February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GRUPPO CARIGEProgramme andCovered Bond IssueInvestor PresentationObbligazioni <strong>Banca</strong>rie Garantite<strong>February</strong> <strong>2011</strong>GRUPPO CARIGE 1

Executive Summary<strong>Banca</strong> <strong>Carige</strong> Ratings: A2/P1 Moody’s, A/F1 Fitch, A-/A2 S&P Among the top 10 Italian banking Groups Adequate capital ratios Excellent / long standing mortgage origination and servicing historyItalian MortgageMarket Low level of indebtedness by households High home ownership of the Italian households Property values’ volatility much lower than in other European countriesOBGProgrammeCollateralCharacteristics Italian legislative covered bond: Obbligazioni <strong>Banca</strong>rie Garantite (“OBG”) Triple A expected rating (Moody’s, Fitch Ratings) Benefits from 20.7% currently committed over-collateralisation 97.2% Italian prime residential mortgages, 2.8% Italian commercialmortgages all originated by <strong>Gruppo</strong> <strong>Carige</strong> Eligible mortgage loans, as per Italian OBG law All loans are performing High concentration in the North of Italy (80%) Highly seasoned portfolio (249.6 Months Weighted Average term atmortgage granting) WA LTV: 51.36% (Residential) and 23.28% (Commercial)GRUPPO CARIGE 2

Table of ContentsIssuer descriptionItalian mortgage market<strong>Gruppo</strong> <strong>Carige</strong>’s mortgage business<strong>Banca</strong> <strong>Carige</strong> OBG ProgrammeCover Pool DescriptionAnnexe : Italian OBG Law vs. European Covered Bond FrameworkGRUPPO CARIGE 3

<strong>Banca</strong> <strong>Carige</strong> Group todayFondazione CRGenova e ImperiaBPCE SAAssicurazioniGeneraliFloating~50,000 smallshareholders44.06% *14.98% *2.97% *37.99% *<strong>Banca</strong> <strong>Carige</strong> SpACassa di Risparmio di Genova e ImperiaBanking• <strong>Banca</strong> <strong>Carige</strong>• CR Savona• CR Carrara• BM Lucca• B. Cesare PontiInsurance• <strong>Carige</strong> Vita Nuova (life)• <strong>Carige</strong> Ass.ni (non life)Finance• <strong>Carige</strong> AM SGR• Creditis (Consumercredit)Trustee• Centro FiduciarioMain Companies Only6,008EMPLOYEES1.9 M CUSTOMERS(1.2 M BANKING; 0.7M ASSURANCE)667 BRANCHES &428 INSURANCE OUTLETS858 CONSULTANTSEQUITY3.5 € BILLION*Holding calculated on the basis of ordinary sharesShort term credit rating: P-1Long term credit rating: A2Outlook:NegativeShort term credit rating:Long term credit rating:Outlook:F1AStableShort term credit rating: A2Long term credit rating: A-Outlook:NegativeOperational and accounting data as at 30 September 2010GRUPPO CARIGE 4

Among the top Italian banking Groups35,630,5Market Cap (1) (€b)• Ordinary shares 2.7 €b• Savings shares 0.5 €b#5969677Total Assets 3Q10 (€b)#85,1 4,7 3,3 2,4 2,0 1,7 1,7 1,3 0,8243136 13258 52 40 29 26 25(1) Data as at 10 <strong>February</strong> 2010Branch Network 3Q10 (#)C/I (%) 3Q109,585#57,669#856.2% 57.4% 59.3% 60.3% 62.2% 64.2% 66.3% 69.0% 70.0% 74.4% 76.6%2,9802,178 1,8991,292782 667 563 540 305Source: Companies dataOperational data and accounting data (3Q10 report)GRUPPO CARIGE 5

Sound capital ratiosT1R minT1R recommendedT1R <strong>Carige</strong> GroupTCR minTCR recommended12,00%10,00%8,00%6,00%4,00%10,03%7,87%7,06%9,31%6,84%6,07%3Q10 including the fullconversion of theconvertible bonds atcurrent share priceTCR 10.6%T1R 8.1%CT1R 7.4%TCR <strong>Carige</strong> GroupCT1R <strong>Carige</strong> Group2,00%2005 2006 2007 2008 2009 Sept 2010 (*)(*) Operational dataT1R and TCR recommended: refer to the level of Tier 1 Ratio and TotalCapital Ratio that large Italian Groups are requested to achieve and maintainby the Bank of Italy8.6%Core Tier 1 ratio (%) 3Q10 - Comparison7.7% 7.4% 6.3%8.0%6.1%9.5% 8.8% 8.1% 7.6% 7.3% 7.2% 6.1% 5.7% 5.3% 4.9% 3.4%DTA (Deferred Tax Assets)T Bonds (Tremonti Bonds): securities issued by someItalian banks, subscribed by the Italian State in orderto improve capitalisationCT1R excluding DTA adj and T BondsCT1RSource: Companies dataGRUPPO CARIGE 6

€mCustomer based funding and no pressure on liquidityFunding3Q10€m %Interbank deposits 2,202.3 7.7money market depositsand current accounts 1,837.3 6.4other deposits 365.0 1.3Customer deposits 22,869.1 79.7short term deposits 15,757.9 54.9medium/long term deposits24.8and domestic bonds 7,111.2EMTN programme 903.8 3.1shuldsheine 50.0 0.2bonds 853.8 3.0Subordinated and convertible bonds 964.8 3.4Securitisation 262.1 0.9RMBS performing securities 262.1 0.9Covered Bonds 1,509.0 5.3Change3Q10/3Q09+8.1%600500400Interbankdeposits8%CoveredBonds5%Securitisation1%Subordinatedloans3%EMTNprogramme3%New issues for 2 €bover the last 12months)Retail bondsCustomerdeposits80%TOTAL FUNDING 28,711.0 100.0Funding includes also:-€79.8 million from the securitization ArgoMortgage carried out in 2001, derecognisedin the financial statement pursuant to theexemption allowed by IFRS 1 on first timeadoption300200100-Medium/long term deposits and bonds includeconvertible bonds for 379€m (net of costs)issued bondsmatured bondsData as at Dec 2010Operational data and accounting data (3Q10 report)GRUPPO CARIGE 7

