annual report 2012 - Pumpkin Patch investor relations

annual report 2012 - Pumpkin Patch investor relations

annual report 2012 - Pumpkin Patch investor relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

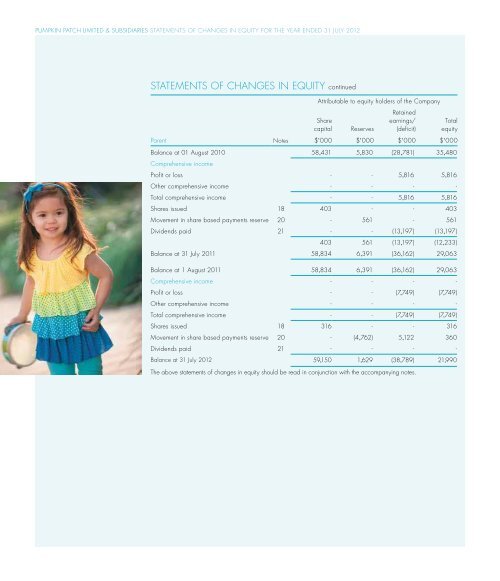

pumpkin patch limited & subsidiaries STATEMENTS OF CHANGES IN EQUITY for the year ended 31 july <strong>2012</strong>pumpkin patch limited & subsidiaries statements OF CASH FLOWS for the year ended 31 july <strong>2012</strong>STATEMENTS OF CHANGES IN EQUITY continuedAttributable to equity holders of the CompanySharecapitalReservesRetainedearnings/(deficit)TotalequityParent Notes $’000 $’000 $’000 $’000Balance at 01 August 2010 58,431 5,830 (28,781) 35,480Comprehensive incomeProfit or loss - - 5,816 5,816Other comprehensive income - - - -Total comprehensive income - - 5,816 5,816Shares issued 18 403 - - 403Movement in share based payments reserve 20 - 561 - 561Dividends paid 21 - - (13,197) (13,197)403 561 (13,197) (12,233)Balance at 31 July 2011 58,834 6,391 (36,162) 29,063Balance at 1 August 2011 58,834 6,391 (36,162) 29,063Comprehensive income - - - -Profit or loss - - (7,749) (7,749)Other comprehensive income - - - -Total comprehensive income - - (7,749) (7,749)Shares issued 18 316 - - 316Movement in share based payments reserve 20 - (4,762) 5,122 360Dividends paid 21 - - - -Balance at 31 July <strong>2012</strong> 59,150 1,629 (38,789) 21,990The above statements of changes in equity should be read in conjunction with the accompanying notes.STATEMENTS OF CASH FLOWS For the year ended 31 July <strong>2012</strong>Cash flows from operating activitiesCash was provided from:Consolidated - Year endedParent - Year ended31 July 31 July 31 July 31 July<strong>2012</strong> 2011 <strong>2012</strong> 2011Notes $’000 $’000 $’000 $’000Receipts from customers 330,389 359,836 - -Interest received 696 259 - -Other operating income 3 177 192 - -Cash was applied to:Payments to suppliers and employees (307,495) (352,460) (40,025) (40,657)Interest paid (4,566) (4,033) (2) (2)Sales tax paid 3 (1,816) (2,389) 13 (704)Income taxes paid (3,232) (5,979) (1,100) 615Net cash inflow / (outflow) fromoperating activitiesCash flows from investing activitiesCash was applied to:24 14,153 (4,574) (41,114) (40,748)Purchase of property, plant and equipment (5,169) (12,793) (511) (878)Purchase of intangibles (2,671) (4,351) (2,480) (4,258)Net cash (outflow) from investing activities (7,840) (17,144) (2,991) (5,136)Cash flows from financing activitiesCash was provided from:Advances from group companies - - 44,223 58,944Proceeds of borrowings - 38,000 - 131Cash was applied to:Repayment of borrowings (11,000) - (107) -Dividends paid 21 - (13,197) - (13,197)Net cash (outflow) / inflow fromfinancing activitiesNet (decrease)/ increase in cash andcash equivalentsCash and cash equivalents at the beginningof the financial year(11,000) 24,803 44,116 45,878(4,687) 3,085 11 (6)10,030 6,945 25 31Cash and cash equivalents at end of year 7 5,343 10,030 36 25The above statements of cash flows should be read in conjunction with the accompanying notes.47