Röhlig Annual Report 2011 pdf, 0 Pages, 4.8

Röhlig Annual Report 2011 pdf, 0 Pages, 4.8

Röhlig Annual Report 2011 pdf, 0 Pages, 4.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2011</strong><br />

COMPETENCE IN<br />

DISTANT MARKETS

Contents<br />

5<br />

6<br />

8<br />

10<br />

12<br />

15<br />

16<br />

20<br />

22<br />

25<br />

26<br />

28<br />

29<br />

30<br />

31<br />

Foreword<br />

Overcoming Borders<br />

Knowing Markets<br />

Connecting Continents<br />

Management <strong>Report</strong><br />

Business Development<br />

Divisions and Regions<br />

Consolidated Companies<br />

Group<br />

Structural Changes<br />

and Risk Management<br />

Outlook<br />

<strong>Annual</strong> Financial Statement<br />

Balance Sheet<br />

Consolidated Income Statement<br />

Cash Flow<br />

Auditor’s Certifi cate<br />

Advisory Board <strong>Report</strong>

Consolidated fi nancial statements as of 31 December <strong>2011</strong><br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG, Bremen, in TEUR<br />

<strong>2011</strong> 2010 2009 2008 2007<br />

Balance sheet total 129,169 108,978 87,853 86,520 93,482<br />

Fixed assets 27,851 16,076 13,349 14,846 12,280<br />

Current assets 100,041 92,217 73,267 70,492 80,197<br />

Equity *) 36,359 31,455 23,037 24,559 21,514<br />

Liabilities **) 61,660 65,105 55,784 49,078 56,116<br />

Gross profi t 96,185 83,292 67,515 77,850 73,853<br />

Personnel costs 61,016 52,874 46,215 48,201 43,334<br />

Depreciation 1,521 982 903 866 858<br />

Income taxes 3,972 3,038 1,028 3,038 2,634<br />

EBIT 15,427 12,415 2,158 10,345 14,594<br />

Net income 10,154 8,027 65 6,007 11,104<br />

Cash fl ow 11,677 9,212 1,013 6,923 11,948<br />

Investments 11,094 1,100 1,961 3,398 1,727<br />

Average no. of employees 1,163 1,035 997 990 911<br />

Equity ratio ***) 28.1% 28.9% 26.2% 28.4% 23.0%<br />

Return on equity before income taxes ***) 38.9% 35.2% 4.7% 36.8% 63.9%<br />

*) Balance sheet equity plus payables due to shareholders, third-party accounts and the silent partnership<br />

**) Excluding payables to shareholders and third-party accounts<br />

***) As related to the equity expanded by payables to shareholders, third-party accounts and the silent partnership as of 31 December<br />

Dear Ladies and Gentlemen,<br />

Dear Customers and Partners,<br />

In economic terms, <strong>2011</strong> was undoubtedly America’s<br />

year. This country’s unfailing belief in freedom<br />

and self-determination and the confidence it has<br />

in its market economy has helped it once again to<br />

emerge out of the financial crisis stronger than<br />

ever. The USA still remains the world’s largest<br />

national economy, far ahead of China which<br />

gen erates less than half that of America’s gross<br />

domestic product. The headquarters of seven of<br />

the ten most prosperous companies in the world<br />

are based in the USA. This country boasts more<br />

elite universities and innovative start-ups than any<br />

other. Even the high level of public debt has not<br />

been able to shake market confidence in the US<br />

dollar. On the contrary, the dominance of the dollar<br />

as a reserve currency is greater than ever before.<br />

The strategy we developed years ago, which<br />

focused on targeting development of American<br />

business, has started to bear fruit. In the last financial<br />

year, <strong>Röhlig</strong> increased its gross profit in the USA by<br />

44 per cent and profit almost doubled. The regional<br />

companies in Asia and the Pacific region, in South<br />

Africa and parts of Europe were also able to significantly<br />

increase their gross profit and results compared<br />

to the previous year and, as such, contributed<br />

to the company’s success. In this, our 160th year of<br />

operation, we expanded globally by 15.5 per cent<br />

and, with an EBIT of Euro 15.4 million, achieved the<br />

highest ever gross yield in our company’s history.<br />

Via a 50 per cent share in our South American<br />

partner company, Procargo, we extended our network<br />

to Argentina, Bolivia, Paraguay and Uruguay<br />

in <strong>2011</strong>. Since we are now truly a global operation<br />

and more than two-thirds of our services are provided<br />

outside Europe, we have adapted our managerial<br />

structure to meet these needs. Since 1 June<br />

<strong>2011</strong>, the business has been managed by the<br />

newly created <strong>Röhlig</strong> Global Executive Board,<br />

whose six members control the company from<br />

Bremen and Hamburg in Germany, Miami and<br />

Hong Kong. The presence of top management in<br />

the dynamic Asian and American regions means<br />

that we are now even closer to our customers and<br />

their business activities. At the same time, we have<br />

avoided the disadvantages associated with an additional<br />

level of hierarchy in the shape of regional<br />

management. We believe that this new structure<br />

will offer us additional momentum for growth.<br />

With this report, we wish to highlight that we offer<br />

first-class expertise even in distant markets. We<br />

accompany you as the “architect” of your supply<br />

chains to all four corners of the globe. In doing so,<br />

we not only network your company with the world<br />

but also connect your subsidiaries, customers or<br />

suppliers with each other.<br />

The developments of the past years give us the<br />

strength and courage to pursue our strategy of<br />

growth. However, we are also well aware that it is<br />

our customers and business partners in particular<br />

that we have to thank for this success. We would<br />

like to express our sincere gratitude to them, the<br />

Advisory Board and our dedicated employees for<br />

the trust they have placed in us.<br />

Thomas W. Herwig<br />

Managing Partner<br />

FOREWORD<br />

The <strong>Röhlig</strong> Global Executive Board (from left to right): Thomas W. Herwig,<br />

Ulrike Baum, Jan Skovgaard, Hans-Ludger Körner, Quentin Lacoste<br />

4 5

“Our fantastic service is a<br />

result of our dedicated <strong>Röhlig</strong><br />

employees, state-of-the-art IT<br />

systems and a strong relation-<br />

ship with our customers.”<br />

Jochen Brandt I National Sales Manager<br />

<strong>Röhlig</strong> New Zealand Ltd.<br />

Overcoming borders<br />

In 1983, when trade barriers between Australia and<br />

New Zealand were dismantled, <strong>Röhlig</strong> was aware<br />

that there was only one course of action: this<br />

growing market was there for the taking. “The two<br />

countries had always been each other’s most important<br />

trade partners. Following the Free Trade<br />

Agreement, we saw a sharp rise in demand,” explains<br />

Jochen Brandt, National Sales Manager at<br />

<strong>Röhlig</strong> New Zealand. <strong>Röhlig</strong> was already active in<br />

