Part A Supplement to the Northrop Grumman ... - Benefits Online

Part A Supplement to the Northrop Grumman ... - Benefits Online

Part A Supplement to the Northrop Grumman ... - Benefits Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

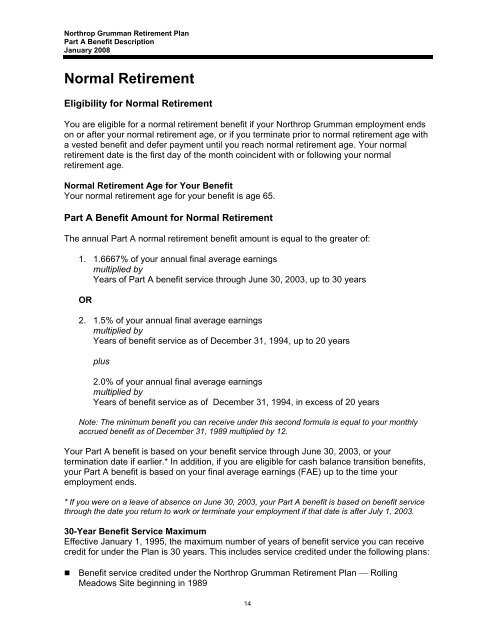

<strong>Northrop</strong> <strong>Grumman</strong> Retirement Plan<strong>Part</strong> A Benefit DescriptionJanuary 2008Normal RetirementEligibility for Normal RetirementYou are eligible for a normal retirement benefit if your <strong>Northrop</strong> <strong>Grumman</strong> employment endson or after your normal retirement age, or if you terminate prior <strong>to</strong> normal retirement age witha vested benefit and defer payment until you reach normal retirement age. Your normalretirement date is <strong>the</strong> first day of <strong>the</strong> month coincident with or following your normalretirement age.Normal Retirement Age for Your BenefitYour normal retirement age for your benefit is age 65.<strong>Part</strong> A Benefit Amount for Normal RetirementThe annual <strong>Part</strong> A normal retirement benefit amount is equal <strong>to</strong> <strong>the</strong> greater of:1. 1.6667% of your annual final average earningsmultiplied byYears of <strong>Part</strong> A benefit service through June 30, 2003, up <strong>to</strong> 30 yearsOR2. 1.5% of your annual final average earningsmultiplied byYears of benefit service as of December 31, 1994, up <strong>to</strong> 20 yearsplus2.0% of your annual final average earningsmultiplied byYears of benefit service as of December 31, 1994, in excess of 20 yearsNote: The minimum benefit you can receive under this second formula is equal <strong>to</strong> your monthlyaccrued benefit as of December 31, 1989 multiplied by 12.Your <strong>Part</strong> A benefit is based on your benefit service through June 30, 2003, or yourtermination date if earlier.* In addition, if you are eligible for cash balance transition benefits,your <strong>Part</strong> A benefit is based on your final average earnings (FAE) up <strong>to</strong> <strong>the</strong> time youremployment ends.* If you were on a leave of absence on June 30, 2003, your <strong>Part</strong> A benefit is based on benefit servicethrough <strong>the</strong> date you return <strong>to</strong> work or terminate your employment if that date is after July 1, 2003.30-Year Benefit Service MaximumEffective January 1, 1995, <strong>the</strong> maximum number of years of benefit service you can receivecredit for under <strong>the</strong> Plan is 30 years. This includes service credited under <strong>the</strong> following plans:• Benefit service credited under <strong>the</strong> <strong>Northrop</strong> <strong>Grumman</strong> Retirement Plan ⎯ RollingMeadows Site beginning in 198914