The FHR™ Report - Rapid Ratings

The FHR™ Report - Rapid Ratings

The FHR™ Report - Rapid Ratings

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Contact Details<br />

Head Office<br />

86 Chambers Street, Suite 701<br />

New York, NY 10007<br />

Ph: +1.646.233.4600<br />

Fax: +1.646.219.7460<br />

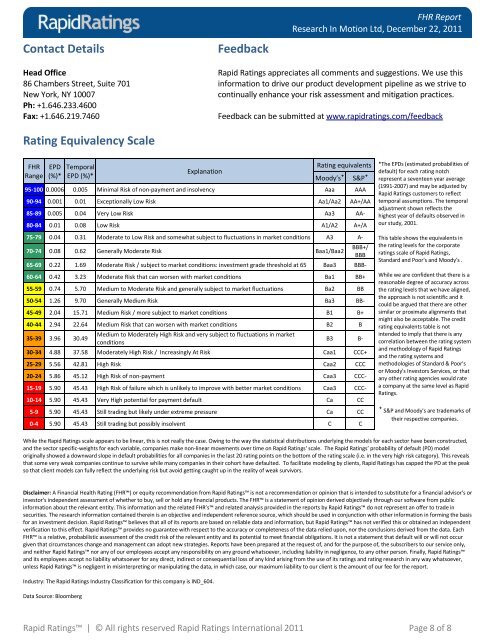

Rating Equivalency Scale<br />

FHR<br />

Range<br />

EPD<br />

(%)*<br />

Temporal<br />

EPD (%)*<br />

Explanation<br />

Rating equivalents<br />

Moody’s⁺ S&P⁺<br />

*<strong>The</strong> EPDs (estimated probabilities of<br />

default) for each rating notch<br />

represent a seventeen year average<br />

95-100 0.0006 0.005 Minimal Risk of non-payment and insolvency Aaa AAA<br />

(1991-2007) and may be adjusted by<br />

<strong>Rapid</strong> <strong>Ratings</strong> customers to reflect<br />

90-94 0.001 0.01 Exceptionally Low Risk Aa1/Aa2 AA+/AA temporal assumptions. <strong>The</strong> temporal<br />

85-89 0.005 0.04 Very Low Risk Aa3 AAadjustment<br />

shown reflects the<br />

highest year of defaults observed in<br />

80-84 0.01 0.08 Low Risk A1/A2 A+/A our study, 2001.<br />

75-79 0.04 0.31 Moderate to Low Risk and somewhat subject to fluctuations in market conditions A3 A-<br />

70-74 0.08 0.62 Generally Moderate Risk Baa1/Baa2<br />

65-69 0.22 1.69 Moderate Risk / subject to market conditions: investment grade threshold at 65 Baa3 BBB-<br />

60-64 0.42 3.23 Moderate Risk that can worsen with market conditions Ba1 BB+<br />

55-59 0.74 5.70 Medium to Moderate Risk and generally subject to market fluctuations Ba2 BB<br />

50-54 1.26 9.70 Generally Medium Risk Ba3 BB-<br />

45-49 2.04 15.71 Medium Risk / more subject to market conditions B1 B+<br />

40-44 2.94 22.64 Medium Risk that can worsen with market conditions B2 B<br />

35-39 3.96 30.49<br />

Medium to Moderately High Risk and very subject to fluctuations in market<br />

conditions<br />

BBB+/<br />

BBB<br />

B3 B-<br />

30-34 4.88 37.58 Moderately High Risk / Increasingly At Risk Caa1 CCC+<br />

25-29 5.56 42.81 High Risk Caa2 CCC<br />

20-24 5.86 45.12 High Risk of non-payment Caa3 CCC-<br />

15-19 5.90 45.43 High Risk of failure which is unlikely to improve with better market conditions Caa3 CCC-<br />

