France EU27 EU-27 POULTRY AND PRODUCTS ... - Eurocarne

France EU27 EU-27 POULTRY AND PRODUCTS ... - Eurocarne

France EU27 EU-27 POULTRY AND PRODUCTS ... - Eurocarne

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

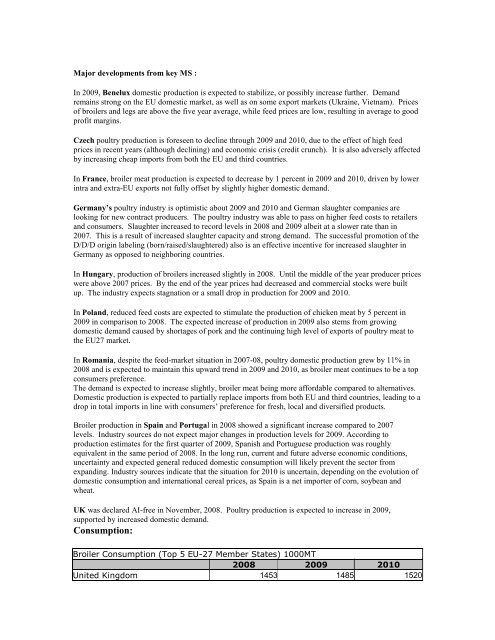

Major developments from key MS :In 2009, Benelux domestic production is expected to stabilize, or possibly increase further. Demandremains strong on the <strong>EU</strong> domestic market, as well as on some export markets (Ukraine, Vietnam). Pricesof broilers and legs are above the five year average, while feed prices are low, resulting in average to goodprofit margins.Czech poultry production is foreseen to decline through 2009 and 2010, due to the effect of high feedprices in recent years (although declining) and economic crisis (credit crunch). It is also adversely affectedby increasing cheap imports from both the <strong>EU</strong> and third countries.In <strong>France</strong>, broiler meat production is expected to decrease by 1 percent in 2009 and 2010, driven by lowerintra and extra-<strong>EU</strong> exports not fully offset by slightly higher domestic demand.Germany’s poultry industry is optimistic about 2009 and 2010 and German slaughter companies arelooking for new contract producers. The poultry industry was able to pass on higher feed costs to retailersand consumers. Slaughter increased to record levels in 2008 and 2009 albeit at a slower rate than in2007. This is a result of increased slaughter capacity and strong demand. The successful promotion of theD/D/D origin labeling (born/raised/slaughtered) also is an effective incentive for increased slaughter inGermany as opposed to neighboring countries.In Hungary, production of broilers increased slightly in 2008. Until the middle of the year producer priceswere above 2007 prices. By the end of the year prices had decreased and commercial stocks were builtup. The industry expects stagnation or a small drop in production for 2009 and 2010.In Poland, reduced feed costs are expected to stimulate the production of chicken meat by 5 percent in2009 in comparison to 2008. The expected increase of production in 2009 also stems from growingdomestic demand caused by shortages of pork and the continuing high level of exports of poultry meat tothe <strong><strong>EU</strong><strong>27</strong></strong> market.In Romania, despite the feed-market situation in 2007-08, poultry domestic production grew by 11% in2008 and is expected to maintain this upward trend in 2009 and 2010, as broiler meat continues to be a topconsumers preference.The demand is expected to increase slightly, broiler meat being more affordable compared to alternatives.Domestic production is expected to partially replace imports from both <strong>EU</strong> and third countries, leading to adrop in total imports in line with consumers’ preference for fresh, local and diversified products.Broiler production in Spain and Portugal in 2008 showed a significant increase compared to 2007levels. Industry sources do not expect major changes in production levels for 2009. According toproduction estimates for the first quarter of 2009, Spanish and Portuguese production was roughlyequivalent in the same period of 2008. In the long run, current and future adverse economic conditions,uncertainty and expected general reduced domestic consumption will likely prevent the sector fromexpanding. Industry sources indicate that the situation for 2010 is uncertain, depending on the evolution ofdomestic consumption and international cereal prices, as Spain is a net importer of corn, soybean andwheat.UK was declared AI-free in November, 2008. Poultry production is expected to increase in 2009,supported by increased domestic demand.Consumption:Broiler Consumption (Top 5 <strong>EU</strong>-<strong>27</strong> Member States) 1000MT2008 2009 2010United Kingdom 1453 1485 1520