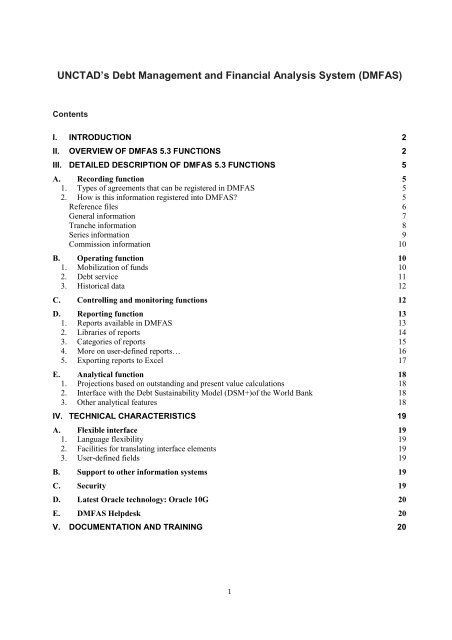

UNCTAD's Debt Management and Financial Analysis System (DMFAS

UNCTAD's Debt Management and Financial Analysis System (DMFAS

UNCTAD's Debt Management and Financial Analysis System (DMFAS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DMFAS</strong> main menu follows the typical operational life cycle of a debt instrument.Loan negotiation,Signature of loancontractLOAN LIFE CYCLEREPORTINGANALYSISContract information<strong>and</strong>loan termsReal drawingsPayment ofprincipal <strong>and</strong>interestReporting on thecountry's debt<strong>Debt</strong> Strategy<strong>DMFAS</strong> MAIN MENUAdministrationMobilizeServiceReport<strong>Analysis</strong>The debt <strong>and</strong> other instruments details are registered in the Administration section <strong>and</strong>,based on the contract information, amortization tables are calculated <strong>and</strong> initial drawingestimates made.The Administration section also contains a Reference files menu where the user entersinformation on daily exchange rates, variable interest rates, commercial interest referencerates, budget line identification numbers, etc. as well as creditors/debtors <strong>and</strong> otherparticipants to the agreements.As disbursements or subscriptions take place, these will be registered into the Mobilizesection of <strong>DMFAS</strong>. This section may also, upon the user’s request, be programmed to printdrawing requests automatically. Thereafter, all transactions related to the servicing of debtinstruments, including operations on arrears, penalty interest, rescheduling, swaps, etc., arerecorded in the Service section. The service section contains links to budget lines. Theautomatic registry of operations function enables the user to create blocks of payments,arrears, rescheduled arrears or write-offs for a given subset of debt instruments.To ensure consistency among data for a particular debt instrument, <strong>DMFAS</strong> executes anumber of automatic controls. Users can also produce different validation reports to checkthe data, using the user-defined report facilities in the Report section of <strong>DMFAS</strong>. <strong>Debt</strong>managers can also produce a large number of reports for monitoring purposes, using<strong>DMFAS</strong> Report facilities.3

After data validation, the database should contain reliable information that debt officers canuse for their reporting needs. <strong>DMFAS</strong> Report section meets both the internal <strong>and</strong> externalreporting needs of debt officers. For example, <strong>DMFAS</strong> supports the production of Forms 1<strong>and</strong> 2 of the <strong>Debt</strong>or Reporting <strong>System</strong> (DRS) that the World Bank requires from itsborrowing countries. <strong>DMFAS</strong> is also capable of generating a wide range of st<strong>and</strong>ard <strong>and</strong>customized reports, <strong>and</strong> data can be transferred easily to Excel <strong>and</strong> in HTML format.Once the database has been loaded with information from loan, bond <strong>and</strong> grant contracts,<strong>DMFAS</strong> becomes a very powerful tool. As the software processes huge amounts ofinformation on a debt, more time <strong>and</strong> energy can be deployed on analytical tasks. The<strong>Analysis</strong> section enable debt managers to calculate projections based on outst<strong>and</strong>ing <strong>and</strong> ontotal commitment as well as present values of future debt service obligations. They canquickly analyze the impact on the country’s overall future debt burden resulting fromhypothetical changes in financial markets. <strong>DMFAS</strong> makes debt service calculations showinghow the total of debt service obligations would be affected by taking on a proposed loan, <strong>and</strong>projects the impact of borrowing decisions of various entities on a country’s global debtprofile. The <strong>DMFAS</strong> installation package also includes the World Bank’s <strong>Debt</strong>Sustainability Model (DSM+) which lets debt managers perform further sophisticatedmacro-economic <strong>and</strong> balance-of-payment analysis.4