Australia at that time and, in 1989, its first office<br />

was set up in New Zealand. Since then, the company<br />

has continuously expanded its activities and,<br />

today, serves all of the major trade routes between<br />

the two countries from its eight regional offices.<br />

FREMANTLE<br />

“We have always looked at the region as an international<br />

market without borders, which has proven to<br />

be a definite advantage,” states Jochen Brandt.<br />

A multitude of competitors and short transit<br />

times make the region a dynamic trading market.<br />

Jochen Brandt notes, “Right from the very start,<br />

we developed products specifically for this market.<br />

For ex ample, we simplified our freight services<br />

so that they could be more easily understood by<br />

customers and allowed them to estimate costs<br />

more effectively – a unique approach in the market.”<br />

Furthermore, <strong>Röhlig</strong> is committed to quick<br />

communication channels and expects its staff to<br />

AUSTRALIA<br />

ADELAIDE<br />

MELBOURNE<br />

“WE HAVE ALWAYS LOOKED<br />

AT THE REGION AS<br />

AN IINTERNATIONAL<br />

MARKET<br />

SYDNEY<br />

NEW ZEALAND<br />

BRISBANE<br />

assume a high degree of responsibility in order to<br />

be able to react quickly in response to situations. “In<br />

a challenging industry <strong>Röhlig</strong> has continued to<br />

maintain outstanding levels of service, deliveries<br />

on schedule and effective communication,” stresses<br />

Gilbert Im, the Chief Financial Officer of <strong>Röhlig</strong>’s<br />

long-standing client, Ontera Modular Carpets.<br />

At present, the market is still growing by around<br />

9 per cent each year. “We have a clear vision,”<br />

explains Jochen Brandt resolutely. “Over the next<br />

few years we want to become the premium forwarder<br />

on the Trans-Tasman trade routes.”<br />

,<br />

WHICH HAS PROVEN TO BE<br />

A DE<br />

DEFINITE ADVANTAGE.”<br />

CHRISTCHURCH<br />

AUCKLAND<br />

WELLINGTON<br />

6 7

Knowing markets<br />

USA<br />

CHICAGO<br />

Juliana Rivi, Branch Manager at Weiss-<strong>Röhlig</strong> USA<br />

in Miami during the course of <strong>2011</strong>, is feeling rather<br />

proud, “In just three years we have almost tripled<br />

our business volume with Latin America.” The impact<br />

of the financial and economic crisis barely<br />

digested, <strong>Röhlig</strong> decided to invest in the market in<br />

2010. At that time, <strong>Röhlig</strong> had only one office in<br />

Chile, however customer demand was such that in<br />

<strong>2011</strong> the company took a major decision and<br />

bought into its long-term partner Procargo. “It was<br />

a decisive move. Although we had always been<br />

able to serve all countries, 85 per cent of our business<br />

was in the hands of our agents which, in the<br />

long term, was not satisfactory for us,” explains<br />

MIAMI<br />

SANTIAGO DE CHILE<br />

BOSTON<br />

BALTIMORE<br />

SOUTH AMERICA<br />

VALPARAÍSO<br />

ASUNCIÓN<br />

MONTEVIDEO<br />

BUENOS AIRES<br />

Hans-Ludger Körner, Chief Financial Officer at<br />

<strong>Röhlig</strong>. By investing in Procargo, <strong>Röhlig</strong> could now<br />

rely on additional representation in Argentina,<br />

Uruguay, Paraguay and Bolivia.<br />

Procargo’s expertise and its local presence has<br />

brought Weiss-<strong>Röhlig</strong> USA distinct advantages<br />

when it comes to dealing with Latin America.<br />

Juliana Rivi notes, “To survive you need to know<br />

the market inside out, especially how to handle<br />

customs regulations. If customs find even minor<br />

discrepancies in the documentation, you can<br />

expect your entire freight to be stopped at the<br />

border.” The language barrier can also be a<br />

NEED TO KNOW<br />

THE MARKET<br />

INSIDE OUT.”<br />

challenge. Most South American companies do<br />

not use English as a business language – as such,<br />

there is huge potential for inaccuracy and<br />

misunderstanding. Weiss-<strong>Röhlig</strong> USA relies on<br />

specially trained employees who are familiar<br />

with both cultures.<br />

“Having our own offi ces in<br />

Latin America is a massive<br />

advantage for us.”<br />

Juliana Rivi I Branch Manager Miami<br />

during the course of <strong>2011</strong>, Weiss-<strong>Röhlig</strong> USA LLC.<br />

8 9

CHINA<br />

Connecting continents<br />

“50 per cent of all US imports originate in China,<br />

so it was obvious to us that we needed to pene trate<br />

this market,” comments Matt Ingram, Vice President<br />

of Sales at Weiss-<strong>Röhlig</strong> USA. In 2007, Weiss-<strong>Röhlig</strong><br />

USA began to strategically develop its business<br />

between China and the USA. Weiss-<strong>Röhlig</strong> has<br />

subsequently expanded its development programme<br />

successfully to cover the whole of Asia<br />

and the Indian subcontinent, utilising its own 38<br />

offices throughout the region for customer services.<br />

“We have always been very aware that success<br />

would not only be about business transactions,<br />

but also about embracing many different<br />

QINGDAO<br />

HONG KONG<br />

SHENZHEN<br />

SHANGHAI<br />

NINGBO<br />

cultures,” Matt Ingram continues. Weiss- <strong>Röhlig</strong><br />

therefore invested considerable time and effort<br />

towards the development of a cultural and business<br />

awareness programme for employees on<br />

either side of the Pacific, aimed at promoting<br />

internal communications and mutual understanding.<br />

Customers have felt the benefits, too.<br />

“Operating on the Trans-Pacific trade lane is subject<br />

to major fluctuation, with change being<br />

difficult to predict. Our modern IT systems<br />

ensure processes are straightforward and transactions<br />

as transparent as possible.” Moreover, by<br />

means of a flexible and centralised space and<br />

rate management system, Weiss-<strong>Röhlig</strong> also<br />

SAN FRANCISCO<br />

USA<br />

LOS ANGELES<br />

CHICAGO<br />

“WEISS-RÖHLIG HAS THE POTENTIAL<br />

TO BECOME ONE OF THE<br />

ON THIS TRADE LANE.”<br />

ensures it can react quickly and in the clients’<br />

best interests to changing market conditions.<br />

“In recent years Weiss-<strong>Röhlig</strong>’s development in<br />

the region has been rapid,” adds Benton Kauffman,<br />

Senior Director at Maersk Line USA, one of<br />

Weiss-<strong>Röhlig</strong>’s most valued carrier partners. Matt<br />

Ingram concedes, “And we’re still just getting<br />

started. Weiss-<strong>Röhlig</strong> has a long-term commitment<br />

to the region and has the potential to<br />

become one of the top 10 freight forwarders on<br />

this trade lane.”<br />

NEW YORK<br />

“Our results result to t date d<br />

arenotdue to any one<br />

individual person, offi ce or<br />

national company, but rather<br />

to a team approach.”<br />

Matt Ingram I Vice President Sales<br />

Weiss-<strong>Röhlig</strong> USA LLC.<br />

10 11

MANAGEMENT REPORT | BUSINESS DEVELOPMENT MANAGEMENT REPORT | BUSINESS DEVELOPMENT<br />

Profi table growth as the basis for<br />

sustainable corporate success<br />

Best-ever sales and gross profit results<br />

since the company’s foundation<br />

The past business year proved to be extremely<br />

successful for <strong>Röhlig</strong>. The business saw expansion<br />

in all regions, whereby the most impressive growth<br />

figures were achieved in America and the Pacific<br />

region. With sales totalling Euro 491 million, the<br />

highest gross profit in the company’s history was<br />

recorded at Euro 96.2 million. This represents an<br />

increase of 15.5 per cent compared to the<br />

previous year.<br />

This growth was made possible through the<br />

adaptation of our corporate structures to the<br />

changing conditions, as well as the identification<br />

and fostering of suitable young talent in good<br />

time. Our long-standing efforts to enhance<br />

our brand image and reputation as an attractive<br />

employer have started to pay dividends.<br />

Euro crisis slows down growth in Europe<br />

The regular reports on debt restructuring and conversion<br />

measures in the European debtor countries<br />

resulted in uncertainty amongst all market players<br />

as to the future economic outlook. In Spain, Italy<br />

and Belgium, our business suffered under the poor<br />

economic conditions in these countries. In contrast,<br />

the companies in Great Britain and France managed<br />

to significantly increase both their gross profit<br />

and overall result. We do not expect to see dynamic<br />

and positive growth in this region until the refinancing<br />

of the debtor countries has been finalised.<br />

Consolidated companies<br />

Gross profi t development<br />

2007–<strong>2011</strong> in TEUR<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Gross profi t<br />

