imaxx⢠Guaranteed Investment Funds - Transamerica Life Canada

imaxx⢠Guaranteed Investment Funds - Transamerica Life Canada

imaxx⢠Guaranteed Investment Funds - Transamerica Life Canada

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

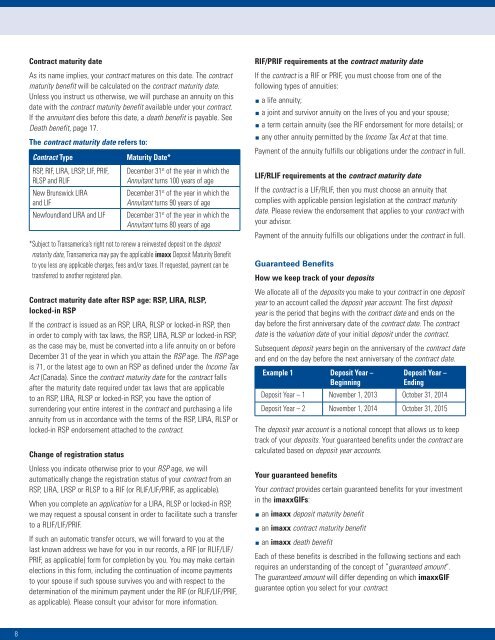

Contract maturity dateAs its name implies, your contract matures on this date. The contractmaturity benefit will be calculated on the contract maturity date.Unless you instruct us otherwise, we will purchase an annuity on thisdate with the contract maturity benefit available under your contract.If the annuitant dies before this date, a death benefit is payable. SeeDeath benefit, page 17.The contract maturity date refers to:Contract TypeRSP, RIF, LIRA, LRSP, LIF, PRIF,RLSP and RLIFNew Brunswick LIRAand LIFNewfoundland LIRA and LIFMaturity Date*December 31 st of the year in which theAnnuitant turns 100 years of ageDecember 31 st of the year in which theAnnuitant turns 90 years of ageDecember 31 st of the year in which theAnnuitant turns 80 years of age*Subject to <strong>Transamerica</strong>’s right not to renew a reinvested deposit on the depositmaturity date, <strong>Transamerica</strong> may pay the applicable imaxx Deposit Maturity Benefitto you less any applicable charges, fees and/or taxes. If requested, payment can betransferred to another registered plan.Contract maturity date after RSP age: RSP, LIRA, RLSP,locked-in RSPIf the contract is issued as an RSP, LIRA, RLSP or locked-in RSP, thenin order to comply with tax laws, the RSP, LIRA, RLSP or locked-in RSP,as the case may be, must be converted into a life annuity on or beforeDecember 31 of the year in which you attain the RSP age. The RSP ageis 71, or the latest age to own an RSP as defined under the Income TaxAct (<strong>Canada</strong>). Since the contract maturity date for the contract fallsafter the maturity date required under tax laws that are applicableto an RSP, LIRA, RLSP or locked-in RSP, you have the option ofsurrendering your entire interest in the contract and purchasing a lifeannuity from us in accordance with the terms of the RSP, LIRA, RLSP orlocked-in RSP endorsement attached to the contract.Change of registration statusUnless you indicate otherwise prior to your RSP age, we willautomatically change the registration status of your contract from anRSP, LIRA, LRSP or RLSP to a RIF (or RLIF/LIF/PRIF, as applicable).When you complete an application for a LIRA, RLSP or locked-in RSP,we may request a spousal consent in order to facilitate such a transferto a RLIF/LIF/PRIF.If such an automatic transfer occurs, we will forward to you at thelast known address we have for you in our records, a RIF (or RLIF/LIF/PRIF, as applicable) form for completion by you. You may make certainelections in this form, including the continuation of income paymentsto your spouse if such spouse survives you and with respect to thedetermination of the minimum payment under the RIF (or RLIF/LIF/PRIF,as applicable). Please consult your advisor for more information.RIF/PRIF requirements at the contract maturity dateIf the contract is a RIF or PRIF, you must choose from one of thefollowing types of annuities:a life annuity;a joint and survivor annuity on the lives of you and your spouse;a term certain annuity (see the RIF endorsement for more details); orany other annuity permitted by the Income Tax Act at that time.Payment of the annuity fulfills our obligations under the contract in full.LIF/RLIF requirements at the contract maturity dateIf the contract is a LIF/RLIF, then you must choose an annuity thatcomplies with applicable pension legislation at the contract maturitydate. Please review the endorsement that applies to your contract withyour advisor.Payment of the annuity fulfills our obligations under the contract in full.<strong>Guaranteed</strong> BenefitsHow we keep track of your depositsWe allocate all of the deposits you make to your contract in one deposityear to an account called the deposit year account. The first deposityear is the period that begins with the contract date and ends on theday before the first anniversary date of the contract date. The contractdate is the valuation date of your initial deposit under the contract.Subsequent deposit years begin on the anniversary of the contract dateand end on the day before the next anniversary of the contract date.Example 1 Deposit Year –BeginningDeposit Year –EndingDeposit Year – 1 November 1, 2013 October 31, 2014Deposit Year – 2 November 1, 2014 October 31, 2015The deposit year account is a notional concept that allows us to keeptrack of your deposits. Your guaranteed benefits under the contract arecalculated based on deposit year accounts.Your guaranteed benefitsYour contract provides certain guaranteed benefits for your investmentin the imaxxGIFs:an imaxx deposit maturity benefitan imaxx contract maturity benefitan imaxx death benefitEach of these benefits is described in the following sections and eachrequires an understanding of the concept of “guaranteed amount”.The guaranteed amount will differ depending on which imaxxGIFguarantee option you select for your contract.8