III. Detailed description of <strong>DMFAS</strong> 5.3 FunctionsA. Recording function1. Types of agreements that can be registered in <strong>DMFAS</strong><strong>DMFAS</strong> 5.3 has facilities to register the following types of agreements:Loans. The software can record all loan-typecontracts, including revolving credits <strong>and</strong> syndicatedloans. It also facilitates the registration ofloans with common characteristics granted tolocal governments or other subnational entities.<strong>DMFAS</strong> can store quantitative information (suchas financial terms) <strong>and</strong> qualitative information(such as notes for specific comments ormemor<strong>and</strong>um items, like the type of legal clausesin the contract).Bonds. The term “bond” is used by <strong>DMFAS</strong> inits generic sense to cover government “papers”, promissory notes, treasury bills, notes, bonds, – eurobondsthat is, short-, medium- <strong>and</strong> long-term obligations. The bonds module is designed to h<strong>and</strong>le typical bondconcepts such as yields, discounts, average price, capitalized interest, as well as bi-monthly <strong>and</strong> weeklypayments.Grants. The module for registration of grants contains the same facilities as the loans module, except forrepayment conditions.Projects. This facility permit easy identification of individual projects <strong>and</strong> their relationship to debtinstruments <strong>and</strong> grants financing them, as well as the individual disbursements related to them.On-lent loans. The software can record on-lent loans <strong>and</strong> their relationship with the original loan.General agreements. The facility permits the user to register frame agreements which are linked to severalindividual credits (<strong>and</strong>/or grants) <strong>and</strong> to link these agreements to the individual loans or grants arising fromthem.Reorganization agreements. <strong>DMFAS</strong> can link bilateral loans with the relevant “Agreed Minutes” <strong>and</strong> isdesigned to provide supporting data for reorganization negotiations (particularly for Paris Clubnegotiations), to facilitate recording of the reorganized terms received, <strong>and</strong> to facilitate identification <strong>and</strong>reporting of reorganized transactions.2. How is this information registered into <strong>DMFAS</strong>?<strong>DMFAS</strong> captures financial terms of individual credits as specified in each loan or bond contract. Thecharacteristics to be entered include, among others, principal terms, interest terms <strong>and</strong> commission terms.On the basis of this information, the system automatically calculates estimated disbursements <strong>and</strong>amortization tables.Loan (or bond) information is entered on three levels, General information, Tranches (or Series forbonds) <strong>and</strong> Commissions, in the Administration section. Each loan/bond has one general information5

section <strong>and</strong> at least one tranche/series section. Nevertheless, before registering any agreement, basicinformation needs first to be entered in <strong>DMFAS</strong> reference files.The Loans moduleGeneral InformationTranchesCommissionsEstimated Drawings Principal Terms Interest TermsAmortization TableThe Bonds moduleGeneral InformationSeriesCommissionsEstimatedSubscriptionsPrincipal TermsInterest TermsAmortization TableReference filesReference files contain detailed information which can berefer to from many <strong>DMFAS</strong> modules. They include bothessential <strong>and</strong> optional data about:• The Participants (debtors, creditors, etc.) in thedifferent agreements. The system requires theavailability of a set of information on each one of theparticipants (for example, institution type, country ofresidence, contact data, etc.).• Participants’ Bank accounts, which can be useful whenpreparing banking transactions.• Daily Exchange rates. These rates are used by <strong>DMFAS</strong> in calculations such as real drawings <strong>and</strong> debtservice operations. Scripts are available for downloading the official exchange rates published in anumber of websites on a daily basis.• Common interest rates, which are floating interest rates that <strong>DMFAS</strong> uses for interest calculations inother modules. They can also be used for projection purposes.• Commercial interest reference rates (CIRRs), used for present value calculations. CIRRs arepublished by the OECD.• Euro National Currency Units exchange rates, so that <strong>DMFAS</strong> can convert operations from nationalcurrency units to euros.• Historical Exchange Rates, for Asian Development Fund loans.• Interest rate groups <strong>and</strong> Maturity groups. The user to customize the range of these loan attributes forselection <strong>and</strong> sorting needs.6

