Student Aid Form ⢠2010 - Lycée Français de New York

Student Aid Form ⢠2010 - Lycée Français de New York

Student Aid Form ⢠2010 - Lycée Français de New York

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

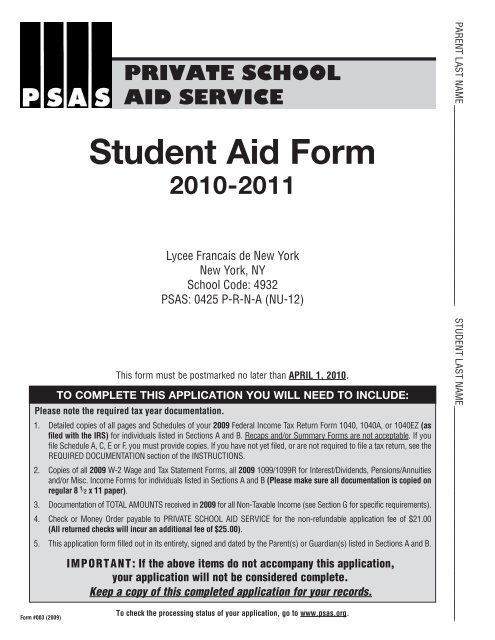

Please note the required tax year documentation.1. Detailed copies of all pages and Schedules of your 2009 Fe<strong>de</strong>ral Income Tax Return <strong>Form</strong> 1040, 1040A, or 1040EZ (asfiled with the IRS) for individuals listed in Sections A and B. Recaps and/or Summary <strong>Form</strong>s are not acceptable. If youfile Schedule A, C, E or F, you must provi<strong>de</strong> copies. If you have not yet filed, or are not required to file a tax return, see theREQUIRED DOCUMENTATION section of the INSTRUCTIONS.2. Copies of all 2009 W-2 Wage and Tax Statement <strong>Form</strong>s, all 2009 1099/1099R for Interest/Divi<strong>de</strong>nds, Pensions/Annuitiesand/or Misc. Income <strong>Form</strong>s for individuals listed in Sections A and B (Please make sure all documentation is copied onregular 8 1 ⁄ 2 x 11 paper).3. Documentation of TOTAL AMOUNTS received in 2009 for all Non-Taxable Income (see Section G for specific requirements).4.5.<strong>Form</strong> #003 (2009)PRIVATE SCHOOLAID SERVICE<strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong><strong>2010</strong>-2011Lycee Francais <strong>de</strong> <strong>New</strong> <strong>York</strong><strong>New</strong> <strong>York</strong>, NYSchool Co<strong>de</strong>: 4932PSAS: 0425 P-R-N-A (NU-12)This form must be postmarked no later than april 1, <strong>2010</strong>.TO COMPLETE THIS APPLICATION YOU WILL NEED TO INCLUDE:Check or Money Or<strong>de</strong>r payable to PRIVATE SCHOOL AID SERVICE for the non-refundable application fee of $21.00(All returned checks will incur an additional fee of $25.00).This application form filled out in its entirety, signed and dated by the Parent(s) or Guardian(s) listed in Sections A and B.IMPORTANT: If the above items do not accompany this application,your application will not be consi<strong>de</strong>red complete.Keep a copy of this completed application for your records.To check the processing status of your application, go to www.psas.org.PARENT LAST NAME___________________________________________________________________________________ STUDENT LAST NAME________________________________________________________________________________________

<strong>Form</strong> #003 (2009)A<strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong> • <strong>2010</strong> – 2011PARENT, GUARDIAN or OTHER ADULT RESPONSIBLE FOR TUITION• IMPORTANT: Print clearly and neatly with a ball point pen •Check one: o Father o Mother o Stepfather o Stepmother o Other Adult Check one: o Father o Mother o Stepfather o Stepmother o Other AdultBPARENT, GUARDIAN or OTHER ADULT RESIDING WITH PARENT A_____________________________________________________________________________________________________________________________________________Last Name First Name MI____________________________________________________ __________ ( ____________ ) ___________________________________________________Social Security Number Age (Area Co<strong>de</strong>) Home Phone_____________________________________________________________________________________________________________________________________________Address Apt. #_____________________________________________________________________________________________________________________________________________City State Zip( ________ ) _________________________________________________ __________________________________(Area Co<strong>de</strong>) Work PhoneE-mail address_____________________________________________________________________________________________________________________________________________Last Name First Name MI____________________________________________________ _________ ( ____________ ) ___________________________________________________Social Security Number Age (Area Co<strong>de</strong>) Home Phone_____________________________________________________________________________________________________________________________________________Address Apt. #_____________________________________________________________________________________________________________________________________________City State Zip( ________ )_________________________________________________ __________________________________(Area Co<strong>de</strong>) Work PhoneE-mail address_________________________________________May PSAS contact you at work ifEmployed by How Long? there are questions? o Yes o Noo If you are self-employed, check this box and refer to Section K of this form.CDEPENDENTS(DO NOT LEAVE BLANK)_________________________________________May PSAS contact you at work ifEmployed by How Long? there are questions? o Yes o Noo If you are self-employed, check this box and refer to Section K of this form.Number of <strong>de</strong>pen<strong>de</strong>nt children who will attend a tuition charging school: daycare, Pre-K, elementary school, secondary school, or college in the fall of <strong>2010</strong>. __________Please list all <strong>de</strong>pen<strong>de</strong>nt children in or<strong>de</strong>r of ol<strong>de</strong>st to youngest, including college stu<strong>de</strong>nts. Indicate each <strong>de</strong>pen<strong>de</strong>nt’s relationship to Parent/Guardian A: child, foster child, grandchild, etc.Depen<strong>de</strong>ntLast NameDepen<strong>de</strong>ntFirst NameMIAgeRelationshipto Parent/Guardian AName of school stu<strong>de</strong>nt plans to enter in thefall of <strong>2010</strong>(PLEASE DO NOT ABBREVIATE)City/StateGra<strong>de</strong>in thefall of<strong>2010</strong>Applyingfor <strong>Aid</strong>?