SGAM Fund >SGAM Fund BOOK - Self Bank

SGAM Fund >SGAM Fund BOOK - Self Bank

SGAM Fund >SGAM Fund BOOK - Self Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

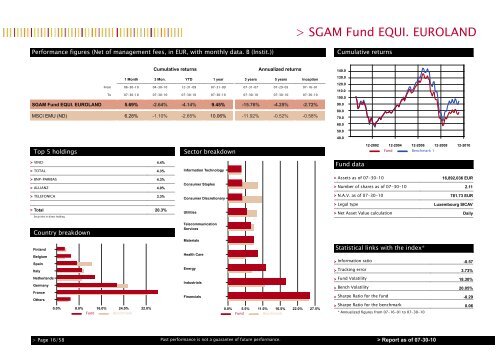

<strong>SGAM</strong> <strong>Fund</strong> EQUI. EUROLANDPerformance figures (Net of management fees, in EUR, with monthly data. B (Instit.))Cumulative returnsCumulative returnsAnnualized returns140.0FromTo1 Month06-30-1007-30-103 Mon.04-30-1007-30-10YTD12-31-0907-30-101 year07-31-0907-30-103 years07-31-0707-30-105 years07-29-0507-30-10Inception07-16-0107-30-10130.0120.0110.0100.0<strong>SGAM</strong> <strong>Fund</strong> EQUI. EUROLANDMSCI EMU (ND)5.69%6.28%-2.64%-1.10%-4.14%-2.65%9.45%10.06%-15.76%-11.92%-4.25%-0.52%-2.72%-0.58%90.080.070.060.050.040.0Top 5 holdings12-2002 12-2004 12-2006 12-2008 12-2010Sector breakdown<strong>Fund</strong> Benchmark 1> VINCI> TOTAL> BNP-PARIBAS> ALLIANZ4.4%4.3%4.3%4.0%Information TechnologyConsumer Staples<strong>Fund</strong> data> Assets as of 07-30-10> Number of shares as of 07-30-1016,892,036 EUR2.11> TELEFONICA> TotalSecurities in direct holding3.3%20.3%Consumer DiscretionaryUtilities> N.A.V. as of 07-30-10> Legal type> Net Asset Value calculation781.73 EURLuxembourg SICAVDailyCountry breakdownTelecommunicationServicesFinlandBelgiumSpainItalyMaterialsHealth CareEnergyStatistical links with the index*> Information ratio> Tracking error-0.573.73%NetherlandsGermanyFranceOthers0.0% 8.0% 16.0% 24.0% 32.0%<strong>Fund</strong>BenchmarkIndustrialsFinancials0.0% 5.5% 11.0% 16.5% 22.0% 27.5%<strong>Fund</strong>Benchmark> <strong>Fund</strong> Volatility> Bench Volatility> Sharpe Ratio for the fund> Sharpe Ratio for the benchmark* Annualized figures from 07-16-01 to 07-30-1018.30%20.05%-0.290.06> Page 16/58 Past performance is not a guarantee of future performance.> Report as of 07-30-10