annual report 2012 - Pumpkin Patch investor relations

annual report 2012 - Pumpkin Patch investor relations

annual report 2012 - Pumpkin Patch investor relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

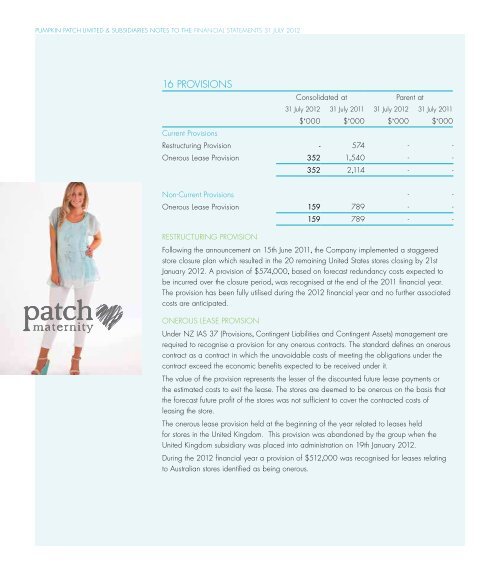

pumpkin patch limited & subsidiaries NOTES TO THE financial statements 31 july <strong>2012</strong>pumpkin patch limited & subsidiaries NOTES TO THE financial statements 31 july <strong>2012</strong>16 ProvisionsConsolidated at Parent at31 July <strong>2012</strong> 31 July 2011 31 July <strong>2012</strong> 31 July 2011$’000 $’000 $’000 $’000Current ProvisionsRestructuring Provision - 574 - -Onerous Lease Provision 352 1,540 - -352 2,114 - -Non-Current Provisions - -Onerous Lease Provision 159 789 - -159 789 - -Restructuring ProvisionFollowing the announcement on 15th June 2011, the Company implemented a staggeredstore closure plan which resulted in the 20 remaining United States stores closing by 21stJanuary <strong>2012</strong>. A provision of $574,000, based on forecast redundancy costs expected tobe incurred over the closure period, was recognised at the end of the 2011 financial year.The provision has been fully utilised during the <strong>2012</strong> financial year and no further associatedcosts are anticipated.Onerous Lease ProvisionUnder NZ IAS 37 (Provisions, Contingent Liabilities and Contingent Assets) management arerequired to recognise a provision for any onerous contracts. The standard defines an onerouscontract as a contract in which the unavoidable costs of meeting the obligations under thecontract exceed the economic benefits expected to be received under it.The value of the provision represents the lesser of the discounted future lease payments orthe estimated costs to exit the lease. The stores are deemed to be onerous on the basis thatthe forecast future profit of the stores was not sufficient to cover the contracted costs ofleasing the store.The onerous lease provision held at the beginning of the year related to leases heldfor stores in the United Kingdom. This provision was abandoned by the group when theUnited Kingdom subsidiary was placed into administration on 19th January <strong>2012</strong>.During the <strong>2012</strong> financial year a provision of $512,000 was recognised for leases relatingto Australian stores identified as being onerous.17 Interest bearing liabilitiesConsolidated at Parent at31 July <strong>2012</strong> 31 July 2011 31 July <strong>2012</strong> 31 July 2011$’000 $’000 $’000 $’000Current interest bearing liabilitiesBank overdrafts - - 52 159Bank loans 45,000 20,000 - -Total current interest bearing45,000 20,000 52 159liabilitiesNon current interest bearingliabilitiesBank loans 15,000 51,000 - -Total non current interest bearing 15,000 51,000 - -liabilitiesTotal interest bearing borrowings 60,000 71,000 52 159The bank loans are provided under the terms of an ANZ National Bank Limited RevolvingAdvances Facility Agreement dated 24 June 2009. The bank facilities outlined in thisagreement expire in December 2013. The <strong>annual</strong> review of these facilities is scheduledfor October <strong>2012</strong> and the directors are expecting that the tenure of the facilities will beextended for periods between two and three years.The Group draws down on its bank facility as required via short term loans which arerequired to be disclosed under current liabilities for external financial <strong>report</strong>ing purposes.These borrowings have been aged in accordance with the repayment terms of the facilities.At year end the weighted average interest rate is 3.97% (2011: 3.60%).As at 31 July <strong>2012</strong>, the Group had $42,000,000 of unused lines of credit (2011:$35,000,000).Fair valueThe fair value of interest bearing liabilities approximates their carrying value.SecurityThe Company has guaranteed, together with subsidiary companies, the indebtednessof <strong>Pumpkin</strong> <strong>Patch</strong> Limited and subsidiaries at 31 July <strong>2012</strong>, together with, in all cases,interest thereon under a cross guarantee deed dated 18 April 1996 and a guarantee andindemnity dated 11 July 2005. At 31 July <strong>2012</strong> the total indebtedness guaranteed by thedeed amounted to $58,360,000 (2011: $68,668,000).Included in this are other guarantees held by the ANZ National Bank Limited of:- Rent guarantees to certain landlords amount to $2,438,000 (2011: $2,720,000);- Guarantees provided to the UK Customs Department, amounting to $820,000 (2011:$787,000); &- A guarantee of $75,000 (2011:$75,000) to the NZX.79