Diversified loan book...by segmentby area (*)PublicEntities3.8%SME38.0%Other9.9%Private &Affluent2.4%MassMarket27.1%SmallBusiness9.7%LargeCorporate9.1%¾ of loanstoretailcustomersCentre20.6%North35.6%South &Islands6.0%Liguria37.8%(*) by customers’ residenceby maturityby sectorshort term24%NPL4%m/l term72%mortgage loans toindividuals39%public entities3%consumer credit5%loans to corporate53%Shippingand airtransport3,0%Hotel andcateringservices4,9%Other26,4%Wholesale& retailtrade,salvageand repairs15,4%Buildingand publicworks17,1%Salesrelatedservices33,2%Small business = turnover< 1 m€; SMEs= 100 m€Mass Market: total deposits < 80 k€, Affluent > 80 k€, Private > 500 k€LOANS TO CUSTOMERS 3Q10 : 24.2 €bnNon-financial businesses and personalbusinesses (total 14.2€b) by sectorOperational and accounting data (3Q10 report )GRUPPO CARIGE 8

with sound credit qualityBreakdown of impaired loans (€m)3Q10 Gross Adj. Net CoveragePerforming loans 22.008 70 21.937 0,3%Impaired loans 2.145 555 1.590 25,9%NPL (Sofferenze) 1.040 480 560 46,1%Watchlist (Incagli) 586 64 522 11,0%Rescheduled (Ristrutturati) 128 3 124 2,6%Past due (Scaduti) 391 8 383 2,0%Total loans to customers 24.153 626 23.527 2,6%Impaired loans 3Q10Comparison wih the System (€m)<strong>Carige</strong> Group (Sept10 - Impaired loans 2.1 €b)836924991 1,040622586499408 444474 498442474391242132 130 130 1285annualised 3Q10 FY09Cost of risk 0,5% 0,4%Impaired loan ratio7.4%8.2% 8.9%6.2% 6.0%4.1% 4.6%5.5% 6.3% 6.8%Dec 07 Dec 08 Sept 09 Dec 09 Sept 10NPL ratio4.3%3.6%3.6% 3.6%2.9%2.4%2.0%1.6%2.0%1.4%Dec 07 Dec 08 Sept 09 Dec 09 Sept 10(*) Source: ABI Monthly Outlook, November 2010GrossNetSystem4.4% (*)GrossNetDec 08 Dec 09 Mar 10 June 10 Sept 10System (June 10 - Impaired loans 146 €b)69,45764,79860,24242,79149,141 51,30751,85033,2869,2901,70515,759 13,449 13,8687,697 9,234 10,844Dec 08 Dec 09 Mar 10 June 10Source: Bank of Italy<strong>Carige</strong>ChangeDec09/Dec 08 Sept10/Sept09 Mar10/Dec09 June10/Mar10 Sept10/June10NPL 34,4% 32,7% 10,5% 7% 5%Watchlist 8,7% 27,5% -0,5% 12,9% 17,6%Rescheduled 2442,3% 10,8% -1,7% 0,4% -2,1%Past due 95,7% 54,2% 4,9% -4,8% -17,5%Impaired loans 47,6% 33,0% 5,7% 5,0% 2,5%SystemChangeDec09/Dec 08 Sept10/Sept09 Mar10/Dec09 June10/Mar10 Sept10/June10NPL 40,8% 31,5% 7,6% 7,2% 6,2%Watchlist 47,6% 14,4% 4,4% 1,1% 1,1%Rescheduled 351,4% 85,3% 20,0% 17,4% 8,8%Past due 69,6% 4,2% -14,7% 3,1% 10,5%Impaired loans 52,6% 24,7% 4,5% 5,2% 5,0%NPLWatchlistRescheduledPast dueOperational and accounting data (FY07 report – FY08 report - FY09 report 1Q10 report – 1H10 report – 3Q10 report)GRUPPO CARIGE 9

A diversified networkThe network todaynewbranchesex ISPbranchesex Unicreditbranchesex MPSbranchesFrance11/156/305 873/75 46/ 3928/ 21254/ 1479/22 5/122/9794064322266711/2439/ 38164269/3331375221989 2007 20092TODAY25100% 72%71%69%63/4896% 48%39%38%Banking branches 667Insurance outlets 433% of BranchesinNorthern Italy% ofBranchesin LiguriaGRUPPO CARIGE 10

Stable net profitNet profit (€m)ROE FY092007 2008 2009Change %08/07 09/08 09/07BPS 147 44 201 -70.4% 361.1% 36.5%CARIPARMA 295 297 311 0.7% 5.4% 5.4%CARIGE 205 206 205 0.3% -0.1% 0.3%BPVI 114 109 101 -4.4% -7.1% -11.2%CREVAL 86 101 76 17.2% -24.1% -11.2%BP 617 -333 267 … … -56.7%ISP 7,250 2,553 2,805 -64.8% 9.9% -61.3%CREDEM 249 157 89 -37.0% -43.4% -64.4%BPM 324 75 104 -76.8% 37.6% -68.0%BPER 374 134 116 -64.3% -13.4% -69.1%UBI 881 69 270 -92.2% 291.4% -69.3%UNICREDIT 6,506 4,012 1,702 -38.3% -57.6% -73.8%MPS 1,438 923 220 -35.8% -76.9% -84.7%12.6%8.4%7,2% ROE Adjusted*5,7% 5.6%4.1% 4.0% 3.7% 3.0% 2.9% 2.7% 2.4% 2.4% 1.5%(*) Net of AFS reserve for the revaluation of the stake in Bank of ItalySource : Companies dataAccounting data (FY07 report – FY08 report - FY09 report)GRUPPO CARIGE 11