• Funds related to revolving credit <strong>and</strong> local government debt.• Budget lines, which are useful in the disbursement <strong>and</strong> debt-servicing processes, as required. In otherwords, budget lines refer to the budget account numbers that are used to service the different debtinstruments.General informationFor any loan agreement, it is necessary to fill in the GeneralInformation window where all the basic information about theagreement, such as different references, the signature date <strong>and</strong> theavailability date, is recorded. The loan’s tranche structure <strong>and</strong>participants (borrowers, lenders, guarantors, beneficiaries, etc.) are alsodefined at this level.The loan’s general information is summarized in the Loan Information Sheet.<strong>DMFAS</strong> 5.3 incorporates a classification <strong>and</strong> coding system which is compliant with new requirements inthe field of debt statistics as well as with internationally accepted st<strong>and</strong>ards. Some of the codes used for theclassification of debt instruments are selected in the General Information window, for example, the debtsource, the public guarantee, the debtor category, lender category, etc.7

Among the immediate benefits, the new classification <strong>and</strong> coding system gives the debt officer the ability toproduce reports that adhere to World Bank st<strong>and</strong>ards <strong>and</strong> the IMF’s General Data Dissemination St<strong>and</strong>ards(GDDS) <strong>and</strong> which are in accordance with the IMF’s External <strong>Debt</strong> Statistics: Guide for Compilers <strong>and</strong>Users.Furthermore, the loan module has facilities for:• Recording secondary market shares <strong>and</strong> share movements for syndicated loans in order to report theexposure of each member of the syndicate at a given point in time;• Maintaining records of amendments to loan agreements;• Maintaining records of the loan status throughout the lifetime of the loan (active, fully paid, cancelled,written-off, etc.);• Recording currency pool loans (World Bank <strong>and</strong> regional development bank loans); linking loans tospecific agreed minutes, general agreements, projects <strong>and</strong> budget lines;• Recording customized information through user-defined fields. These fields allow the debt officers tocater to country-specific loan details that can then be used as selection <strong>and</strong> sorting criteria whengenerating reports.The bond module is similar to the loan module: all the basicinformation such as the different references, the issue date <strong>and</strong> theissue end date is recorded in the General Information window. Thebond’s series structure <strong>and</strong> participants (issuer, subscribers, guarantors,beneficiaries, etc.) are also defined at this level.From the point of view of debt, bonds are debt securities with an original maturity of over one year. Theyare usually traded in organized financial instrument markets. Bonds usually give the holder an unconditionalright to money income that is either fixed or variable <strong>and</strong> determined contractually. Except for perpetualbonds, bonds also provide the holder with an unconditional right to a fixed sum as repayment of principal ona specified date or dates. In <strong>DMFAS</strong> the term “bond” is used as a generic term covering government“papers”, promissory notes, treasury bills, notes, bonds or eurobonds; that is, short-, medium- <strong>and</strong> long-termobligations.Tranche informationWhat is a tranche?In a loan, a tranche is a set of disbursements, the repayment of which is under its own specific financialterms. Tranches represent the distinct parts of a loan as defined by the creditor in the detailed paymentschedules sent to the debtor.In <strong>DMFAS</strong> a “tranche” is defined as an autonomous entity with its own currency, drawings, principalpayment schedule <strong>and</strong> interest terms: each tranche has its own amortization table. Furthermore, a tranchecan have its own participants. Using this information, <strong>DMFAS</strong> automatically calculates amortization tables.What are they used for?Tranches allow more accurate recording of loans in several currencies <strong>and</strong> with several interest rates.Multilateral borrowing, for instance, often has several currency tranches under the same credit. These8