(check one)YES NOAmount I/Wefeel I/We canpay towardtuitionTuitionchargedyearly perstu<strong>de</strong>ntOfficeUse Only12345o Please check if additional <strong>de</strong>pen<strong>de</strong>nts are listed on a separate sheet.DHOUSEHOLD INFORMATION1. Number of individuals who will resi<strong>de</strong> in my/our household during the <strong>2010</strong>-2011 school year:School Name:City/State:School Name:City/State:School Name:City/State:School Name:City/State:School Name:City/State:2. Current marital status/housing arrangement of Parent/Guardian A:E<strong>Form</strong> #003 (2009)Parents/Guardians ___________ Children ___________ Other* ___________*If Other, please explain relationship to Parent _ ________________________DIVORCED, SEPARATED OR SINGLE PARENTS (TO BE COMPLETED BY PARENT OR GUARDIAN LISTED IN SECTION A)1. Date of separation (Month/Year) ____________________________________________________________________________________2. Date of divorce (Month/Year) _________________________________________________________________________________________3. Non-custodial parent _____________________________________________________________________________________________________Last Name First Name MI4. Do you receive or pay child support? o Receive $______________________ per yearo Pay $__________________________ per yearo Neithera. o Single, never Married* d. o Divorced* g. o Residing w/Significant Otherb. o Married e. o Remarried* h. o Other:______________c. o Widowed f. o Separated* ______________________5. Who claimed stu<strong>de</strong>nt as a tax <strong>de</strong>pen<strong>de</strong>nt in 2009? ____________________________6. Who is responsible for the tuition for the <strong>de</strong>pen<strong>de</strong>nt(s) listed in Section C?o Fathero Mother*If Divorced, Remarried, Separated or Single, please complete Section E.% Name ____________________________________________________% Name ____________________________________________________o Other % Name ____________________________________________________ **If tuition is shared, each responsible party must complete a <strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong> (SAF).

FTAXABLE INCOMEThe 2009 fe<strong>de</strong>ral tax return for stu<strong>de</strong>nt’s household was:o Filedo Not filed yet (See Required Documentation section)o I/we do not file. I/we only receive non-taxable income1. Total number of exemptions claimedon Fe<strong>de</strong>ral Income Tax form:2. Parent/Guardian A total taxableincome from W-2 wages.(List total income for Parent A only)3. Parent/Guardian B total taxableincome from W-2 wages.(List total income for Parent B only)Actual 2009 Estimate <strong>2010</strong>$ ______________ $ _____________$ ______________ $ _____________4. Net business income* from self-employment,farm, rentals, and other businesses.(*Go to Section K)(Attach Schedule C, E, and/or F from your IRS 1040) $ ______________ $ _____________See 2009 1040 lines 12, 17 and 185. Other non-work taxable income from interest,divi<strong>de</strong>nds, alimony, unemployment, and nonbusinessincome.See 2009 1040 lines 8a, 9a-11, 13, 14, 15b, 16b, 19-21See 2009 1040A lines 8a-14b6 Allowable “Adjustments to Income” as reportedon your IRS 1040, 1040A or 1040EZ.See 2009 1040 line 36 or 1040A line 207. Total “Adjusted Gross Income” as reportedon your IRS 1040, 1040A or 1040EZ.See 2009 1040 line 37 or 1040A line 218. Total Tax Paid as reported on yourIRS 1040, 1040A or 1040EZ.See 2009 1040 line 60 or 1040A line 379. Medical/<strong>de</strong>ntal expenses as reported onSchedule A line 1 of your IRS 1040 <strong>Form</strong>.GNON-TAXABLE INCOME$ ______________ $ _____________$ ______________ $ _____________$ ______________ $ _____________$ ______________ $ _____________$ ______________ $ _____________List the total amount received from 1/1/09-12/31/09 for all recipients in household.DO NOT list monthly amounts.HIHOUSING INFORMATION (DO NOT LEAVE BLANK)20. Do you rent or own your resi<strong>de</strong>nce? o Rent o Own (go to line 22)21. If renting, what is the monthly rental payment? $ _________________________________________________________a. Amount paid by household $ ______________________________________ per monthb. Amount paid by other source(s) $ ______________________________________ per month22. If