3Q10 – Growth of Deposits and LoansTOTAL DEPOSITS (€b)GROSS LOANS TO CUSTOMERS (€b)+ 12.6%+ 10.2%+ 9.6% + 6.7%DIRECT DEPOSITS (€b)+12.7%+ 10.6%LOANSTO CUSTOMERSDIRECT DEPOSITS=91.3%of which:LOANS TO INDIVIDUALS (€b)+8.4%+ 3.3%INDIRECT DEPOSITS (€b)LOANS TO CORPORATES (€b)+12.6%+ 8.5%changechange net of ex MPSbranches’ contribution+9.2%+ 6.3%GRUPPO CARIGE Operational data and accounting data (3Q09 report – 3Q10 report) 12

3Q10 – Economic resultsNET PROFIT (€m)GROSS OPERATING INCOME (€m)-38.7%-4.9%COSTS (€m)of which:NET INTEREST INCOME (€m)1.1%-6%NET VALUE ADJUSTMENTS ONLOANS (€m)NET COMMISSIONS (€m)+38.3%+5.5%changeOperational data and accounting data (3Q09 report – 3Q10 report)GRUPPO CARIGE 13

Table of ContentsIssuer descriptionItalian mortgage market<strong>Gruppo</strong> <strong>Carige</strong>’s mortgage business<strong>Banca</strong> <strong>Carige</strong> OBG ProgrammeCover Pool DescriptionAnnexe: Italian OBG Law vs. European Covered Bond FrameworkGRUPPO CARIGE 14

The mortgage market in ItalyIn recent years the rapid growth in the mortgagemarket has slowed down and only in 2009 arecovery took place……partly in response to diminishing interest rates35030025020015010050017,4%12,5%8,5%8,8%6,1%-0,4%Dec-05 dic-06 dic-07 dic-08 dic-09 giu-1020%15%10%5%0%-5%stock (€ bn)annual growthThe Italian mortgage market has a limited size……and Italy shows the lowest mortgage debt-to-GDP ratio of any major Western European nation965753661347Italy France Germany SpainStock as at 30 September 2010 (€bn)70.0%60.0%50.0%40.0%30.0%20.0%10.0%0.0%62.5%37.5% 38.4%18.4%Italy France Germany SpainMortgage debt/GDP as at 31 Dec 09Sources: ECB, Bank of Italy, Agenzia del territorio, BOE, Bank of Spain, CentralBank of Ireland, NVM, <strong>Banca</strong> d'Italia, Bank of Greece, INE PortugalGRUPPO CARIGE 15

The Italian mortgage profileThe size of mortgage loans has been moderatelyrising over the years.4% 4% 4% 3% 4%16% 19% 18% 18% 19%52% 52% 51% 51% 52%23% 22% 23% 24% 22%5% 3% 4% 4% 3%2006 2007 2008 2009 1H10€m=500Most mortgages have floating rate.15% 9% 10% 14% 14%39%18%64%48%73%72%52%38%21%13%2006 2007 2008 2009 1H10fixed rate floating rate mixed rateSince 2009, also because of diminishing interestrates lenders have gradually reduced the mortgagetenorThe indirect channel has gradually gainedimportance, but since 2009 it has significantly lostground35% 43% 43% 38% 38%23%17% 18% 19% 21%22% 21% 21% 22% 21%13%7%12%7%12%6%13%8%13%7%2006 2007 2008 2009 1H1040% 40% 42%60% 60% 58%31% 28%69% 72%years=262006 2007 2008 2009 1H10direct channelindirect channelSources: Osservatorio AssofinGRUPPO CARIGE 16

ForecastItaly’s macroeconomic overview2009 2010E <strong>2011</strong>EGDP -5.1% 1.0% +0.9%Inflation rate 0.8% 1.5% 2.2%Unemployment rate 7.8% 8.5% 9.2%Loans +2.2% +4.7% +4.6%Direct deposits +7.8% +6.3% +3.9%Indirect deposits +4.8% +1.9% +5.5%Mortgage loans expected growthExpected bad loan ratio for mortgage loans15%4,0%10%3,5%5%0%-5%2006 2007 2008 2009 2010E <strong>2011</strong>E 2012Emortgage loans3,0%2,5%2,0%1,5%2007 2008 2009 2010E <strong>2011</strong>E 2012Ebad loan ratio for mortgage loansSources: Prometeia, CRIF, ABI, ISVAP, <strong>Carige</strong>GRUPPO CARIGE 17

House prices in ItalyOver years house prices in Italy show a more stable trend in comparison to other European countriesSince the late 90’s, property units on the Italian propertymarkets have increased constantly without anysignificant volatility.Since 2004 there have been some signs ofdeceleration in the dynamic of prices per square meter.According to the ECB, 2009 saw a slight decrease inresidential property prices (-0.5%).Europe: Nominal house prices yoy growth rates(source: EMF)The hypothesis of a fall in prices for residential propertyunits is improbable according to the majority of operatorsin the sector for the following reasons:Firstly, although there has been a significant increase inproperty values in Italy since 1997, it is among thelowest in the international context and this wouldseem to exclude the existence of prices artificially inflatedby speculation;Secondly there is no excess of supply over demand inItaly partly because of the scarcity of public sector socialhousing;% Change in Housing PricesEurope: Nominal house price index(source: EMF)Thirdly the ANCE (nationalassociation of propertybuilders) has underlined thatthere has been an increase inrefurbishment work inrecent years, a circumstancewhich confirms the need tocapitalise on the existingsupply;Low interest rates aresupportive of mortgageborrowing and housepurchases.Last 10 years (%)UK 107.23Spain 105.47Sweden 100.37Italy 77.36France 74.66Greece 67.42Denmark 64.83Netherlands 38.16Switzerland 35.82Sources: Global Property Guide, EMFGRUPPO CARIGE 18

Mortgage and RMBS SnapshotEuropean House PricesEuropean Late Stage Arrears• While the credit performance of Italian mortgages andRMBS pools has weakened slightly since the onset of thecredit crisis, the deterioration has not been particularlylarge on average.• Since the end of 2009, RMBS credit trends haveimproved slightly with late stage arrears in the sector as awhole falling from 2.1% at the peak to 1.6% morerecently.• Looking forward the low household leverage inItaly is a positive (residential mortgages outstanding areonly 23% of GDP which can be compared to 62% inSpain for example).•Mortgage lending never really became particularly looseand – perhaps as a result – house prices never quite roseas much as in other jurisdictions.Prime Repayment RateSources: Moodys, DBGRUPPO CARIGE 19