different tranches may or may not have the same rate of interest. Each currency will therefore be registeredas a separate tranche with its own amortization schedule.<strong>DMFAS</strong> captures specific floating interest rates for the tranches. These rates are either entered into thecommon exchange rate file for the entire debt portfolio in the system or they are entered as characteristics ofa loan tranche. Because different creditors may be using different interest rates for the same currency on thesame date, <strong>DMFAS</strong> allows you to record creditor-specific interest rates.Tranche management options<strong>DMFAS</strong> offers three different options for managing tranches manually or automatically:• One tranche only• Unknown number of tranches• Multiple known tranches“One tranche only” is the most frequently used option for managing tranches since most loans contain onlyone tranche in which drawings <strong>and</strong> repayments are always expressed in the loan currency.Example of a Tranche Information Sheet which summarizes all the information registered at the tranche levelSeries informationIn <strong>DMFAS</strong> the concept of “series” is similar to the one of tranche: it is an autonomous entity with its ownprincipal repayment schedule, its own currency <strong>and</strong> its own interest terms. More precisely, a series is agroup of certificates of indebtedness belonging to the same bond <strong>and</strong> sharing the same attributes <strong>and</strong>repayment conditions. In addition, it may have its own participants.9

Example of a Series Information Sheet which summarizes all the information registered at the series levelCommission informationFinally, loan/bond commissions <strong>and</strong> fees are recorded in a separate window since you can enter thisinformation at both the loan/bond <strong>and</strong> tranche/series levels.B. Operating function<strong>DMFAS</strong> records all types of individual transactions: drawings, also called disbursements, (registered inthe Mobilize section) <strong>and</strong> repayments of principal, payment of interest <strong>and</strong> commissions, etc. (registered inthe Service section).1. Mobilization of fundsThe section Mobilize is for registering drawings <strong>and</strong> subscriptions.<strong>DMFAS</strong> can h<strong>and</strong>le drawings in the same (or different) currency as that ofthe tranche <strong>and</strong> registers the equivalent value in the loan currency, in thetranche currency, <strong>and</strong> in the local currency as well as in the euro <strong>and</strong>U.S.dollar. For validation all the figures are checked for consistency against10

the exchange rates registered in the corresponding files. A drawing can also be related to a project or aprogram allocation.A feature in <strong>DMFAS</strong> allows to update or roll forward estimated drawings up to a date specified by the user:the Roll forward estimated drawings facility. This feature improves projections by eliminating estimateddrawings scheduled prior to this date.2. <strong>Debt</strong> serviceThe <strong>Debt</strong> service operations are h<strong>and</strong>led in the Servicesection. There is an option dealing with principal <strong>and</strong>interest <strong>and</strong> two other options for commissions <strong>and</strong>penalty interest. All debt service operations can beentered <strong>and</strong>/or followed in various currencies: local,tranche, loan, effective, euro, U.S. dollar <strong>and</strong> SDR.The main functionalities of the Service section are the following:• The debt-service operations are ordered by scheduled date, <strong>and</strong> the field status informs the user of thecurrent stage in the servicing process for the maturity concerned (scheduled, waiting, in arrear, paid,written-off, rescheduled, etc.).• The generation of the list of debt service maturities is based on the amortization table. The user willcheck this list <strong>and</strong> take appropriate action for maturities with a waiting status (those for which apayment is due): this means recording a payment, a rescheduling, a write-off, a swap or confirming theexistence of an arrear. <strong>DMFAS</strong> also offers a utility for the automatic recording of debt serviceoperations, like payments, arrears or rescheduled arrears <strong>and</strong> write-offs, for a given set of loans orbonds.• The accumulation of arrears may lead to the accumulation of a stock of Penalty interest due to differentcreditors. <strong>DMFAS</strong> can generate reports displaying the details of penalty interest for each arrear <strong>and</strong>h<strong>and</strong>les payment, rescheduling <strong>and</strong> written-off operations on penalty interest.• This section is also where Budget period allocations are registered. The system allows entry of budgetallocations for comparison with actual payments. The user defines the budget periods <strong>and</strong> loads thebudget line identifications <strong>and</strong> the allocation to each budget line. The allocation is then linked totranches <strong>and</strong> individual transactions, so that <strong>DMFAS</strong> automatically monitors the allocation against theaccumulated amount of actual transactions during the specified budget period. A warning is issued if thesum of actual transactions exceeds the allocation. Therefore, the budgeting of payments may bemonitored on loans’ or bonds’ interest, principal <strong>and</strong> commissions, <strong>and</strong> can easily be adjusted to theneeds of individual countries.• The Adjustment factors used in some of the currency pool loans from multilateral institutions areregistered here.11

