- Page 1 and 2: NATIONAL SECURITIES DEPOSITORY LIMI

- Page 3 and 4: DISCLAIMERThis Manual provides info

- Page 5 and 6: CIRCULARS INDEXSubject Date(s) Page

- Page 7 and 8: Subject Date(s) Page No.INSTRUCTION

- Page 9 and 10: Subject Date(s) Page No.September 2

- Page 11 and 12: Subject Date(s) Page No.DP SERVICE

- Page 13 and 14: Subject Date(s) Page No.November 14

- Page 15 and 16: Low End DPM System - Recommended ha

- Page 17 and 18: General ManagerMarket Intermediarie

- Page 19 and 20: Name and Address of NomineeName: ..

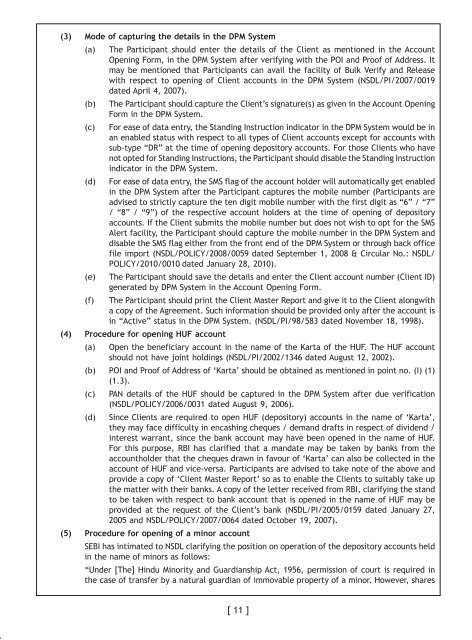

- Page 21 and 22: (II) Guidelines in respect of accou

- Page 23 and 24: (a) Proof of Identity (POI):I. Pass

- Page 25: documents which can be accepted as

- Page 29 and 30: S. No. ProcedureReference Remark(ix

- Page 31 and 32: (b) If the NRI has never purchased

- Page 33 and 34: appropriate option as given below:(

- Page 35 and 36: (iii) Client should visit the Parti

- Page 37 and 38: Participants should open the deposi

- Page 39 and 40: (c) Participant should collect Proo

- Page 41 and 42: (B)Trust Act, 1950 or The Indian So

- Page 43 and 44: Participants for receiving securiti

- Page 45 and 46: (b)(c)(d)Following documents are re

- Page 47 and 48: Dear Sir,Sub: Shifting of Clearing

- Page 49 and 50: eg. : - In case of joint holdings i

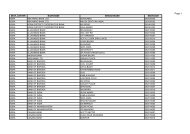

- Page 51 and 52: 28 Body Corporate Central Governmen

- Page 53 and 54: Participants are advised to capture

- Page 55 and 56: Account opening - Bank account deta

- Page 57 and 58: Account opening Forms and New Featu

- Page 59 and 60: Address Line 4For more information,

- Page 61 and 62: dematerialized mode. The procedure

- Page 63 and 64: Council Resolutions / EU Common Pos

- Page 65 and 66: Reason codeDescription1 Allotment o

- Page 67 and 68: Dear Sirs,Sub: Mandatory requiremen

- Page 69 and 70: egister the request and the checker

- Page 71 and 72: convenience upto 15 days, by login

- Page 73 and 74: 3.3 to collect copies of PAN cards

- Page 75 and 76: Sr. No Activities executed by the R

- Page 77 and 78:

(ii) Update the PAN field and enabl

- Page 79 and 80:

6. The Stock Exchanges are advised

- Page 81 and 82:

4.6. In case of HUF, Association of

- Page 83 and 84:

NSDL’s operating guidelines:(a)(b

- Page 85 and 86:

No further guidelines in this regar

- Page 87 and 88:

AnnexureGENERAL MANAGERMARKET REGUL

- Page 89 and 90:

5. The Depositories are advised to:

- Page 91 and 92:

c. Power of AttorneyAccount operati

- Page 93 and 94:

of the trade for online disseminati

- Page 95 and 96:

Annexure IIDP DP ID Client NSDL NSD

- Page 97 and 98:

NOTES[ 82 ]

- Page 99 and 100:

Facility for Cancellation of Pendin

- Page 101 and 102:

of account (enclosed) issued by you

- Page 103 and 104:

gram respectively. The purity grade

- Page 105 and 106:

(b) Participants are required to ex

- Page 107 and 108:

Circular No:Sub: Facility for cance

- Page 109 and 110:

Demat request - POA holdersCircular

- Page 111 and 112:

