Prospectus (Muthoot NCD) v3 220212 (with BSE in-principle ... - Karvy

Prospectus (Muthoot NCD) v3 220212 (with BSE in-principle ... - Karvy

Prospectus (Muthoot NCD) v3 220212 (with BSE in-principle ... - Karvy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

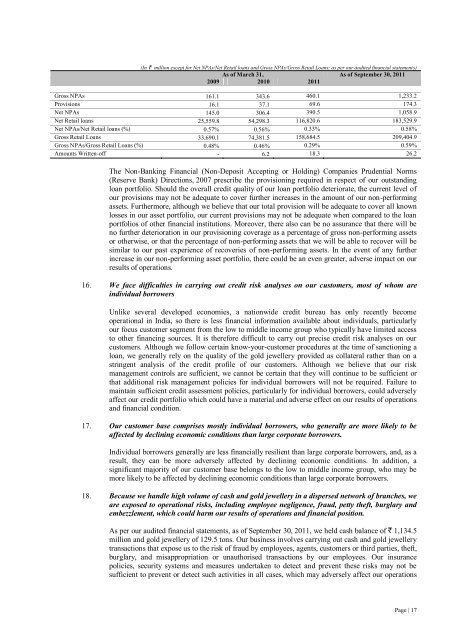

(In ` million except for Net NPAs/Net Retail loans and Gross NPAs/Gross Retail Loans; as per our audited f<strong>in</strong>ancial statements)As of March 31, As of September 30, 20112009 2010 2011Gross NPAs 161.1 343.6 460.1 1,233.2Provisions 16.1 37.1 69.6 174.3Net NPAs 145.0 306.4 390.5 1,058.9Net Retail loans 25,559.8 54,298.3 116,820.6 183,529.9Net NPAs/Net Retail loans (%) 0.57% 0.56% 0.33% 0.58%Gross Retail Loans 33,690.1 74,381.5 158,684.5 209,404.9Gross NPAs/Gross Retail Loans (%) 0.48% 0.46% 0.29% 0.59%Amounts Written-off - 6.2 18.3 26.2The Non-Bank<strong>in</strong>g F<strong>in</strong>ancial (Non-Deposit Accept<strong>in</strong>g or Hold<strong>in</strong>g) Companies Prudential Norms(Reserve Bank) Directions, 2007 prescribe the provision<strong>in</strong>g required <strong>in</strong> respect of our outstand<strong>in</strong>gloan portfolio. Should the overall credit quality of our loan portfolio deteriorate, the current level ofour provisions may not be adequate to cover further <strong>in</strong>creases <strong>in</strong> the amount of our non-perform<strong>in</strong>gassets. Furthermore, although we believe that our total provision will be adequate to cover all knownlosses <strong>in</strong> our asset portfolio, our current provisions may not be adequate when compared to the loanportfolios of other f<strong>in</strong>ancial <strong>in</strong>stitutions. Moreover, there also can be no assurance that there will beno further deterioration <strong>in</strong> our provision<strong>in</strong>g coverage as a percentage of gross non-perform<strong>in</strong>g assetsor otherwise, or that the percentage of non-perform<strong>in</strong>g assets that we will be able to recover will besimilar to our past experience of recoveries of non-perform<strong>in</strong>g assets. In the event of any further<strong>in</strong>crease <strong>in</strong> our non-perform<strong>in</strong>g asset portfolio, there could be an even greater, adverse impact on ourresults of operations.16. We face difficulties <strong>in</strong> carry<strong>in</strong>g out credit risk analyses on our customers, most of whom are<strong>in</strong>dividual borrowersUnlike several developed economies, a nationwide credit bureau has only recently becomeoperational <strong>in</strong> India, so there is less f<strong>in</strong>ancial <strong>in</strong>formation available about <strong>in</strong>dividuals, particularlyour focus customer segment from the low to middle <strong>in</strong>come group who typically have limited accessto other f<strong>in</strong>anc<strong>in</strong>g sources. It is therefore difficult to carry out precise credit risk analyses on ourcustomers. Although we follow certa<strong>in</strong> know-your-customer procedures at the time of sanction<strong>in</strong>g aloan, we generally rely on the quality of the gold jewellery provided as collateral rather than on astr<strong>in</strong>gent analysis of the credit profile of our customers. Although we believe that our riskmanagement controls are sufficient, we cannot be certa<strong>in</strong> that they will cont<strong>in</strong>ue to be sufficient orthat additional risk management policies for <strong>in</strong>dividual borrowers will not be required. Failure toma<strong>in</strong>ta<strong>in</strong> sufficient credit assessment policies, particularly for <strong>in</strong>dividual borrowers, could adverselyaffect our credit portfolio which could have a material and adverse effect on our results of operationsand f<strong>in</strong>ancial condition.17. Our customer base comprises mostly <strong>in</strong>dividual borrowers, who generally are more likely to beaffected by decl<strong>in</strong><strong>in</strong>g economic conditions than large corporate borrowers.Individual borrowers generally are less f<strong>in</strong>ancially resilient than large corporate borrowers, and, as aresult, they can be more adversely affected by decl<strong>in</strong><strong>in</strong>g economic conditions. In addition, asignificant majority of our customer base belongs to the low to middle <strong>in</strong>come group, who may bemore likely to be affected by decl<strong>in</strong><strong>in</strong>g economic conditions than large corporate borrowers.18. Because we handle high volume of cash and gold jewellery <strong>in</strong> a dispersed network of branches, weare exposed to operational risks, <strong>in</strong>clud<strong>in</strong>g employee negligence, fraud, petty theft, burglary andembezzlement, which could harm our results of operations and f<strong>in</strong>ancial position.As per our audited f<strong>in</strong>ancial statements, as of September 30, 2011, we held cash balance of ` 1,134.5million and gold jewellery of 129.5 tons. Our bus<strong>in</strong>ess <strong>in</strong>volves carry<strong>in</strong>g out cash and gold jewellerytransactions that expose us to the risk of fraud by employees, agents, customers or third parties, theft,burglary, and misappropriation or unauthorised transactions by our employees. Our <strong>in</strong>surancepolicies, security systems and measures undertaken to detect and prevent these risks may not besufficient to prevent or detect such activities <strong>in</strong> all cases, which may adversely affect our operationsPage | 17