116 MICROFINANCE INDIAdoes not seem adequate enough. The field agent hasto provide a security deposit, cover <strong>the</strong> cost <strong>of</strong> <strong>the</strong>POS terminal, attend to cash management and mee<strong>the</strong>r travel and incidental costs even when <strong>the</strong> entirerange <strong>of</strong> services are not made available through her.Who will be willing to work as BC staff?The FINO BC model 10 <strong>of</strong>fers no-frills-accountservices involving savings and withdrawals. EachCustomer Service Point (CSP) at <strong>the</strong> client levelreports to <strong>the</strong> Block Coordinator, who is in turn,monitored by a District Coordinator. The CSP isa contract employee <strong>of</strong> FINO Fintech foundation,who is a local resident, and is given a fixed remuneration<strong>of</strong> ` 750 plus a commission <strong>of</strong> 50 paiseon every transaction irrespective <strong>of</strong> <strong>the</strong> amounttransacted. These CSPs work an average <strong>of</strong> fourhours per day and have this job as ei<strong>the</strong>r <strong>the</strong> onlysource <strong>of</strong> income or as a part-time business. On anaverage, each CSP handles around 700–800 clientsin her/his service area. Each CSP is provided witha POS machine for transactions and has to depositan initial amount <strong>of</strong> ` 10000 with FINO Fintechfoundation (` 5000 for <strong>the</strong> POS and ` 5000 for<strong>the</strong> CSP) as guarantee money. A transaction limit<strong>of</strong> ` 5000 is imposed on <strong>the</strong> CSP and once <strong>the</strong>limit is breached, <strong>the</strong> POS machine <strong>of</strong> <strong>the</strong> CSPgets blocked. It would <strong>the</strong>n require a visit by <strong>the</strong>Block Coordinator to collect <strong>the</strong> cash and unlock<strong>the</strong> machine to carry out fur<strong>the</strong>r transactions.The FINO CSPs found it difficult to sustain<strong>the</strong> business, as <strong>the</strong> income obtained from <strong>the</strong>present BC model was difficult to cover <strong>the</strong> costsincurred. The door-to-door services providedby <strong>the</strong> CSPs added to <strong>the</strong>ir cost. Apart from this,only 30 per cent to 40 per cent <strong>of</strong> <strong>the</strong> clients wereactive which fur<strong>the</strong>r reduced <strong>the</strong> commissionsfor <strong>the</strong> CSP. However, it was feasible for CSPswho ran kirana stores, as majority <strong>of</strong> <strong>the</strong>ir clientsvisited <strong>the</strong> store as part <strong>of</strong> <strong>the</strong>ir daily chores andalso made transactions with <strong>the</strong> CSP; he madefewer doorstep services than o<strong>the</strong>r CSPs whowere housewives or working in o<strong>the</strong>r companies.On interactions with <strong>the</strong> clients, <strong>the</strong> team couldinfer that <strong>the</strong> transaction limits imposed on <strong>the</strong>CSP was a major hindrance to <strong>the</strong> clients in utilizing<strong>the</strong>se services efficiently and frequently.Many a times, any client who wants to withdrawor deposit amount that is greater than <strong>the</strong> limitwould have to inform <strong>the</strong> CSP prior hand. Thus,it would usually take around three days to complete<strong>the</strong> transaction, consequently undermining<strong>the</strong> efficiency <strong>of</strong> <strong>the</strong> system.The banks and higher tier institutions seem to beabsolving <strong>the</strong>mselves <strong>of</strong> <strong>the</strong> responsibility <strong>of</strong> inclusionafter planning, and placing <strong>the</strong> burden <strong>of</strong> implementationon <strong>the</strong> small agent in <strong>the</strong> field without arealistic assessment <strong>of</strong> <strong>the</strong> compensation needed.The notion that BC models would breakevenwithin short periods is not well founded. Since a newnetwork with technology based architecture is beingbuilt, <strong>the</strong>re would be significant costs that need tobe amortized and recovered over a period <strong>of</strong> time.Investments in <strong>the</strong> inclusion space have to be seenas project investments and treated as such within <strong>the</strong>business for taking appropriate decisions. The strategizingand planning that follow <strong>the</strong> investment modelwould target volumes, costs and earnings. Technologycosts should be minimized and <strong>the</strong> inclusionprogramme should not be a victim to <strong>the</strong> ambitions<strong>of</strong> technology. Smart, cost-effective technologies thatdo not demand too much training <strong>of</strong> <strong>the</strong> agents andcustomers should be brought in. Patient capital isneeded in <strong>the</strong> inclusion sphere. Inclusion businesscan make surpluses only when customers are able toaccess and use a range <strong>of</strong> services.Unique Identification Numberand inclusionThe Unique Identification (UID) project is ga<strong>the</strong>ringpace with registrars for issue <strong>of</strong> UID numbersbeing enrolled. The expectations from UID aremany. The expectations from <strong>the</strong> financial sectorare that UID will solve all problems relating to KYCfor <strong>the</strong> customer. UID will identify <strong>the</strong> customer,<strong>the</strong> place <strong>of</strong> residence and enable au<strong>the</strong>nticationthrough biometrics. Banks are required to followcustomer identification procedures while openingnew accounts, to reduce <strong>the</strong> risk <strong>of</strong> fraud and moneylaundering. The know-your-resident (KYR) verificationprocess carried out before issue <strong>of</strong> UID willmeet <strong>the</strong> standards <strong>of</strong> verification set by banks forKYC for opening accounts. The strong au<strong>the</strong>nticationthat <strong>the</strong> UID will <strong>of</strong>fer, combined with its KYRstandards, can remove <strong>the</strong> need for such individualKYC by banks for basic, no-frills-accounts and significantlybring down KYC costs for banks. TheUID’s clear au<strong>the</strong>ntication and verification processeswill allow banks to network with village-basedBCs such as SHGs and kirana stores. Customerswill be able to withdraw money and make depositsat <strong>the</strong> local BC. Multiple BCs at <strong>the</strong> local level willalso give customers a choice <strong>of</strong> BCs. This will makecustomers, particularly in villages, less vulnerable tolocal power structures, and lower <strong>the</strong> risk <strong>of</strong> beingexploited by BCs. The UID will mitigate <strong>the</strong> highcustomer acquisition costs, high transaction costs