you own your resi<strong>de</strong>nce:a. What is the current market value? $ ______________________________________________b. What is the amount still owed,including home equity loans?ASSETS & INVESTMENTS (AS OF 12/31/09)23. Total amount in cash, checking, and savings accounts $ __________________________________24. Total value of money market funds, mutual funds,stocks, bonds, CDs, or other securities25. Total value of IRA, Keogh, 401K, SEP or otherretirement accounts26. If you own real estate other than your primary resi<strong>de</strong>nce,$ ______________________________________________c. What is the monthly mortgage payment? $ ______________________________________ per month$ __________________________________$ __________________________________a. What is the fair market value? $ _______________b. What is the amount still owed? $ __________________________________27. Do you own a business? o Yes o NoIf Yes, please go to Section K.a. What is the fair market value of your business? $ __________________________________b. What is the amount still owed? $ __________________________________28. Do you own a farm? o Yes o NoIf Yes, please go to Section K.a. What is the fair market value of your farm? $ __________________________________10. Child support $ ______________________________ per year11. Cash Assistance (TANF) $ ______________________________ per year*12. Food Stamps $ ______________________________ per year*a. Medicaid received in 2009? o Yes o No13. Social Security income (SSA/SSD, etc.)(Provi<strong>de</strong> documentation for all recipients in household.)a. Social Securtiy income (SSI ONLY)(Provi<strong>de</strong> documentation for all recipients in household.)14. <strong>Stu<strong>de</strong>nt</strong> loans and/or grants received for PARENT’s education.(Not college attending <strong>de</strong>pen<strong>de</strong>nts or stu<strong>de</strong>nts listed in Section C.)a. total received in 2009 $$ ______________________________ per year*$ ______________________________ per year*b. total used for household expenses $ ______________________________ per year*15. Housing Assistance (Sec. 8, HUD, etc.) $ ______________________________ per year*a. Religious Housing Assistance(parsonage, manse, etc.)$ ______________________________ per year*16. Other non-taxable income (Workers’ Comp., Disability,Pension/Retirement, etc. I<strong>de</strong>ntify source(s) in Section L) $ ______________________________ per year*17. Loans/Gifts from friends or relatives $ ______________________________ per year18. Personal Savings/Investment Accounts usedfor household expenses(Do not inclu<strong>de</strong> totals listed in Section I)$ ______________________________ per year19. Total non-taxable income for 2009 $____________________________ per year*You must provi<strong>de</strong> 2009 YEAR-END documentation for items 11-16; either a Year-EndStatement from the appropriate Public Agency, or documentation showing totals from1/1/09 - 12/31/09.JGo to next page _b. What is the amount still owed? $ __________________________________UNUSUAL CIRCUMSTANCESCheck all that apply to your situation within the past 12 months:a. o Loss of job i. o Death in the familyb. o Recent separation/divorce j. o Shared custodyc. o Change in family living status k. o High <strong>de</strong>btd. o Change in work status l. o Child support reductione. o Bankruptcy m. o Medical/Dental expensesf. o College expenses n. o Shared tuitiong. o Income reduction o. o Other (Explain in Section L)h. o Illness or injury

Parent/Guardian A: SS# – –KLPrint NameBUSINESS INCOME ESTIMATE (2009 TOTALS)(If you have not filed your 2009 Tax Return, and are Self-Employed, Own a Business, Rental Property and/or Farm DO NOT LEAVE BLANK)Schedule C Schedule E Schedule F1. What is your total estimated GROSS business taxable income? $_____________ $_____________ $_____________2. What is your total NET business taxable income/loss? $_____________ $_____________ $_____________3. If your business pays your home rent or mortgage, what is the annual total? $_________________________4. If your business pays for your personal automobile, what is the annual total? $_________________________5. If your business pays any portion of other personal expenses, list total amount and explain in SECTION L. $_________________________6. If you own rental property: What was the total amount of Rental Income received? $_________________________EXPLANATIONS (USE THIS SPACE TO EXPLAIN ANY ANSWERS WHICH MAY NEED CLARIFICATION)M CERTIFICATION, AUTHORIZATION AND DOCUMENTATION CHECKLISTWHAT IS NEEDED TO PROCESS THIS APPLICATION(IF ANY OF THE FOLLOWING IS MISSING, YOUR APPLICATION WILL NOT BE CONSIDERED COMPLETE)1. This application form filled out in its entirety, signed and dated below by the Parent or Guardian listed in Sections A and B.2. A check or money or<strong>de</strong>r ma<strong>de</strong> payable to PRIVATE SCHOOL AID SERVICE in the amount of $21.00. This is a non-refundable application fee.3.SIGN HEREI/we <strong>de</strong>clare that the information on this form is true, correct, and complete to the best of our knowledge. I/we authorize PRIVATE SCHOOL AID SERVICE to return this form and allattachments only to the schools and agencies named in Section C un<strong>de</strong>r contract with PSAS._If you have filed a2009 IRS form 1040:A complete photocopy of your 2009 <strong>Form</strong> 1040, 1040A,or 1040EZ (as filed with the IRS, including all Schedules).2009 W-2 <strong>Form</strong>s, 2009 1099/1099R, or 1098 <strong>Form</strong>s for anywage-earning adult residing with the applicant(s).If you have NOT YET filed a2009 IRS <strong>Form</strong> 1040:A complete photocopy of your most recent <strong>Form</strong> 1040, 1040Aor 1040EZ (as filed with the IRS, with all Schedules). 