in TEUR<br />

73,853<br />

77,850<br />

67,515<br />

83,292<br />

96,185<br />

2007 2008 2009 2010 <strong>2011</strong><br />

<strong>2011</strong> 2010<br />

Gross profi t consolidated companies 96,185 83,292<br />

Gross profi t associated companies 43,704 38,772<br />

Total 139,889 122,064<br />

Dwindling dynamism in the sea and air<br />

freight markets<br />

According to the market analysts at IHS Global<br />

Insight and Drewry, the sea freight market grew<br />

by 6.5 per cent in <strong>2011</strong> and was thus unable to<br />

match the level achieved in 2010. For 2012, we are<br />

expecting further growth but, again, at a slower<br />

rate compared to <strong>2011</strong>.<br />

On the basis of the container volumes transported<br />

in <strong>2011</strong>, IHS Global Insight believes that growth of<br />

35 per cent is realistic up to 2016. As such, this<br />

sector is continuing to develop positively and<br />

record high growth rates. We are anticipating<br />

market disturbances from the high number of<br />

container ships, which are poised to enter service.<br />

Even in <strong>2011</strong>, rates to and from Asia were put under<br />

major pressure and volumes were transferred to<br />

the world’s largest shipping companies.<br />

Overall, air freight tonnages transported globally in<br />

the year under review were slightly below the impressive<br />

volumes of the previous year. However, the<br />

initially strong growth slackened off considerably<br />

over the course of the year. The reasons for this<br />

were the economic downturn, the unsolved European<br />

sovereign debt crisis and the decline in<br />

consumption in Europe as a result of the fear of<br />

recession. Contrary to this trend, the <strong>Röhlig</strong> Group<br />

increased its gross profit in this market sector<br />

by 7.1 per cent, in particular in the Australia/New<br />

Zealand region.<br />

At 15.5 per cent, the increase in consolidated<br />

gross profit was above the growth rate of the<br />

overall market. This clearly shows that in <strong>2011</strong><br />

<strong>Röhlig</strong> was able to build on its dynamic growth<br />

record of the previous year. We continue to regard<br />

the growth targets formulated in our Strategy<br />

2018 as valid and remain convinced that we will<br />

achieve these.<br />

The consolidated operating performance (EBIT)<br />

increased in the year under review by Euro 3 million<br />

to Euro 15.4 million. This represents the best result<br />

for the company in its 160-year history.<br />

Workforce continues to grow<br />

For the first time in its history, the <strong>Röhlig</strong> Group<br />

now employs more than 2,000 staff.<br />

We have recruited additional staff due to the<br />

dynamic nature of many of our sub-markets.<br />

The yearly average number of employees in the<br />

<strong>Röhlig</strong> Group was 2,092 and, as such, 168 more<br />

than the yearly average of the previous year.<br />

Personnel development has been a central issue<br />

at <strong>Röhlig</strong> for many years now. We attach great<br />

importance to familiarising new staff with the<br />

values and structures of our company from<br />

the start. Furthermore, standardised as well as<br />

customised training programmes take place at<br />

all levels. Such measures ensure that our highly<br />

qualified staff are able to handle the challenges<br />

presented both by the market and our customers,<br />

and can always offer customer services of the<br />

highest possible quality.<br />

The second Blue Arena programme which got<br />

under way last year was successfully concluded in<br />

February 2012. As part of this programme, 12 experienced<br />

managers have received training and also<br />

developed and implemented projects concerned<br />

with reducing costs and product development.<br />

12 13<br />

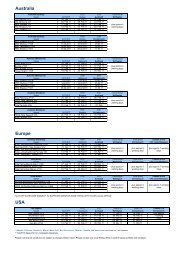

Employees<br />

<strong>2011</strong> 2010<br />

Germany 337 309<br />

Belgium 20 19<br />

France 112 101<br />

Great Britain 40 39<br />

Italy 44 37<br />

The Netherlands 19 23<br />

Spain 25 26<br />

Denmark 6 6<br />

Australia 159 141<br />

New Zealand 51 51<br />

Hong Kong/China 125 102<br />

Singapore 25 24<br />

Korea 35 33<br />

USA 128 92<br />

Canada 12 11<br />

Chile<br />

Total <strong>Röhlig</strong> consolidated<br />

25 21<br />

companies 1,163 1,035<br />

South Africa 464 440<br />

India* 163 174<br />

Thailand 13 12<br />

Japan 6 5<br />

China 232 211<br />

UAE 25 24<br />

Taiwan 27 23<br />

Total associated companies 929 889<br />

* Employees India: 31.12.<strong>2011</strong><br />

Total <strong>Röhlig</strong> Group 2,092 1,924

MANAGEMENT REPORT | BUSINESS DEVELOPMENT<br />

Integrated IT as the key to success<br />

Since we operate in all of the world’s time zones,<br />

our IT systems must be available around the clock.<br />

By means of the company’s own computer centre<br />

our IT subsidiary, <strong>Röhlig</strong> blue-net, is able to service<br />

these tough technical demands 24/7. The technical<br />

availability, and the intelligence of the software<br />

products offered, help us to stay one step ahead<br />

of the competition. In terms of administrative software,<br />

we trust in the market leader, SAP. We aim to<br />

have completed implementation in all sub sidiaries<br />

within the next two years. Cargowise operational<br />

software is a one-file model, with single data<br />

entry, which helps to minimise error rates. Staff all<br />

around the world can access standardised data<br />

records at all times.<br />

Double-digit growth in all divisions<br />

World trade growth in the year under review<br />

slowed down considerably compared to 2010. This,<br />

naturally, had an impact on transport volumes. Sea<br />

freight volumes grew by a mere 5 per cent whilst<br />

the air freight sector saw a slight decline. Nevertheless,<br />

<strong>Röhlig</strong> was able to increase its gross profit<br />

in sea freight by 19.9 per cent and in air freight by<br />

7.1 per cent.<br />

The high level of growth in the other business<br />

areas is a sign of our strong commitment to<br />

our warehousing, supply chain management<br />

and project logistics operations.<br />

Gross profi t by division (consolidated companies)<br />

in TEUR/shares<br />

Growth in all regions<br />

<strong>2011</strong> 2010<br />

Sea freight 57,236 59.5% 47,720 57.3%<br />

Air freight 35,717 37.1 % 33,360 40.0%<br />

Other 3,232 3.4% 2,212 2.7%<br />

Total 96,185 100% 83,292 100%<br />

The distribution of the gross profit generated by<br />

the <strong>Röhlig</strong> consolidated companies is displaying<br />

an increasingly improving balance between<br />

regions. This is a consequence of the internationalisation<br />

strategy consistently pursued by<br />

MANAGEMENT REPORT | DIVISIONS AND REGIONS<br />

<strong>Röhlig</strong> in recent years. While the Pacific region<br />

and America, particularly the USA, are showing<br />

disproportionate growth, the share of the gross<br />

profit generated in Germany is slowly declining.<br />

Through timely planning within the framework of<br />

Strategy 2018, we were also able to participate<br />

in the fast-growing sea and air freight business<br />

within Asia (“Intra-Asia”) and between North and<br />

South America.<br />

In the <strong>Röhlig</strong> Group, to which, for example, the<br />

associated companies in China and South Africa<br />

also belong, a balanced distribution of the gross<br />

profit among the six regions has come about.<br />

This fact alone makes clear that in recent years,<br />

<strong>Röhlig</strong> has transformed itself from an international<br />

carrier based in Germany to a global provider of<br />

logistics services.<br />

Gross profi t by regions (consolidated companies)<br />

in TEUR/shares<br />

<strong>2011</strong> 2010<br />

Germany 20,509 21.3% 19,557 23.5%<br />

Europe (excl. Germany) 26,094 27.1 % 22,824 27.4%<br />

Australia/New Zealand 19,762 20.6% 17,097 20.5%<br />

Asia 12,068 12.5% 10,898 13.1 %<br />

America 17,752 18.5% 12,916 15.5%<br />

Total 96,185 100% 83,292 100%<br />

14 15<br />

Air freight<br />

35,717<br />

37.1%<br />

Other<br />

3,232<br />

3.4%<br />

Sea freight<br />

57,236<br />

59.5%<br />

Asia<br />

12,068<br />

12.5%<br />

America<br />

17,752<br />

18.5%<br />

Australia/<br />