Table of ContentsIssuer descriptionItalian mortgage market<strong>Gruppo</strong> <strong>Carige</strong>’s mortgage business<strong>Banca</strong> <strong>Carige</strong> OBG ProgrammeCover Pool DescriptionAnnexe : Italian OBG Law vs. European Covered Bond FrameworkGRUPPO CARIGE 20

€mOrigination StatisticsResidential mortgages (€m)120100806040200Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec2008 2009 2010RESIDENTIAL 2008 2009 2010Jan 85,5 34,4 41,6Feb 81,0 30,5 48,8Mar 71,9 42,9 59,7Apr 72,9 41,4 56,2May 73,8 50,8 63,4Jun 80,4 59,0 66,1Jul 99,7 83,7 73,0Aug 32,5 18,6 17,4Sep 77,6 50,3 56,8Oct 96,0 57,0 49,7Nov 70,3 55,7 56,5Dec 63,8 69,4 75,9Total 905 594 665Commercial mortgages (€m)400,0350,0300,0250,0200,0150,0100,050,0-Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec2008 2009 2010COMMERCIAL 2008 2009 2010Jan 44,8 43,5 136,6Feb 82,5 54,8 78,5Mar 46,5 167,0 69,6Apr 48,2 125,2 84,0May 62,7 280,4 81,0Jun 67,5 265,6 110,3Jul 240,2 361,2 109,5Aug 63,8 37,8 23,6Sep 89,9 61,7 47,7Oct 227,5 153,7 88,8Nov 186,5 53,0 92,7Dec 294,1 102,7 179,31.454 1.707 1.102Sources: Operational data as at 31 December 2010All figures refer to volume of originated mortgagesGRUPPO CARIGE 21

Origination and underwritingSales force All mortgages are originated through the Group’s 667 banking branches and 427insurance outletsUnderwritingAll mortgages are underwritten at branch levelThe officer that approves the mortgage loan depends mainly on the amountrequestedUnderwriting criteria involve scoring and customer limitsPropertyValuationAll mortgaged properties are assessed by independent appraisersAll evaluations are based on full physical inspectionMortgaged properties involve an insurance policy in favour of <strong>Carige</strong>Servicing<strong>Banca</strong> <strong>Carige</strong> performs all of its own servicingGRUPPO CARIGE 22

The underwriting processDATA COLLECTIONAND INPUTCollection of documents from theborrower (financial status &credit performance; as well asproperty information—location,type)INTERNAL RATING SCORINGAssessment of borrower’s creditworthiness via internal model,based on borrower’s and otheravailable informationCREDIT BUREAUBorrower’s credit checkwith CRIFPROPERTY VALUATIONProperty appraisal performedby an independent appraiserDELIBERATIONKey facts for credit decision• Debt to income• Credit Score• Credit period• LTV• Age• CRIF Score• Property appraisal report• Balance sheet analysisATTRIBUTION OF FILEACCORDING TO LIMITSOn the basis of the internallimits and of the borrower’s andloan characteristics, the file isassigned to the appropriateresponsible for the creditdecisionPre-closing procedures:• Execution of loan & guarantor’s contracts• Signing of insurance contracts• Notarisation of the mortgage contract• Registration of the propertyClosingGRUPPO CARIGE 23

The underwriting criteria• CARIGE’s mortgage officers are highly qualified individuals (who work within CARIGE’sregional head offices or offices specialised in mortgage financing)• CARIGE uses the following guidelines (1) to determine the maximum amount of amortgage:AFFORDABILITYDebt-to-income• The amount of the instalments does not exceed 35% ofthe borrower’s (2) total monthly income (net of otherdebt service)• Additional credit can be granted on personalguarantees from third parties or on pledges over cashor securities in favour of CARIGESECURITYLoan-to-value• The initial amount of the mortgage must not exceed80% of the value of the property to be mortgaged• Since 2004, the various underwriting criteria have been applied via a credit scoringprocess.• It takes approximately 15-20 days to receive approval for the granting of a mortgage loan• The current scoring process for credit approval is operative since 2007(1) introduced in July 2008(2) Family income rather than individual income onlyGRUPPO CARIGE 24

Overview of the Scoring System• <strong>Carige</strong> has implemented different Rating Models to assess the credit risk associatedwith each relevant class of borrower• Each type of borrower is separately credit-scored on the basis of the applicablespecific modelRisk segmentationProbability of Default (PD): ModelsFAMILIES(Consumer)FAMILIES(Producer)TURNOVERNot importantNot importantN.A. orLINE OFCREDITNot importantNot important< 250 K €PRIVATESMALLBUSINESSRetailApplicationInternally developedmodel incorporatingEntrance Score onCredit BureauBehaviouralScore model based onbehavioural variablesand Centrale RischiCOMPANIES< 1 Mio. €1-100 Mio. €> 250 K €Not importantSMESMECorporateIntegrated, internallydeveloped ratingmodel incorporatingelementary submodels(CentraleRischi)Integrated, internallyrating modelincorporating financialsub-model, quantitativeand qualitativeinformation>100 Mio. €Not importantLARGECORPORATELargeCorporateIntegrated Evaluation model with qualitativefinancial and public information; evaluation becomesrating through information from Centrale RischiResults and analysis are integratedand led back to a common rating scale(master scale)GRUPPO CARIGE 25

