Marna Kearney - tips

Marna Kearney - tips

Marna Kearney - tips

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

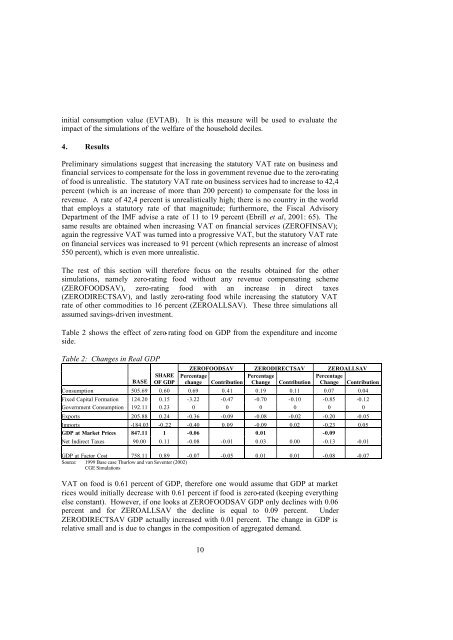

initial consumption value (EVTAB). It is this measure will be used to evaluate theimpact of the simulations of the welfare of the household deciles.4. ResultsPreliminary simulations suggest that increasing the statutory VAT rate on business andfinancial services to compensate for the loss in government revenue due to the zero-ratingof food is unrealistic. The statutory VAT rate on business services had to increase to 42,4percent (which is an increase of more than 200 percent) to compensate for the loss inrevenue. A rate of 42,4 percent is unrealistically high; there is no country in the worldthat employs a statutory rate of that magnitude; furthermore, the Fiscal AdvisoryDepartment of the IMF advise a rate of 11 to 19 percent (Ebrill et al, 2001: 65). Thesame results are obtained when increasing VAT on financial services (ZEROFINSAV);again the regressive VAT was turned into a progressive VAT, but the statutory VAT rateon financial services was increased to 91 percent (which represents an increase of almost550 percent), which is even more unrealistic.The rest of this section will therefore focus on the results obtained for the othersimulations, namely zero-rating food without any revenue compensating scheme(ZEROFOODSAV), zero-rating food with an increase in direct taxes(ZERODIRECTSAV), and lastly zero-rating food while increasing the statutory VATrate of other commodities to 16 percent (ZEROALLSAV). These three simulations allassumed savings-driven investment.Table 2 shows the effect of zero- rating food on GDP from the expenditure and incomeside.Table 2: Changes in Real GDPBASESHAREOF GDPZEROFOODSAV ZERODIRECTSAV ZEROALLSAVPercentagePercentagePercentagechange Contribution Change Contribution Change ContributionConsumption 505.69 0.60 0.69 0.41 0.19 0.11 0.07 0.04Fixed Capital Formation 124.20 0.15 -3.22 -0.47 -0.70 -0.10 -0.85 -0.12Government Consumption 192.11 0.23 0 0 0 0 0 0Exports 205.88 0.24 -0.36 -0.09 -0.08 -0.02 -0.20 -0.05Imports -184.03 -0.22 -0.40 0.09 -0.09 0.02 -0.23 0.05GDP at Market Prices 847.11 1 -0.06 0.01 -0.09Net Indirect Taxes 90.00 0.11 -0.08 -0.01 0.03 0.00 -0.13 -0.01GDP at Factor Cost 758.11 0.89 -0.07 -0.05 0.01 0.01 -0.08 -0.07Source: 1999 Base case Thurlow and van Seventer (2002)CGE SimulationsVAT on food is 0.61 percent of GDP, therefore one would assume that GDP at marketrices would initially decrease with 0.61 percent if food is zero-rated (keeping everythingelse constant). However, if one looks at ZEROFOODSAV GDP only declines with 0.06percent and for ZEROALLSAV the decline is equal to 0.09 percent. UnderZERODIRECTSAV GDP actually increased with 0.01 percent. The change in GDP isrelative small and is due to changes in the composition of aggregated demand.10