New Zealand<br />

19,762<br />

20.6%<br />

Germany<br />

20,509<br />

21.3%<br />

Europe<br />

(excl. Germany)<br />

26,094<br />

27.1%<br />

Divisions<br />

Regions

MANAGEMENT REPORT | DIVISIONS AND REGIONS<br />

Consolidated<br />

Companies<br />

Gross profi t by regions (Group)<br />

in TEUR/shares<br />

<strong>2011</strong> 2010<br />

Germany 20,509 14.7 % 19,557 16.0 %<br />

Europe (excl. Germany) 26,094 18.7 % 22,824 18.7 %<br />

Australia/New Zealand 19,762 14.1 % 17,097 14.0%<br />

Africa 27,336 19.5% 24,788 20.3%<br />

Asia 28,437 20.3% 24,882 20.4%<br />

America 17,752 12.7% 12,916 10.6%<br />

Total 139,889 100% 122,064 100%<br />

Asia<br />

28,437<br />

20.3%<br />

It is remarkable that our companies in Europe<br />

have maintained their share of the gross profit,<br />

showing growth of 14.3 per cent, despite economic<br />

stagnation or recession in most member<br />

states of the European Union.<br />

Germany<br />

America<br />

17,752<br />

12.7%<br />

Africa<br />

27,336<br />

19.5%<br />

Germany<br />

20,509<br />

14.7%<br />

Europe<br />

(excl. Germany)<br />

26,094<br />

18.7%<br />

Australia/<br />

New Zealand<br />

19,762<br />

14.1 %<br />

Germany again achieved the highest gross profit<br />

of all consolidated companies. In <strong>2011</strong>, the business<br />

expanded by 5 per cent which, given the<br />

difficult market conditions, must be seen as a<br />

success. Scheduled shipping rates in Germany<br />

in <strong>2011</strong> continued to be under pressure, with<br />

order numbers and economic potential here<br />

growing only slowly. We reacted to this by opening<br />

new sales offices in Dresden and in Münster/<br />

Osnabrück. Furthermore, as planned, we recruited<br />

new staff in sales, route development and tender<br />

management. The investments made in the new<br />

sites and sales resulted in an operating loss in<br />

<strong>2011</strong>. However, this strategic investment was necessary<br />

to ensure that the company is well positioned<br />

in Germany in the future. For 2012, we are anticipating<br />

further standardisation of operational processes<br />

as well as even more successful development of our<br />

markets by our strengthened sales team.<br />

Germany*<br />

in TEUR<br />

<strong>2011</strong> 2010<br />

Gross profi t 20,509 19,557<br />

Thereof: Sea freight 10,471 10,843<br />

Air freight 8,126 8,361<br />

Other 1,912 353<br />

Adjusted net income –1,705 610<br />

Thereof: Sea/Air freight –604 173<br />

Holding/IBG/Blue Services –1,101 437<br />

Employees 337 309<br />

Trainees 42 34<br />

* <strong>Röhlig</strong> & Co. Holding GmbH & Co. KG, <strong>Röhlig</strong> Deutschland GmbH &<br />

Co. KG, R+C Commodity GmbH & Co. KG, <strong>Röhlig</strong> & Co. Internationale<br />

Beteiligungsgesellschaft mbH, <strong>Röhlig</strong> blue-net GmbH, Blue Services<br />

GmbH & Co. KG<br />

Europe (excluding Germany)<br />

Europe developed positively in <strong>2011</strong>. At 14.3 per<br />

cent, the increase in gross profit was well above<br />

the overall market average. In addition, productivity<br />

was significantly boosted so that during this<br />

period the workforce grew by just 6 per cent. The<br />

individual country companies faired differently in<br />

the year under review. In Great Britain, the Nether<br />

lands, France and Denmark, <strong>Röhlig</strong> increased its<br />

gross profits markedly compared to the previous<br />

year, whereas in Belgium, Italy and Spain gross<br />

profits were constant or, indeed, slightly down.<br />

The reorganisation and restructuring measures<br />

which took place in the Netherlands a few years<br />

ago are starting to bear fruit. Service quality has<br />

been considerably improved and the growth<br />

achieved is proof that this has been recognised<br />

by the market and customers.<br />

In Great Britain, our gross profit rose by 9 per cent<br />

and the overall result by 27 per cent. This is due, in<br />

part, to the development of new vertical markets.<br />

SAP and Cargowise were implemented in Italy<br />

in the year under review. As a result of this,<br />

<strong>Röhlig</strong> Italia expects to see additional growth<br />

potential in the future thanks to more efficient<br />

processes. Given the economic difficulties which<br />

Italy is experiencing, we consider recession possible,<br />

nevertheless we also expect the corporate<br />

network to provide <strong>Röhlig</strong> Italia with further<br />

stimulus for growth.<br />

The major squeeze on margins in Belgium has led<br />

to an unsatisfactory result. In 2012, we intend to<br />

develop new vertical markets and also focus on the<br />

transatlantic business.<br />

Europe (excluding Germany)*<br />

in TEUR<br />

With gross profit growth of 26 per cent and an<br />

increase in the overall result of 124 per cent, <strong>2011</strong><br />

was an extremely positive year for <strong>Röhlig</strong> France.<br />

This can be traced back to the systematic optimisation<br />

of our business processes, the conclusion of<br />

project business and our successful sales.<br />

Spain’s economy has been struggling for some<br />

years now. For this reason, we are satisfied with<br />

<strong>Röhlig</strong> España’s gross profit growth of 2.6 per cent.<br />

This slight increase was achieved by concentrating<br />

on our network countries as well as on niche<br />

markets such as Turkey and Morocco. In <strong>2011</strong>,<br />

we opened a new office in Bilbao. In addition,<br />

the year was shaped by the introduction of<br />

Cargowise and SAP.<br />

At 20 per cent, our company in Denmark, established<br />

three years ago, can boast impressive gross<br />

profit growth. In <strong>2011</strong>, <strong>Röhlig</strong> Danmark was awarded<br />

IATA certification and introduced Cargowise as<br />

an operational platform. We expect this trend<br />

to continue and have a positive impact on the<br />

result in future.<br />

16 17<br />

<strong>2011</strong> 2010<br />

Gross profi t 26,094 22,824<br />

Thereof: Sea freight 16,678 14,246<br />

Air freight 9,054 8,341<br />

Other 362 237<br />

Adjusted net income 684 369<br />

Employees 266 251<br />

* Belgium, Denmark, France, UK, Italy, the Netherlands, Spain<br />

MANAGEMENT REPORT | DIVISIONS AND REGIONS

MANAGEMENT REPORT | DIVISIONS AND REGIONS<br />

Asia<br />

The three Asian companies in Hong Kong/South<br />

China, Korea and Singapore once again achieved<br />

stable growth in <strong>2011</strong>. This is partly due to the<br />

robust economic conditions in this region. In Hong<br />

Kong and Singapore, <strong>Röhlig</strong> was able to signifi -<br />

cantly expand its warehousing and supply chain<br />

management (SCM) in <strong>2011</strong>. <strong>Röhlig</strong> Holding<br />

develops SCM products which we also expect<br />

to lead to further dynamic growth. The company<br />

in Korea has focused in particular on import processing<br />

and, in doing so, has won additional<br />

market shares.<br />

Asia*<br />

in TEUR<br />

* Hong Kong/South China, Korea, Singapore<br />

<strong>2011</strong> 2010<br />

Gross profi t 12,068 10,898<br />

Thereof: Sea freight 7,001 5,135<br />

Air freight 4,406 4,123<br />

Other 662 1,640<br />

Adjusted net income 4,296 2,943<br />

Employees 185 159<br />

Pacifi c (Australia/New Zealand)<br />

Once again, the Pacifi c region was able to increase<br />

its gross profi t compared to the previous<br />

year by 15.6 per cent. Both <strong>Röhlig</strong> Australia<br />

and <strong>Röhlig</strong> New Zealand successfully expanded<br />

their import businesses, particularly with India<br />

and South East Asia. IT integration is well<br />

advanced which enables these companies to<br />

lead the way in terms of customer accessibility<br />

and connection to our operational software. This<br />

level of integration enables customers to track<br />

the status of their consignments at all times and<br />

also place orders.<br />

Australia/New Zealand<br />

in TEUR<br />

<strong>2011</strong> 2010<br />

Gross profi t 19,762 17,097<br />

Thereof: Sea freight 11,661 10,232<br />

Air freight 7,977 6,694<br />

Other 124 171<br />

Adjusted net income 2,659 1,534<br />

Employees 210 192<br />

America<br />

In <strong>2011</strong>, <strong>Röhlig</strong> acquired a 50 per cent share of<br />