Servicing and delinquency management process• CARIGE monitors the payments of mortgage instalments on a continuous basis‣ 1st day of month: report to branches with unpaid standing orders‣ 16th day of month: report to branches with unpaid direct debit• By the 20th of the month CARIGE determines unpaid instalments and the branch informally contacts the borrowerin order to settle the debt and to get to know the financial situation of the client• If also the following instalment is unpaid, the borrower automatically receives a standard letter within 10 days.Normal ServicingPerformed at branchlevel and partially atcentral levelMost payments arecollected via directdebit procedureFIRSTMISSEDPAYMENTPaymentReportGenerated onthe 20 th ofeach monthand madeavailable toeach branchshowing whichclients hasmissed apaymentInitialContactThe Branchcontacts theborrower,warns that apayment hasbeen missedand tries tounderstandthe reasonsSECONDMISSEDPAYMENT10 DaysLETTERSentautomaticallybythesystemCaseHandledat BranchLevelPOSITIVERESOLUTIONOF THE CASEAND END OFDELINQUENCYCREDITRECOVERYDEPARTMENT7 Days• The branch is responsible for monitoring the delinquent loan from the first emergence of the problem• The reference manager for the client segment handles the relationship with the client by trying to understandthe reasons underlying the delay and the potential work-out strategies. The branch advises on the mosteffective way to deal with the delinquency• In most cases, CARIGE agrees a longer maturity or lower instalments on the loan rather than a penalty on theloan interest rate• A second letter threatening to start legal action is sent if the delinquency extends beyond six months. If theletters and the measures taken by the branch prove ineffective, the loan is passed to the central recovery unit,which, after a last attempt of out-of-court recovery, begins legal action• Only for debt up to € 25,000.00 unsecured by real guarantee, the claim is assigned to an external debtcollection companyGRUPPO CARIGE 26

Table of ContentsIssuer descriptionItalian mortgage market<strong>Gruppo</strong> <strong>Carige</strong>’s mortgage business<strong>Banca</strong> <strong>Carige</strong> OBG ProgrammeCover Pool DescriptionAnnexe : Italian OBG Law vs. European Covered Bond FrameworkGRUPPO CARIGE 27

Bank of Italy RequirementsPursuant to Bank of Italy supervisory regulation (dated 15 May 2007), OBG may only be issued bybanks with: minimum consolidated regulatory capital of € 500m,minimum Total Capital Ratio of 9%, and minimum Tier 1 Ratio of 6%.In addition the transfer of assets to the cover pool is subject to certain limits based on the bank’s totalcapital and Tier 1 ratios:TCR ≥ 11%T1R ≥ 7%10% ≤ TCR < 11%T1R ≥ 6.5%9% ≤ TCR < 10%T1R ≥ 6%No limitsUp to 60% of the availableeligible assetsUp to 25% of the availableeligible assets<strong>Carige</strong>RatiosFY09 3Q10(*) 3Q10PF(**)T1R 7.87% 6.84% 8.12%TC R 10.03% 9.31% 10.59%(*) Operational data(**) Including the full conversion of the convertiblebonds at current share priceSources: Bank of Italy, <strong>Banca</strong> <strong>Carige</strong>GRUPPO CARIGE 28

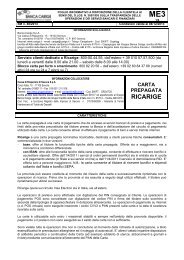

Summary of the programmeIssuerSeller/OriginatorProgramme size<strong>Banca</strong> <strong>Carige</strong> S.p.A.; ratings A (Fitch) / A2 (Moody’s) / A- neg (S&P)<strong>Banca</strong> <strong>Carige</strong> S.p.A.€ 5 billion – Including registered covered bondsGuarantor <strong>Carige</strong> Covered Bond S.r.l., established pursuant to Law 130/1999Cover poolExpected issue ratingMaximum LTVSegregation of collateralListingOver-collateralisationCalculation agentArrangerAsset monitorGoverning lawRepresentative of CBHoldersItalian prime, first economic lien residential mortgages and commercial mortgagesoriginated by the seller and its banking subsidiariesAaa/AAA (Moody’s/Fitch)80% for residential mortgages and 60% for commercial mortgagesCollateral sold to the guarantor is segregated for the benefit of covered bondholders andother secured parties in the context of the programmeCovered Bonds are admitted to trading to the Luxembourg Stock ExchangeThe asset coverage test is intended to ensure that on any monthly calculation date, theadjusted aggregate loan amount is at least equal to the aggregate principal amountoutstanding of the covered bonds. Maximum Asset Percentage of 90% corresponding to anabsolute 11% over-collateralisation floor<strong>Banca</strong> <strong>Carige</strong> S.p.A.Natixis and UBS Investment BankMazars & Guérard S.p.A. is the asset monitorItalian, except for the swap agreement’s and the deed of charge, which will be governed bythe English Law and the French Deed of Pledge (French law)Deutsche Trustee Company LimitedGRUPPO CARIGE 29

<strong>Banca</strong> <strong>Carige</strong> activity on the CB marketTransations as at 31/12/2010 Issue MaturityAmount(€m)Outstanding(€m)COVERED BOND 12/2008 12/2010 500,0 -COVERED BOND 11/2009 11/2016 1.000,0 1.000,0COVERED BOND 9/2010 9/2013 500,0 500,0Reg COVERED BOND 9/2010 10/2022 20,0 20,0Reg COVERED BOND 9/2010 9/2030 75,0 75,0COVERED BOND 10/2010 11/2016 180,0 180,0Reg COVERED BOND 10/2010 10/2022 20,0 20,0Reg COVERED BOND 10/2010 10/2040 20,0 20,0Reg COVERED BOND 11/2010 11/2030 18,5 18,5Reg COVERED BOND 11/2010 11/2030 20,0 20,0Reg COVERED BOND 12/2010 12/2030 40,0 40,0Total 2.393,5 1.893,5GRUPPO CARIGE 30

Asset MonitorStructural overviewItalian CoveredBond FrameworkCOVER POOLSWAPCOUNTERPARTIESCOVERED BONDSWAPCOUNTERPARTIES<strong>Banca</strong> <strong>Carige</strong> S.p.A(Issuer, Originator,Seller, Servicer)Cover Pool Purchase PriceTransfer of Cover PoolSubordinated LoanSwapCashflows<strong>Carige</strong> CoveredBond S.r.l.(Guarantor)Repayment of Subordinated LoanCoveredBondIssuanceCash purchase price for CBCoveredBondGuaranteeCB issuance and ongoing payment obligationCoveredBondholdersGRUPPO CARIGE 31