• The Payment order, a country-specific facility, can also be either printed or electronically transmittedfrom this option. If there is a linkage with a budget system, the payment order can be processed throughthe corresponding budget allocations.3. Historical dataA public debt software should be able to show <strong>and</strong> calculate historical data. Loading the information aboutthe individual transactions in order to fulfill this requirement can be very tedious <strong>and</strong>, in some cases, anoverwhelming task. <strong>DMFAS</strong>, in order to overcome this problem, permits the user to load balances on aloan-by-loan <strong>and</strong> tranche-by ranche basis at a given date (the user-defined <strong>DMFAS</strong> cut-off date).The Historical amount balances will include total principal repaid, total interest paid, etc., at the cut-offdate. This will allow the system to calculate, at any date after the cut-off date, stocks <strong>and</strong> flows at any levelof aggregation.C. Controlling <strong>and</strong> monitoring functionsThe first controlling function is on the data accuracy <strong>and</strong> data validation. Once data is entered, it will beupdated regularly or deleted, as the case may be. To ensure consistency among data for a particular debtinstrument, a certain number of controls have been incorporated in the system. By means of a number oferror messages, the user will correct <strong>and</strong> validate data. The user may also produce different reports tocheck the data for correctness.The software can also produce a large number of reports for the purpose of control <strong>and</strong> monitoring the debtmanagementoperations. For example, <strong>DMFAS</strong> enables debt officers to:• Produce reports of payments falling due in the next month, in order to pay them on time;• Produce reports where loans are selected by economic sector, type of creditor, financing type, etc., thatcan be used for controlling ceilings on outst<strong>and</strong>ing debt or debt servicing;• To identify loans where debt service is in arrears <strong>and</strong> calculate penalty payments.12

D. Reporting functionAll the data recorded in <strong>DMFAS</strong> is ultimately aimed at producing reports that are accurate, complete <strong>and</strong>compliant with st<strong>and</strong>ards. To this end, <strong>DMFAS</strong> offers extensive features that simplify debt officers’reporting tasks. <strong>DMFAS</strong> reports are multi-purpose in that they address three categories of user needs:internal, external <strong>and</strong> control.• Internal: debt officers need to produce reports about debt in the specific formats required by nationalauthorities <strong>and</strong> other related users.• External: debt officers need to produce reports in the specific formats required by internationalorganizations <strong>and</strong> that adhere to an international st<strong>and</strong>ardization of statistics.• Control: <strong>DMFAS</strong> users need to produce reports for the purposes of data validation (see previoussection).1. Reports available in <strong>DMFAS</strong>Reports are created from <strong>DMFAS</strong> Report section which is divided into two parts: <strong>DMFAS</strong> St<strong>and</strong>ardReports <strong>and</strong> User-defined Reports.<strong>DMFAS</strong> St<strong>and</strong>ard Reports are predefined reports delivered with the system. These are reports that havealready been created by the central team of the <strong>Debt</strong> <strong>Management</strong> – <strong>DMFAS</strong> Programme.User-defined Reports are reports created <strong>and</strong> generated by the <strong>DMFAS</strong> users in any given country. A userdefinedreport can be based on a <strong>DMFAS</strong> st<strong>and</strong>ard report. This means that users can copy a <strong>DMFAS</strong>st<strong>and</strong>ard report <strong>and</strong> then modify it.The levels for <strong>DMFAS</strong> St<strong>and</strong>ard Reports are illustrated below.St<strong>and</strong>ard ReportsOperational ReportsAnalytical & <strong>Management</strong> Reports13

