annual report 2012 - Pumpkin Patch investor relations

annual report 2012 - Pumpkin Patch investor relations

annual report 2012 - Pumpkin Patch investor relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

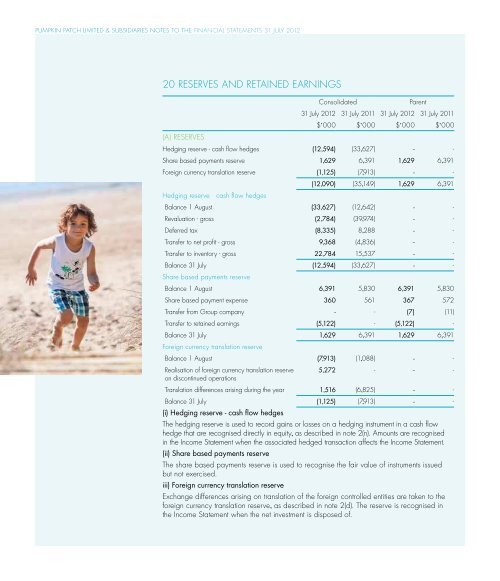

pumpkin patch limited & subsidiaries NOTES TO THE financial statements 31 july <strong>2012</strong>pumpkin patch limited & subsidiaries NOTES TO THE financial statements 31 july <strong>2012</strong>20 Reserves and retained earnings(a) ReservesConsolidated Parent31 July <strong>2012</strong> 31 July 2011 31 July <strong>2012</strong> 31 July 2011$’000 $’000 $’000 $’000Hedging reserve - cash flow hedges (12,594) (33,627) - -Share based payments reserve 1,629 6,391 1,629 6,391Foreign currency translation reserve (1,125) (7,913) - -Hedging reserve cash flow hedges(12,090) (35,149) 1,629 6,391Balance 1 August (33,627) (12,642) - -Revaluation - gross (2,784) (39,974) - -Deferred tax (8,335) 8,288 - -Transfer to net profit - gross 9,368 (4,836) - -Transfer to inventory - gross 22,784 15,537 - -Balance 31 July (12,594) (33,627) - -Share based payments reserveBalance 1 August 6,391 5,830 6,391 5,830Share based payment expense 360 561 367 572Transfer from Group company - - (7) (11)Transfer to retained earnings (5,122) - (5,122) -Balance 31 July 1,629 6,391 1,629 6,391Foreign currency translation reserveBalance 1 August (7,913) (1,088) - -Realisation of foreign currency translation reserve 5,272 - - -on discontinued operationsTranslation differences arising during the year 1,516 (6,825) - -Balance 31 July (1,125) (7,913) - -(i) Hedging reserve - cash flow hedgesThe hedging reserve is used to record gains or losses on a hedging instrument in a cash flowhedge that are recognised directly in equity, as described in note 2(n). Amounts are recognisedin the Income Statement when the associated hedged transaction affects the Income Statement.(ii) Share based payments reserveThe share based payments reserve is used to recognise the fair value of instruments issuedbut not exercised.iii) Foreign currency translation reserveExchange differences arising on translation of the foreign controlled entities are taken to theforeign currency translation reserve, as described in note 2(d). The reserve is recognised inthe Income Statement when the net investment is disposed of.20 Reserves and retained earnings continued(b) Retained earnings/ (deficit)Consolidated at Parent at31 July <strong>2012</strong> 31 July 2011 31 July <strong>2012</strong> 31 July 2011$’000 $’000 $’000 $’000Balance 1 August 8,940 24,013 (36,162) (28,781)Net profit/(loss) for the year (27,527) (1,876) (7,749) 5,816Dividends - (13,197) - (13,197)Transfer from share based paymentsreserve 5,122 - 5,122 -Balance 31 July (13,465) 8,940 (38,789) (36,162)21 DividendsInterim dividend for the period ended31 January 2011Final dividend for the period ended31 July 2010Consolidated and Parent - Year ended31 July <strong>2012</strong> 31 July 2011 31 July <strong>2012</strong> 31 July 2011Cents pershareCents pershare $’000 $’000- 3.00 - 5,033- 5.00 - 8,164Total dividends provided for or paid - 8.00 - 13,197Supplementary dividends of $nil (2011: $387,000) were paid to shareholders not tax residentin New Zealand for which the Group received a foreign <strong>investor</strong> tax credit entitlement.85