Summary of the proposed IssueInstrument:Issuer:Sellers:Obbligazioni <strong>Banca</strong>rie Garantite (―OBG‖)<strong>Banca</strong> <strong>Carige</strong> S.p.A<strong>Banca</strong> <strong>Carige</strong> S.p.AGuarantor:Expected Ratings:Status/Ranking of the Notes:Cover Pool:Expected Issue size:Currency:Maturity:Coupon:Documentation:Listing:Denominations:Arrangers:Marketing:<strong>Carige</strong> Covered Bond s.r.l. a bankruptcy remote, special purpose entity which benefits ofsegregations principals well established under law 130/1999Aaa / AAA (Moody’s / Fitch)Direct, unconditional, unsecured and unsubordinated€ 3,423 billion*Minimum € 500 millionEuroSoft bullet with 15 month extension periodFixed, AnnuallyOff <strong>Banca</strong> <strong>Carige</strong>’s OBG ProgrammeLuxembourg Stock ExchangeEUR 100,000 + EUR 1,000<strong>Banca</strong> IMI / Barclays / LBBW / Natixis / RBSfEuropean Roadshow* Cover Pool as at 31 December 2010GRUPPO CARIGE 32

Mandatory testsNominalValue Test‣ The Nominal Value Test (NVT) ensures that, on each Calculation Date theoutstanding aggregate notional amount of the asset comprised in the CoverPool shall be at least equal to, or higher than, the aggregate notional amountof all outstanding Series of Covered BondsNet PresentValue Test‣ The Net Present Value Test (NPTV) ensures that on each Calculation Date thenet present value of the Cover Pool shall be at least equal to, or higher than,the net present value of the outstanding Covered Bonds, also taking intoaccount the payments expected to be received under the hedgingarrangementsInterestCoverage Test‣ The Interest Coverage Test (ICT) ensures that on each Calculation Date theamounts of interests and other revenues generated by the assets included inthe Cover Pool, net of the costs borne by the Guarantor, shall be at leastequal to, or higher than, the interests and costs due by the Issuer under theCovered Bonds, taking also into account any hedging arrangements enteredinto in relation to the transactionGRUPPO CARIGE 33

Monthly Public Disclosures of Cover Pool & Test Performance<strong>Carige</strong> is committed to provide the utmost transparency to investors and publishes on both websiteand Bloomberg :• Test performance reports summarizing compliance with the programme’s tests in theprevious months• Cover pool compositionhttp://www.gruppocarige.it/grp/gruppo/html/ita/investor_relations/covered_bonds.htmMortgage Portfolio Summary al 31/12/2010Reside ntia l Mortga geTotal Loan Balance € 2,652,669,204Average Loan Balance € 88,632Number of Loans 29,929WA Seasoning (in months): 252.58WA Remaining Terms (in months): 214.92WA LTV (in %): 50.05%Comme rcia l Mortga geTotal Loan Balance € 132,934,830Average Loan Balance € 129,566Number of Loans 1,026WA Seasoning (in months): 173.39WA Remaining Terms (in months): 87.37WA LTV (in %): 23.62%T ota lTotal Loan Balance € 2,785,604,034Average Loan Balance € 89,989Number of Loans 30,955WA Seasoning (in months): 248.80WA Remaining Terms (in months): 208.83WA LTV (in %): 48.79%Years to MaturityT ota l Comme rcia l Reside ntia lYe a rs to Ma turity Amount % of Total Number Ye a rs to Ma turity Amount % of Total Number Ye a rs to Ma turity Amount % of Total Numberyrs 122,460,817 4.40% to 5 yrs 48,186,660 36.25% 556 to 5 yrs 74,274,158 2.80% 2,907up to 5 3,463 up upover 5 - 10 yrs 400,452,608 14.38% 6,551 over 5 - 10 yrs 50,084,620 37.68% 321 over 5 - 10 yrs 350,367,989 13.21% 6,230over 10 - 15 yrs 643,175,667 23.09% 7,479 over 10 - 15 yrs 30,417,051 22.88% 125 over 10 - 15 yrs 612,758,616 23.10% 7,354over 15 - 20 yrs 553,324,820 19.86% 5,350 over 15 - 20 yrs 3,405,506 2.56% 20 over 15 - 20 yrs 549,919,315 20.73% 5,330over 20 - 25 yrs 473,154,099 16.99% 3,935 over 20 - 25 yrs 840,993 0.63% 4 over 20 - 25 yrs 472,313,106 17.81% 3,931over 25 - 30 yrs 586,192,113 21.04% 4,134 over 25 - 30 yrs - 0.00% - over 25 - 30 yrs 586,192,113 22.10% 4,134over 30 yrs 6,843,909 0.25% 43 over 30 yrs - 0.00% - over 30 yrs 6,843,909 0.26% 43Total 2,785,604,034 100.00% 30,955 Total 132,934,830 100.00% 1,026 Total 2,652,669,204 100.00% 29,929Current Loan To ValueT ota l Comme rcia l Reside ntia lCurre nt Loa n to Va lue Amount % of Total Number Curre nt Loa n to Va lue Amount % of Total Number Curre nt Loa n to Va lue Amount % of Total Number10% 58,732,956 2.11% up to 10% 22,049,467.88 16.59% 273 up to 10% 36,683,487.91 1.38% 1,477up to 1,750over 10% - 20% 191,380,170 6.87% 3,886 over 10% - 20% 32,386,136.67 24.36% 285 over 10% - 20% 158,994,033.04 5.99% 3,601over 20% - 30% 313,596,485 11.26% 4,632 over 20% - 30% 37,741,776.90 28.39% 252 over 20% - 30% 275,854,708.49 10.40% 4,380over 30% - 40% 384,680,443 13.81% 4,722 over 30% - 40% 27,655,163.98 20.80% 145 over 30% - 40% 357,025,278.66 13.46% 4,577over 40% - 50% 423,667,290 15.21% 4,549 over 40% - 50% 8,721,363.65 6.56% 42 over 40% - 50% 414,945,926.69 15.64% 4,507over 50% - 60% 467,170,850 16.77% 4,283 over 50% - 60% 4,084,696.12 3.07% 26 over 50% - 60% 463,086,154.25 17.46% 4,257over 60% - 70% 472,776,811 16.97% 3,772 over 60% - 70% 172,173.04 0.13% 2 over 60% - 70% 472,604,638.18 17.82% 3,770over 70% - 80% 452,051,982 16.23% 3,220 over 70% - 80% 124,051.37 0.09% 1 over 70% - 80% 451,927,930.58 17.04% 3,219over 80% 21,547,046.1 0.77% 141 over 80% - 0.00% - over 80% 21,547,046.12 0.81% 141Total 2,785,604,034 100% 30,955 Total 132,934,830 100% 1,026 Total 2,652,669,204 100% 29,929GRUPPO CARIGE 34