Operational Reports include reports on loans, bonds, projects, general agreements, grants <strong>and</strong> referencefiles. For example, for loan instruments users can produce a loan information sheet, a loan accountstatement, an amortization table <strong>and</strong> so on. These reports can be generated whenever users need to checkthat they have recorded all data correctly for a debt instrument.Among these reports are the control reports, also known as Data Validation reports. These are predefinedreports, developed by the central team of the <strong>Debt</strong> <strong>Management</strong> – <strong>DMFAS</strong> Programme. Generated in OracleBrowser, these reports allow users to check the accuracy <strong>and</strong> consistency of the data recorded.Analytical & <strong>Management</strong> Reports consist of reports on debt status, the statistical bulletin, reorganization,World Bank reporting, <strong>and</strong> general agreements involving revolving credit. A number of st<strong>and</strong>ard reports arealready available in the <strong>DMFAS</strong> libraries delivered with the system: 8 in the debt status library <strong>and</strong> 61 in thestatistical bulletin library.Some of the reports available in the <strong>DMFAS</strong> Statistical Bulletin library.The World Bank Reporting option lets users generate Forms 1 <strong>and</strong> 2 of the <strong>Debt</strong>or Reporting <strong>System</strong> (DRS)<strong>and</strong> send them electronically to the World Bank.2. Libraries of reports<strong>DMFAS</strong> offers libraries for use with reports. These libraries are secure repositories in which users can storereports for future use. The libraries available in <strong>DMFAS</strong> are specialized. There are thus libraries for reportsrelating to data validation, debt status, the statistical bulletin <strong>and</strong> reorganization/data validation.Some of these libraries are delivered with the system; they are made up of <strong>DMFAS</strong> st<strong>and</strong>ard reports. Otherlibraries have already been named but are empty: users can fill them in by creating their own reports throughuser-defined reports.14

3. Categories of reportsReports available in <strong>DMFAS</strong> fall into these categories:• Predefined reports without parameters• Predefined reports with parameters• User-defined reportsPredefined reports without parametersThese reports are “hard-coded” which means that the user cannot change their format in any way. Theseoperational reports display all the data available relating to one or more selected debt instruments.Therefore, no parameters are required. The Amortization table is one example of this type of report.Predefined reports with parametersThe format for these reports is also hard-coded <strong>and</strong> they display all the data available relating to one or moreselected debt instruments. However, as they may contain large volumes of data, the user must specify one orseveral parameters. The parameters can be the report period to be covered, the calculation date, the reportcurrency, etc.User-defined reportsWith user-defined reports, the user can design its own reports by entering specific parameters. He can selectfrom a wide range of debt totals or aggregates relating to debt operations (stocks or flows) such as drawings,debt service operations, etc.; projections, for example on drawings <strong>and</strong> the debt service; the debtoutst<strong>and</strong>ing; present value; accrued interest; commitments; <strong>and</strong> penalty interest. The user can also combineaggregates with general information on debt instruments, for example the creditor name, the signature date,etc.There are two ways of creating user-defined reports, both of which entail use of Oracle Browser or QueryBuilder. The <strong>DMFAS</strong> application is built on top of an Oracle database that stores all the debt-related datayou recorded.Within <strong>DMFAS</strong>, the user can therefore use applications such as Oracle Browser (or Query Builder) tosearch for data recorded in this database. An advanced user can even work with Oracle Browser directly.USER<strong>DMFAS</strong>Oracle Browser/Query Builder(LOAN_TRANCHES <strong>and</strong>GRANTS views)ADVANCED USEROracle Browser/Query Builder(all tables <strong>and</strong> views)Data recorded in <strong>DMFAS</strong> is organized into tables <strong>and</strong> views such as, for example, LOAN_TRANCHES,Participants, Projects, disbursements <strong>and</strong> debt service operations. Over 250 tables exist in <strong>DMFAS</strong>.While creating user-defined reports with <strong>DMFAS</strong>, the views the user can work with in Browser includeLOAN_TRANCHES (for loans <strong>and</strong> bonds) <strong>and</strong> the GRANTS views as well as two specific views for syndicatedloans. When creating reports with Oracle Browser/Query Builder, the user can use all views <strong>and</strong> tables.15

4. More on user-defined reports…To create a user-defined report, the user will first define a set of parameters, such as such as the currency,the level of aggregation <strong>and</strong> the period:• Reports can be produced in local currency, tranche currency, U.S. dollar, euros, SDRs or even in variouscurrencies.• They can be expressed in units, thous<strong>and</strong>s or millions.• Four formats are available for generating user-defined reports. These formats determine the position ofaggregates <strong>and</strong> sub-periods in the rows <strong>and</strong> columns of the report. For certain formats, the report cancontain up to 12 columns as well as express the value of a given column as a percentage of the entirecolumn.User-defined ReportsMain windowBasic information about the report: name, title, currency, etc.Sub-windowsFormat PeriodicityAggregatesPeriodsSubtotalsOracle Browseror Query BuilderData setsThen, among the 15 types of aggregates available, the user will select the type of aggregate <strong>and</strong> the relateddebt totals required to produce the desired report.16

