Investment in Italy

Investment in Italy

Investment in Italy

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

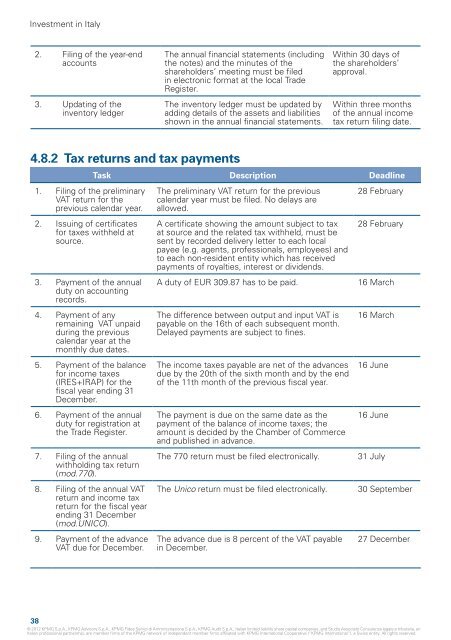

<strong>Investment</strong> <strong>in</strong> <strong>Italy</strong>2. Fil<strong>in</strong>g of the year-endaccounts3. Updat<strong>in</strong>g of the<strong>in</strong>ventory ledgerThe annual f<strong>in</strong>ancial statements (<strong>in</strong>clud<strong>in</strong>gthe notes) and the m<strong>in</strong>utes of theshareholders’ meet<strong>in</strong>g must be filed<strong>in</strong> electronic format at the local TradeRegister.The <strong>in</strong>ventory ledger must be updated byadd<strong>in</strong>g details of the assets and liabilitiesshown <strong>in</strong> the annual f<strong>in</strong>ancial statements.With<strong>in</strong> 30 days ofthe shareholders’approval.With<strong>in</strong> three monthsof the annual <strong>in</strong>cometax return fil<strong>in</strong>g date.4.8.2 Tax returns and tax paymentsTask Description Deadl<strong>in</strong>e1. Fil<strong>in</strong>g of the prelim<strong>in</strong>aryVAT return for theprevious calendar year.2. Issu<strong>in</strong>g of certificatesfor taxes withheld atsource.3. Payment of the annualduty on account<strong>in</strong>grecords.4. Payment of anyrema<strong>in</strong><strong>in</strong>g VAT unpaiddur<strong>in</strong>g the previouscalendar year at themonthly due dates.5. Payment of the balancefor <strong>in</strong>come taxes(IRES+IRAP) for thefiscal year end<strong>in</strong>g 31December.6. Payment of the annualduty for registration atthe Trade Register.7. Fil<strong>in</strong>g of the annualwithhold<strong>in</strong>g tax return(mod.770).8. Fil<strong>in</strong>g of the annual VATreturn and <strong>in</strong>come taxreturn for the fiscal yearend<strong>in</strong>g 31 December(mod.UNICO).9. Payment of the advanceVAT due for December.The prelim<strong>in</strong>ary VAT return for the previouscalendar year must be filed. No delays areallowed.A certificate show<strong>in</strong>g the amount subject to taxat source and the related tax withheld, must besent by recorded delivery letter to each localpayee (e.g. agents, professionals, employees) andto each non-resident entity which has receivedpayments of royalties, <strong>in</strong>terest or dividends.A duty of EUR 309.87 has to be paid.The difference between output and <strong>in</strong>put VAT ispayable on the 16th of each subsequent month.Delayed payments are subject to f<strong>in</strong>es.The <strong>in</strong>come taxes payable are net of the advancesdue by the 20th of the sixth month and by the endof the 11th month of the previous fiscal year.The payment is due on the same date as thepayment of the balance of <strong>in</strong>come taxes; theamount is decided by the Chamber of Commerceand published <strong>in</strong> advance.The 770 return must be filed electronically.The Unico return must be filed electronically.The advance due is 8 percent of the VAT payable<strong>in</strong> December.28 February28 February16 March16 March16 June16 June31 July30 September27 December38© 2012 KPMG S.p.A., KPMG Advisory S.p.A., KPMG Fides Servizi di Amm<strong>in</strong>istrazione S.p.A., KPMG Audit S.p.A., Italian limited liability share capital companies, and Studio Associato Consulenza legale e tributaria, anItalian professional partnership, are member firms of the KPMG network of <strong>in</strong>dependent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.