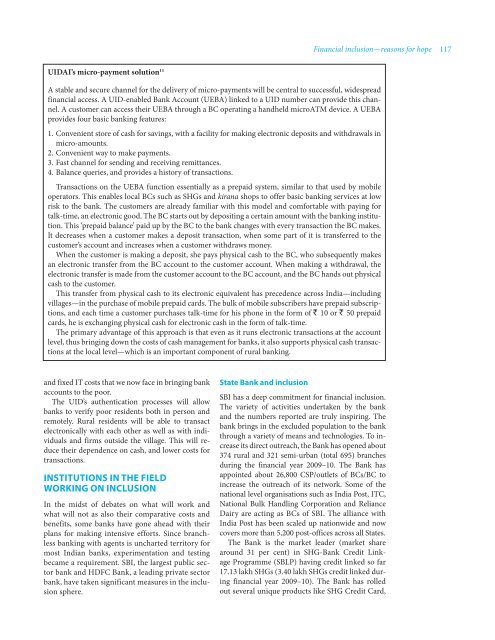

Financial inclusion—reasons for hope 117UIDAI’s micro-payment solution 11A stable and secure channel for <strong>the</strong> delivery <strong>of</strong> micro-payments will be central to successful, widespreadfinancial access. A UID-enabled Bank Account (UEBA) linked to a UID number can provide this channel.A customer can access <strong>the</strong>ir UEBA through a BC operating a handheld microATM device. A UEBAprovides four basic banking features:1. Convenient store <strong>of</strong> cash for savings, with a facility for making electronic deposits and withdrawals inmicro-amounts.2. Convenient way to make payments.3. Fast channel for sending and receiving remittances.4. Balance queries, and provides a history <strong>of</strong> transactions.Transactions on <strong>the</strong> UEBA function essentially as a prepaid system, similar to that used by mobileoperators. This enables local BCs such as SHGs and kirana shops to <strong>of</strong>fer basic banking services at lowrisk to <strong>the</strong> bank. The customers are already familiar with this model and comfortable with paying fortalk-time, an electronic good. The BC starts out by depositing a certain amount with <strong>the</strong> banking institution.This ‘prepaid balance’ paid up by <strong>the</strong> BC to <strong>the</strong> bank changes with every transaction <strong>the</strong> BC makes.It decreases when a customer makes a deposit transaction, when some part <strong>of</strong> it is transferred to <strong>the</strong>customer’s account and increases when a customer withdraws money.When <strong>the</strong> customer is making a deposit, she pays physical cash to <strong>the</strong> BC, who subsequently makesan electronic transfer from <strong>the</strong> BC account to <strong>the</strong> customer account. When making a withdrawal, <strong>the</strong>electronic transfer is made from <strong>the</strong> customer account to <strong>the</strong> BC account, and <strong>the</strong> BC hands out physicalcash to <strong>the</strong> customer.This transfer from physical cash to its electronic equivalent has precedence across India—includingvillages—in <strong>the</strong> purchase <strong>of</strong> mobile prepaid cards. The bulk <strong>of</strong> mobile subscribers have prepaid subscriptions,and each time a customer purchases talk-time for his phone in <strong>the</strong> form <strong>of</strong> ` 10 or ` 50 prepaidcards, he is exchanging physical cash for electronic cash in <strong>the</strong> form <strong>of</strong> talk-time.The primary advantage <strong>of</strong> this approach is that even as it runs electronic transactions at <strong>the</strong> accountlevel, thus bringing down <strong>the</strong> costs <strong>of</strong> cash management for banks, it also supports physical cash transactionsat <strong>the</strong> local level—which is an important component <strong>of</strong> rural banking.and fixed IT costs that we now face in