2009W-2 <strong>Form</strong>s, 2009 1099/1099R, or 1098 <strong>Form</strong>s for any wageearningadult residing with the applicant(s). If this applicationis submitted after April 15, <strong>2010</strong>, you must provi<strong>de</strong> a copy ofthe 2009 Extension for Filing Request, as approved by the IRSand a copy of your last filed tax return.If you DO NOT FILE aN IRSform 1040 AND RECEIVE ONLYNON-TAXABLE INCOME:Photocopies of your 2009 YEAR-END Social Services statement(TANF, etc.), Food Stamp documentation, Housing Assistancedocumentation, <strong>Stu<strong>de</strong>nt</strong> Loans and/or grant documentation forparent’s education, Social Security income statements showingTOTAL AMOUNT received in 2009 for ALL members of thehousehold.Parent/Guardian A ____________________________________________________________________________________ Date ______________________ Parent/Guardian B __________________________________________________________________________________ Date ____________________This <strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong> (SAF), all attachments and an analysis of your SAF are sent only to the school(s) or agencies contracting with PSAS.You will not receive results from PSAS. No other agency will see or receive any information about this application or its attachments.Mail to: PRIVATE SCHOOL AID SERVICE, P.O. Box 770728, Lakewood, Ohio 44107-0034Copyright ©2009 Private School <strong>Aid</strong> Service

Detach herePRIVATE SCHOOL AID SERVICE (PSAS) is un<strong>de</strong>r contract with the school, schoolsystem, or organization from which you obtained this application for tuitionassistance. Our purpose is to provi<strong>de</strong> a reasonable assessment of the ability ofeach family to pay for the education of their children at private and in<strong>de</strong>pen<strong>de</strong>ntelementary and secondary schools.Your <strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong>, all attachments, and an analysis of your SAF are sent onlyto the school(s) or agencies contracting with PSAS. No other agency will receiveany information about this application or its attachments.PRIVATE SCHOOL AID SERVICE does not make any <strong>de</strong>cisions about recipients andamounts of financial aid awar<strong>de</strong>d. Recipients and amounts of aid are <strong>de</strong>terminedby the <strong>de</strong>signated school or agency. YOU WILL NOT RECEIVE RESULTS FROMPRIVATE SCHOOL AID SERVICE.A & BThis form should be filled out by the parent, guardian or other adult responsiblefor the tuition of the child or children attending a private or in<strong>de</strong>pen<strong>de</strong>nt schoolcontracting with PSAS. If the parents/guardians are divorced or separated, onlythe parent responsible for the tuition and any other adult residing in the householdshould fill out the form. If tuition is shared, each responsible party must completea <strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong> (SAF) if financial aid is nee<strong>de</strong>d.Answer all questions for both parent(s), stepparent(s), or guardian(s) responsiblefor tuition for the <strong>de</strong>pen<strong>de</strong>nt(s) listed in Section C. Do not leave any questionsblank. If natural parents are divorced, separated or single, answer all questions inSection E. If natural parents are divorced/separated and remarried, list informationfor custodial parent and new spouse. If either parent answers “self-employed,” andhas not filed a tax return, complete Section K.CALCULATIONS ARE BASED ON TOTAL HOUSEHOLD INCOME.CList all <strong>de</strong>pen<strong>de</strong>nt children residing in your household in or<strong>de</strong>r of ol<strong>de</strong>st toyoungest. Indicate the relationship to Parent/Guardian A listed in Section A of theapplication (i.e. child, grandchild, foster child, stepchild, etc.). If your <strong>de</strong>pen<strong>de</strong>ntswill be enrolled in any tuition charging school or agency next fall (includingdaycare, preschool, elementary school, high school, college, or tra<strong>de</strong> school), listthe name of the school, city and state where the school is located. List the gra<strong>de</strong> yourchild(ren) will enter next fall (<strong>2010</strong>-2011); the amount you feel you can pay towardtuition per year, and the amount of tuition