Demat request - due carepending cou

- Page 113 and 114:

instruction expeditiously. After th

- Page 115 and 116:

mode, to decrease the time period i

- Page 117 and 118:

NOTES[ 102 ]

- Page 119 and 120:

Rule 4.5.2Rule 6.1Rule 12.2.1Rule 1

- Page 121 and 122:

Participants can use either the old

- Page 123 and 124:

(d)In case any DIS is presented for

- Page 125 and 126:

Client, before uploading/executing

- Page 127 and 128:

Participants must take note of the

- Page 129 and 130:

5. The pre-printed serial number of

- Page 131 and 132:

(a) Participants shall accept instr

- Page 133 and 134:

(I) Issuance of DISThe procedure fo

- Page 135 and 136:

(g)balances existing in the CM Pool

- Page 137 and 138:

Instructions - GuidelinesCircular N

- Page 139 and 140:

Pool Account. In case of insufficie

- Page 141 and 142:

6. Participants must ensure through

- Page 143 and 144:

Instructions - Serial number valida

- Page 145 and 146:

into hardship. The process would al

- Page 147 and 148:

1. The tenure of contracts in SLB m

- Page 149 and 150:

Circular No :Sub : Operationalisati

- Page 151 and 152:

The salient features of the SLBS ar

- Page 153 and 154:

Margins and Collaterals All transac

- Page 155 and 156:

VaR Margin and ELM Margin:• VaR m

- Page 157 and 158:

hereinafter referred to as 'Partici

- Page 159 and 160:

Pay-out of securities/funds of reve

- Page 161 and 162:

orders in the SLBS, Participants ma

- Page 163 and 164:

2.2 Reverse Leg transactionsOnly th

- Page 165 and 166:

2.9 Custodial transactionsIn respec

- Page 167 and 168:

Annexure AFile formats for ‘Auto-

- Page 169 and 170:

N000001 CM_USER 4 28052010115649722

- Page 171 and 172:

(iv) Upon receipt of the request fr

- Page 173 and 174:

For more information / clarificatio

- Page 175 and 176:

Line Number Integer 5 14 MTransacti

- Page 177 and 178:

Internet Transaction Id Integer 15

- Page 179 and 180:

Transaction Flag Character 1 18 M I

- Page 181 and 182:

ISIN Character 12 190 MQuantity Dec

- Page 183 and 184:

Detail Record (934 CM pool to pool)

- Page 185 and 186:

Client Id Integer 8 178 MISIN Chara

- Page 187 and 188:

Change Orders for the Day (COD)Desc

- Page 189 and 190:

Annexure ASalient features of the f

- Page 191 and 192:

Order Status Character 2 46Rejectio

- Page 193 and 194:

Order Status integer 2 32 MInstruct

- Page 195 and 196:

Circular No :Sub: Facility of Inter

- Page 197 and 198:

CMs about the new file formats. Eve

- Page 199 and 200:

SPEED-eAdmission fee Rs. 2,00,000Pa

- Page 201 and 202:

In view of the above, Participants

- Page 203 and 204:

in our aforesaid circular will be a

- Page 205 and 206:

DPs who have subscribed to SPEED-e

- Page 207 and 208:

Auto Corporate Action for redemptio

- Page 209 and 210:

NOTES[ 194 ]

- Page 211 and 212:

Rule 12.6.2(i) Annexure 'OC' - Form

- Page 213 and 214:

12.6.3.3. A nomination, substitutio

- Page 215 and 216:

Rule 12.6.5a) Request for transmiss

- Page 217 and 218:

3. Obtain the PAN details of the no

- Page 219 and 220:

NOTES[ 204 ]

- Page 221 and 222:

Transaction Statements to clients t

- Page 223 and 224:

NOW THEREFORE in consideration of t

- Page 225 and 226:

Internet-based Demat Account Statem

- Page 227 and 228:

d) After successful entry of the ab

- Page 229 and 230:

d) After the account holder has suc

- Page 231 and 232:

E-token* based UserBO Only IDeAS NI

- Page 233 and 234:

days, in their depository accounts.