bringing bankaccounts to <strong>the</strong> poor.The UID’s au<strong>the</strong>ntication processes will allowbanks to verify poor residents both in person andremotely. Rural residents will be able to transactelectronically with each o<strong>the</strong>r as well as with individualsand firms outside <strong>the</strong> village. This will reduce<strong>the</strong>ir dependence on cash, and lower costs fortransactions.Institutions in <strong>the</strong> fieldworking on inclusionIn <strong>the</strong> midst <strong>of</strong> debates on what will work andwhat will not as also <strong>the</strong>ir comparative costs andbenefits, some banks have gone ahead with <strong>the</strong>irplans for making intensive efforts. Since branchlessbanking with agents is uncharted territory formost Indian banks, experimentation and testingbecame a requirement. SBI, <strong>the</strong> largest public sectorbank and HDFC Bank, a leading private sectorbank, have taken significant measures in <strong>the</strong> inclusionsphere.<strong>State</strong> Bank and inclusionSBI has a deep commitment for financial inclusion.The variety <strong>of</strong> activities undertaken by <strong>the</strong> bankand <strong>the</strong> numbers reported are truly inspiring. Thebank brings in <strong>the</strong> excluded population to <strong>the</strong> bankthrough a variety <strong>of</strong> means and technologies. To increaseits direct outreach, <strong>the</strong> Bank has opened about374 rural and 321 semi-urban (total 695) branchesduring <strong>the</strong> financial year 2009–10. The Bank hasappointed about 26,800 CSP/outlets <strong>of</strong> BCs/BC toincrease <strong>the</strong> outreach <strong>of</strong> its network. Some <strong>of</strong> <strong>the</strong>national level organisations such as India Post, ITC,National Bulk Handling Corporation and RelianceDairy are acting as BCs <strong>of</strong> SBI. The alliance withIndia Post has been scaled up nationwide and nowcovers more than 5,200 post-<strong>of</strong>fices across all <strong>State</strong>s.The Bank is <strong>the</strong> market leader (market sharearound 31 per cent) in SHG-Bank Credit LinkageProgramme (SBLP) having credit linked so far17.13 lakh SHGs (3.40 lakh SHGs credit linked duringfinancial year 2009–10). The Bank has rolledout several unique products like SHG Credit Card,

- Page 1:

Microfinance India

- Page 4 and 5:

Copyright ©ACCESS Development Serv

- Page 7 and 8:

List of Tables, Figures, Boxes,Abbr

- Page 9 and 10:

List of Tables, Figures, Boxes, Abb

- Page 11 and 12:

List of Tables, Figures, Boxes, Abb

- Page 13 and 14:

ForewordAfter coping with the uncer

- Page 15:

ForewordxvI’m happy that the 2010

- Page 18 and 19:

xviiiMICROFINANCE INDIASadhan’s c

- Page 20 and 21:

2 MICROFINANCE INDIARBI is focused

- Page 22 and 23:

4 MICROFINANCE INDIAcent in 2009. 1

- Page 24 and 25:

6 MICROFINANCE INDIAMFIs did not se

- Page 26:

8 MICROFINANCE INDIA(DFID) had prio

- Page 29:

Overview—the juggernaut decelerat

- Page 32 and 33:

14 MICROFINANCE INDIASavings Perfor

- Page 34 and 35:

16 MICROFINANCE INDIAamply clear th

- Page 36 and 37:

18 MICROFINANCE INDIAyears have a l

- Page 38 and 39:

20 MICROFINANCE INDIAThe study whil

- Page 40 and 41:

22 MICROFINANCE INDIAper cent peopl

- Page 42 and 43:

24 MICROFINANCE INDIAState andname

- Page 44 and 45:

26 MICROFINANCE INDIAinnovation tha

- Page 46 and 47:

28 MICROFINANCE INDIAANNEX 2.2Micro

- Page 48 and 49:

30 MICROFINANCE INDIARegion/StateF

- Page 50 and 51:

32 MICROFINANCE INDIAMFIs in the mi

- Page 52 and 53:

34 MICROFINANCE INDIAreturn-on-asse

- Page 54 and 55:

36 MICROFINANCE INDIAneeds introspe

- Page 56 and 57:

38 MICROFINANCE INDIACompetition an

- Page 58 and 59:

40 MICROFINANCE INDIAIt looks unfai

- Page 60 and 61:

42 MICROFINANCE INDIAwas a commenda

- Page 62 and 63:

44 MICROFINANCE INDIAterms of ideas

- Page 64 and 65:

46 MICROFINANCE INDIAfast growth of

- Page 66 and 67:

48 MICROFINANCE INDIASecond wave of

- Page 68 and 69:

50 MICROFINANCE INDIABut to make MF

- Page 70 and 71:

52 MICROFINANCE INDIA11. In Chapter

- Page 72 and 73:

54 MICROFINANCE INDIAflow of funds

- Page 74 and 75:

56 MICROFINANCE INDIAThe MHP requir

- Page 76 and 77:

58 MICROFINANCE INDIAto boomerang o

- Page 78 and 79:

60 MICROFINANCE INDIAlocal populati

- Page 80 and 81:

62 MICROFINANCE INDIAInvestor Inves

- Page 82 and 83:

64 MICROFINANCE INDIAand 3.1 in Eas

- Page 84 and 85: 66 MICROFINANCE INDIAto have the la

- Page 86 and 87: 68 MICROFINANCE INDIAand it also ha

- Page 89 and 90: Savings, investmentsand pensionMicr

- Page 91 and 92: Savings, investments and pension 73

- Page 93 and 94: Savings, investments and pension 75

- Page 95 and 96: Savings, investments and pension 77

- Page 97 and 98: Savings, investments and pension 79

- Page 99 and 100: On the other hand, a third of respo

- Page 101 and 102: Policy environmentand regulationThe

- Page 103 and 104: Policy environment and regulation 8

- Page 105 and 106: Policy environment and regulation 8

- Page 107 and 108: Technology in microfinanceMicrofina

- Page 109 and 110: Technology in microfinance 91Other

- Page 111 and 112: Technology in microfinance 93100%90

- Page 113 and 114: Social performance,transparency and

- Page 115 and 116: Social performance, transparency an

- Page 117 and 118: Social performance, transparency an

- Page 119 and 120: Social performance, transparency an

- Page 121 and 122: Table 9.2 Mission orientation and a

- Page 123 and 124: Social performance, transparency an

- Page 125: Social performance, transparency an

- Page 128 and 129: 110 MICROFINANCE INDIATable 10.1 Wh

- Page 130 and 131: 112 MICROFINANCE INDIAtransfer serv

- Page 132 and 133: 114 MICROFINANCE INDIAManaging BC n

- Page 136 and 137: 118 MICROFINANCE INDIASHG Sahayog N

- Page 138 and 139: 120 MICROFINANCE INDIATo conclude,

- Page 140 and 141: 122 MICROFINANCE INDIA6. Further, b

- Page 142 and 143: 124 MICROFINANCE INDIASl. No. Recom

- Page 144 and 145: 126 MICROFINANCE INDIA• To provid

- Page 146 and 147: 128 MICROFINANCE INDIAInstitutional

- Page 149 and 150: AppendixTable A.1 Fact sheet on cov

- Page 151 and 152: Appendix 133Name of the bankCommerc

- Page 153 and 154: Appendix 135mobilization by SHGs an

- Page 155 and 156: BibliographyThe Union Budget 2010-1

- Page 157: Bibliography 139‘How India Earns,