Table of ContentsIssuer descriptionItalian mortgage market<strong>Gruppo</strong> <strong>Carige</strong>’s mortgage business<strong>Banca</strong> <strong>Carige</strong> OBG ProgrammeCover Pool DescriptionAnnexe : Italian OBG Law vs. European Covered Bond FrameworkGRUPPO CARIGE 35

Cover Pool Highlights at 31 December 2010TOTAL PORTFOLIO RESIDENTIAL PORTION COMMERCIAL PORTIONBalance (€) 3,422,767,928 3,289,833,098 132,934,830% of Pool 100.0% 97.2% 2.8%Number of Loans 36,573 35,547 1,026Average Loan Balance (€) 93,587 92,549 129,566WA Term at mortgage granting (Months) 249.65 252.79 172.00WA Remaining Term (Months) 213.61 218.75 86.18Number of Borrowers 35,483 35,424 988WA CLTV 50.23% 51.36% 23.28%Percentage of Floating Rate Mortgages 67.22% 66.37% 96.59%WA Interest Rate on Floating Rate Loans (%) 2.57% 2.57% 2.49%WA Margin on Floating Rate Loans (bps) 150 151 146WA Interest Rate on Fixed Rate Loans (%) 5.55% 5.55% 5.82%Currency Euro Euro EuroFigures refer to volume of outstanding mortgages - Data as at 31 December 2010GRUPPO CARIGE 36

Total Porftfolio BreakdownCommercial/ResidentialGeographical distributionCommercialSouth &2,8% CentreIsles9,7%10,5%Residential97,2%North79,8%Current LTV90 - 10080 - 9070 - 8060 - 7050 - 6040 - 5030 - 4020 - 3010 - 20

Residential Portion Breakdown/1Current Loan BalanceCurrent LTV>500k400k - 500k300k - 400k200k - 300k150k - 200k100k - 150k50k - 100k

Residential Portion Breakdown/2Current Interest RatesCurrent Margins>7.06.5 - 7.06.0 - 6.55.5 - 6.05.0 - 5.54.5 - 5.04.0 - 4.53.5 - 4.03.0 - 3.52.5 - 3.02.0 - 2.5250225 - 250200 - 225175 - 200150 - 175125 - 150100 - 12575 - 10050 - 75

Commercial Portion Breakdown/1Current Loan BalanceCurrent LTV>500k27,7%70 - 800,1%400k - 500k6,1%60 - 700,1%300k - 400k200k - 300k150k - 200k100k - 150k50k - 100k

Commercial Portion Breakdown/2Current Interest RatesMargins>7.06.5 - 7.06.0 - 6.55.5 - 6.05.0 - 5.54.5 - 5.04.0 - 4.53.5 - 4.03.0 - 3.52.5 - 3.02.0 - 2.5250225 - 250200 - 225175 - 200150 - 175125 - 150100 - 12575 - 10050 - 75

loans in arrear/total loan balance (%)Arrears and BuybacksCover pool arrears (*)54,543,532,521,510,50Pool Transfer(25 September 200926 July 2010)(*) Arrears amount includesloans with more than 30days of arrears and excludesdefaulted loans<strong>Carige</strong>’s BuybacksNon Performing Loans Other Loans Total2009 2,788,696 2,788,6962010 11,482,694 7,473,725 18,956,41921,745,115GRUPPO CARIGE 42

The last segregation (21 <strong>February</strong> <strong>2011</strong>)TOTAL PORTFOLIO(RESIDENTIAL ONLY)Balance (€) 633,772,323% of the new total cover pool 18.5%Number of Loans 5,618Average Loan Balance (€) 112,811WA Term at mortgage granting (Months) 227.79WA Remaining Term (Months) 203.91Number of Borrowers 5,495WA CLTV 56.48%Percentage of Floating Rate Mortgages 48.83%WA Interest Rate on Floating Rate Loans (%) 2.67%WA Margin on Floating Rate Loans (bps) 162WA Interest Rate on Fixed Rate Loans (%) 4.89%CurrencyEuroGRUPPO CARIGE 43

Table of ContentsIssuer descriptionItalian mortgage market<strong>Gruppo</strong> <strong>Carige</strong>’s mortgage business<strong>Banca</strong> <strong>Carige</strong> OBG ProgrammeCover Pool DescriptionAnnexe: Italian OBG Law vs. European Covered Bond FrameworkGRUPPO CARIGE 44

Italian Covered Bond Legal Framework (1/2)Name of the instrument (s)LegislationSpecial banking principleRestriction on business activityAsset AllocationInclusion of hedge positionsObbligazioni <strong>Banca</strong>rie GarantiteLaw 80 of 14 may 2005, amending Article 7-bis & 7-ter of law 130/1999, Ministry ofEconomy & Finance regulation 310 dated 14 December 2006 and Bank of Italy instructionsissued on 17 may 2007 and on 24 Marcgh 2010No: any Italian bank fulfilling specific issuance criteriaN/ACover assets are segregated through the transfer to a separate entityHedge position are part of the structural enhancements intended to protect bondholdersSubstitute collateral Up to 15%Restrictions incl. CommercialmortgagesGeographical scope for publicassetsGeographical scope formortgage assetsNoEEA states and Switzerland, subject to a maximum risk weighting of 20% and up to 10% ofthe cover poolNon-EEA states or local authorities subject to a maximum risk weighting of 20%EEA and SwitzerlandLTV barrier residential 80%LTV barrier commercial 60%Basis for valuationValuation CheckSpecial SupervisionMarket value. The approach needs approval from Bank of Italy and is verified by anindependent auditorSemi-annual review and annual reporting to the Bank of ItalyBank of ItalyGRUPPO CARIGE 45

