Microfinance Banks and Household Access to Finance

Microfinance Banks and Household Access to Finance

Microfinance Banks and Household Access to Finance

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

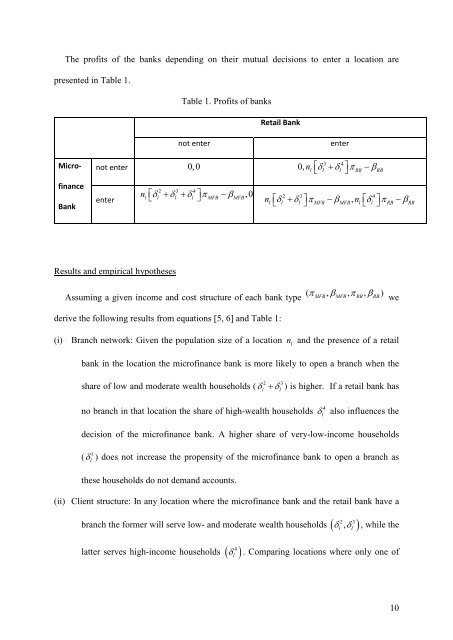

The profits of the banks depending on their mutual decisions <strong>to</strong> enter a location arepresented in Table 1.Table 1. Profits of banksRetail Banknot enterenter<strong>Microfinance</strong>Banknot enter 0,0enter⎡⎣ + ⎤⎦ −3 40, nl δl δl πRB βRB2 3 4n ⎡l ⎣δ ,0l+ δl + δ ⎤l ⎦πMFB −βMFB 2 3 4n ⎣⎡δ + δ ⎦⎤π −β , n ⎣⎡δ ⎦⎤π −βl l l MFB MFB l l RB RBResults <strong>and</strong> empirical hypothesesAssuming a given income <strong>and</strong> cost structure of each bank type ( π , , , )MFBβMFB πRB βRBwederive the following results from equations [5, 6] <strong>and</strong> Table 1:(i) Branch network: Given the population size of a location n l<strong>and</strong> the presence of a retailbank in the location the microfinance bank is more likely <strong>to</strong> open a branch when the2 3share of low <strong>and</strong> moderate wealth households ( δ + δ ) is higher. If a retail bank has4no branch in that location the share of high-wealth households δlalso influences thedecision of the microfinance bank. A higher share of very-low-income households( δ ) does not increase the propensity of the microfinance bank <strong>to</strong> open a branch as1lthese households do not dem<strong>and</strong> accounts.(ii) Client structure: In any location where the microfinance bank <strong>and</strong> the retail bank have a2 3branch the former will serve low- <strong>and</strong> moderate wealth households ( l,l )4latter serves high-income households ( δl )llδ δ , while the. Comparing locations where only one of10