charged per stu<strong>de</strong>nt per year.PSAS will consi<strong>de</strong>r all stu<strong>de</strong>nts listed in Section C with a check in the“Yes” box for tuition assistance at any school or agency un<strong>de</strong>r contract withPSAS. If the “No” box is checked, that stu<strong>de</strong>nt will not be consi<strong>de</strong>red. For alladditional <strong>de</strong>pen<strong>de</strong>nts, use a separate sheet.NOTE: The information regarding tuition charged per stu<strong>de</strong>nt assistsPSAS in making the most equitable analysis of your ability to pay for privateeducation. If you are unsure, please estimate.DINTRODUCTIONINSTRUCTIONSPARENT, GUARDIAN OR OTHER ADULTSTUDENT INFORMATIONHOUSEHOLD INFORMATIONITEM 1: Enter total number of individuals living in household. Inclu<strong>de</strong> any collegestu<strong>de</strong>nts claimed on the tax return. Do not inclu<strong>de</strong> children who have moved outof the home. Inclu<strong>de</strong> all family members <strong>de</strong>pen<strong>de</strong>nt on and residing with parentlisted in Section A.ITEM 2: Check the appropriate box indicating custodial parents’ marital status. Ifparents are divorced, separated or single, complete Section E.EDIVORCED, SEPARATED OR SINGLE PARENTSIf <strong>de</strong>pen<strong>de</strong>nt(s) parents are divorced or separated, or do not resi<strong>de</strong> in the samehousehold, the custodial parent must provi<strong>de</strong> the information requested in SectionE about the non-custodial parent.If the date of separation took place in the year 2009, PSAS will require copiesof any tax returns filed jointly or in<strong>de</strong>pen<strong>de</strong>ntly by both parent(s)/guardian(s) for2009. Be sure to estimate the income in Section F for <strong>2010</strong>.ITEM 4: List the total amount of child support actually received by custodial parentslisted in Sections A & B. If total received differs from court or<strong>de</strong>red amount, list onlythe total received.ITEM 6: Indicate who is responsible for tuition and what percentage for the <strong>de</strong>pen<strong>de</strong>ntslisted in Section C.FTAXABLE INCOMEList all actual amounts for 2009 and estimated amounts for <strong>2010</strong>.ITEM 1: Enter the total number of exemptions you claimed on your 2009 IRS <strong>Form</strong>1040, 1040A, or 1040EZ.ITEM 2: Enter the total 2009 taxable income earned in wages, salaries and tips forparent/guardian/other listed in SECTION A. Attach all copies of 2009 W-2 formsand/or 2009 1099 forms from all employers.ITEM 3: Enter the total 2009 taxable income earned in wages, salaries and tips forparent/guardian/other listed in SECTION B. Attach all copies of 2009 W-2 formsand/or 2009 1099 forms from all employers.ITEM 4: Enter the total net income from business (attach Schedule C or C-EZ),all rents, royalties, partnerships (attach Schedule E), and all farm income or loss(attach Schedule F). If you have received income from any of these sources andare estimating your income for 2009, you must also fill out Section K of thisapplication. (See 2009 1040 lines 12, 17 and 18, enter sum total.)ITEM 5: Enter the total of all other taxable income from interest, divi<strong>de</strong>nd income(attach Schedule B if over $400), taxable refunds, credits or offsets of state and localincome taxes, alimony received, capital gain or loss (attach Schedule D). List allcapital gain distributions not previously reported, total IRA distributions (if rolledover,explain in Section L), pensions and annuities, unemployment compensation,taxable social security benefits, and any other taxable income. Attach copies of all<strong>Form</strong> 1099/1099R, and/or <strong>Form</strong> 1098 for Interest/Divi<strong>de</strong>nds, Pensions/Annuitiesor other misc. income. Attach copies of Social Security Income statements andUnemployment Compensation documentation for year-end 2009. (See 2009 1040lines 8a, 9a-11, 13, 14, 15b, 16b, 19-21 or 1040A lines 8a-14b, enter sum total.)ITEM 6: Enter allowable adjustments to income, such as IRA payments, selfemploymenttax, self-employed health insurance <strong>de</strong>duction, Keogh retirement planand self-employed SEP <strong>de</strong>ductions, penalty on early savings withdrawals, and alimonypaid. Add together to arrive at your total adjustments. DO NOT inclu<strong>de</strong> your standard<strong>de</strong>duction or <strong>de</strong>duction amounts for each family member. (See 2009 1040 line 36 or1040A line 20.)ITEM 7: Enter total adjusted gross income as reported on your IRS <strong>Form</strong> 1040, 1040Aor 1040EZ. Attach all pages of the applicable tax form (1040, 1040A, 1040EZ) fordocumentation. (See 2009 1040 line 37 or 1040A line 21.)ITEM 8: Enter the Total Tax paid (not withheld) as reported on your IRS <strong>Form</strong> 1040,1040A, or 1040EZ. (See 2009 1040 line 60 or 1040A line 37.)ITEM 9: Enter the total of any medical and <strong>de</strong>ntal expenses reported on Schedule Aline 1 of your IRS <strong>Form</strong> 1040 (attach Schedule A).