Once the user has created a report, it is stored by <strong>DMFAS</strong> so that the user can retrieve it in order to print itout with the original or new data, as well as to modify its format if needed. Below is an example of aprojection report generated in <strong>DMFAS</strong>.5. Exporting reports to ExcelThe user can export the user-defined reports created as ASCII files in <strong>DMFAS</strong> to Microsoft Excel. Theexported report files preserve their original formatting. In Excel the user can then benefit from the widerangeof formatting <strong>and</strong> layout features available in the application.17

E. Analytical function1. Projections based on outst<strong>and</strong>ing <strong>and</strong> present value calculationsThe analysis module has been specifically designed to calculate projections based on outst<strong>and</strong>ing, <strong>and</strong> thepresent value amount using CIRRs as the rates of discount, of a debt portfolio.Because debt indicators based on the nominal value of a debt are static, they may not exactly reflect acountry’s underlying solvency. Unlike nominal value, present value takes into account the terms <strong>and</strong> theconcessionality of a debt portfolio while reflecting the costs of servicing it in “today’s money”. <strong>Debt</strong>indicators based on present value are a more appropriate measure to apprehend a country’s solvency <strong>and</strong> itsdebt servicing situation. Present value allows debt officers to more easily compare debt portfolios betweencreditors by eliminating the effects of concessionality.The module on projections based on outst<strong>and</strong>ing is useful when the user needs to calculate:• The amount of interest due in the near future (for example, the amount of interest to be paid in the nextmonth), the cash flow needs of the central bank; etc.• Future debt service payments for a loan in which he foresees a cancellation of the undisbursed amount.• A debt’s present value for the purposes of analysis such as in the framework of the HIPC initiative.This module enables the user to choose between different parameters <strong>and</strong> calculation methods (the pro-rata<strong>and</strong> the truncation methods) of particular interest to produce <strong>and</strong> compare different scenarios for the debtsustainabilityanalysis of HIPC.2. Interface with the <strong>Debt</strong> Sustainability Model (DSM+)of the World BankAn interface has been created between <strong>DMFAS</strong> <strong>and</strong> DSM+, which is a tool designed to help officialsanalyze the external financing requirements of a country <strong>and</strong> to quantify the effects of debt-relief operationsor new borrowing. This interface provides the <strong>DMFAS</strong> user with the means to export data from the <strong>DMFAS</strong>system for subsequent import into DSM+.3. Other analytical features<strong>DMFAS</strong> system also provides analytical support for debt managers by, for example:• Facilitating easy registration of potential new debt <strong>and</strong> analyzing the effect of these new debts on thefuture debt-service pattern;• Permitting easy simulations to determine the effect of interest rate fluctuations <strong>and</strong> exchange ratevariations over a period of time;• Calculating <strong>and</strong> giving information on detailed penalty interest from the scheduled date of a maturityregistered as an arrear to a given date; <strong>and</strong>• Calculating accrued interest. <strong>DMFAS</strong> allows debt officers to generate automatically such information,at the end of the previous month, for use by other departments, including the accounting unit.18

