Directors - Caribbean Cement Company Limited

Directors - Caribbean Cement Company Limited

Directors - Caribbean Cement Company Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

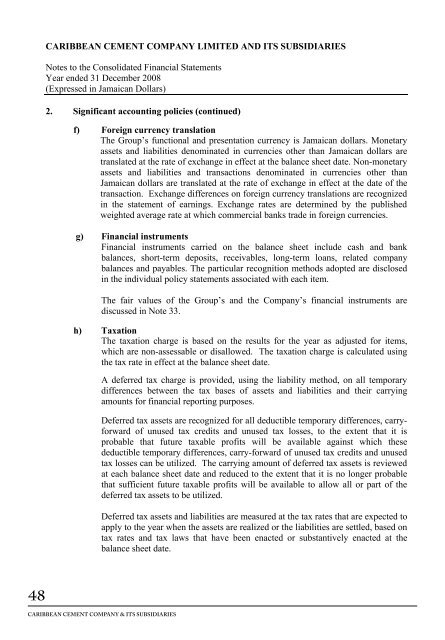

CARIBBEAN CEMENT COMPANY LIMITED AND ITS SUBSIDIARIESNotes to the Consolidated Financial StatementsYear ended 31 December 2008(Expressed in Jamaican Dollars)2. Significant accounting policies (continued)f) Foreign currency translationThe Group’s functional and presentation currency is Jamaican dollars. Monetaryassets and liabilities denominated in currencies other than Jamaican dollars aretranslated at the rate of exchange in effect at the balance sheet date. Non-monetaryassets and liabilities and transactions denominated in currencies other thanJamaican dollars are translated at the rate of exchange in effect at the date of thetransaction. Exchange differences on foreign currency translations are recognizedin the statement of earnings. Exchange rates are determined by the publishedweighted average rate at which commercial banks trade in foreign currencies.g) Financial instrumentsFinancial instruments carried on the balance sheet include cash and bankbalances, short-term deposits, receivables, long-term loans, related companybalances and payables. The particular recognition methods adopted are disclosedin the individual policy statements associated with each item.The fair values of the Group’s and the <strong>Company</strong>’s financial instruments arediscussed in Note 33.h) TaxationThe taxation charge is based on the results for the year as adjusted for items,which are non-assessable or disallowed. The taxation charge is calculated usingthe tax rate in effect at the balance sheet date.A deferred tax charge is provided, using the liability method, on all temporarydifferences between the tax bases of assets and liabilities and their carryingamounts for financial reporting purposes.Deferred tax assets are recognized for all deductible temporary differences, carryforwardof unused tax credits and unused tax losses, to the extent that it isprobable that future taxable profits will be available against which thesedeductible temporary differences, carry-forward of unused tax credits and unusedtax losses can be utilized. The carrying amount of deferred tax assets is reviewedat each balance sheet date and reduced to the extent that it is no longer probablethat sufficient future taxable profits will be available to allow all or part of thedeferred tax assets to be utilized.Deferred tax assets and liabilities are measured at the tax rates that are expected toapply to the year when the assets are realized or the liabilities are settled, based ontax rates and tax laws that have been enacted or substantively enacted at thebalance sheet date.4820CARIBBEAN CEMENT COMPANY & ITS SUBSIDIARIES