COVER SHEET PHILIPPINE SEVEN CORPORATION - 7-Eleven

COVER SHEET PHILIPPINE SEVEN CORPORATION - 7-Eleven

COVER SHEET PHILIPPINE SEVEN CORPORATION - 7-Eleven

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

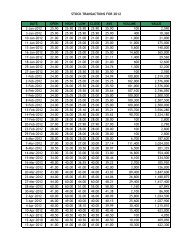

We obtain the majority of our working capital from these sources:Cash flows generated from our retailing operations and franchising activitiesBorrowings under our revolving credit facilityWe believe that operating activities and available working capital sources will provide sufficientliquidity in 2008 to fund our operating costs, capital expenditures and debt service. The following arethe discussion of the sources and uses of cash for the year 2007.Cash Flows from Operating ActivitiesNet cash generated by operating activities in 2007 reached P266 million, lower compared to the P358million generated in 2006. Although pre-tax income in 2007 is higher compared to a year ago, thedecline in net cash from operating activities was due to the increase in receivables and the payment ofaccounts payable, accrued expenses and current portion of long term debt.Cash Flows from Investing ActivitiesNet cash used in investing activities reached P243 million in 2006 compared to net cash out flow ofP218 million in 2007. Major cash outlay went to the procurement of store equipment, new storeconstructions and store renovations. Total acquisitions of property and equipment dropped this year byP23.7 million against 2006. Significant investment in 2006 went to the procurement of POS Machinesand the roll-out of batches of store renovations.Majority of the company’s commitments for capital expenditures for the year are for new storeconstructions and renovations. Funds for these expenditures are expected to come from the anticipatedincrease in cash flows from retail operations and from additional borrowings if the need for such mayarise.Cash Flows from Financing ActivitiesNet cash outflow from financing activities during the year was P68.4 million. The year ended withoutstanding bank loans of P375 million, an improvement from P411.2 million at the beginning of theyear. The Company was able to pre-pay some of its loan as a result of improved profitability in 2007.DISCUSSION OF THE COMPANY’S KEY PERFORMANCE INDICATORSSystem Wide SalesSystem-wide sales represents the overall retail sales to customers of corporate and franchise-operatedstores.Sales per Store DayAverage daily sales of mature and new stores computed periodically and determine growth of all stores.Gross Margin