ANNUAL REPORT 2001 - Anglo Platinum

ANNUAL REPORT 2001 - Anglo Platinum

ANNUAL REPORT 2001 - Anglo Platinum

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

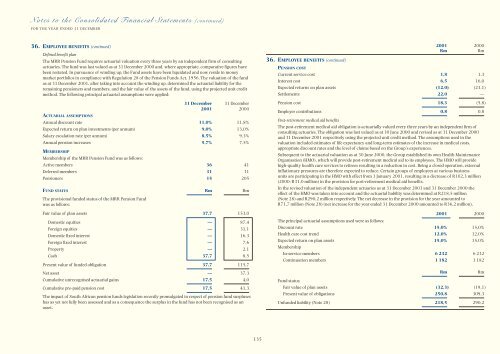

Notes to the Consolidated Financial Statements (continued)FOR THE YEAR ENDED 31 DECEMBER36. EMPLOYEE BENEFITS (continued)Defined benefit planThe MRR Pension Fund requires actuarial valuation every three years by an independent firm of consultingactuaries. The fund was last valued as at 31 December 2000 and, where appropriate, comparative figures havebeen restated. In pursuance of winding up, the Fund assets have been liquidated and now reside in moneymarket portfolios in compliance with Regulation 28 of the Pension Funds Act, 1956. The valuation of the fundas at 31 December <strong>2001</strong>, after taking into account the winding up, determined the actuarial liability for theremaining pensioners and members, and the fair value of the assets of the fund, using the projected unit creditmethod. The following principal actuarial assumptions were applied:31 December 31 December<strong>2001</strong> 2000ACTUARIAL ASSUMPTIONSAnnual discount rate 11,0% 11,8%Expected return on plan investments (per annum) 9,0% 13,0%Salary escalation rate (per annum) 8,5% 9,3%Annual pension increases 5,7% 7,5%MEMBERSHIPMembership of the MRR Pension Fund was as follows:Active members 36 41Deferred members 31 31Pensioners 15 205FUND STATUS Rm RmThe provisional funded status of the MRR Pension Fundwas as follows:Fair value of plan assets 37,7 153,0Domestic equities — 87,4Foreign equities — 31,1Domestic fixed interest — 16,3Foreign fixed interest — 7,6Property — 2,1Cash 37,7 8,5Present value of funded obligation 37,7 115,7Net asset — 37,3Cumulative unrecognised actuarial gains 17,5 4,0Cumulative pre-paid pension cost 17,5 41,3The impact of South African pension funds legislation recently promulgated in respect of pension fund surpluseshas as yet not fully been assessed and as a consequence the surplus in the fund has not been recognised as anasset.36. EMPLOYEE BENEFITS (continued)PENSION COST<strong>2001</strong> 2000RmRmCurrent service cost 1,8 1,3Interest cost 6,5 16,0Expected returns on plan assets (12,0) (23,1)Settlements 22,0 —Pension cost 18,3 (5,8)Employer contributions 0,8 0,8Post-retirement medical aid benefitsThe post-retirement medical aid obligation is actuarially valued every three years by an independent firm ofconsulting actuaries. The obligation was last valued as at 30 June 2000 and revised as at 31 December 2000and 31 December <strong>2001</strong> respectively using the projected unit credit method. The assumptions used in thevaluation included estimates of life expectancy and long-term estimates of the increase in medical costs,appropriate discount rates and the level of claims based on the Group’s experiences.Subsequent to the actuarial valuation as at 30 June 2000, the Group established its own Health MaintenanceOrganisation (HMO), which will provide post-retirement medical aid to its employees. The HMO will providehigh-quality health care services to retirees resulting in a reduction in cost. Being a closed operation, externalinflationary pressures are therefore expected to reduce. Certain groups of employees at various businessunits are participating in the HMO with effect from 1 January <strong>2001</strong>, resulting in a decrease of R102,3 million(2000: R31,0 million) in the provision for post-retirement medical aid benefits.In the revised valuation of the independent actuaries as at 31 December <strong>2001</strong> and 31 December 2000 theeffect of the HMO was taken into account and the actuarial liability was determined at R218,5 million(Note 28) and R290,2 million respectively. The net decrease in the provision for the year amounted toR71,7 million (Note 28) (net increase for the year ended 31 December 2000 amounted to R36,2 million).<strong>2001</strong> 2000The principal actuarial assumptions used were as follows:Discount rate 15,0% 15,0%Health care cost trend 12,0% 12,0%Expected return on plan assets 15,0% 15,0%MembershipIn-service members 6 232 6 232Continuation members 1 182 1 182Fund statusFair value of plan assets (32,3) (19,1)Present value of obligations 250,8 309,3Unfunded liability (Note 28) 218,5 290,2RmRm135

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)