Microfinance and Capital Markets - Council of Microfinance Equity ...

Microfinance and Capital Markets - Council of Microfinance Equity ...

Microfinance and Capital Markets - Council of Microfinance Equity ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

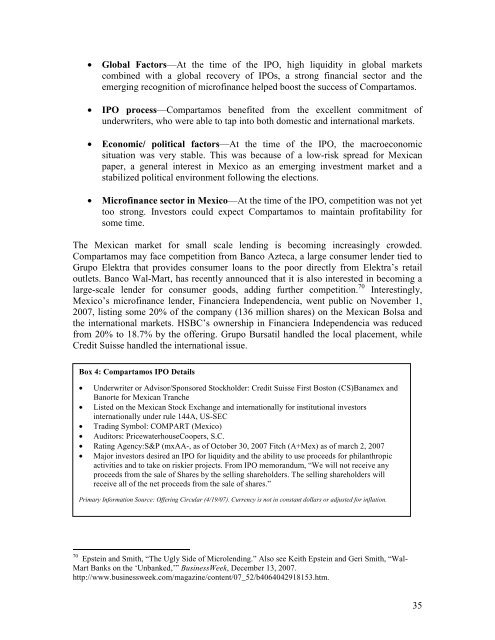

• Global Factors—At the time <strong>of</strong> the IPO, high liquidity in global marketscombined with a global recovery <strong>of</strong> IPOs, a strong financial sector <strong>and</strong> theemerging recognition <strong>of</strong> micr<strong>of</strong>inance helped boost the success <strong>of</strong> Compartamos.• IPO process—Compartamos benefited from the excellent commitment <strong>of</strong>underwriters, who were able to tap into both domestic <strong>and</strong> international markets.• Economic/ political factors—At the time <strong>of</strong> the IPO, the macroeconomicsituation was very stable. This was because <strong>of</strong> a low-risk spread for Mexicanpaper, a general interest in Mexico as an emerging investment market <strong>and</strong> astabilized political environment following the elections.• <strong>Micr<strong>of</strong>inance</strong> sector in Mexico—At the time <strong>of</strong> the IPO, competition was not yettoo strong. Investors could expect Compartamos to maintain pr<strong>of</strong>itability forsome time.The Mexican market for small scale lending is becoming increasingly crowded.Compartamos may face competition from Banco Azteca, a large consumer lender tied toGrupo Elektra that provides consumer loans to the poor directly from Elektra’s retailoutlets. Banco Wal-Mart, has recently announced that it is also interested in becoming alarge-scale lender for consumer goods, adding further competition. 70 Interestingly,Mexico’s micr<strong>of</strong>inance lender, Financiera Independencia, went public on November 1,2007, listing some 20% <strong>of</strong> the company (136 million shares) on the Mexican Bolsa <strong>and</strong>the international markets. HSBC’s ownership in Financiera Independencia was reducedfrom 20% to 18.7% by the <strong>of</strong>fering. Grupo Bursatil h<strong>and</strong>led the local placement, whileCredit Suisse h<strong>and</strong>led the international issue.Box 4: Compartamos IPO Details• Underwriter or Advisor/Sponsored Stockholder: Credit Suisse First Boston (CS)Banamex <strong>and</strong>Banorte for Mexican Tranche• Listed on the Mexican Stock Exchange <strong>and</strong> internationally for institutional investorsinternationally under rule 144A, US-SEC• Trading Symbol: COMPART (Mexico)• Auditors: PricewaterhouseCoopers, S.C.• Rating Agency:S&P (mxAA-, as <strong>of</strong> October 30, 2007 Fitch (A+Mex) as <strong>of</strong> march 2, 2007• Major investors desired an IPO for liquidity <strong>and</strong> the ability to use proceeds for philanthropicactivities <strong>and</strong> to take on riskier projects. From IPO memor<strong>and</strong>um, “We will not receive anyproceeds from the sale <strong>of</strong> Shares by the selling shareholders. The selling shareholders willreceive all <strong>of</strong> the net proceeds from the sale <strong>of</strong> shares.”Primary Information Source: Offering Circular (4/19/07). Currency is not in constant dollars or adjusted for inflation.70 Epstein <strong>and</strong> Smith, “The Ugly Side <strong>of</strong> Microlending.” Also see Keith Epstein <strong>and</strong> Geri Smith, “Wal-Mart Banks on the ‘Unbanked,’” BusinessWeek, December 13, 2007.http://www.businessweek.com/magazine/content/07_52/b4064042918153.htm.35