COVER SHEET PHILIPPINE SEVEN CORPORATION - 7-Eleven

COVER SHEET PHILIPPINE SEVEN CORPORATION - 7-Eleven

COVER SHEET PHILIPPINE SEVEN CORPORATION - 7-Eleven

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

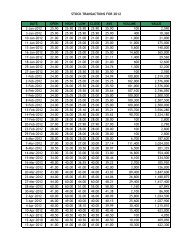

escalations.Service fees are higher by 24%, from P83.2 million in 2007 to P103.2 million. This is primarily due toSA conversions during 2007, which operated as SA store, full year in 2008.Interest ExpenseCost of debt servicing in 2008 totaled P25.3 million, lower by 20% than last year’s level of P31.5million. Loan pre-termination and lower interest rates are the factors for the decline. Outstanding loanbalance at the end of 2008 was pegged at P330 million, down from the P375 million a year ago.Net IncomeNet income for the year increased by 54% to P84.3 million primarily due to better sales, containedcosts and improved support from trade suppliersThe Company’s net income translated into a 1.6% return on sales and 11.2% return on equity. The keyratios in 2008 are improvements from the previous year. Moreover, EPS is pegged P0.32 and P0.21, in2008 and 2007, respectively.Financial ConditionTotal assets grew by P385.5 million or 20.5% to P2.26 billion at the end of 2008. Cash and cashequivalents increased to P314.9 million from P308.9 million at the beginning of 2008. Receivableswent up by P72.8 million as a result of the increase in suppliers’ support and collectibles from thefranchisees. Moreover, inventories went up by P15.6 million as a result of the increased number ofstores. Further, prepayments increased by P51.3 million arising from advance rental payments for newstores. This resulted into an aggregate increase in total current assets by P145.6 million.Total current liabilities rose by P308.3 million or 29% due mainly to the increase in trade payables andaccrued expenses. Current ratio stood at .67 to1 as of December against last year’s .72 to 1.Property and equipment, net of accumulated depreciation increased by P219.6 million because of theconstruction cost incurred and acquisition of new equipment deployed to newly opened stores.Stockholders’ equity at the end of 2008 comprises 33% of total assets, compared to 36% at thebeginning of the year. Debt to equity ratio stood at 2 to 1, compared to 1.8 to 1 a year ago.Liquidity and Capital ResourcesWe obtain the majority of our working capital from these sources:Cash flows generated from our retailing operations and franchising activitiesBorrowings under our revolving credit facilityWe believe that operating activities and available working capital sources will provide sufficientliquidity in 2009 to fund our operating costs, capital expenditures and debt service. The following arethe discussion of the sources and uses of cash for the year 2008.