Italian Covered Bond Legal Framework (2/2)Protection against mismatchingProtection against credit riskProtection against operative riskThe nominal value of the cover pool assets must at all times be at least equal to the nominalvalue of the OBG outstanding. The net present value (NPV) of the covered pool must be atleast equal to the net present value of the OBG issued. Furthermore, the cover pool assetsneed to accrue sufficient interest to cover interest payment on the OBG outstandingSponsor banks may replace non-performing loans or affected loansStipulated through contractual rulesMandatory over- collateralisationVoluntary over-collateralisationis protectedBankruptcy remoteness of theissuerOutstanding OBG to regulatorycapital1st claim in the event ofinsolvencyExternal support mechanismsCompliant with UCITS Art. 22par. 4Compliance with CRDExpected to be subject to an asset coverage testYesNo, but all assets are ring-fenced within a specially separated entityDepending on Tier 1 and total capital ratios. There is no limit as long as the respective bankmaintains a total capital ratio above 11% and a tier 1 ratio above 7%All payments are received from the special entity's assets. These payments are expected to becollected in a separate account. Investors continue to receive scheduled payments, as if theissuer had not defaultedIn the event of insufficient pool assets proceeds to cover their claim, investors rank pari passuwith senior debt holders. There is a simultaneous unsecured dual claim against the issuer andsecured against the portfolio held by the specially separated entityYesYesGRUPPO CARIGE 46

European Overview on Covered Bond FrameworkName of debt InstrumentSpecialBankingPrincipleSupervisionSubstituteCollateralProtection AgainstMismatchingMandatoryovercollateralisationVoluntaryovercollateralisation isprotectedFulfilsUCITS22(4)ItalyObbligazioni bancariegarantite (OBG)NoBank of ItalyUp to15%Net-present valuecover requiredNo Yes YesGermanyHypothekenpfand-briefe,Öffentliche Pfandbriefe,SchiffspfandbriefeNoBundesanstaltfür Finanzdienstleistungsaufsicht andindependenttrusteeUp to10%Net-present value coverrequired102% Yes YesSpainCédulas Hipotecarias (CH)Cédulas Territoriales (CT)NoBanco deEspanaUp to 5%Coverage by nominalvalue125% (CH)143% (CT)YesYesObligations Foncières (OF)YesCommission<strong>Banca</strong>ire andspecialsupervisorUp to15%Not compulsory; but allOFs benefit fromadditional contractualfeaturesNo Yes YesFranceFrench Structured CoveredBondNoCommission<strong>Banca</strong>ire andspecialsupervisorUp to15%Contractual obligation toneutralise interest andcurrency risk. Also,downgrade triggers forswap counterparties anddifferent tests to ensureadequate cash flowsSubject toassetcoverage testYesT.b.d.NetherlandsDutch Covered BondsNoDeNederlandscheBank andindependentauditorUp to10%Exposure to interestrate and currency risk isneutralised. In addition,downgrade triggers forswap counterparties,and various tests ensurecash-flow adequacySubject toassetcoverage testYesFrom 1July 2008onwardsPortugalObrigações Hipotecárias ,Obrigações sector públicoOptionalBanco dePortugalUp to20%Net-present value coverrequired; in addition,limitation of liquidityrisk105% Yes YesGRUPPO CARIGE 47

DisclaimerThis document has been prepared by <strong>Banca</strong> <strong>Carige</strong> SpA solely for information purposes and for use inpresentation of the Group’s strategies and financials. The information contained herein has not beenindependently verified. No representation or warranty, express or implied, is made as to, and no relianceshould be placed on, the fairness, accuracy, completeness or correctness of the information or opinionscontained herein. The information presented or contained in this presentation is current as of the date hereofand is subject to change without notice and its accuracy is not guaranteed. We do not undertake to update thisinformation. This presentation should not be construed as legal, tax, investment or other advice.Neither thecompany, its advisors or representatives shall have any liability whatsoever for any loss howsoever arisingfrom any use of this document or its contents or otherwise arising in connection with this document. Theforward-looking information contained herein has been prepared on the basis of a number of assumptionswhich may prove to be incorrect and, accordingly, actual results may vary.This document does not constitute an offer or invitation to purchase or subscribe for any securities and nopart of it shall form the basis of or be relied upon in connection with any contract or commitment whatsoever.The distribution of this presentation in certain jurisdictions may be restricted by law. In particular, thispresentation may not be taken or transmitted into the United States, Canada or Japan or distributed, directlyor indirectly, in the United States, Canada or Japan. Recipients of this presentation should inform themselvesabout and observe such restrictions.The information herein may not be reproduced or published in whole or in part, for any purpose, or distributedto any other party. By accepting this document you agree to be bound by the foregoing limitations.*****The manager responsible for preparing the company’s financial reports Ms. Daria Bagnasco, Deputy GeneralManager (Governance and Control) of <strong>Banca</strong> CARIGE S.p.A., declares, pursuant to paragraph 2 of Article 154bis of the Consolidated Law on Finance, that the accounting information contained in this presentationcorresponds to the document results, books and accounting records.GRUPPO CARIGE 48

ContactsDaria BagnascoDeputy General Manager (Governance and Control)daria.bagnasco@carige.itTel: +390105794869Giacomo BurroCFO & Wealth Management Head Office Managergiacomo.burro@carige.itTel: +390105794580Nicola PegoraroHead of Tradingnicola.pegoraro@carige.itTel: +390105793377Emilio ChiesiInternational Fundingemilio.chiesi@carige.itTel: +390105794568Investor Relationsinvestor.relations@carige.itTel: +390105794877GRUPPO CARIGE 49