the South American company Procargo. With<br />

this, we have strengthened our profile in Argentina,<br />

Uruguay, Paraguay and Bolivia. Although<br />

operational integration took place in <strong>2011</strong>,<br />

integration into the annual report and complete<br />

consolidation will not be concluded until the<br />

2012 annual report.<br />

With annual growth of 44 per cent, Weiss- <strong>Röhlig</strong><br />

USA achieved its best-ever result since its foundation<br />

in 2005. The acquisition of the logistics<br />

company Seajet, Boston, which specialises in<br />

Asia, and the customs agent CSI International,<br />

Chicago, has on the one hand, allowed us to<br />

considerably boost our competitive position in<br />

the transpacific sector and, on the other hand,<br />

enabled us to offer customs services nationwide<br />

in the future. Furthermore, with our new<br />

site in Boston we can focus on growing our<br />

transatlantic business.<br />

The two smaller companies in Canada and Chile<br />

also managed to conclude the year on a high.<br />

Our focus on the US import market continued<br />

to pay dividends in Chile. Compared to the<br />

previous year, <strong>Röhlig</strong> Chile increased its gross<br />

profit by 20 per cent.<br />

MANAGEMENT REPORT | DIVISIONS AND REGIONS<br />

America*<br />

in TEUR<br />

<strong>2011</strong> 2010<br />

Gross profi t 17,752 12,916<br />

Thereof: Sea freight 11,426 7,075<br />

Air freight 6,154 5,841<br />

Other 172 0<br />

Adjusted net income 1,574 936<br />

Employees 165 124<br />

* Chile, Canada, USA<br />

18 19

MANAGEMENT REPORT | DIVISIONS AND REGIONS<br />

Group<br />

<strong>Röhlig</strong> Group<br />

In addition to the consolidated companies, the<br />

<strong>Röhlig</strong> Group also includes the associated companies<br />

in South Africa, China, India, Japan, Taiwan,<br />

Thailand and the United Arab Emirates. These<br />

sites are all of major strategic relevance for the<br />

<strong>Röhlig</strong> network. The companies are included “at<br />

equity” in the consolidated accounts.<br />

South Africa<br />

After a record-breaking 2010, our associated<br />

company in South Africa continued to develop<br />

very positively in <strong>2011</strong>. <strong>Röhlig</strong>-Grindrod was<br />

again able to achieve the best result in the company’s<br />

history. One of the reasons for the success<br />

enjoyed in the year under review was the attraction<br />

of numerous new customers as a result of<br />

enhanced sales activities. We have expanded<br />

in the warehousing sector and have concluded<br />

a significant number of new contracts in the<br />

project business.<br />

South Africa*<br />

(50% share in capital) in TEUR<br />

South East/East Asia<br />

<strong>2011</strong> 2010<br />

Gross profi t 27,336 24,788<br />

Net income after taxes 6,006 4,451<br />

Net income from equity consolidation 3,003 2,225<br />

Employees 464 440<br />

* Mozambique, Republic of South Africa<br />

The South East/East Asia region comprises our<br />

companies in China, Taiwan, Japan and Thailand<br />

which we operate together with our Austrian<br />

alliance partner Gebrüder Weiss. Making<br />

up an 85 per cent share of gross profit, China<br />

is our most important associated company in<br />

these markets. As in past years, Weiss-<strong>Röhlig</strong><br />

China played a key role in the growth in this<br />

region and achieved a very good result. The<br />

associated companies in Taiwan and Thailand<br />

also developed positively during the year under<br />

review, both in terms of gross profit and results.<br />

With a clear focus on future success, our company<br />

in Japan has strengthened its position<br />

with the acquisition of the logistics service<br />

provider JHB Express.<br />

South East/East Asia*<br />

in TEUR<br />

<strong>2011</strong> 2010<br />

Gross profi t 12,867 11,300<br />

Net income after taxes 3,655 2,620<br />

Net income from equity consolidation 1,742 1,271<br />

Employees 278 251<br />

* China (50%), Japan (50%), Taiwan (50%), Thailand (37.5%)<br />

India<br />

An initial consolidation was carried out in our<br />

associated company in India in 2009. Due to the<br />

differing financial year in India, the reporting<br />

period here is taken from 1 April 2010 to 31 March<br />

<strong>2011</strong>. The results reflect the continuing negative<br />

impact of the global financial crisis. We introduced<br />

our operational platform EDI/ Cargowise<br />

as well as the SAP financial platform in the<br />

year under review. These systems are now well<br />

integrated and recognised and are contributing<br />

to gains in productivity.<br />

Middle East<br />

<strong>2011</strong> was a poor year for the building industry<br />

in the United Arab Emirates (UAE). Contrary to<br />

all expectations, many of the emirates were<br />

re luctant to award projects. Well-known rating<br />

agencies warned that major state companies<br />

could experience difficulties with the refinancing<br />

of due debt. In spite of these difficult financial conditions,<br />

Weiss-<strong>Röhlig</strong> UAE was able to improve its<br />

results essentially through active sales and the<br />

acquisition of new customers.<br />

MANAGEMENT REPORT | DIVISIONS AND REGIONS<br />

* Weiss-<strong>Röhlig</strong> Middle East Ltd. (50%), Weiss-<strong>Röhlig</strong> UAE (L.L.C.) (24.5 %)<br />

Agency network<br />

In order to achieve worldwide coverage beyond<br />

our own network, we work together with agents in<br />

many countries. The strongest of these partners<br />

are awarded the Premium Agent quality seal. Today<br />

our global network comprises 27 such accredited<br />

Premium Agents.<br />

Events after the reporting period<br />

In this respect, there have been no events or<br />

incidents of particular significance since the end<br />

of the business year.<br />

20 21<br />

India<br />

(25% share in capital) in TEUR (01.04.2010–31.03.<strong>2011</strong>)<br />

<strong>2011</strong> 2010<br />

Gross profi t 2,203 1,517<br />

Net income after taxes –282 –558<br />

Net income from equity consolidation –70 –139<br />

Employees 163 174<br />

Middle East*<br />

in TEUR<br />

<strong>2011</strong> 2010<br />

Gross profi t 1,299 1,167<br />

Net income after taxes 129 87<br />

Net income from equity consolidation 64 43<br />

Employees 25 24

MANAGEMENT REPORT | STRUCTURAL CHANGES AND RISK MANAGEMENT MANAGEMENT REPORT | STRUCTURAL CHANGES AND RISK MANAGEMENT<br />

