Contents

Contents

Contents

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

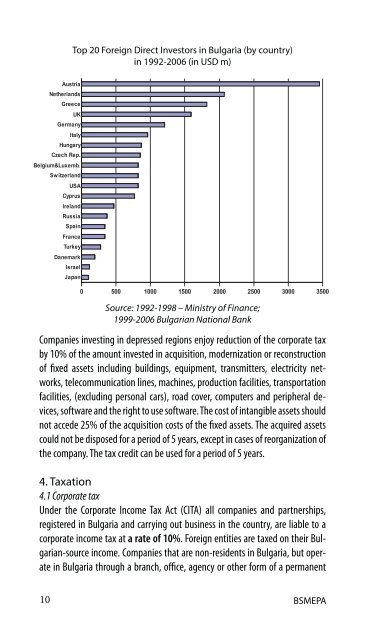

Top 20 Foreign Direct Investors in Bulgaria (by country)in 1992-2006 (in USD m)AustriaNetherlandsGreeceUKGermanyItalyHungaryCzech Rep.Belgium&Luxemb.SwitzerlandUSACyprusIrelandRussiaSpainFranceTurkeyDanemarkIsraelJapan0 500 1000 1500 2000 2500 3000 3500Source: 1992-1998 – Ministry of Finance;1999-2006 Bulgarian National BankCompanies investing in depressed regions enjoy reduction of the corporate taxby 10% of the amount invested in acquisition, modernization or reconstructionof fixed assets including buildings, equipment, transmitters, electricity networks,telecommunication lines, machines, production facilities, transportationfacilities, (excluding personal cars), road cover, computers and peripheral devices,software and the right to use software.The cost of intangible assets shouldnot accede 25% of the acquisition costs of the fixed assets. The acquired assetscould not be disposed for a period of 5 years, except in cases of reorganization ofthe company.The tax credit can be used for a period of 5 years.4. Taxation4.1 Corporate taxUnder the Corporate Income Tax Act (CITA) all companies and partnerships,registered in Bulgaria and carrying out business in the country, are liable to acorporate income tax at a rate of 10%. Foreign entities are taxed on their Bulgarian-sourceincome. Companies that are non-residents in Bulgaria, but operatein Bulgaria through a branch, office, agency or other form of a permanent10 BSMEPA