- Page 235 and 236:

Transaction Statement - Controls on

- Page 237 and 238:

Providing Statement of transaction

- Page 239 and 240:

4. The Participant informs such cli

- Page 241 and 242:

Debit of Mutual Fund Units“______

- Page 243 and 244:

ChargesNo charge is levied by NSDL

- Page 245 and 246:

the CSPs and other service provider

- Page 247 and 248:

The revised details of this facilit

- Page 249 and 250:

NOTES[ 234 ]

- Page 251 and 252:

Alteration in Memorandum of Associa

- Page 253 and 254:

Sr. No. Particulars Reference Deadl

- Page 255 and 256:

Mobile numberEmail Address of alter

- Page 257 and 258:

Sr.No.Particulars Reference Deadlin

- Page 259 and 260:

(e) Prevention of Money Laundering

- Page 261 and 262:

Notes:1. Details of item mentioned

- Page 263 and 264:

1. Objectives of auditFollowing are

- Page 265 and 266:

ChecklistSrl.No.Audit AreasAuditor'

- Page 267 and 268:

Srl.No.Audit Areas4.1.4 Whether iss

- Page 269 and 270:

Srl.No.Audit AreasAuditor'sObservat

- Page 271 and 272:

Srl.No.Audit AreasAuditor'sObservat

- Page 273 and 274:

Srl.No.Audit AreasAuditor'sObservat

- Page 275 and 276:

Annexure 1A. Objectives of internal

- Page 277 and 278:

) Circular No. NSDL/POLICY/2007/001

- Page 279 and 280:

k) Circular No. NSDL/POLICY/2008/00

- Page 281 and 282:

e) Circular No. NSDL/PI/2004/1514 d

- Page 283 and 284:

ecorded in the report. (Circular No

- Page 285 and 286:

0021 dated June 24, 2006 regarding

- Page 287 and 288:

Circular No.NSDL/PI/2000/515Date :

- Page 289 and 290:

Nature of No of No of No of Manner

- Page 291 and 292:

Circular No. With reference to our

- Page 293 and 294:

NOTES[ 278 ]

- Page 295 and 296:

Dear Sir / Madam,Sub: Disclosure of

- Page 297 and 298:

Report 1B: Redressal of Complaints

- Page 299 and 300:

Report 2A: Details of Arbitration P

- Page 301 and 302:

Report 3A: Penal Actions against De

- Page 303 and 304:

Report 4A: Redressal of Complaints

- Page 305 and 306:

TypeType II aI bI cI dI eType IIII

- Page 307 and 308:

make the Indian securities market a

- Page 309 and 310:

Nature of No of No of No of Manner

- Page 311 and 312:

Nature of No of No of No of Manner

- Page 313 and 314:

NOTES[ 298 ]

- Page 315 and 316:

AnnexureCHIEF GENERAL MANAGERMARKET

- Page 317 and 318:

Circular No.NSDL/PI/99/637Date: Aug

- Page 319 and 320:

Sr.No.Annexure BParticulars Referen

- Page 321 and 322:

6) DPs are also advised to note tha

- Page 323 and 324:

Manual ElectronicProcessingprocessi

- Page 325 and 326:

Participant or any other person pro

- Page 327 and 328:

NOTES[ 312 ]

- Page 329 and 330:

Rule 4.1.4The permission to use the

- Page 331 and 332:

instructions per client account) an

- Page 333 and 334:

Securities and Exchange Board of In

- Page 335 and 336:

Dear Sir,Sub : Reduction in charges

- Page 337 and 338:

3. All the Stock Exchanges are advi

- Page 339 and 340:

(II)Penalty in case of non complian

- Page 341 and 342:

Circular No.Sub : Addendum to circu

- Page 343 and 344:

Fees for Rematerialisation of Secur

- Page 345 and 346:

NOTES[ 330 ]

- Page 347 and 348:

pose a risk to the international fi

- Page 349 and 350:

the ML/FT risks posed by Pakistan a

- Page 351 and 352:

Circular No. Date of circular Subje

- Page 353 and 354:

espectively of the abovementioned t

- Page 355 and 356:

2. Back Ground:The PMLA came into e

- Page 357 and 358:

prevention of money laundering and

- Page 359 and 360:

providing full and complete informa

- Page 361 and 362:

c) Registered intermediaries shall

- Page 363 and 364:

(ii) all series of cash transaction

- Page 365 and 366:

g) Unusual transactions by CSCs and

- Page 367 and 368:

and STR to FIU-IND. The reports may

- Page 369 and 370:

of Transactions, the Procedure and

- Page 371 and 372:

identity and address, one recent ph

- Page 373 and 374:

an AML/CFT regime that meets intern

- Page 375 and 376:

institutions should remain aware th

- Page 377 and 378:

(iv)(v)Details of credit due to off

- Page 379 and 380:

Further, Participants are requested

- Page 381 and 382:

DPs are also requested to take note

- Page 383 and 384:

Further, FIU-IND has also advised t

- Page 385 and 386:

have been used as genuine or where

- Page 387 and 388:

NOTES[ 372 ]

- Page 389 and 390:

Format:Date of Reason for dialup Ty

- Page 391 and 392:

NOTES[ 376 ]

- Page 393 and 394:

Rule 16.1.2Rule 16.1.3c) Freezing o

- Page 395 and 396:

3. Further, it has been noticed tha

- Page 397 and 398:

NOTES[ 382 ]

- Page 399 and 400:

called the Depository Participant C

- Page 401 and 402:

the Participant should capture the

- Page 403 and 404:

which highlights various types of b

- Page 405 and 406:

In case of any further information/

- Page 407 and 408:

ANNEXURE -IMPLS TARIFFNo Bandwidth

- Page 409 and 410:

While NSDL will continue to provide

- Page 411 and 412:

and at 4.30 pm instead of 4.00 pm o

- Page 413 and 414:

Quantity Decimal 18 72 M 15+3 witho

- Page 415 and 416:

Transaction Statement ExportFile Fo

- Page 417 and 418:

Counter CM-BP Id Character 8 174 O

- Page 419 and 420:

157 Lend Initiation161 SLB Confirma

- Page 421 and 422:

Original Order Integer 7 66 O Used

- Page 423 and 424:

Annexure BRejection reason code and

- Page 425 and 426:

(iii) Save the notepad in the SOT/S

- Page 427 and 428:

structure. Similar warning message

- Page 429 and 430:

2) Addition of new sub-type named

- Page 431 and 432:

PAN structure in Client account. Ho

- Page 433 and 434:

an account transfer instruction. Th

- Page 435 and 436:

e) When the instruction is captured

- Page 437 and 438:

• Certified true copy of Board Re

- Page 439 and 440:

irrespective of the source and anot

- Page 441 and 442:

Detailed Description:General1. The

- Page 443 and 444:

In the Version 8.0, a utility will

- Page 445 and 446:

instruction (Maker) and the one who

- Page 447 and 448:

5. "Cancellation" rights would be a

- Page 449 and 450:

File Generation Date and Time : Fil

- Page 451 and 452:

5. Creation(N)/ Character 30 "N" :

- Page 453 and 454:

authorised signatory, which has bee

- Page 455 and 456:

e set to 3. Whereas DP would be abl

- Page 457 and 458:

3 No. of Minimum Number of 2 New va

- Page 459 and 460:

Functional Rights Admin UserGISMO F

- Page 461 and 462:

Important Note:Depository Participa

- Page 463 and 464:

1. Import PAN and PAN flag in the r

- Page 465 and 466:

instaed of nominee has been chosen

- Page 467 and 468:

in the row 4 of the bank address de

- Page 469 and 470:

3. Incorrect Pin codes in bank addr

- Page 471 and 472:

for Clients accounts with statii

- Page 473 and 474:

In regard to point nos. 4,5,6 and 7

- Page 475 and 476:

• The systems person must take ba

- Page 477 and 478:

• Thus communication process shou

- Page 479 and 480:

Sr. Name of files What to check Whe

- Page 481 and 482:

Thus, the instructions which are ve

- Page 483 and 484:

absence of ADMIN User, his/her duti

- Page 485 and 486:

c) uninstall the existing Microsoft

- Page 487 and 488:

FAQs for backupCircular No.NSDL/PI/

- Page 489 and 490:

6. In case the system flashes a mes

- Page 491 and 492:

• Restore all the transaction log

- Page 493 and 494:

Circular No.Attention of Participan

- Page 495 and 496:

Scan Engine:A virus scan engine is

- Page 497 and 498:

overnight if new Virus of serious n

- Page 499 and 500:

Single Processor8 Online Users are

- Page 501 and 502:

Participants are free to choose the

- Page 503 and 504:

Description Hardware SoftwareEntry

- Page 505 and 506:

Description Hardware SoftwareMinimu

- Page 507 and 508:

Circular No.NSDL/PI/2000/032Date: J

- Page 509 and 510:

Sr. CPU RAM No. of No. of No. of No

- Page 511 and 512:

(2) The hardware configuration for

- Page 513 and 514:

• In case the upgradation of your

- Page 515 and 516:

NOTES[ 500 ]

- Page 517 and 518:

iv. Debenture Trusteesv. Bankers to

- Page 519 and 520:

Letter of Representation for Deposi

- Page 521 and 522:

NOTES[ 506 ]

- Page 523 and 524:

11 Amendments to Business Rules - N

- Page 525 and 526:

ANNEXURE BParticipant’s Name, Add

- Page 527:

NOTES[ 512 ]