- Page 3:

Ever since the war on terror began

- Page 6 and 7:

Town OfficersBoard of SelectmenHans

- Page 8 and 9:

Conservation CommissionChuck Crowe,

- Page 10 and 11:

Volunteer Fire Department Engineers

- Page 12 and 13:

Detective Corporal John SableDetect

- Page 14 and 15:

Local Energy CommissionBruce Clevel

- Page 16 and 17:

lv{EI-,qNSON HEarri & ecrit,ri-ANy.

- Page 18 and 19:

TOWN OF SANDOWN, NEW HAMPSHIREGOVER

- Page 20 and 21:

TOWN OF SANDOWN, NEW HAMPSHIREGOVER

- Page 22 and 23:

TOWN OF SANDOWN, NEW HAMPSHIREGENER

- Page 24 and 25:

2011 TOWN CLERK REPORTMOTOR VEHICLE

- Page 26 and 27:

45 22

- Page 28 and 29:

47 24

- Page 30 and 31:

2010 Property Tax Lien2010 Property

- Page 32 and 33:

TOWN OF SANDOWNTreasurer's ReportMO

- Page 34 and 35:

TOWN OF SANDOWNPREA ACCOUNTBeginnin

- Page 36 and 37:

TOWN OF SANDOWNTreasurer's ReportCo

- Page 38 and 39:

TOWN OF SANDOWNCABLE TV TREASURER R

- Page 40 and 41:

TOWN OF SANDOWN NHUnaudited Profit

- Page 42 and 43:

TOWN OF SANDOWN NHUnaudited Profit

- Page 44 and 45:

TOWN OF SANDOWN NHUnaudited Profit

- Page 46 and 47:

TOWN OF SANDOWN NHUnaudited Profit

- Page 48 and 49:

TOWN OF SANDOWN NHUnaudited Profit

- Page 50 and 51:

SCHOOL IMPACT FEESYear Collected IF

- Page 52 and 53:

Town Owned PropertiesMap Block Lot

- Page 54 and 55:

2012 TOWN CANDIDATESPOSITION TERM I

- Page 57 and 58:

TOWN OF SANDOWNSTATE OF NEW HAMPSHI

- Page 59 and 60: Special Warrant Article 7. Shall th

- Page 61 and 62: Warrant Article 17. Shall the Town

- Page 63 and 64: Town Warrant - March 13, 201281 58

- Page 65 and 66: SANDOWN PRIDELocal Groups60

- Page 67 and 68: 62 85

- Page 69 and 70: 64 87

- Page 71 and 72: 66 89

- Page 73 and 74: 68 91

- Page 75 and 76: 70 93

- Page 77 and 78: 72 95

- Page 79 and 80: 74 97

- Page 81 and 82: 76 99

- Page 83 and 84: 101 78

- Page 85 and 86: 103 80

- Page 87 and 88: Dept: Executive Account : 4130.0FY

- Page 89 and 90: Dept: Elec & Reg. Account: 4140.2(S

- Page 91 and 92: Dept: Benefits Account: 4155.0FY 20

- Page 93 and 94: Dept: Trustees Account: 4199.0FY 20

- Page 95 and 96: Dept: Fire Account: 4220.0FY 2011 F

- Page 97 and 98: Dept: Highway Facility Account: 431

- Page 99 and 100: Dept: Sanitation Site Account: 4325

- Page 101 and 102: Dept: Community Assistance Account:

- Page 103 and 104: Dept: Rec. Building Operations Acco

- Page 105 and 106: Dept: Patriotic Purposes Account: 4

- Page 107 and 108: TOWN ADMINISTRATION REPORTHans Nico

- Page 109: ASSESSOR’S ANNUAL REPORT for 2011

- Page 113 and 114: BUILDING / ELECTRICAL / HEALTH DEPA

- Page 115 and 116: 2011 CEMETERY REPORTAPPROPRIATION 3

- Page 117 and 118: FALL FESTIVALLast year’s Fall Fes

- Page 119 and 120: 119 114

- Page 121 and 122: Report of Forest Fire Warden and St

- Page 123 and 124: Annual Report of theSoutheastern Ne

- Page 125 and 126: Response Team TrainingIn 2011 the E

- Page 127 and 128: Sandown Planning Board ReportThe Pl

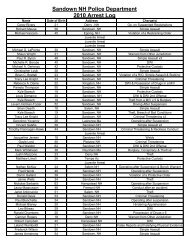

- Page 129 and 130: SANDOWN POLICE DEPARTMENT2011, as w

- Page 131 and 132: Hazel MarlowA smile takes but a mom

- Page 133 and 134: I would also like to acknowledge th

- Page 135 and 136: 135 130

- Page 137 and 138: RECREATION COMMISSIONPARKS AND RECR

- Page 139 and 140: Highway/Sanitation DepartmentPO Box

- Page 141 and 142: 142 136

- Page 143 and 144: “Partnering to make recycling str

- Page 145 and 146: Keep up with Channel 17:Our website

- Page 147: SANDOWN TAX RATE HISTORYYear Munici