Part A Supplement to the Northrop Grumman ... - Benefits Online

Part A Supplement to the Northrop Grumman ... - Benefits Online

Part A Supplement to the Northrop Grumman ... - Benefits Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

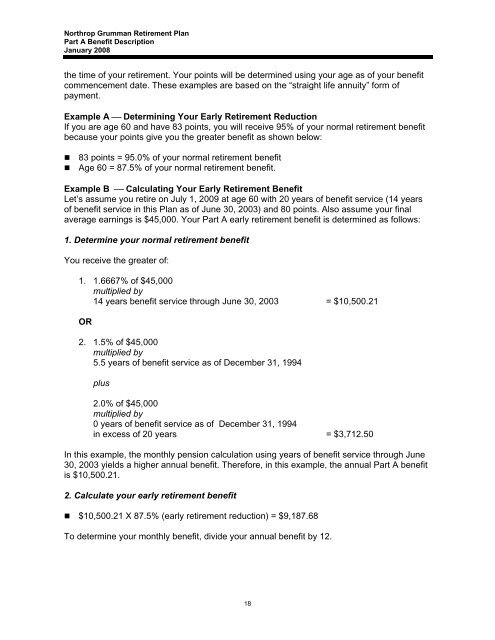

<strong>Northrop</strong> <strong>Grumman</strong> Retirement Plan<strong>Part</strong> A Benefit DescriptionJanuary 2008<strong>the</strong> time of your retirement. Your points will be determined using your age as of your benefitcommencement date. These examples are based on <strong>the</strong> “straight life annuity” form ofpayment.Example A ⎯ Determining Your Early Retirement ReductionIf you are age 60 and have 83 points, you will receive 95% of your normal retirement benefitbecause your points give you <strong>the</strong> greater benefit as shown below:• 83 points = 95.0% of your normal retirement benefit• Age 60 = 87.5% of your normal retirement benefit.Example B ⎯ Calculating Your Early Retirement BenefitLet’s assume you retire on July 1, 2009 at age 60 with 20 years of benefit service (14 yearsof benefit service in this Plan as of June 30, 2003) and 80 points. Also assume your finalaverage earnings is $45,000. Your <strong>Part</strong> A early retirement benefit is determined as follows:1. Determine your normal retirement benefitYou receive <strong>the</strong> greater of:1. 1.6667% of $45,000multiplied by14 years benefit service through June 30, 2003 = $10,500.21OR2. 1.5% of $45,000multiplied by5.5 years of benefit service as of December 31, 1994plus2.0% of $45,000multiplied by0 years of benefit service as of December 31, 1994in excess of 20 years = $3,712.50In this example, <strong>the</strong> monthly pension calculation using years of benefit service through June30, 2003 yields a higher annual benefit. Therefore, in this example, <strong>the</strong> annual <strong>Part</strong> A benefitis $10,500.21.2. Calculate your early retirement benefit• $10,500.21 X 87.5% (early retirement reduction) = $9,187.68To determine your monthly benefit, divide your annual benefit by 12.18