GIf you receive non-taxable income, you must list and provi<strong>de</strong> documentation of theTOTAL YEARLY AMOUNTS received in 2009 for all recipients in the household for thefollowing: Cash Assistance (TANF), Food Stamps, Social Security income, <strong>Stu<strong>de</strong>nt</strong> loansand/or grants (received for PARENT’s education), Housing assistance (Section 8, HUD,etc.), Worker’s Compensation, Disability or Retirement.ITEM 10: Child support: Report total amount received for 2009 for all children in thehousehold.ITEM 11: Cash Assistance (TANF): Report total amount received for 2009.ITEM 12: Food Stamps: Report total amount received for 2009. Do not combine withTANF or Medicaid.ITEM 12a: Did you receive Medicaid in 2009?ITEM 13: Social Security benefits: Report the total non-taxable (SSA/SSD, etc) amountreceived in 2009 for all recipients in household.ITEM 13a: Social Security benefits: Report the total non-taxable (SSI ONLY) amountreceived in 2009 for all recipients in household.ITEM 14: <strong>Stu<strong>de</strong>nt</strong> loans and/or grants: Report the total amount received in 2009 forPARENT’S education. Do not list loans, grants or scholarships received for <strong>de</strong>pen<strong>de</strong>ntsin Section C. I<strong>de</strong>ntify how much of this income was used for household expenses in2009.ITEM 15: Housing assistance: Report the total amount received for 2009. I<strong>de</strong>ntify inSection L all sources of Housing assistance (government assistance, Section 8, HUD,family/friends or other sources), including monies received toward rental/mortgagepayments and/or utilities.ITEM 15a: Religious Housing assistance: Report the total amount received for 2009.ITEM 16: Other non-taxable income: Report all additional non-taxable income receivedin 2009 including: Deductible IRA or Keogh payments; untaxed portions of pensions;tax exempt interest income; foreign income exclusion; Workers’ Compensation; veteransnon-education benefits (Death Pension, Depen<strong>de</strong>ncy and In<strong>de</strong>mnity Compensation,etc.); food and other living allowances paid to members of the military, clergy orothers; cash support or any money paid on your behalf, including support from a noncustodialparent or any other person (do not inclu<strong>de</strong> court or<strong>de</strong>red support here); or anyother untaxed benefit or income not subject to taxation by any government (RefugeeAssistance, VA Educational Work-Study, etc.). I<strong>de</strong>ntify source(s) in Section L.ITEM 17: Loans/Gifts received from friends or relatives: Report the total amountreceived in 2009.ITEM 18: Personal Savings/Investment Accounts: Report the total amount used in 2009for household expenses.ITEM 19: Total non-taxable income for 2009: Add together Items 10-18.HITEM 20 and 21: If you rent your home or apartment, list your monthly rental or lease paymenthere, including amounts paid by household and other sources.ITEM 22a: Determine the present value of the family home and list it. Local real estateagents should be able to help you if you are unsure.ITEM 22b: Check with your lending institution and enter the amount still owed, includingsecond mortgages.INON-TAXABLE INCOMEHOUSING INFORMATIONASSETS AND INVESTMENTSITEM 23: List total of current balances in cash, savings, and checking accounts. Do notinclu<strong>de</strong> IRAs or Keoghs.ITEM 24: List total current market value of money market funds,mutual funds, stocks, bonds, CDs or other securities.ITEM 25: List total current market value of all retirement funds, including IRA, Keogh,401K, and SEP plans or other retirement accounts.ITEM 26: Answer Items 26a and 26b for any and all investment real estate (not includingthe family’s primary resi<strong>de</strong>nce), if applicable. Second homes, rental properties, and landcontracts should be inclu<strong>de</strong>d.ITEM 27: If you own a business, check the Yes box and answer Items 27a and 27b. Ifyou have not filed your 2009 tax return, complete Section K of this application.ITEM 28: If you own a farm, check the Yes box and answer