State of the Sector Report 2010 - Microfinance Gateway

State of the Sector Report 2010 - Microfinance Gateway

State of the Sector Report 2010 - Microfinance Gateway

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

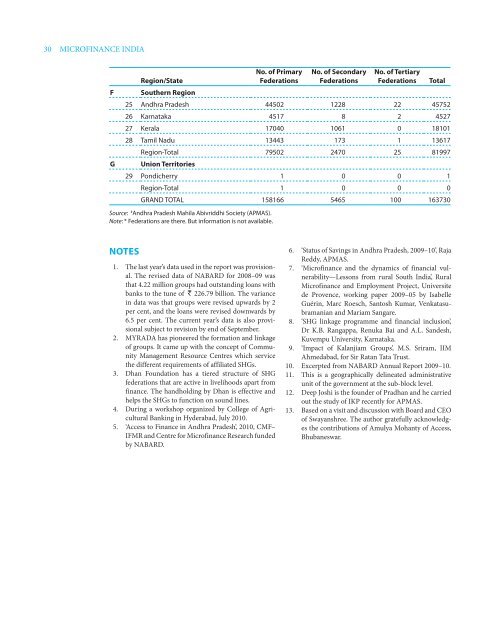

30 MICROFINANCE INDIARegion/<strong>State</strong>F Sou<strong>the</strong>rn RegionNo. <strong>of</strong> PrimaryFederationsNo. <strong>of</strong> SecondaryFederationsNo. <strong>of</strong> TertiaryFederations25 Andhra Pradesh 44502 1228 22 4575226 Karnataka 4517 8 2 452727 Kerala 17040 1061 0 1810128 Tamil Nadu 13443 173 1 13617TotalRegion-Total 79502 2470 25 81997G Union Territories29 Pondicherry 1 0 0 1Region-Total 1 0 0 0GRAND TOTAL 158166 5465 100 163730Source: # Andhra Pradesh Mahila Abivriddhi Society (APMAS).Note: * Federations are <strong>the</strong>re. But information is not available.Notes1. The last year’s data used in <strong>the</strong> report was provisional.The revised data <strong>of</strong> NABARD for 2008–09 wasthat 4.22 million groups had outstanding loans withbanks to <strong>the</strong> tune <strong>of</strong> ` 226.79 billion. The variancein data was that groups were revised upwards by 2per cent, and <strong>the</strong> loans were revised downwards by6.5 per cent. The current year’s data is also provisionalsubject to revision by end <strong>of</strong> September.2. MYRADA has pioneered <strong>the</strong> formation and linkage<strong>of</strong> groups. It came up with <strong>the</strong> concept <strong>of</strong> CommunityManagement Resource Centres which service<strong>the</strong> different requirements <strong>of</strong> affiliated SHGs.3. Dhan Foundation has a tiered structure <strong>of</strong> SHGfederations that are active in livelihoods apart fromfinance. The handholding by Dhan is effective andhelps <strong>the</strong> SHGs to function on sound lines.4. During a workshop organized by College <strong>of</strong> AgriculturalBanking in Hyderabad, July <strong>2010</strong>.5. ‘Access to Finance in Andhra Pradesh’, <strong>2010</strong>, CMF–IFMR and Centre for Micr<strong>of</strong>inance Research fundedby NABARD.6. ‘Status <strong>of</strong> Savings in Andhra Pradesh, 2009–10’, RajaReddy, APMAS.7. ‘Micr<strong>of</strong>inance and <strong>the</strong> dynamics <strong>of</strong> financial vulnerability—Lessonsfrom rural South India’, RuralMicr<strong>of</strong>inance and Employment Project, Universitede Provence, working paper 2009–05 by IsabelleGuérin, Marc Roesch, Santosh Kumar, Venkatasubramanianand Mariam Sangare.8. ‘SHG linkage programme and financial inclusion’,Dr K.B. Rangappa, Renuka Bai and A.L. Sandesh,Kuvempu University, Karnataka.9. ‘Impact <strong>of</strong> Kalanjiam Groups’, M.S. Sriram, IIMAhmedabad, for Sir Ratan Tata Trust.10. Excerpted from NABARD Annual <strong>Report</strong> 2009–10.11. This is a geographically delineated administrativeunit <strong>of</strong> <strong>the</strong> government at <strong>the</strong> sub-block level.12. Deep Joshi is <strong>the</strong> founder <strong>of</strong> Pradhan and he carriedout <strong>the</strong> study <strong>of</strong> IKP recently for APMAS.13. Based on a visit and discussion with Board and CEO<strong>of</strong> Swayanshree. The author gratefully acknowledges<strong>the</strong> contributions <strong>of</strong> Amulya Mohanty <strong>of</strong> Access,Bhubaneswar.