT-services industry was born in Mumbai in 1967 with the creationof TCS. The first software export zone SEEPZ was set up here way back in 1973,the old avatar of the modern day IT park. There was a time when more than 80percent of the country’s software exports happened out of SEEPZ.There are around 30 registered units of electronic and hardware firmsand around 74 registered units of electronics and software firms in SEEPZat present. SEEPZ is relatively a safer area in Mumbai because there isn’t toomuch of new business or growth that is happening currently. Other parts ofMumbai are witnessing bigger growth and, hence, are more riskier.Mumbai is the preferred choice of outsourcing buyers for financial servicesBPO sector, contract research, which is in the growing mode and legal serviceswhich has a major center in the city. It is easy to find quality resourcesin Mumbai but costlier than other cities. ADM is the core strength of this cityand the new model, which is growing here is marketing and financial analytics.Some niche skills which are prominent here are engineering services andresearch and development.The city exhibitsan establishedposition in theglobal outsourcingspace owing tovarious factors likeinfrastructure, alarge talent poolof around 60,000in BPO sector anddeveloped policies<strong>Top</strong> services providers like TCS, IBM, Infosys,Wipro, HCL, Mahindra Satyam, Accenture,CSC, ACS, Caliber Point, Firstsource, Convergys,Genpact, WNS <strong>Global</strong> Services, Minacs, Cognizantand EDS are present here.Estimated exports from Mumbai in softwareservices (including IT and IT-enabledservices) in 2008 were $3.0 billion to 3.6 billion.However, if Mumbai continues to growat 63 percent (as last year), it is expected totouch $ 4.1 billion.Being home to many financial institutions,the city faced a considerable impact of recession.<strong>Tholons</strong> Analyst Saugata Sen Gupta says,“The captive centers in Mumbai suffered badlydue to economic slowdown. The job marketbecame sluggish. A lot of engineers faced salarydeductions, and layoffs. The market has notyet recovered. We see some hopes in the end offirst quarter of 2010.”GS26 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

The gateway to the global sourcing of IT and BPO servicesManila NCR, The PhilippinesManila is the central business district of the Philippines and contributes 65percent to the country’s economic growth. According to Business ProcessingAssociation of the Philippines (BPA/P), the country’s export revenue is$6 billion, which is growing at an annual rate of 36 percent.The Philippines’ recognition as an attractive outsourcing destination cameto pass largely because of the development of the Manila NCR outsourcing sectorover a period of time. Factors that drive outsourcing in the city are availabilityof English-speaking talent with strong cultural affinity to North America.Manila’s 270 higher education institutions churn out about 90,000 graduatesevery year. Of which 23 percent (about 22,000) are technical graduates while77 percent (about 75,000) are non-technical graduates. This is why, Manila’sstrength lies in contact-center outsourcing services, distantly followed by smallerniche back-office processes, FAO, software development and engineering design,transcription services and animation and graphics design.Although its non-voice BPO segment is relatively smaller compared to thevoice-based BPO segment, its employee base has posted a YoY growth rate of 41percent from 2004 to 2007.The prominent firms that have their outsourcing centers in the city are HSBC,Citi, Convergys, JP Morgan, Accenture, PeopleSupport, IBM, Fujitsu, Sykes, Dell,Teletech, Teleperformance, Unisys and Trend Micro.The city’s sound infrastructure and robust telecommunications make it acompetitive destination. The city attracts service providers to open up their outsourcingcenters there. As there are too many BPOs located in the region, it is becomingcongested. Almost 70 percent of the total number of BPO employees inthe country work in Manila; and therefore, it’s started getting saturated. That iswhy the government is promoting the next-wave cities for companies to exploreother tier-2 or tier-3 destinations outside the capital. This will not only generatejobs in that particular area, but it will boost the local economy of the certain areaas well, according to industry experts.Its labor has an entry-level salary cost of $320 to $340 in the ITO sector and$240 to $260 in the BPO segment. The city is in competition with Cebu City,Delhi NCR, Bangalore, Pune and nearshore destinations including Mexico,Costa Rica, Brazil, the U.K., Poland andCzech Republic (which also have multilingualcapabilities).Manila NCR is now witnessing rising attritionrates due to availability of large numberof MNCs, which are at risk of repeatingthese costs simply to retain employeebases. It is also tackling with the problemof diminishing supply of high-quality laborpool. The high rates of attrition mentionedmay also be reflective of the thinning supplyof quality labor in the city as competitionto ‘get the best’ becomes tighter.However, inability to move toward moremature services from contact-centers andback office is a real concern. BPA/P and thegovernment have taken a number of initiativesoff late to improve the