Marna Kearney - tips

Marna Kearney - tips

Marna Kearney - tips

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

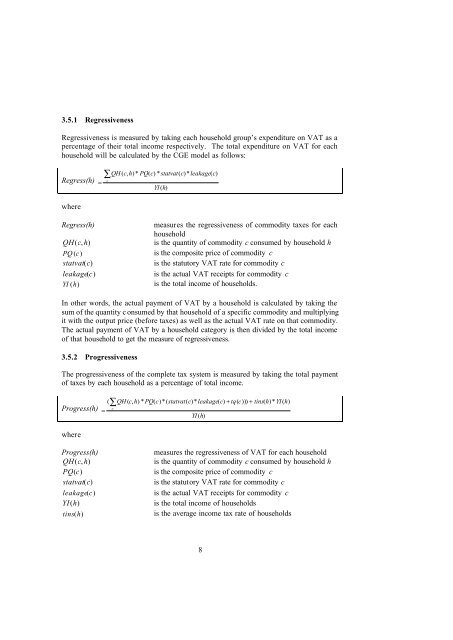

3.5.1 RegressivenessRegressiveness is measured by taking each household group’s expenditure on VAT as apercentage of their total income respectively. The total expenditure on VAT for eachhousehold will be calculated by the CGE model as follows:Regress(h)=∑cQH ( c,h)*PQ(c)* statvat(c)*leakage(c)YI ( h)whereRegress(h)measures the regressiveness of commodity taxes for eachhouseholdQH ( c,h)is the quantity of commodity c consumed by household hPQ (c)is the composite price of commodity cstatvat (c)is the statutory VAT rate for commodity cleakage (c)is the actual VAT receipts for commodity cYI (h)is the total income of households.In other words, the actual payment of VAT by a household is calculated by taking thesum of the quantity c onsumed by that household of a specific commodity and multiplyingit with the output price (before taxes) as well as the actual VAT rate on that commodity.The actual payment of VAT by a household category is then divided by the total incomeof that household to get the measure of regressiveness.3.5.2 ProgressivenessThe progressiveness of the complete tax system is measured by taking the total paymentof taxes by each household as a percentage of total income.Progress(h)(=∑cQH ( c,h)* PQ(c)*(statvat(c)*leakage(c)+ tq(c)))+ tins(h)*YI ( h)YI ( h)whereProgress(h)measures the regressiveness of VAT for each householdQH ( c,h)is the quantity of commodity c consumed by household hPQ (c)is the composite price of commodity cstatvat (c)is the statutory VAT rate for commodity cleakage (c)is the actual VAT receipts for commodity cYI (h)is the total income of householdstins (h)is the average income tax rate of households8