Production Sharing Contracts - AIPN

Production Sharing Contracts - AIPN

Production Sharing Contracts - AIPN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

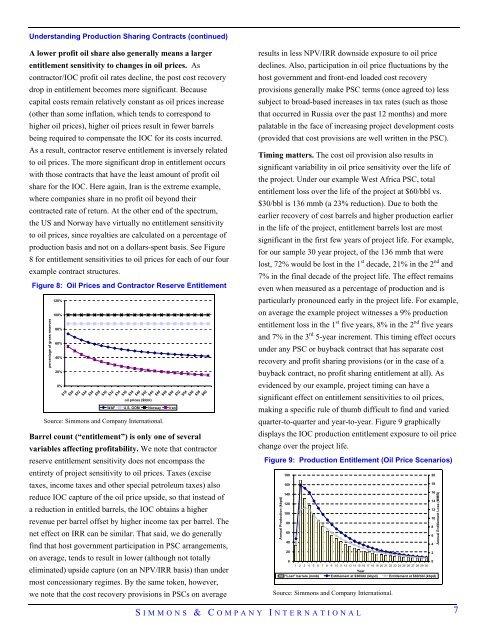

Understanding <strong>Production</strong> <strong>Sharing</strong> <strong>Contracts</strong> (continued)A lower profit oil share also generally means a largerentitlement sensitivity to changes in oil prices. Ascontractor/IOC profit oil rates decline, the post cost recoverydrop in entitlement becomes more significant. Becausecapital costs remain relatively constant as oil prices increase(other than some inflation, which tends to correspond tohigher oil prices), higher oil prices result in fewer barrelsbeing required to compensate the IOC for its costs incurred.As a result, contractor reserve entitlement is inversely relatedto oil prices. The more significant drop in entitlement occurswith those contracts that have the least amount of profit oilshare for the IOC. Here again, Iran is the extreme example,where companies share in no profit oil beyond theircontracted rate of return. At the other end of the spectrum,the US and Norway have virtually no entitlement sensitivityto oil prices, since royalties are calculated on a percentage ofproduction basis and not on a dollars-spent basis. See Figure8 for entitlement sensitivities to oil prices for each of our fourexample contract structures.Figure 8: Oil Prices and Contractor Reserve Entitlementpercentage of gross reserves120%100%80%60%40%20%0%$18$20$22$24$26$28$30$32$34$36oil prices ($/bbl)WAF U.S. GOM Norway IranSource: Simmons and Company International.$38$40$42$44$46$48$50$52$54$56$58$60Barrel count (“entitlement”) is only one of severalvariables affecting profitability. We note that contractorreserve entitlement sensitivity does not encompass theentirety of project sensitivity to oil prices. Taxes (excisetaxes, income taxes and other special petroleum taxes) alsoreduce IOC capture of the oil price upside, so that instead ofa reduction in entitled barrels, the IOC obtains a higherrevenue per barrel offset by higher income tax per barrel. Thenet effect on IRR can be similar. That said, we do generallyfind that host government participation in PSC arrangements,on average, tends to result in lower (although not totallyeliminated) upside capture (on an NPV/IRR basis) than undermost concessionary regimes. By the same token, however,we note that the cost recovery provisions in PSCs on averageresults in less NPV/IRR downside exposure to oil pricedeclines. Also, participation in oil price fluctuations by thehost government and front-end loaded cost recoveryprovisions generally make PSC terms (once agreed to) lesssubject to broad-based increases in tax rates (such as thosethat occurred in Russia over the past 12 months) and morepalatable in the face of increasing project development costs(provided that cost provisions are well written in the PSC).Timing matters. The cost oil provision also results insignificant variability in oil price sensitivity over the life ofthe project. Under our example West Africa PSC, totalentitlement loss over the life of the project at $60/bbl vs.$30/bbl is 136 mmb (a 23% reduction). Due to both theearlier recovery of cost barrels and higher production earlierin the life of the project, entitlement barrels lost are mostsignificant in the first few years of project life. For example,for our sample 30 year project, of the 136 mmb that werelost, 72% would be lost in the 1 st decade, 21% in the 2 nd and7% in the final decade of the project life. The effect remainseven when measured as a percentage of production and isparticularly pronounced early in the project life. For example,on average the example project witnesses a 9% productionentitlement loss in the 1 st five years, 8% in the 2 nd five yearsand 7% in the 3 rd 5-year increment. This timing effect occursunder any PSC or buyback contract that has separate costrecovery and profit sharing provisions (or in the case of abuyback contract, no profit sharing entitlement at all). Asevidenced by our example, project timing can have asignificant effect on entitlement sensitivities to oil prices,making a specific rule of thumb difficult to find and variedquarter-to-quarter and year-to-year. Figure 9 graphicallydisplays the IOC production entitlement exposure to oil pricechange over the project life.Figure 9: <strong>Production</strong> Entitlement (Oil Price Scenarios)Annual <strong>Production</strong> (kbpd)1801601401201008060402001 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30Year"Lost" barrels (mmb) Entitlement at $30/bbl (kbpd) Entitlement at $60/bbl (kbpd)Source: Simmons and Company International.S IMMONS & C OMPANY I NTERNATIONAL 720181614121086420Annual Entitlement Loss (MMB)