Items 28a and 28b.If you have not filed your 2009 tax return, complete Section K of this application.JCheck any and all items that apply to your situation. If your circumstances requireexplanation beyond the scope of this application, please notify the school to which youare applying. Do not inclu<strong>de</strong> a letter of explanation with this application.KProvi<strong>de</strong> 2009 Business Income Estimates if you have not filed your 2009 Tax Return.ITEM 1: List estimated total GROSS taxable business income for 2009.ITEM 2: List estimated total NET taxable business income/loss for 2009.ITEM 3: List the total amount paid by business in 2009 for home rent or mortgage.ITEM 4: List the total amount paid by business in 2009 for personal automobile.ITEM 5: List the total amount of personal expenses paid by business in 2009 that do notfall into one of the categories above.ITEM 6: List total amount of estimated rental income received in 2009.If providing income estimates for more than one business, corporation or farm (ScheduleC, Schedule E and/or Schedule F) please list information for each business, corporationor farm separately. Use additional sheet or Section L, if necessary.LUNUSUAL CIRCUMSTANCESBUSINESS INCOMEEXPLANATIONIf any specific question requires clarification, write a brief explanation in this space. If yourcircumstances require explanation beyond the scope of this application, please notify theschool to which you are applying.M PARENTS’ CERTIFICATION, AUTHORIZATION,AND DOCUMENTATION CHECKLISTYou must sign the form in this section. Your signature authorizes PSAS to release theform and attachments to the contracting schools indicated in Section C. By signing theform, you also certify that the information submitted is correct. This application CANNOTbe processed without the appropriate signature(s) and the appropriate documentation.REQUIRED DOCUMENTATIONIf you have filed your 2009 IRS <strong>Form</strong> 1040:You must submit photocopies of all pages of your 2009 Fe<strong>de</strong>ral Tax Return <strong>Form</strong> 1040,1040A or 1040EZ (as filed with the IRS, with all Schedules, 2009 W-2 <strong>Form</strong>s, 20091099/1099R, or 1098 <strong>Form</strong>s for any wage-earning adult residing with the applicant(s).Do not inclu<strong>de</strong> your State tax return unless requested.If you have not filed your 2009 IRS <strong>Form</strong> 1040:You must submit photocopies of all 2009 W-2 <strong>Form</strong>s, 2009 1099/1099R, or 1098 <strong>Form</strong>sfor any wage-earning adult residing with the applicant(s), and photocopies of all pagesof your most recent Fe<strong>de</strong>ral Tax Return <strong>Form</strong> 1040, 1040A or 1040EZ (as filed with theIRS, with all Schedules). If this application is submitted after April 15, <strong>2010</strong>, you mustprovi<strong>de</strong> a copy of the 2009 Extension for Filing Request, as approved by the IRS.If you are an In<strong>de</strong>pen<strong>de</strong>nt Contractor or self-employed and have not filedyour 2009 IRS <strong>Form</strong> 1040:You must complete Section K and submit photocopies of all pages of your mostrecent Fe<strong>de</strong>ral Tax Return <strong>Form</strong> 1040, 1040A or 1040EZ (as filed with the IRS, with allSchedules), 2009 W-2 <strong>Form</strong>s, 2009 1099/1099R, or 1098 <strong>Form</strong>s for any wage-earningadult residing with the applicant(s). If this application is submitted after April 15,<strong>2010</strong>, you must provi<strong>de</strong> a copy of the 2009 Extension for Filing Request, as approvedby the IRS.If you receive non-taxable income:You must submit photocopies of your 2009 YEAR-END (01/01/09 - 12/31/09) CashAssistance documentation (TANF, etc.), Food Stamp documentation, Housing Assistancedocumentation, <strong>Stu<strong>de</strong>nt</strong> loan and/or grant documentation (for PARENT’s education),Social Security Income statements, showing the TOTAL AMOUNT received in 2009for ALL members of the household. If you list any total for line 16, you must i<strong>de</strong>ntifysource(s) in Section L.

