SDI JUL09.qxd - Soft Drinks International

SDI JUL09.qxd - Soft Drinks International

SDI JUL09.qxd - Soft Drinks International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

38 MARKET ANALYSIS<br />

<strong>Soft</strong> <strong>Drinks</strong> <strong>International</strong> – JULY 2009<br />

Packaging<br />

innovation<br />

in a weakening economy<br />

Contrary to<br />

economic<br />

instincts,<br />

innovation may<br />

offer brand<br />

owners much<br />

needed product<br />

differentiation,<br />

writes<br />

Dr Benjamin<br />

Punchard.<br />

In a weakening economy consumption levels<br />

are seeing growth rates slashed and in some<br />

cases consumption dropping overall as consumers<br />

turn off high cost soft drinks. It is at<br />

times like these that packaging's abilities to communicate<br />

with consumers and sell the product<br />

come into their own – now is not the time for<br />

products to be hiding away! The need to innovate<br />

is highest in those high margin categories<br />

that are now weakening, such as energy drinks,<br />

or in economy categories where consumers can<br />

save by switching to tap water.<br />

Despite this drive, many brand owners are<br />

choosing not to innovate, preferring to wait for the<br />

crisis to ease and taking the short term benefit of a<br />

reduction in development costs. Where budget is<br />

still being spent there is a clearer drive towards<br />

product innovation and marketing, squeezing yet<br />

further the opportunities for novel beverage packaging<br />

to hit the shelves. Euromonitor predicts that<br />

it is those brands that continue to develop their<br />

packaging in tune with consumers changing<br />

lifestyles and priorities that will best ride out<br />

these turbulent times.<br />

Liquid cartons offering an<br />

economic option<br />

One pack type that has benefited from the recent<br />

squeeze on the consumer wallet is liquid cartons,<br />

in 2008 achieving over 5% growth globally on<br />

2007 retail unit volumes, rising to 10% in dynamic<br />

Latin America. Consumers have long been<br />

aware of the health benefits of fruit and vegetable<br />

juice, a category driving much of the growth. Now<br />

that price has become a significant factor consumers<br />

are looking again at the benefits of ambient<br />

juices in liquid cartons over fresh, and with<br />

this we are seeing uptake of brick liquid cartons<br />

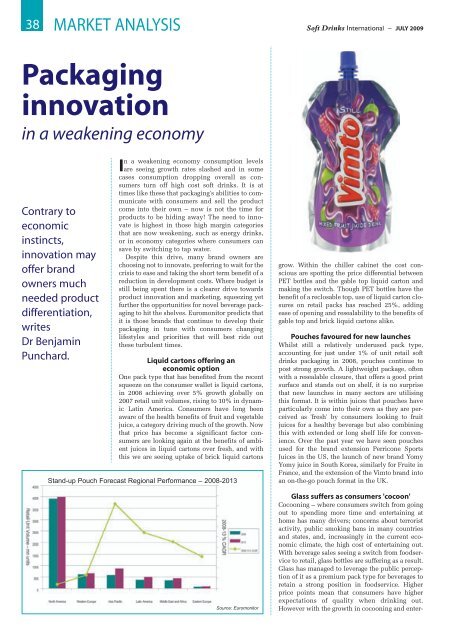

Stand-up Pouch Forecast Regional Performance – 2008-2013<br />

Source: Euromonitor<br />

grow. Within the chiller cabinet the cost conscious<br />

are spotting the price differential between<br />

PET bottles and the gable top liquid carton and<br />

making the switch. Though PET bottles have the<br />

benefit of a reclosable top, use of liquid carton closures<br />

on retail packs has reached 25%, adding<br />

ease of opening and resealability to the benefits of<br />

gable top and brick liquid cartons alike.<br />

Pouches favoured for new launches<br />

Whilst still a relatively underused pack type,<br />

accounting for just under 1% of unit retail soft<br />

drinks packaging in 2008, pouches continue to<br />

post strong growth. A lightweight package, often<br />

with a resealable closure, that offers a good print<br />

surface and stands out on shelf, it is no surprise<br />

that new launches in many sectors are utilising<br />

this format. It is within juices that pouches have<br />

particularly come into their own as they are perceived<br />

as 'fresh' by consumers looking to fruit<br />

juices for a healthy beverage but also combining<br />

this with extended or long shelf life for convenience.<br />

Over the past year we have seen pouches<br />

used for the brand extension Perricone Sports<br />

Juices in the US, the launch of new brand Yomy<br />

Yomy juice in South Korea, similarly for Fruite in<br />

France, and the extension of the Vimto brand into<br />

an on-the-go pouch format in the UK.<br />

Glass suffers as consumers 'cocoon'<br />

Cocooning – where consumers switch from going<br />

out to spending more time and entertaining at<br />

home has many drivers; concerns about terrorist<br />

activity, public smoking bans in many countries<br />

and states, and, increasingly in the current economic<br />

climate, the high cost of entertaining out.<br />

With beverage sales seeing a switch from foodservice<br />

to retail, glass bottles are suffering as a result.<br />

Glass has managed to leverage the public perception<br />

of it as a premium pack type for beverages to<br />

retain a strong position in foodservice. Higher<br />

price points mean that consumers have higher<br />

expectations of quality when drinking out.<br />

However with the growth in cocooning and enter