10-14 5.90 45.43 Very High potential for payment default Ca CC<br />

5-9 5.90 45.43 Still trading but likely under extreme pressure Ca CC<br />

0-4 5.90 45.43 Still trading but possibly insolvent C C<br />

This table shows the equivalents in<br />

the rating levels for the corporate<br />

ratings scale of <strong>Rapid</strong> <strong>Ratings</strong>,<br />

Standard and Poor's and Moody's .<br />

While we are confident that there is a<br />

reasonable degree of accuracy across<br />

the rating levels that we have aligned,<br />

the approach is not scientific and it<br />

could be argued that there are other<br />

similar or proximate alignments that<br />

might also be acceptable. <strong>The</strong> credit<br />

rating equivalents table is not<br />

intended to imply that there is any<br />

correlation between the rating system<br />

and methodology of <strong>Rapid</strong> <strong>Ratings</strong><br />

and the rating systems and<br />

methodologies of Standard & Poor's<br />

or Moody's Investors Services, or that<br />

any other rating agencies would rate<br />

a company at the same level as <strong>Rapid</strong><br />

<strong>Ratings</strong>.<br />

⁺ S&P and Moody's are trademarks of<br />

their respective companies.<br />

While the <strong>Rapid</strong> <strong>Ratings</strong> scale appears to be linear, this is not really the case. Owing to the way the statistical distributions underlying the models for each sector have been constructed,<br />

and the sector specific-weights for each variable, companies make non-linear movements over time on <strong>Rapid</strong> <strong>Ratings</strong>' scale. <strong>The</strong> <strong>Rapid</strong> <strong>Ratings</strong>’ probability of default (PD) model<br />

originally showed a downward slope in default probabilities for all companies in the last 20 rating points on the bottom of the rating scale (i.e. in the very high risk category). This reveals<br />

that some very weak companies continue to survive while many companies in their cohort have defaulted. To facilitate modeling by clients, <strong>Rapid</strong> <strong>Ratings</strong> has capped the PD at the peak<br />

so that client models can fully reflect the underlying risk but avoid getting caught up in the reality of weak survivors.<br />

Disclaimer: A Financial Health Rating (FHR) or equity recommendation from <strong>Rapid</strong> <strong>Ratings</strong> is not a recommendation or opinion that is intended to substitute for a financial advisor's or<br />

investor's independent assessment of whether to buy, sell or hold any financial products. <strong>The</strong> FHR is a statement of opinion derived objectively through our software from public<br />

information about the relevant entity. This information and the related FHR’s and related analysis provided in the reports by <strong>Rapid</strong> <strong>Ratings</strong> do not represent an offer to trade in<br />

securities. <strong>The</strong> research information contained therein is an objective and independent reference source, which should be used in conjunction with other information in forming the basis<br />

for an investment decision. <strong>Rapid</strong> <strong>Ratings</strong> believes that all of its reports are based on reliable data and information, but <strong>Rapid</strong> <strong>Ratings</strong> has not verified this or obtained an independent<br />

verification to this effect. <strong>Rapid</strong> <strong>Ratings</strong> provides no guarantee with respect to the accuracy or completeness of the data relied upon, nor the conclusions derived from the data. Each<br />

FHR is a relative, probabilistic assessment of the credit risk of the relevant entity and its potential to meet financial obligations. It is not a statement that default will or will not occur<br />

given that circumstances change and management can adopt new strategies. <strong>Report</strong>s have been prepared at the request of, and for the purpose of, the subscribers to our service only,<br />

and neither <strong>Rapid</strong> <strong>Ratings</strong> nor any of our employees accept any responsibility on any ground whatsoever, including liability in negligence, to any other person. Finally, <strong>Rapid</strong> <strong>Ratings</strong><br />

and its employees accept no liability whatsoever for any direct, indirect or consequential loss of any kind arising from the use of its ratings and rating research in any way whatsoever,<br />

unless <strong>Rapid</strong> <strong>Ratings</strong> is negligent in misinterpreting or manipulating the data, in which case, our maximum liability to our client is the amount of our fee for the report.<br />

Industry: <strong>The</strong> <strong>Rapid</strong> <strong>Ratings</strong> Industry Classification for this company is IND_604.<br />

Data Source: Bloomberg<br />

Feedback<br />

FHR <strong>Report</strong><br />

Research In Motion Ltd, December 22, 2011<br />

<strong>Rapid</strong> <strong>Ratings</strong> appreciates all comments and suggestions. We use this<br />

information to drive our product development pipeline as we strive to<br />

continually enhance your risk assessment and mitigation practices.<br />

Feedback can be submitted at www.rapidratings.com/feedback<br />

<strong>Rapid</strong> <strong>Ratings</strong> | © All rights reserved <strong>Rapid</strong> <strong>Ratings</strong> International 2011 Page 8 of 8