Achieving our global goals<br />

with a regional focus<br />

International logistics focus on driving forward<br />

both regional and local developments in order<br />

to strengthen the global network. In order to<br />

boost our international presence, we have<br />

acquired a 50 per cent share of our long-standing<br />

agent Procargo. This move has served to<br />

significantly enhance our profile in South America<br />

where we now have representative offices in<br />

Argentina, Bolivia, Paraguay and Uruguay. Furthermore,<br />

we are also extremely well positioned with<br />

our long-standing subsidiary in Chile.<br />

In the US market, following the takeover of the<br />

company Seajet, we are now also represented in<br />

Boston. And with the acquisition of our customs<br />

agent in Chicago, today we are in a position to offer<br />

customs services throughout the entire country. In<br />

order to complete our branch network, we have<br />

opened new sales offices both in Germany and<br />

Italy. In spite of the considerable uncertainties on<br />

the international financial markets and the impact<br />

this has on the real economy, with this decision<br />

<strong>Röhlig</strong> has demonstrated its optimism regarding<br />

the development of the global economy. Strategic<br />

investments in growth markets and our qualified<br />

staff are proof of our conviction that we can<br />

achieve the ambitious strategy goals for 2018.<br />

Risk management<br />

Our growth rate, which is well above the market<br />

average, demands professional cash flow management.<br />

This has been one of the focuses of our<br />

work over recent years. In <strong>2011</strong>, we successfully<br />

ensured that the receivable turnover ratio increased.<br />

In addition to active cash management,<br />

a company’s capital funding also plays a key role<br />

in terms of future risk-taking capability. In the<br />

year under review, the <strong>Röhlig</strong> Group was able to<br />

increase its equity from Euro 31.5 million to<br />

Euro 36.4 million, even though Euro 1 million was<br />

transferred back to Nord Holding capital. As a<br />

result, the risk-bearing ability in the reporting<br />

year has been further increased.<br />

In <strong>2011</strong>, a new team by the name of Blue+ was<br />

established. Within <strong>Röhlig</strong>, this unit specialises in<br />

the professional organisation of quality management,<br />

process optimisation and risk management.<br />

The team also acts as an internal auditing unit for<br />

management of the Holding. Blue+ carried out<br />

process optimisation projects in many countries in<br />

the year under review and, as part of its risk management<br />

activities, has developed an overview of<br />

all the risk factors associated with the individual<br />

subsidiaries. This catalogue is now available as a<br />

global information tool and enables us to align our<br />

risk management policies more closely to the<br />

actual conditions.<br />

In principle, a distinction is made between risks<br />

that constrain a company’s development and<br />

those that threaten its continued existence. At<br />

present, we are not aware of any risks that could<br />

threaten the company’s continued existence. We<br />

do, however, classify the following individual<br />

risks as constraining company development:<br />

Exchange rate risks<br />

Just as in 2010, <strong>2011</strong> was a year characterised by<br />

highly volatile global currencies. As part of our<br />

corporate policy, we limit currency fluctuations<br />

through the strategic closure of hedging transactions<br />

in order to minimise any negative impact.<br />

Speculation is not part of our company policy.<br />

Using our dividend parameters, we investigate the<br />

equity required in the particular countries which<br />

we must make available to the subsidiaries. This,<br />

in turn, allows us to considerably reduce the<br />

re-evaluation risks in the consolidated companies<br />

at year end.<br />

As in the past, we continue to cover currency risk<br />

with forward exchange transactions and options.<br />

Market interest rates are at a historically low level,<br />

although this is only true for the large industrial<br />

nations. It has been our experience that local<br />

financing in the international network means significant<br />

interest charges compared to the levels<br />

with which we are familiar in Germany. Through<br />

the central financing of international growth, the<br />

Holding is able to make a positive contribution to<br />

the overall result. We are expecting to see a considerable<br />

increase in the cost of external financing<br />

in the coming years. It can be safely assumed that,<br />

in the near future, decisions on interest rates will<br />

be politically motivated and, as such, will be<br />

extremely difficult to deduce on the basis of economic<br />

theories.<br />

We have optimised the netting process on a<br />

global scale with regard to exchange rate risks.<br />

Our central Treasury division based in Bremen<br />

coordinates global interest and currency cover<br />

transactions as well as additional measures to<br />

ensure optimal management of our cash flows.<br />

Del credere management<br />

Both 2010 and <strong>2011</strong> saw a global economic<br />

upturn as well as a clear drop in loan losses. Consequently,<br />

business relations with underwriters<br />

have returned to normal.<br />

As in previous years, Germany, Denmark, the<br />

Netherlands, Belgium, the USA, Spain, the UK,<br />

France and Australia are included in the credit insurance.<br />

No changes are planned here at present.<br />

Integrated IT systems enable <strong>Röhlig</strong> to react to<br />

inherent business risks with rigorous claims management.<br />

This systematic support mechanism<br />

and regular credit status checks of our customers<br />

has resulted in major improvements in terms<br />

of credit limit assignment rules and automated<br />

collection processes.<br />

Relations with our agents are monitored centrally.<br />

Monitoring extends not only to debtors but also<br />

to the business relationship in general.<br />

Working capital management<br />

Just as in past years, we have focused on optimising<br />

the DSOs (Days Sales Outstanding).<br />

These efforts have meant that we were able to<br />

reduce this parameter from 44.5 days in 2010<br />

to 41.1 days in the year under review in spite of<br />

considerable growth and an increase in sales<br />

volume. This was a major boost for the <strong>Röhlig</strong><br />

Group’s internal financing capacity and also<br />

created the platform for the internal financing<br />

of our growth. Furthermore, we have sufficient<br />

funding lines from long-term banking partners<br />

with whom we foster open, trusting and longstanding<br />

relations. We regard ourselves as well<br />

positioned for further growth as well as the<br />

challenges of the coming years.<br />

Transport damage/financial damage<br />

We are insured against possible claims arising<br />

from our international transport and logistics<br />

activities through global forwarding indemnity<br />

insurance with the TT Club in London. The TT<br />

Club’s IT system provides us with a continuous<br />

overview of all claims reported internationally.<br />

Due to our General Terms and Conditions and<br />

our business model, we only have limited liability<br />

for damages. This is based on the fact that we<br />

do not carry out any physical transport services<br />

but contract them out.<br />

22 23

MANAGEMENT REPORT | STRUCTURAL CHANGES AND RISK MANAGEMENT<br />

Inherent business risks<br />

Global logistics follow the international flow of<br />

goods. For a number of years now, we have seen<br />

increasingly large parts of our global value-added<br />

chain shifting to the so-called emerging markets.<br />

Inevitably, these markets are becoming growth<br />

markets for us. In order to handle the associated<br />

increase in complexity, we have developed an<br />

effective information system. Our Controlling department<br />

promptly provides us with the relevant<br />

information. It is only possible to manage this level<br />

of complexity by harmonising the IT systems used.<br />

For example, we have launched Cargowise in Spain,<br />

Italy and Denmark so that 13 countries are now<br />

active on this platform. The SAP platform, which<br />

we use for our financial and accounting processes,<br />

has been implemented in Spain, Italy and France.<br />

This means we are one step closer to our goal of a<br />

“one file concept”. In the future, we will be able to<br />

optimise information flows and also significantly<br />

improve information quality.<br />

Structural changes<br />

In order to cope structurally with our above-<br />

average growth in <strong>2011</strong>, we decided to restructure<br />

the Executive Board of the Holding. In addition<br />

to the central functions Human Resources and<br />

Finance/IT, three CEOs based in the regions are<br />

responsible for the operational side of the business.<br />

Jan Skovgaard, the former managing director<br />