ALONG WITH YOUR APPLICATION YOU MUST INCLUDE:Copies of your 2009 1040, 1040A or1040EZ form (all pages)Documentation Checklisto Copies of all pages of your 2009 IRS <strong>Form</strong>1040, 1040A or 1040EZ including allSchedules.o Copies of all W-2 and 1099 forms forindividuals listed in Sections A and B.(All documentation should be copied on regular8 1 ⁄2 x 11 paper)o A check or money or<strong>de</strong>r for $21.00 ma<strong>de</strong>payable to PRIVATE SCHOOL AID SERVICE.(All returned checks will incur an additionalfee of $25.00)o A self-addressed stamped postcardor envelope if you require notificationthat PSAS has received your application(PSAS will not return any documentation).o Copies of all required non-taxable incomedocumentation.Copies of all 2009 W-2 formsFROM ALL EMPLOYERSCopies of all 2009 1099 forms(where applicable)If you do not have all of the documentation required:Contact the IRS for a transcript of your complete 1040, 1040A or 1040EZ, and any Schedules, etc.Contact your employer for a copy of your W-2. Contact the appropriate company for a copy of your 1099.

The most common error that applicants make is sending the application incomplete.In or<strong>de</strong>r for an application to be reviewed, it must inclu<strong>de</strong>:• All pages of your 2009 IRS <strong>Form</strong> 1040, 1040A, or 1040EZ (fe<strong>de</strong>ral income tax return). Do not send your state tax return, recap or tax summary.(If you have not yet filed your 2009 IRS <strong>Form</strong> 1040, or you do not file, please see the Required Documentation section of the instructions.)• 2009 W-2 and/or 1099 forms for individual(s) listed in Sections A and B (Please make sure all documentation is copied on regular 8 1 ⁄2 x 11 paper).• Non-taxable income verification.• A check or money or<strong>de</strong>r for the non-refundable application fee of $21.00. All returned checks will be subject to an additional $25.00 fee.PPPPPPPAVOIDING THE MOST COMMON ERRORSPrint clearly and neatly with a black or dark ball point pen.Make a photocopy of your completed <strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong> for your records.Do not staple ANYTHING to the <strong>Stu<strong>de</strong>nt</strong> <strong>Aid</strong> <strong>Form</strong>.Submit the original application only.Affix proper postage to the envelope (applications without sufficient postage will be returned by the post office).If you would like to receive notification that PRIVATE SCHOOL AID SERVICE has received your application, enclose a self-addressedstamped postcard or envelope with your application.Do not send any original documents. Originals will not be returned.PSAS CANNOT PROCESS YOUR APPLICATION IF YOU HAVE NOT INCLUDEDTHE REQUIRED DOCUMENTATION AND application fee.OTHER COMMON ERRORSSECTIONS A & BList the parent, guardian or other adult responsible for tuition and anyother adult residing in the household. Complete each section in its entirety,including age, social security number, and name of employer. If you are selfemployed,check the box and refer to Section K.SECTION CList all <strong>de</strong>pen<strong>de</strong>nt children, including college stu<strong>de</strong>nts, in or<strong>de</strong>r of ol<strong>de</strong>st toyoungest. If any <strong>de</strong>pen<strong>de</strong>nts will attend a tuition charging school next fall, fillin all columns for those children.SECTION DThis section should inclu<strong>de</strong> the total number of parents, children and otherindividuals residing in the household. Any household member listed as“Other” should be i<strong>de</strong>ntified, using Section L if necessary for explanation.SECTION EThis section should be completed by the custodial parent with informationabout the non-custodial parent.SECTION FAnswer Items 1–9 for BOTH 2009 and <strong>2010</strong>. YOU MUST inclu<strong>de</strong>documentation of all income received by both parents/guardians residingwith the applicant(s). If you are divorced or separated and receive childsupport, list the yearly amount in Section G Item 10.SECTION GList the YEARLY amounts received for Items 10-19. Remember, do not listmonthly amounts.SECTION HIf you rent your home, list your monthly rental payment, including anypayments ma<strong>de</strong> by sources other than the household. If you own yourhome, answer Items 22a, b, and c.SECTION IEnter the totals for Items 23, 24, and 25 based on your investment, savings,and/or checking statements. If you own rental or investment property,answer Items 26a and 26b. You must inclu<strong>de</strong> Schedule E from yourIRS <strong>Form</strong> 1040.If you answered “Yes” to Items 27 or 28 and are estimating 2009 income,complete Section K of the application. You must inclu<strong>de</strong> Schedule C, E and/orSchedule F from your IRS <strong>Form</strong> 1040.SECTION JCheck boxes for any unusual or relevant circumstances which affect theapplicant. If you feel that your circumstances require explanation beyond thescope of this application, please notify the school to which you are applying.Do not inclu<strong>de</strong> a letter of explanation with this application.SECTION K (If estimating 2009 income)Answer each question that pertains to your estimated income.SECTION LIf you feel that any specific question requires clarification and/or anexplanation, write a brief summary in the space provi<strong>de</strong>d.SECTION MConfirm that you have attached ALL REQUIRED DOCUMENTATION and thatyou have signed the application.Detach here