skill level of theIT and other technical workforce. GSManila’s 270higher educationinstitutions churn outabout 90,000 gradsevery year. Of which23% (about 22,000)are technical gradswhile 77% (about75,000) are nontechnicalgradsSpecial ReportJonathan Defensor De Luzuriaga, Executive Director,Industry Affairs, BPA/P“22–23% growth inManila outsourcingservices by 2010”Q&AWhere do you see Manila in 2010?We see 22 to 23 percent growth inManila’s outsourcing services by 2010.There has been a demand of 100,000new employees YoY. We believe thataround 120,000 graduates would be inbusiness and accountacy field, whichgives us a message that outside voice,customer service, techincal supportrequirement, Manila could also serviceBFSI sector. There are lots of captiveoperators operating in Metro Manilagiving the global F&A requirement.Numerous incentives are in place nowto encourage outsourcing.What has been the impact of recessionon the city’s outsourcing sector andthe cities operating into it?The Philipiones has been exempted fromthe global economic crisis because wewere at the better bargaining end. ThePhilippines has been the beneficiary ofthe mergers and the acquisitions whichhappned due to economic crisis. We havenever seen any decrease in terms ofthe demand of manpower as well as theoperations stepping down. GS— By Pratibha VermaOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 27

Special ReportThe gateway to the global sourcing of IT and BPO servicesQ&APaul Pierotti, Management Consultant,PA Consulting, Dublin“Wages in the privatesector are reducingdramatically”Don’t you think that high labor cost is abane to this destination?The current recession is hitting Irelandhard and with it there labor costs in theprivate sector are reducing dramatically.Public sector salaries remain high andaddressing this is likely to be a priority inthe coming government budget.What has been the impact of recession?Where do you see Dublin in 2010?It is hard to overstate the impact thisrecession is having on Ireland. For example,unemployment has increased from nearzero to some of the highest in Europe andthe banking system has only survived dueto massive government bail outs—Ireland’sbad bank is covering a staggering—90billion euro worth of assets2010 is likely to be a challenging yearfor Ireland as the economy continues toperform badly. Further, there is likely to besignificant industrial unrest in the publicsector as the government seeks to cutspending and address the large deficit.However, the fundamentals of the Irisheconomy remain good and many analystsexpect to see some form of recovery bythe end of 2010. GS— By Pratibha VermaDublin, IrelandDublin, the capital of Ireland, is considered as an excellent nearshore outsourcingdestination for Western Europe. Its capabilities lie in high-endshared services. The city attracts the major portion of FDIs from other WesternEuropean countries.According to estimates, <strong>50</strong> percent of Ireland’s revenues come from Dublinwherein country’s revenue for the year 2008 was $3.5 billion. Around 47,000students graduate every year from the city’s three top universities as it is theprimary center of education in Ireland.Today, the city is ranked 10th (up from 13th in 2008) in the <strong>Global</strong> FinancialCenters Index and has one of the fastest growing populations of any Europeancapital city. Being the center of Ireland’s economic growth, the city offers ahigh standard of living with high cost.In 2008, Dublin was listed as the fifth-richest city in the world and is nowthe world’s 16th most expensive city (8th most expensive city in Europe,excluding Russian cities),according to Wikipedia. It was also listed as thethird most expensive city in the world. However, it has the second highestwages in the world, ahead of both New York City and London, thoughbehind Zurich.The city’s outsourcing capabilities lie in English contact support, IT-infrastructuremanagement services, business analytics, multi-lingual contact support,F&A, product development, research & development, health care and legalprocessing services. Prominent companies like Accenture, IBM, Microsoft,Fujitsu, HP, Dell, Intel, Capgemini, Oracle and Citi have their centers here.Western European countries prefer to nearshore their work to the cityheadquartered service providers as this place offers them an advantage ofsame time zone. The city also has the people who have same work culture,and offers sound infrastructure attracting investment from the companies inwestern and central Europe.The main reason which prevents offshoring is its high labor cost. The entrylevel salary cost in the city is $1,200 in ITO and $900 in BPO sectors.The major disadvantages of this destination are high cost and competitionalthough the productivity and quality are of high quality. Dublin is now facinga competition with other EE cities like Krakow,Around 47,000studentsgraduate everyyear from thecity’s threetop universitiesas it is theprimary centerof education inIreland.Warsaw, Prague and Budapest.Year 2009 to 2010 adversely affected the city’seconomy due to recession leading to many dealsterminations and delay in new deals. The entireeconomy in Ireland saw a downward trend in theyear 2009 to 2010 although it has started picking upbut the change is slow.The city’s scalability, which is talent pool, is limitedand not as large as other offshore nations. Dueto limited talent availability in the city, there is apossibility that industry would be saturated in thenear future. This aspect of the talent pool needs tobe improved exponentially to compete with otheroffshore nations like India/Philippines.With all the pros and cons, the city has a greatpotential to grow as an attractive and mature destinationdue to its high-value services and highclass talent pool. GS28 <strong>Global</strong>Services www. globalservicesmedia.com October 2009