IV. Technical characteristicsA. Flexible interface1. Language flexibility<strong>DMFAS</strong> is language independent. This means that its textual components (such as messages or menunames) have been externalized from the system itself.<strong>DMFAS</strong> 5.3 is available in Arabic, English, French, Russian <strong>and</strong> Spanish. At any time during a <strong>DMFAS</strong>session, the user can easily switch from one language to another. This feature is particularly important forcountries operating the system in languages that they cannot use for reporting to the World Bank <strong>and</strong> otherinternational organizations or creditors. For example, an institution working in a Russian-speakingenvironment can work with <strong>DMFAS</strong> in Russian <strong>and</strong> yet switch to English for reporting to the World Bank.2. Facilities for translating interface elements<strong>DMFAS</strong> allows an institution to modify the translation of interface elements so that they suit theterminology used in the country or institution. These elements include labels, field messages <strong>and</strong> lists ofvalues.In addition, the code file of the system is divided into st<strong>and</strong>ard <strong>and</strong> user-defined codes. This allows countryspecific customization of codes, such as Location, Economic Sector codes, etc.3. User-defined fields<strong>DMFAS</strong> windows provide user-defined fields, i.e. fields that can be customized according to theinstitution’s needs. They offer greater flexibility for customizing a <strong>DMFAS</strong> installation. <strong>DMFAS</strong> providesthree types of user-defined fields: user codes, user fields <strong>and</strong> user dates.B. Support to other information systems<strong>DMFAS</strong> 5.3 can be linked with other softwares. It may therefore provide debt data for other informationsystems, such as those dealing with balance of payments, budget, public <strong>and</strong>/or central bank accounting,government revenue <strong>and</strong> expenditure, currency management, etc.C. SecurityToday more than ever, security is one of the most critical issues faced by all information systems throughoutthe world. Most organizations have already undertaken significant measures to protect the confidentiality oftheir databases <strong>and</strong> control access to sensitive data.<strong>DMFAS</strong> security feature addresses these vital concerns by offering a safe <strong>and</strong> secure framework for acountry’s data. Yet another advantage of this feature is that it clearly organizes the responsibilities <strong>and</strong> roles19

of <strong>DMFAS</strong> users. For any user or user group, the manager can determine the access rights that areappropriate <strong>and</strong> subsequently exp<strong>and</strong> or restrict them according to its institution’s needs. For example, amanager can assign loans, bonds <strong>and</strong> grants exclusively to individual users or groups. In addition, a newfeature for password management has been introduced.D. Latest Oracle technology: Oracle 10G<strong>DMFAS</strong> 5.3 supports Oracle 9i <strong>and</strong> 10G, which is the latest RDBMS released by Oracle. Among the manyfeatures it offers are:• the ability to run a single database on a cluster of servers• new technology to reduce downtime thus allowing maintenance procedures on online databases• facilities to reduce disk fragmentation <strong>and</strong> improve applications performance• tools to define both e-mails <strong>and</strong> pager alerts for common database events•E. <strong>DMFAS</strong> HelpdeskThe <strong>DMFAS</strong> helpdesk offers extensive support in the use of <strong>DMFAS</strong>. The helpdesk provides timely <strong>and</strong>reliable advice <strong>and</strong> assistance on a wide range of functional <strong>and</strong> technical issues in response to any issueusers may have.V. Documentation <strong>and</strong> TrainingA comprehensive set of documentation is available for <strong>DMFAS</strong> 5.3. It includes:• A comprehensive User’s Guide, with its supplements <strong>and</strong> updates;• A basic tutorial “Introduction to <strong>DMFAS</strong>” <strong>and</strong> an advanced tutorial on how to register an AsianDevelopment Fund loan in <strong>DMFAS</strong>.• A <strong>Debt</strong> <strong>and</strong> <strong>DMFAS</strong> Glossary;• A Database Administrator’s Manual; <strong>and</strong>• An Installation Guide (for Oracle 8i, 9i <strong>and</strong> 10G).20

In addition to the basic training on debt, the <strong>Debt</strong> <strong>Management</strong> - <strong>DMFAS</strong> Programme offers the followingtraining modules relating to <strong>DMFAS</strong>:Module<strong>DMFAS</strong> 5.3Data validation<strong>Debt</strong> statisticsseminar<strong>Debt</strong> sustainabilityworkshopDescriptionCovers new features such as bonds, reorganization, the newclassification <strong>and</strong> coding system, AsDF loans, local government debt<strong>and</strong> revolving credit. It can last from 5 to 10 days.Provides techniques for data control. It is aimed at debt managersseeking to set up quality control procedures for use with databases <strong>and</strong>reports.Explains how to compile <strong>and</strong> analyze international debt statistics <strong>and</strong>how to report them to international organizations.Teaches the concepts for achieving <strong>and</strong> measuring a debt sustainabilityanalysis. It explains how to export debt data from <strong>DMFAS</strong> to DSM+ <strong>and</strong>then use DSM+ to analyze the debt portfolio for its sustainability.21