of our Hong Kong organisation, was appointed as<br />

a new member of the Board. One Board member<br />

is based in Hamburg and is responsible for the<br />

regions Europe and India, one in Miami for the<br />

regions North and South America and South Africa<br />

as well as one in Hong Kong for the Asia/Pacific<br />

region. For us it was important to achieve closer<br />

proximity to the market via a regional presence<br />

without introducing a further level of hierarchy.<br />

Just as before, every country manager at <strong>Röhlig</strong><br />

has direct access to a Board member. On acquiring<br />

Seajet, Procargo and CSI we placed great<br />

importance on the fact that these companies had<br />

a similar business model to <strong>Röhlig</strong>’s and that their<br />

founders shared similar values and standards. We<br />

believe that this is a prerequisite for successful<br />

integration in our organisation.<br />

Outlook –<br />

responsible growth<br />

Forecasts for the development of the global<br />

economy in 2012 improved somewhat in the fi rst<br />

quarter. As such, the IMF is more optimistic now<br />

than at the end of <strong>2011</strong>. This change in mood<br />

is due essentially to the agreement on another<br />

emergency package for Greece. Nevertheless,<br />

leading economic-research institutes and many<br />

banks expect diffi cult market conditions and a<br />

high degree of volatility to persist. Even though<br />

the majority of countries in which we are active<br />

have enjoyed positive development to date, we<br />

feel we would be able to react appropriately in<br />

the event of a sudden economic slump.<br />

With a decentralised Holding management structure,<br />

we have created the conditions enabling us<br />

to adapt quickly and without hierarchical fi lters<br />

to the changing market environment. Strategic<br />

acquisitions have served to strengthen our profi le<br />

in both Latin and North America. Furthermore,<br />

we have also expanded sales in our subsidiaries.<br />

All of these measures have not only contributed<br />

to the good result recorded in <strong>2011</strong> but are also<br />

the basis for continuing profi table growth – even<br />

in diffi cult conditions.<br />

We are making good progress with our IT integration<br />

project and are committed to pursuing this<br />

programme. The ultimate aim is that all <strong>Röhlig</strong><br />

offi ces around the world work on the same platform<br />

and have simultaneous access to identical<br />

information. This will not only reduce error rates and<br />

enhance effi ciency but also allow us to provide more<br />

extensive information services to our customers.<br />

MANAGEMENT REPORT | OUTLOOK<br />

In 2012, we expect to see the <strong>Röhlig</strong> Group continue<br />

to grow at a rate that is equal to the previous year.<br />

EBIT is expected to be higher than that in the year<br />

under review. In terms of regions, we see the strongest<br />

growth impulses continuing to come from Asia,<br />

the USA and Latin America. Our acquisitions, on the<br />

one hand, and our broad product portfolios, on the<br />

other hand, all play a positive role here. Our customers<br />

around the world are increasingly demanding<br />

integrated supply chain solutions. For this reason,<br />

we are developing this sector as an independent<br />

product line at Holding level and, with this, are pushing<br />

forward with our global SCM activities for the<br />

benefi t of our customers. We are also focused on<br />

the development and strengthening of our global<br />

sales and, in future, a member of the Global Executive<br />

Board will be directly responsible for this area.<br />

As a result of our close alignment to the market and<br />

by having the necessary tools to react quickly to<br />

market fl uctuations, we are able to look forward to<br />

2012 with confi dence, particularly in terms of profitable<br />

growth. Our actions are guided by a sense of<br />

responsibility: we don’t want growth at any price,<br />

rather we are committed to the sustainable development<br />

of the company which will secure <strong>Röhlig</strong><br />

against future developments and also ensure our<br />

fi nancial independence.<br />

Bremen, 4 April 2012<br />

Thomas W. Herwig Quentin Lacoste<br />

Hans-Ludger Körner Ulrike Baum<br />

Jan Skovgaard<br />

24 25

ANNUAL FINANCIAL STATEMENT | BALANCE SHEET ANNUAL FINANCIAL STATEMENT | BALANCE SHEET<br />

Consolidated balance sheet as of 31 December <strong>2011</strong><br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG, Bremen<br />

ASSETS<br />

<strong>2011</strong> TEUR Prev. year TEUR<br />

A. Assets<br />

I. Intangible assets<br />

1. Goodwill 6,953 10<br />

2. Software 695 138<br />

II. Tangible assets<br />

7,648 148<br />

- other equipment, fi xtures and fi ttings 4,485 4,108<br />

III. Financial assets<br />

4,485 4,108<br />

1. Shares in affi liated companies 1,574 77<br />

2. Shares in associated companies 13,294 11,512<br />

3. Equity participations<br />

4. Loans to companies in which<br />

50 51<br />

shareholdings are held 754 120<br />

5. Non-current marketable securities 0 20<br />

6. Other loans 46 40<br />

15,718 11,820<br />

B. Current assets<br />

I. Inventories<br />

27,851 16,076<br />

Work in progress 5,386 3,314<br />

II. Receivables and other assets<br />

- with a residual term of up to one year<br />

5,386 3,314<br />

1. Trade receivables 78,996 78,275<br />

2. Receivables from affi liated companies<br />

3. Receivables from companies in which<br />

1,185 5<br />

equity participations are held 3,331 2,990<br />

4. Other assets 3,143 3,125<br />

86,655 84,395<br />

III. Cash at hand and cash at banks 8,000 4,508<br />

100,041 92,217<br />

C. Accruals and deferrals (other) 1,277 685<br />

Total assets 129,169 108,978<br />

EQUITY AND LIABILITIES<br />

Prev. year TEUR<br />

A. Equity and liabilities<br />

I. Equity of limited partners 10,000 10,000<br />

II. Consolidated reserves 11,297 7,527<br />

III. Difference in equity due to currency conversion 513 1,089<br />

IV. Minority interests 6,351 5,127<br />

28,161 23,743<br />

B. Silent partnerships 4,000 5,000<br />

C. Provisions and accruals<br />

1. Provisions for pensions and similar obligations 1,305 1,303<br />

2. Tax accruals 1,077 847<br />

3. Other provisions and accruals 28,751 10,178<br />

D. Liabilities<br />

31,133 12,328<br />

1. Liabilities to banks 12,298 8,963<br />

2. Advance payments on orders 11 6<br />

3. Trade payables 35,328 48,346<br />

4. Payables to affi liated companies 197 85<br />

5. Payables to companies in which an equity participation is held 1,397 1,600<br />

6. Payables to shareholders 2,809 1,643<br />

7. Payables to third-party associates 1,389 1,069<br />

8. Other liabilities<br />

- thereof taxes: TEUR 2,366 (previous year: TEUR 1.551)<br />

- thereof social security:<br />

TEUR 1,214 (previous year: TEUR 1,191)<br />

12,429 6,105<br />

65,858 67,817<br />

E. Deferred income 17 90<br />

Total of equity and liabilities 129,169 108,978<br />

26 27<br />

<strong>2011</strong> TEUR

ANNUAL FINANCIAL STATEMENT | CONSOLIDATED INCOME STATEMENT ANNUAL FINANCIAL STATEMENT | CASH FLOW<br />

Consolidated profi t and loss statement for the period from 1 January to 31 December <strong>2011</strong><br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG, Bremen<br />

1. Sales<br />

a) Sales incl. excise and import turnover taxes 742,301 666,506<br />

b) of which excise and import turnover taxes -251,362 -217,297<br />

490,939 449,209<br />

2. Increase of work in progress 1,943 826<br />

3. Cost of purchased services 396,697 366,743<br />

4. Gross profi t 96,185 83,292<br />

5. Other operating income<br />

6. Personnel<br />

4,619 4,705<br />

a) Wages and salaries 51,346 44,695<br />

b) Social security and pensions<br />

- thereof pensions: TEUR 1,765 (previous year: TEUR 1,121)<br />

9,670 8,179<br />

7. Depreciation and amortisation on the intangible assets of fi xed capital<br />

61,016 52,874<br />

investments and property, plant and equipment 1,521 971<br />

8. Other operating expenses 27,670 25,049<br />

10,597 9,103<br />

9. Income from participations in associated companies 4,814 3,541<br />

10. Income from participations 91 75<br />

11. Income from loans of fi nancial assets 5 2<br />

12. Other interest and similar income 87 76<br />

13. Write-off fi nancial assets 0 11<br />

14. Expenditure on assumption of losses from associated companies 75 139<br />

15. Interest and similar expenditure 714 728<br />

4,208 2,816<br />

16. Net income from ordinary operations 14,805 11,919<br />

17. Extraordinary expenditure 0 154<br />

18. Taxes on income and revenue<br />

- thereof latent taxes: TEUR -5 (previous year: TEUR 334)<br />

3,972 3,038<br />

19. Other taxes 109 100<br />

4,081 3,138<br />

20. Costs for partial profi t transfer 570 600<br />

21. Consolidated profi t for the fi nancial year 10,154 8,027<br />

- thereof profi t due to shares of other shareholders 2,626 1,921<br />

Cash fl ow statement for the period from 1 January to 31 December <strong>2011</strong><br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG, Bremen<br />