Chennai, IndiaThe gateway to the global sourcing of IT and BPO servicesChennai is the star city of South India with competitive business environment,operating cost advantages, scalability, quality real estate, telecom connectivity,urban infrastructure, city governance and skilled professionals to deliver qualityoutput.The city is India’s second-largest exporter of software, IT and related servicesand contributes 39 percent of the Indian state of Tamil Nadu’s GDP. The major ITOproviders in the city are TCS, Infosys, Wipro, Cognizant, HCL, Mahindra Satyam,IBM, Accenture, Polaris, L&T InfoTech, PerotSystem and Vertusa.Reputed educational institutions such as IIT, Regional Engineering College,Anna University, Bharathiyar University in Chennai account for 51 percent ofthe total computer and engineering graduates in the country. Tamil Nadu has22 universities, 2<strong>50</strong> engineering colleges, 207 polytechnics and 526 IT institutes.The state churns out 75,000 engineering graduates per year including more than35,000 IT specialists. With 45,000 professional, the state also has the largest numberof IT professionals. This is primarily the reason behind the city’s young English-speakingtalent pool—which is an added advantage for the BPO industry.The BPO providers ruling the city are Office Tiger (now part of RR Donnelley),TCS, 24X7 Customer, HCL BPO, KPMG, Wipro BPO to name a few.The labor cost is significantly cheaper as compared to any U.S. cities. Themonthly salary of an entry-level techie in Chennai is $280 to $300 and for an entry-levelBPO executive is $200 to $220. In addition, the city is much more cost efficientthan any other Indian outsourcing city. It offers best infrastructure amongthe South India cities and has a low cost of living and rapidly developing infrastructure.Its closeness to the airport is a geographical advantage, which a clientmight consider while outsourcing its BPO projects.As any other outsourcing city, Chennai specializes in some specific outsourcingservices. It has an established center of excellence for product development,ADM, testing, engineering services, business analytics, and legal services. It is alsoan emerging destination for R&D.Companies such as Lason, Ajuba Solutions(India), Apollo Health Street, iHealthcare, ParamountHealthcare, and Hinduja TMT in the citysignify the opportunity for healthcare IT firms.The expansion of healthcare services providedwould include ADM services to maintain electronicmedical records, hospital-managementsystems, systems for capture of medical billingand coding, transcription related domain expertise,medical insurance and payment related expertise,and many more.The captives in the city are Citi, Caterpillar,CB Richards Ellis, Maersk, Deloitte, L&T Engg,Philips, Red Hat, Siemens, Texas Instruments.Chennai has grown significantly over the pastdecade along with the government initiativesthrough IT / IT-enabled services state policies(2008) incentives.However, the hot and humid climatic conditionsin the city are still a black mark to some extentwhich might influence a minor percentageof employees to leave the city.GSThe city has a lowcost of living andrapidly developinginfrastructure.Its closeness tothe airport isa geographicaladvantage, whicha client mightconsider whileoutsourcing itsBPO projectsQ&A“<strong>Top</strong> outsourcingdestination”Special ReportVardhman Jain, Managing Director, BusinessProcess Solutions, Perot System, India and ManilaDo you think that recession has adverselyaffected the city’s outsourcing industry?While there are clear concerns about theevolving global economic downturn, we areseeing evidence of strong interest in ourtraditional core services of ITO. Over thelast 21 years, we have weathered at leastfour major recessions. In each of thosedownturns, we experienced substantialgrowth. In part, the growth occurs becauseorganizations need to become more efficientand productive. Clearly, the services thatPerot Systems provides are part of thatequation. So, we anticipate growth duringthis downturn as well. It appears thatinvestment in healthcare and IT to supporthealthcare is a growing priority amongmany of the organizations across the globe.Among the various stimulus packages underconsideration by governments throughoutthe world, one of the constant themes ishealthcare and IT. We believe this puts us ina strong position for development through2009 and into the coming years.With growing demand in healthcareprovider, payer, and life insurance businessthat we are witnessing, we have added anew facility in DLF special economic zone,Chennai to accommodate growth through2009 and into the coming years. GS— By Diksha DuttaOctober 2009 www. globalservicesmedia.com <strong>Global</strong>Services 29