<strong>2011</strong> TEUR Prev. year TEUR<br />

<strong>2011</strong> TEUR<br />

Prev. year TEUR<br />

1. Consolidated net income (including shares in results<br />

by minority shareholders) 10,154 8,027<br />

2. Depreciation on non-current assets<br />

3. Adjustment of proportional assessed value<br />

1,521 985<br />

of associated companies -4,739 -3,402<br />

4. Changes in pension provisions 3 202<br />

5. Changes in other reserves 18,658 2,842<br />

6. Miscellaneous non-cash-item transactions<br />

7. Loss/profi t from disposal of fi xed assets<br />

448 181<br />

and the sale of consolidated companies 89 -526<br />

8. Changes in inventories, trade accounts receivable and other assets<br />

9. Changes in trade accounts payable and other liabilities<br />

-3,847 -13,806<br />

not classifi ed as investment or fi nancing activities -13,840 10,683<br />

10. Cash fl ow from operating activities 8,447 5,186<br />

11. Receipts from retirement of fi xed assets 145 66<br />

12. Payments for fi xed asset investment -1,546 -627<br />

13. Payments for intangible fi xed asset investment -6,102 -118<br />

14. Receipts from associated companies’ dividends 2,000 2,310<br />

15. Receipts from retirement of non-trading assets 16 185<br />

16. Payments for investment in non-trading assets<br />

17. Payments for consolidated companies and acquisition<br />

-1,850 -343<br />

of minority shareholdings -167 -277<br />

18. Cash fl ow from fi nancing activities -7,504 1,196<br />

19. Payments to shareholders -2,680 -2,535<br />

20. Payments to minority shareholders -1,571 -861<br />

21. Payments for redemption of silent partnerships -1,000 0<br />

22. Receipts from taking up fi nancial loans 10,459 2,699<br />

23. Payments for redemption of fi nancial loans -2,690 -5,464<br />

24. Cash fl ow from fi nancing activities 2,518 -6,161<br />

25. Change in capital funds 3,461 221<br />

26. Change in capital fund cash items 3,461 221<br />

27. Exchange-related capital funds changes 31 293<br />

28. Capital funds at the start of the period 4,508 3,994<br />

29. Cash fl ow from fi nancing activities 8,000 4,508<br />

28 29

AUDITOR’S CERTIFICATE ADVISORY BOARD REPORT<br />

The following auditor’s certificate<br />

was issued for the complete consolidated<br />

accounts and the consolidated<br />

management report:<br />

“We have audited the consolidated accounts for<br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG – comprising<br />

the balance sheet, profit and loss account, notes<br />

to the consolidated financial statements, cash flow<br />

statement and statement of equity – and the consolidated<br />

management report for the business<br />

year from 1 January to 31 December <strong>2011</strong>. The<br />

preparation of the consolidated accounts and the<br />

consolidated management report in accordance<br />

with German commercial regulations lies within<br />

the responsibility of the legal representatives of<br />

the company. Our responsibility is to provide an<br />

evaluation of the consolidated accounts and the<br />

consolidated management report on the basis of<br />

the audit which we carried out.<br />

We conducted our audit of the consolidated<br />

accounts pursuant to Section 317 of the German<br />

Commercial Code (HGB) and in compliance with<br />

the generally accepted German auditing standards<br />

adopted by the Institute of Public Auditors in<br />

Germany (IDW). These standards require that an<br />

audit is planned and performed in such a way<br />

that misstatements and infringements that would<br />

materially affect the presentation of net assets,<br />

finances and earnings in the consolidated<br />

accounts in accordance with the applicable principles<br />

of proper accounting and in the consolidated<br />

management report can be detected with reasonable<br />

assurance. In determining the audit procedures,<br />

we take into account our knowledge of the business<br />

activities, the economic and legal environment<br />

of the consolidated companies and expectations<br />

concerning possible errors. Within the framework<br />

of the audit, the effectiveness of the accountingrelated<br />

internal control system and the evidence<br />

supporting the disclosures in the consolidated<br />

accounts and the consolidated management<br />

report are assessed primarily on a random test<br />

basis. The audit includes assessment of the annual<br />

statements of those companies included<br />

in the consolidated accounts, the scope of the<br />

consolidated companies, the accounting and<br />

consolidation principles applied and significant<br />

estimates made by the legal representatives as<br />

well as evaluation of the overall presentation of<br />

the consolidated accounts and the consolidated<br />

management report. We believe that our audit<br />

provides a reasonable basis for our evaluation.<br />

Our audit has not led to any reservations.<br />

According to our evaluation, based on the findings<br />

obtained from the audit, the consolidated<br />

accounts of <strong>Röhlig</strong> & Co. Holding GmbH & Co. KG<br />

for the business year from 1 January to 31 December<br />

<strong>2011</strong> accord with the legal requirements<br />

and provide a picture of the actual state of the<br />

assets, finances and earnings of the consolidated<br />

companies taking into account the principles of<br />

correct accounting procedures. The consolidated<br />

management report agrees with the consolidated<br />

accounts and provides, on the whole, an accurate<br />

picture of the consolidated companies’ position<br />

and appropriately represents the opportunities and<br />

risks of future development.”<br />

Oldenburg, 13 April 2012<br />

Treuhand Oldenburg GmbH<br />

Auditing Company<br />

Schürmann Witte<br />

Auditor Auditor<br />

Dear Ladies and Gentlemen,<br />

Over the course of the last business year, the Advisory<br />

Board has once again provided support<br />

and advised management. At the meetings on<br />

22 March and 9 May <strong>2011</strong>, the company’s management<br />

reported to the Advisory Board on the<br />

developments within the <strong>Röhlig</strong> Group, including<br />

the Group’s financial circumstances and plans for<br />

the future. The newly created <strong>Röhlig</strong> Global Executive<br />

Board assumed responsibility for reporting<br />

at the meetings on 12 September and 18 October<br />

<strong>2011</strong>. Following in-depth discussion of the relevant<br />

questions and ideas, the Advisory Board offered<br />

its advice and put forward recommendations.<br />

The <strong>Röhlig</strong> Group has yet again achieved good<br />

results for the <strong>2011</strong> business year. Worldwide the<br />

Group expanded by around 15 per cent. In this, its<br />

160th business year, the company recorded its<br />

highest ever gross profit of Euro 96 million. Strong<br />

growth in America and the Pacific region in particular<br />

contributed to this success. From the<br />

Advisory Board’s point of view, this confirms that<br />

the company has adopted the correct strategy for<br />

many years, namely that of a consistent and carefully<br />

considered expansion plan to increase the net productivity<br />

of the <strong>Röhlig</strong> Group. Despite the financial<br />

and economic crisis it has thereby been possible<br />

to double net productivity over the past six years.<br />

The accountancy firm, Treuhand Oldenburg GmbH,<br />

audited the <strong>2011</strong> annual accounts and issued an<br />

unqualified audit report, thereby confirming that<br />

this status record provides and confirms a true and<br />

fair view of the financial and economic position of<br />

the <strong>Röhlig</strong> Group. The Advisory Board agrees with<br />

this assessment.<br />

The Advisory Board would like to thank the members<br />

of the Executive Board and all staff for the<br />

commitment and dedication they have shown.<br />

This was a key factor in the success of the last<br />

business year.<br />

Bremen, 20 April 2012<br />

Dr. Hans-Edgar Schütte<br />

Chairman of the Advisory Board<br />

The <strong>Röhlig</strong> Advisory<br />

Board (from left to right):<br />

Dr. Andreas M. Odefey,<br />

Thomas Bagusch,<br />

Dr. Hans-Edgar Schütte,<br />

Prof. Dr. Peer Witten<br />

30 31

Published by: <strong>Röhlig</strong> & Co. Holding GmbH & Co. KG<br />

Coordination: Annika Schütz, Marion Weiner,<br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG<br />

Concept/Design/Realisation:<br />

Blumberry GmbH, Berlin<br />

Printing: Meiners Druck, Bremen<br />

© 2012<br />

<strong>Röhlig</strong> & Co. Holding GmbH & Co. KG<br />

Am Weser-Terminal 8, 28217 Bremen<br />

Postfach 10 21 80, 28021 Bremen<br />

Germany<br />

Tel.: +49.421 3031-0<br />

Fax: +49.421 3031-1185<br />

E-mail: info@rohlig.com<br />

www.rohlig.com